CBA economist Harry Ottley has produced a terrific update on Australia’s rental market, provided below.

Key Points:

- We are increasingly confident the near-term inflation pulse has eased but rents remain a big driver of above target inflation.

- Growth in advertised rents is easing quickly in the 8-capital cities index.

- Sydney, the largest rental market in the country, has seen advertised rents fall in recent months.

- Advertised rents lead rents inflation.

- Household formation is responding to stretched rental markets and population growth is easing, dampening demand growth.

- Evidence is building that rents inflation is set to ease, a further positive sign for the inflation outlook.

We are becoming increasingly confident that the near-term inflationary pulse has eased.

As our Head of Australian Economics Gareth Aird noted, the recent data flow from second-tier measures of inflation have been highly constructive for Q3 24 CPI.

While this is encouraging, rents are often excluded from these measures. It is important to consider rents because rents inflation remains one of the largest drivers of above target inflation. It makes up a large portion of the consumer basket (6.03% -second only to new dwelling purchases as an individual expenditure class) and the rate of growth remains much stronger than the overall basket (7.3%/yr vs 3.8%/yr in Q2 24).

We have previously covered the key reasons behind the run up in rents over the past several years. With these dynamics in mind, we are confident that the worst of the stress in the rental market is likely behind us and rents inflation is set to ease.

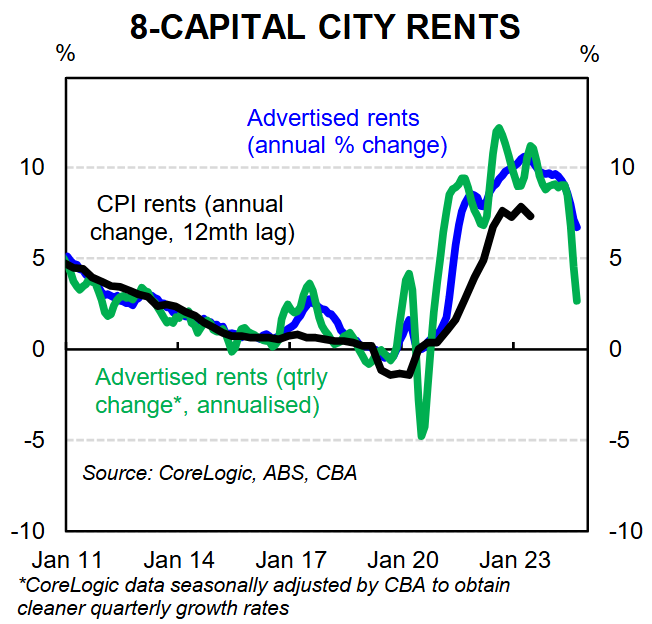

One piece of data we look to is advertised rents as they typically lead rents inflation. Asking rents respond quickly to changing market dynamics.

When rental markets are tightening, the price signal comes through newly listed and renewed rentals. The upshot is that landlords are able to charge a higher price.

The reason advertised rents provide a consistent lead to rents inflation in the CPI is because existing renters are insulated from the price response until their contract needs renewing or they move dwellings. As such, the impact on the stock is delayed.

The recent run of advertised rents data from CoreLogic has been encouraging.

In September, asking rents were flat in the month and 6.7% higher through the year. The annual rate of growth is down from a recent high of 10.0% in March this year.

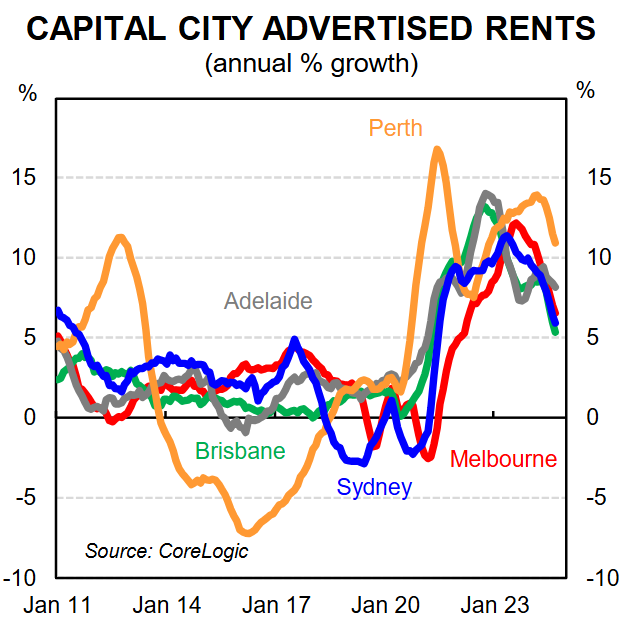

While growth rates remain divergent in a levels sense, annual growth rates are trending lower across all of the five largest cities in Australia.

In Sydney, the largest rental market in the country, asking rents fell by 0.1% in the September quarter.

Over the last few months, the rate of growth looks to have stepped down more materially.

The data is not seasonally adjusted, so to obtain a clearer read of the quarterly growth rates, we performed our own seasonal adjustment.

The first chart shows that the annualised quarterly growth rate (green) has eased significantly in recent months, to just 2.7%/yr.

As mentioned above, the annual rate of growth (blue) is also showing considerable progress in the desired direction.

Rents inflation (black) has likely peaked and should follow asking rents lower once they start to flow through to contracts and the stock of rents.

In summary, the news on advertised rents is positive. We believe there are two main drivers of an easing in rental market conditions:

- Households are responding to pressure in the rental market by economising on housing.

- Population growth is easing.

A key point here is that both responses are coming on the demand side. The supply of new dwellings remains constrained, albeit there is a large pipeline of work to be done.

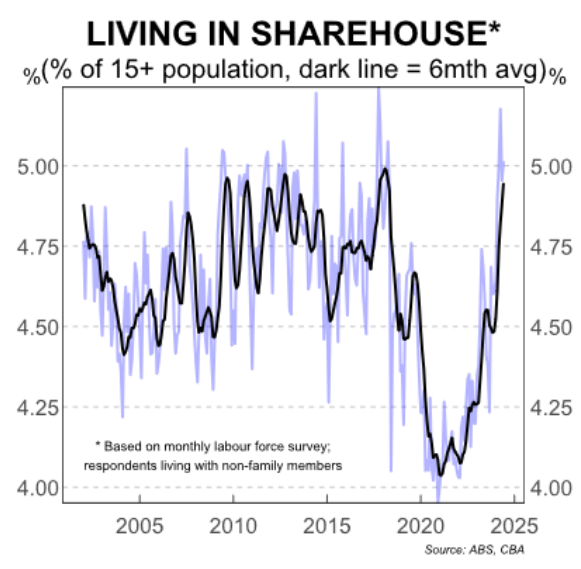

Firstly, as my colleague Stephen Wu outlined previously, households are economising on housing costs. In the note, Stephen says “Given high costs, household behaviours are changing to economise on housing: more people are living in share houses, and fewer are living with just their partner, based on data from the monthly labour force survey”.

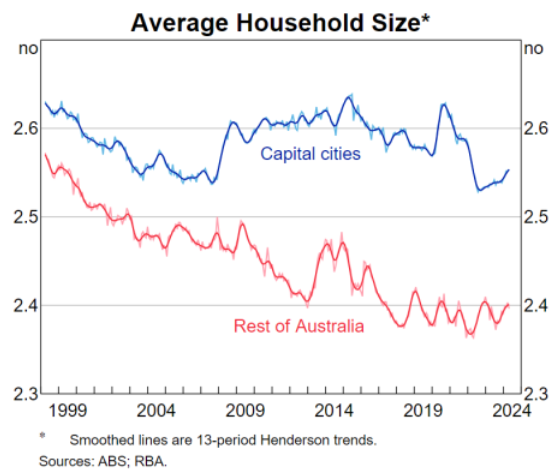

The RBA also recently commented that average household size is increasing, supporting this view.

Recall that during the pandemic, average household size fell as people desired more space, increasing demand for dwellings. Now, in response to current market conditions, this trend is reversing, reducing growth in demand for rental properties.

Secondly, the rate of population growth is easing. Population data is lagged, but to Q1 24, population growth in annual terms fell to 2.3% from a peak of 2.6% in Q3 24.

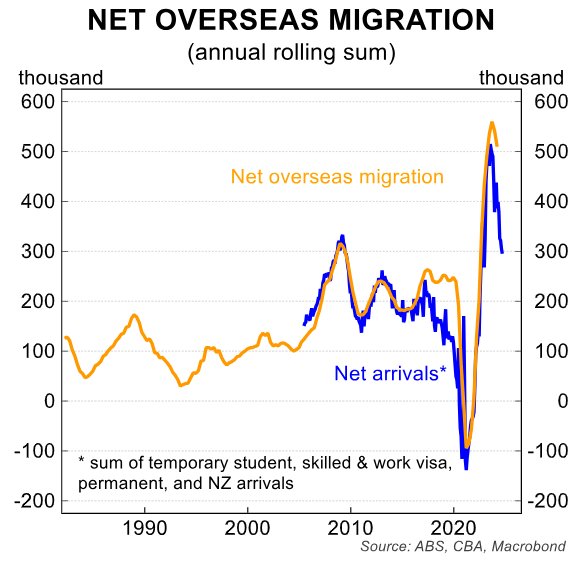

The rate of growth has clearly peaked. By looking at higher-frequency arrivals data, we can calculate a decent steer as to where net overseas migration is headed.

As the next chart shows, all signs point to the rate of net overseas migration easing further and by extension population growth continuing to moderate.

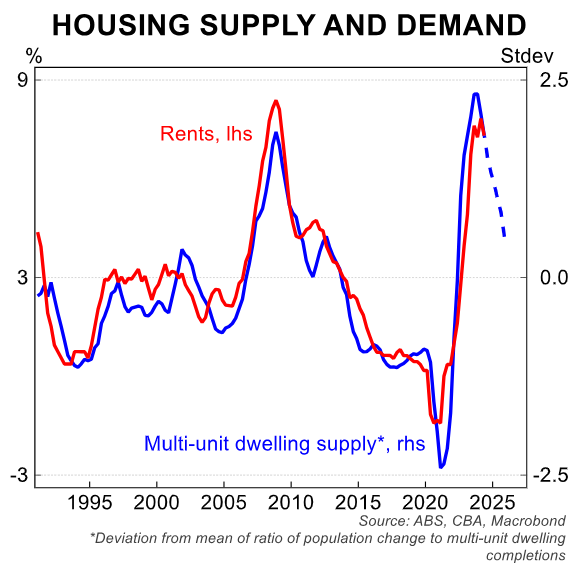

My colleague Belinda Allen will publish a note fleshing this out more soon. As we have outlined before, there is a strong historical correlation between the deviation from the mean of ratio of population change to multi-unit dwelling completions and rents inflation.

In the last chart on this page, we have extended the blue line by inputting continued easing in the rate of population growth and a steady supply of multi-unit dwellings.

Using these assumptions shows that demand and supply are coming into a better albeit still sub-optimal balance.

This is another piece of evidence that gives us confidence that rents inflation is set to moderate. Higher average household size and less population growth are combining to reduce demand and take some of the heat out of the rental market.

This is manifesting through lower advertised rents and vacancy rates that have started to tick up from very low levels.

This likely means that the worst of the rental market squeeze is now behind us.

There is a lag from an easing in rental market conditions to a response in rents inflation but directionally, rents inflation is set to moderate.

Finally we note that the RBA has not increased the cash rate since November 2023. Unlike when interest rates are rising, landlords are likely to be less pro-active in raising rents in an environment of steady rates.