The Australian Bureau of Statistics (ABS) has released the all-important Q3 Consumer Price Index (CPI) data, which undershot economists and the Reserve Bank of Australia’s (RBA) expectations.

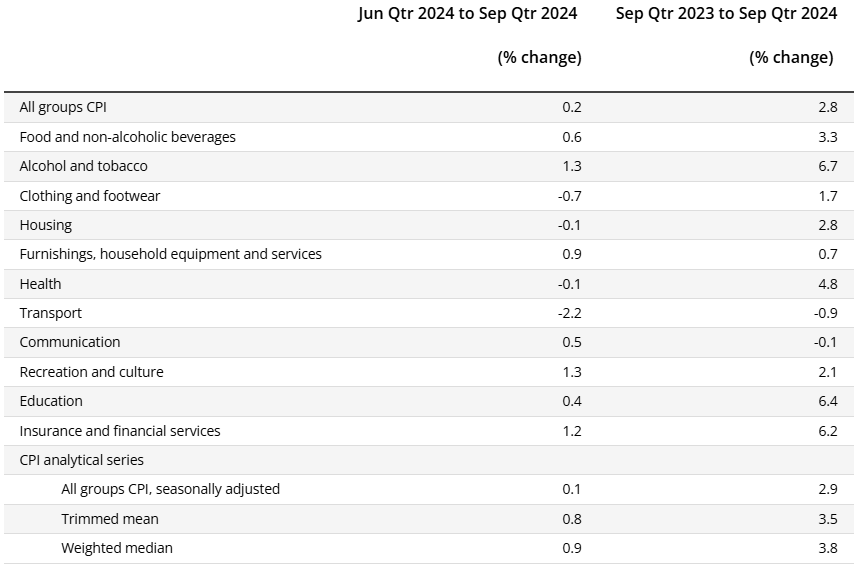

Headline inflation rose by only 02% in Q2, below economists’ expectations of a 0.3% increase. This result was weighed down by energy and rental subsidies.

Michelle Marquardt, ABS head of prices statistics, noted that: “The September quarter’s rise of 0.2% is the lowest outcome since the June 2020 quarter fall, which occurred during the COVID-19 outbreak and was driven by free childcare”.

More importantly, the trimmed mean measure of inflation, which reduces the impact of irregular or temporary price changes (like subsidies) and is the measure that the RBA looks at most closely, came in at 0.8% in Q3 and 3.5% year-on-year. This was bang-on with economists’ expectations.

Source: ABS

Based on the above, the RBA is certain to keep rates on hold until next year, since trimmed mean inflation remains above its target (even on a quarterly basis).

However, expect Treasurer Jim Chalmers to ramp up pressure on the RBA to cut rates given that headline CPI has now fallen within the RBA’s 2% to 3% target.