The world’s largest commercial real estate group, CBRE, released its Apartment vacancy and rent outlook for Australia, projecting that the rental crisis will last until at least the end of the decade.

CBRE expects that median Australian rents will grow by 25% between 2024 and 2029, well above projected CPI inflation.

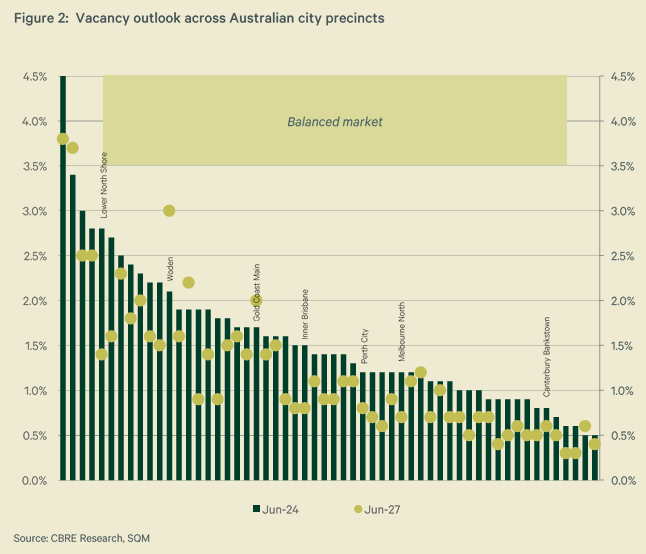

CBRE also projects that Australia’s capital city vacancy rate will fall further to 1.2% by 2029, from 1.9% in 2024.

This compares to an average vacancy rate of 2.5% over the past decade. CBRE also claims that a “balanced market” for apartment rentals is around 4%.

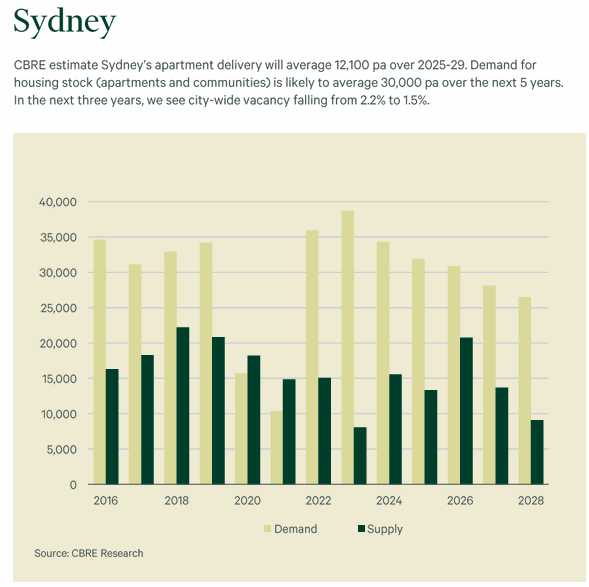

Sydney’s rental vacancy rate is projected to fall from 2.2% to 1.5%.

Melbourne’s rental vacancy rate is projected to fall from 1.8% to 1.4%.

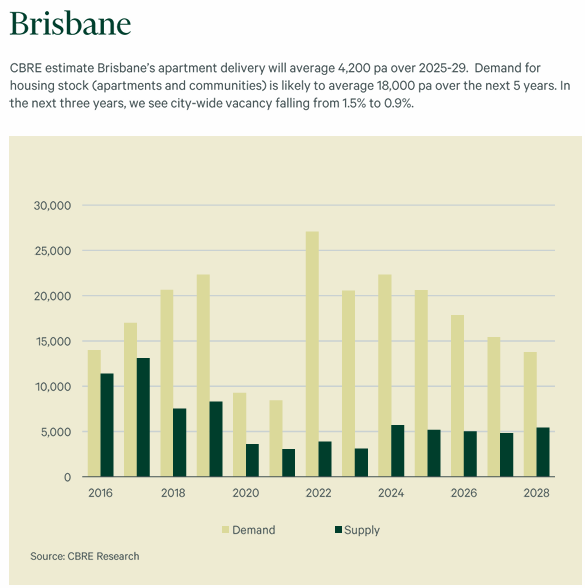

Brisbane’s rental vacancy rate is projected to fall from 1.5% to 0.9%.

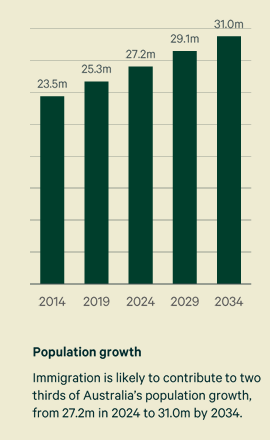

Underpinning the collapse in rental vacancy rates will be a strong rise in Australia’s population from 27.2 million people currently to 31.0 million people by 2034:

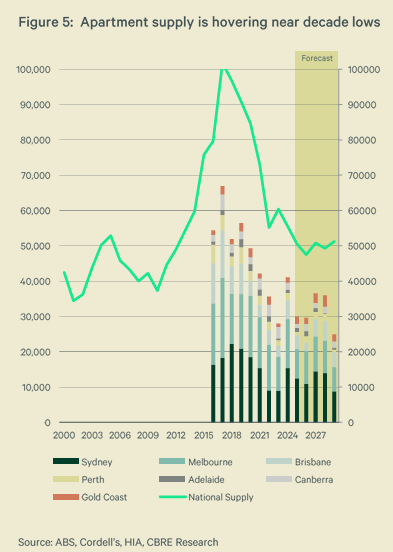

Meanwhile, apartment construction will continue to lag well behind population growth.

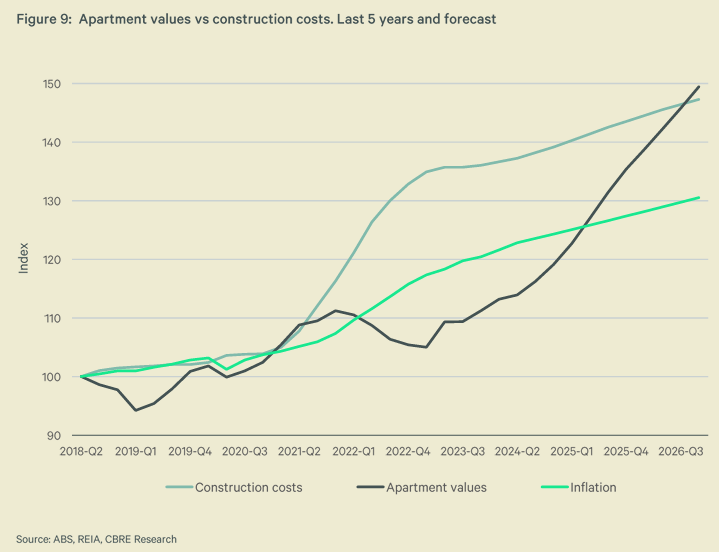

CBRE also warns that structurally higher costs are a major impediment to increasing housing supply:

“In the last five years, values have not kept pace with construction costs. This disparity is currently at 23%”.

“Construction costs for residential have increased by 32% over June 2020 to June 2024, well in excess of the growth in inflation”.

“Tight labour markets… may keep upward pressure on the cost to build new supply”.

“The stricter energy requirements and liveable housing standards will also impact the cost of new builds”.

CBRE forecasts that apartment supply will only average around 50,000 annually between 2025 and 2029, which is around half the 2017 peak and well below the rate required given population growth.

“To balance the market, we estimate an incremental ~90,000 are needed, over and above the current absorption rate”, says CBRE.

“Current population growth forecasts demand apartment supply of ~75,000 pa to avoid further falls in vacancy”.

“CBRE forecast the future supply of apartments is likely to hover around 50,000 pa over 2025-29”.

“During low points of delivery, supply will be 50% below the previous peak in 2017 and near decade lows”, CBRE noted.

Sydney’s apartment delivery is projected to average only 12,100 pa over 2025-29, well below demand of 30,000.

Melbourne’s apartment delivery is projected to average only 8,700 pa over 2025-29, way below demand of 37,000.

Brisbane’s apartment delivery is projected to average only 4,200 pa over 2025-29, way below demand of 18,000.

In summary, Australia’s rental crisis will roll on amid ongoing strong demand via net overseas migration and insufficient new supply.

The reality is that there is only one genuine solution to Australia’s rental crisis: significantly cutting net overseas migration to a level that is below the nation’s capacity to build housing and infrastructure.

However, the federal government has targeted high net overseas migration into perpetuity, which means the rental crisis will become permanent.