Freelancer CEO Matt Barrie was interviewed by the Equity Mates podcast, where he argued that “Australia has all the resources and potential to be the wealthiest country in the world”.

However, policymakers have instead delivered a “cost of living crisis instead”.

Here are some of the interview’s key highlights, followed by my own additions.

Edited Transcript of Matt Barrie’s discussion:

For a while, Australia was a great place to live and we had manufacturing, for example, as a substantial portion of the GDP of this country.

We made cars, we made a bunch of different things. We had whole supply chains for various things. And then we just went into this path of just easy relentless growth where it was just house prices drifting up and shipping iron ore, coal, gas and gold overseas.

You would think that a country with 12200 years of coal supply would be an energy superpower.

You would think a country with 28% of the world’s uranium reserves would be an energy superpower.

You would think a country with 20% of the world’s gas exports, sometimes number one in the world for gas exports, sometimes number two, would be an energy superpower.

You would think a country with 3.46 people per square kilometer would have cheap land and cheap housing.

You would think a country that is third in the world for production of cobalt, has 47% of the world’s lithium production, we are sixth in the world for production of copper, fifth in the world for the production of nickel, would be an energy and electronic and mechanical engineering superpower.

We control 56% of the world’s iron or exports. You would think that we would be a steel superpower.

We have cheap energy, we have abundant iron ore, and we should be turning that into elaborately transformed materials.

We should have become an export powerhouse . We should be the richest country in the world, full stop. We have everything.

But instead we have the greatest erosion of wealth in the developed world. We have a cost living crisis that is the mother of all cost of living crisis…

We have an energy crisis because we stupidly are going down this path of, “well what about the environment”?

We can’t burn coal, etc, But every single thing we’re digging out of the ground is being burned by China, or is being burned by Japan. It’s all being shipped overseas and burned.

We are deluding ourselves by thinking that we are doing anything by not burning it here.

The gas we send overseas in many cases is being re-exported.

Now we’re actually going to import gas in the Eastern Seaboard, which is ludicrous because we don’t have a gas reservation scheme.

So, we have a cost of living crisis caused by input costs. We have an energy crisis through very poor energy policy where we’ll export all the raw materials to build renewable generators.

They are energy negative on the energy that’s consumed to get the materials out of the ground, which ship back to us and are unreliable.

As a result, we can’t run a reliable manufacturing industry in this country. Our manufacturing as a percentage of gross value is 5.39%, which is on par with Botswana.

This country is going to hell on a hand basket. We are 93rd in the Harvard economic complexity index in terms of the complexity of things that we produce, how sophisticated they are, and how much people can replicate them.

Our economy in terms of sophistication and complexity is on par with Equatorial Guinea, where they don’t have a cinema in the entire country.

It is all being caused by government policy, which can be turned around on a dime.

My two cents:

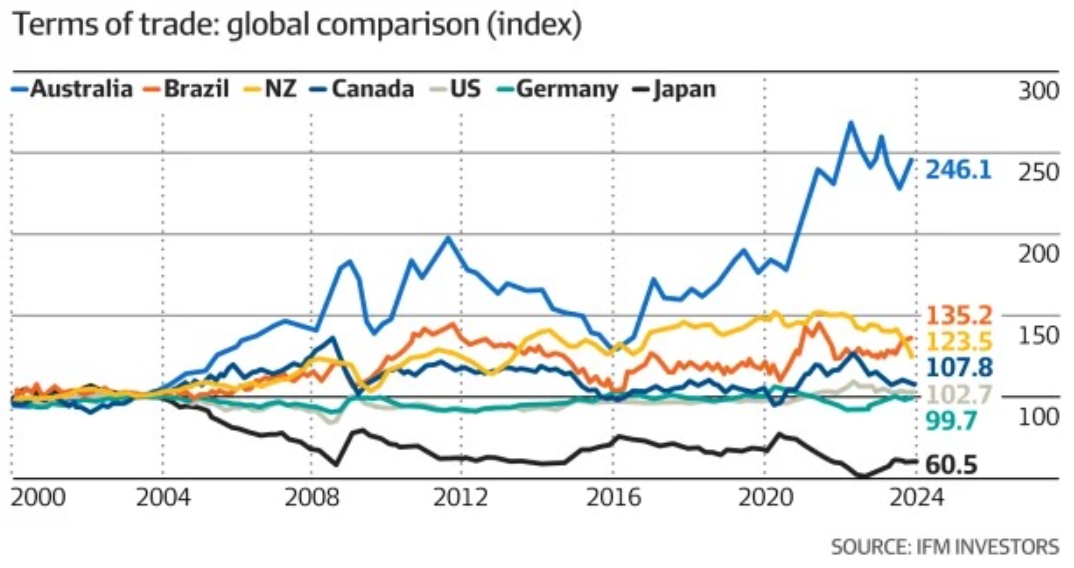

As illustrated in the following chart, Australia has benefited the most from global commodity prices over the last 20 years:

However, Australians have little to show for the good fortune because we do not have a genuine resource tax mechanism in place, as Norway has.

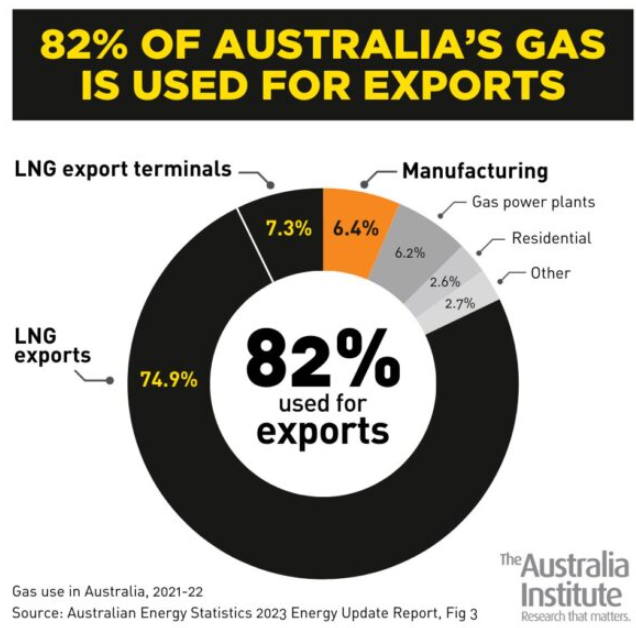

Consider natural gas where Australia is currently the world’s second largest exporter:

Almost all of Australia’s natural gas is exported, which has caused an artificial domestic gas shortage on the East Coast, where no domestic reservation policy exists, and internationally high gas and electricity costs.

The surge in LNG exports, which is reflected in the unprecedented rise in Australia’s terms of trade, has created massive profits for foreign-owned oil and gas companies.

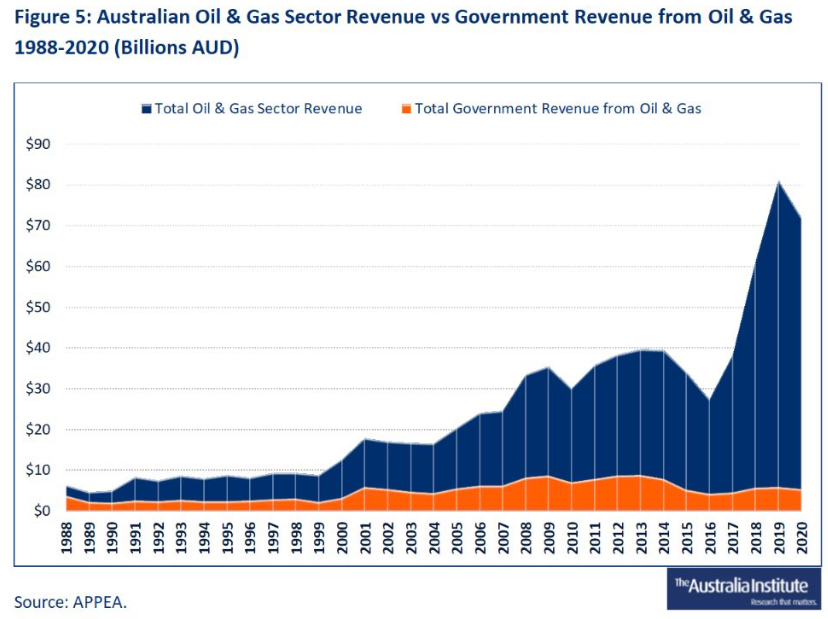

However, Australia’s tax revenues from this boom have stagnated:

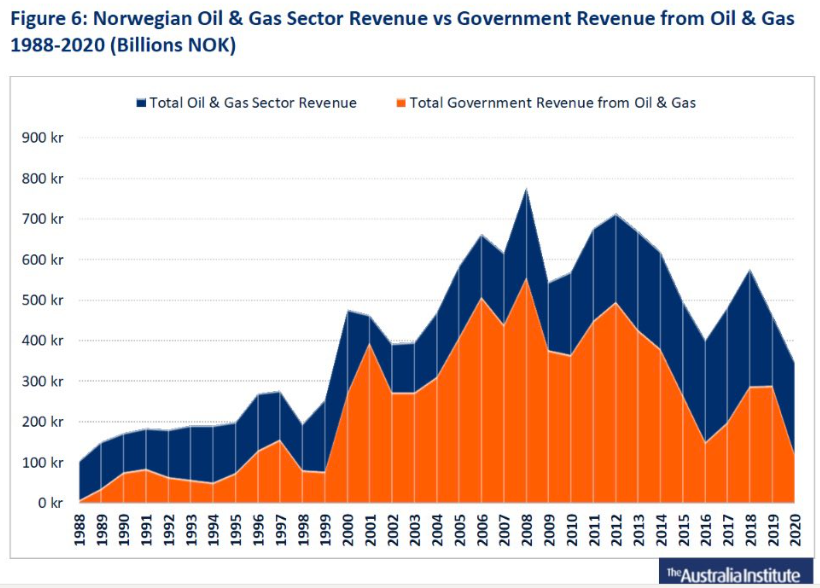

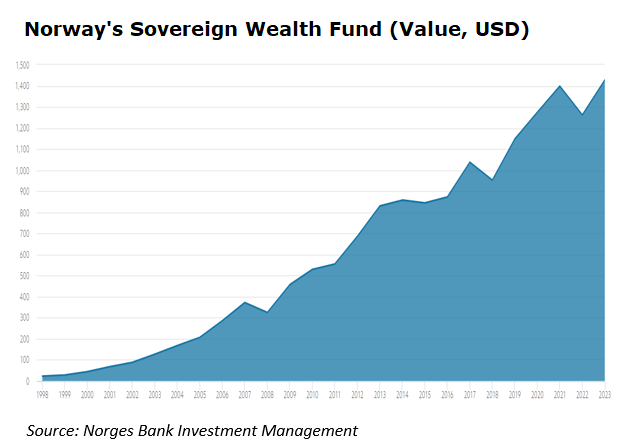

By contrast Norway, which taxes its oil and gas sector at around 80%, has enjoyed a massive tax windfall from its oil and gas sector:

Norway has invested its oil and gas windfall in a sovereign wealth fund that is the world’s largest and valued at approximately US$290,000 per Norwegian resident:

Norway’s oil and gas wealth has made Norwegians the richest people on the planet, a title that Australia would have claimed if we properly taxed our resources.

Instead, we did the opposite and taxed our resources lightly.

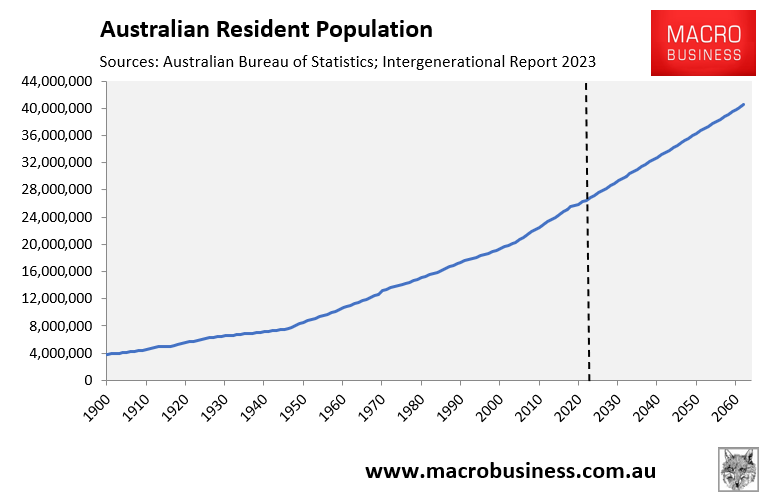

We then grew the nation’s population aggressively via immigration, which has diluted our mineral wealth.

Qataris have also benefited financially by correctly taxing their resources.

As Matt Barrie himself explained earlier this year, “Qatar generates enough wealth from this trade that residents pay zero income tax, zero property tax, zero corporate income tax, have free healthcare, free education, have subsidised housing and plentiful access to cheap electricity and petrol”.

By contrast, “in Australia, most of our export facilities pay no royalties at all to the state or federal government”.

Meanwhile, “China resells about a third of what we need domestically. Half the gas we sell to Japan is resold“.

In other words, Matt Barrie is right. Australians should be the richest people on earth.

Instead, we have impoverished ourselves by engineering an artificial gas shortage, driving up domestic gas and electricity prices, while also diluting the nation’s mineral wealth via mass immigration.

We are not a serious country.