The Coalition is considering stripping the Australian Prudential Regulatory Authority (APRA) of some of its powers to regulate mortgage borrowing and overhauling credit laws to make it easier for first home buyers to borrow for housing.

Some Coalition MPs also want to scrap responsible lending laws, which put the onus on the banks to verify borrowers’ ability to make mortgage repayments.

Coalition housing affordability spokesman, Andrew Bragg, is heading the push for the deregulation of lending rules and will chair a Senate inquiry into the matter, which will hold its first public hearings in the coming weeks ahead of a December reporting date.

Bragg told The Australian that the Albanese government had “spent no time looking at these issues”, noting that APRA had been allowed to set its own rules for borrowers.

“If you can’t get a mortgage, you can’t get a first home”, he said, adding that APRA was “extremely risk averse”.

“Prudential stability hasn’t been balanced against any other competing factor”, Bragg claims.

“First home ownership is not something the regulator thinks about when it makes its prudential standards”.

“We’re in a housing crisis, anyone would accept that”.

“If the frankly quite obscure prudential regulator is making rules which are rubbing out the Australian dream, that is something the parliament needs to look at”, Bragg said.

The SMH’s Elizabeth Knight questioned the merits of reducing the mortgage serviceability test, which would allow more borrowers into the market.

“Even the vaguest prospect of handing over the prudential standards of banks to the government (which is by its nature politicised) is fraught with danger”, Knight wrote.

“As just about every economist will attest, policy moves that increase demand for housing without tackling its supply will only increase property prices, which in turn further restricts buyers from entering the market”.

There is no evidence that credit is too tight, given the rapid rise in average loan sizes, which has helped to propel home prices higher:

Moreover, the very first recommendation of the Hayne Banking Royal Commission was for responsible lending rules to remain untouched.

The Hayne Banking Royal Commission’s central recommendation was to keep responsible lending laws.

Twenty years of empirical evidence show that demand-side “affordability” measures, such as looser credit provision, have helped increase the cost of Australian housing.

Therefore, increasing lending to marginal buyers will exacerbate the housing affordability problem by pushing prices higher, increasing consumer debt, and compromising financial stability.

The Coalition’s push for deregulation will, therefore, be counterproductive and self-defeating from an affordability perspective.

Finally, if the federal government genuinely wants to assist first home buyers to enter the housing market, it should do two things.

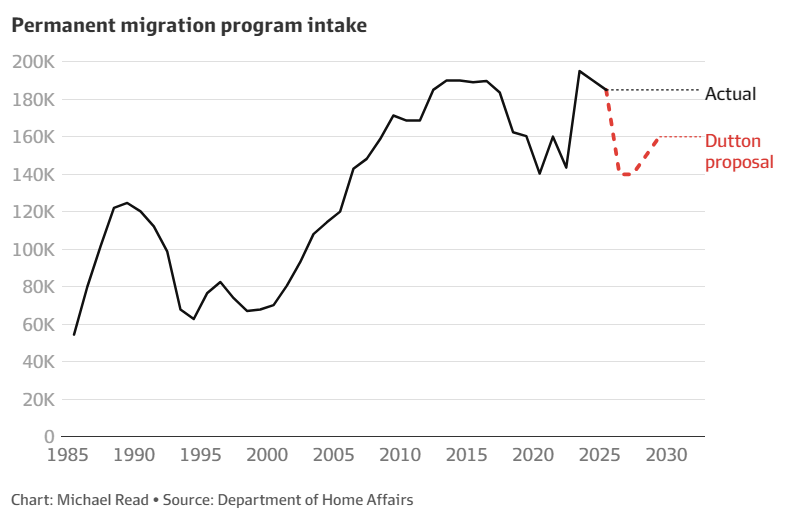

The number one solution to the housing affordability crisis is to slash immigration back to historical post-war levels.

Excessive immigration is especially bad for first home buyers because:

- It drives up rents, making it harder to save a housing deposit.

- It drives up prices, pushing ownership further out of reach.

To its credit, the Coalition has at least promised to cut immigration.

The federal government should also undertake broad-based tax reform that lowers income taxes and reduces property investment concessions.

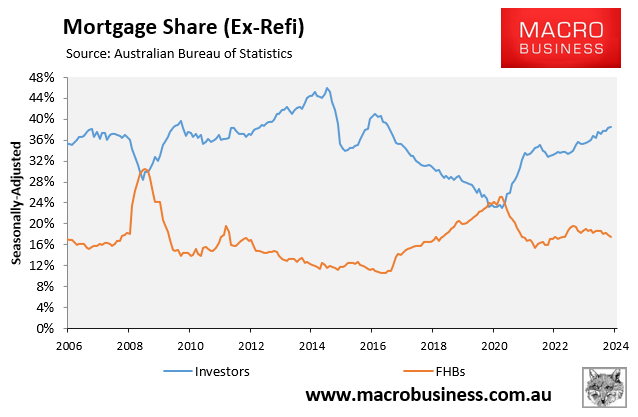

Reducing property tax concessions would reduce demand from investors, thereby boosting the first home buyer share and increasing the home ownership rate.

The truth is that our political leaders do not genuinely want more affordable homes because it would require lower prices.

So, they pretend to care about affordability by providing false solutions and hope to would-be first home buyers while driving the cost of housing higher through stimulatory demand-side measures.