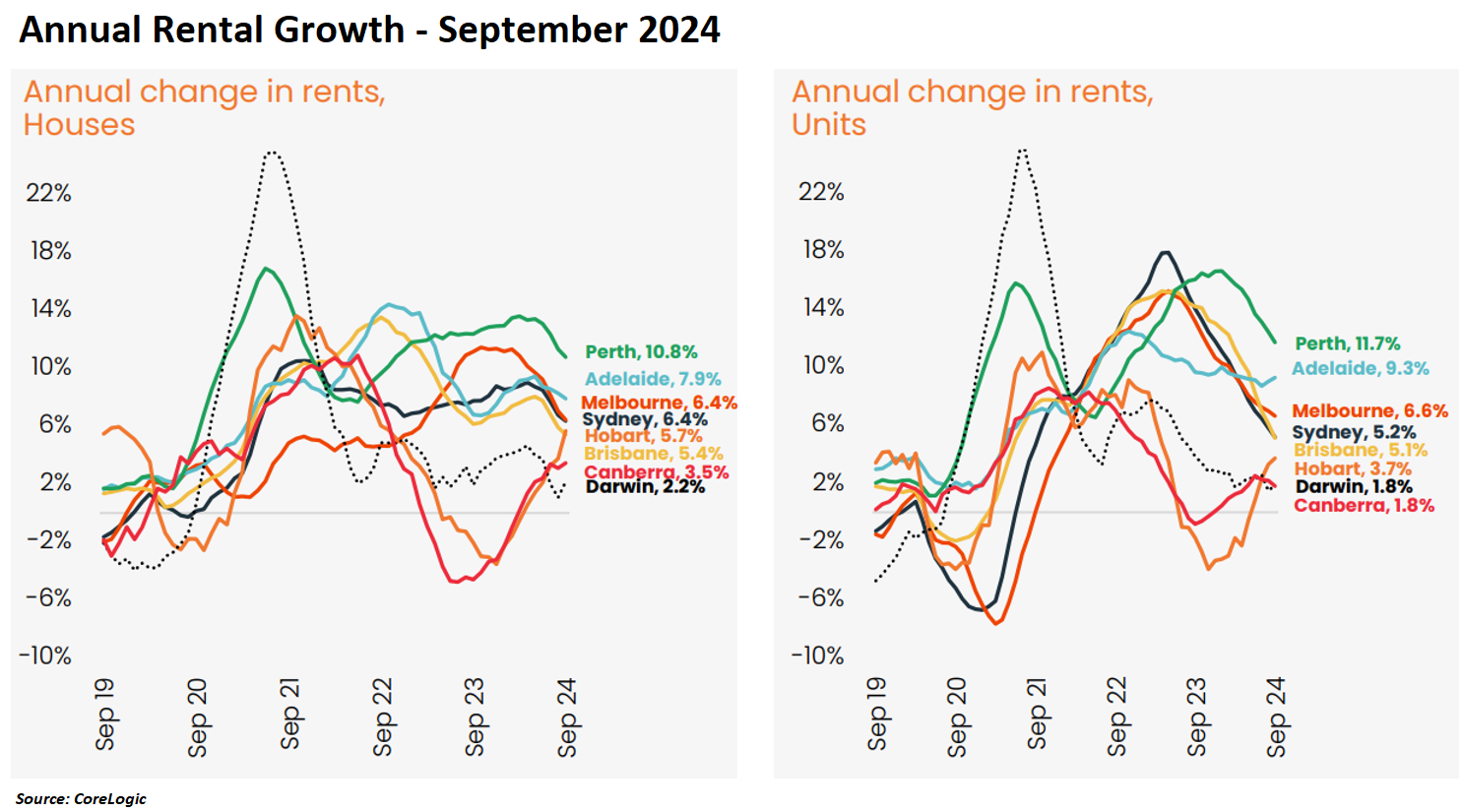

CoreLogic’s September housing market report shows that the national rental index increased by only 0.1% over the September quarter, the smallest change over a rolling three-month period in four years.

Rents fell in Sydney (-0.5%), Brisbane (-0.2%), and Canberra (-0.8%) during the quarter, and rental growth slowed in most other capitals.

Rents in Melbourne and Perth increased by 0.3% during the quarter, a marked decrease from a year ago, when the quarterly trend was up 2.2% and 2.3%, respectively.

CoreLogic attributes the slowing of rents to easing net overseas migration alongside rental affordability pressures forcing a restructuring of demand.

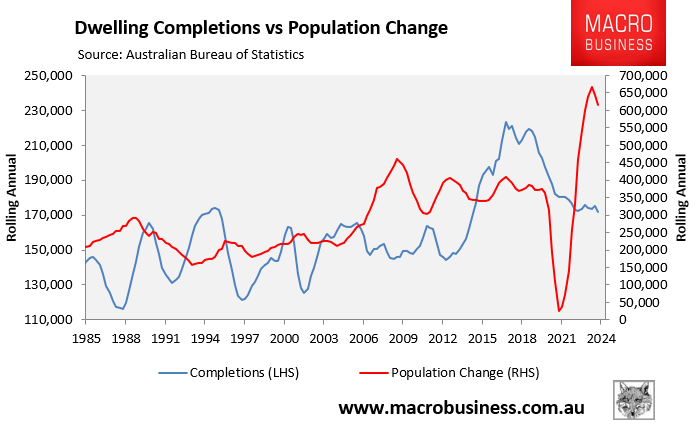

“The latest demographic trends from the ABS showed net overseas migration reduced by 19% from the record highs in the first quarter of 2023″, noted Tim Lawless from CoreLogic.

“The March quarter of 2024 saw 133,800 net overseas migrants arrive in Australia, 31,700 fewer than a year prior, helping to take some pressure off rental demand”.

“Our affordability metrics indicated that the median income household would require around a third of their income to service the median rent value across Australia in June”.

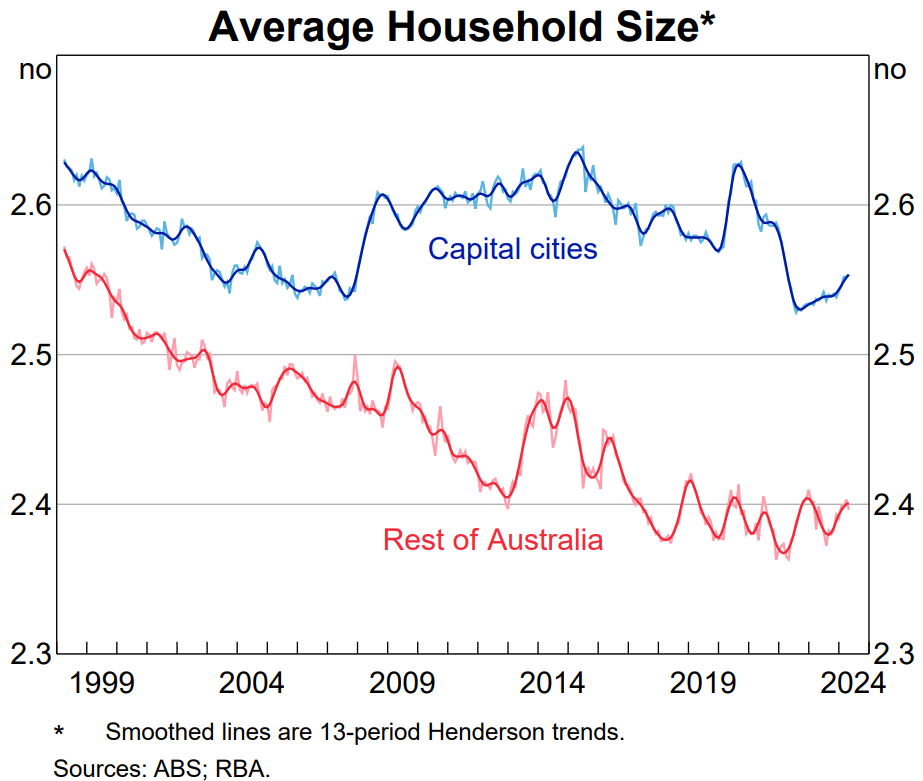

“It wouldn’t be surprising if the average household size has continued to increase as group households and multigenerational households become more common in the face of high rental costs”, Lawless said.

The August Statement of Monetary Policy from the Reserve Bank of Australia (RBA) noted that “average household size has increased further in recent months, possibly in response to affordability constraints”:

Unlike mortgages, rents cannot be leveraged, meaning that rental growth is more tightly linked to household income, limiting its potential increase.

With net overseas migration remaining historically high and housing construction rates depressed, the rental market will remain tight for the foreseeable future:

Australians will likely respond by moving into shared housing to economise on costs, tempering rental increases.