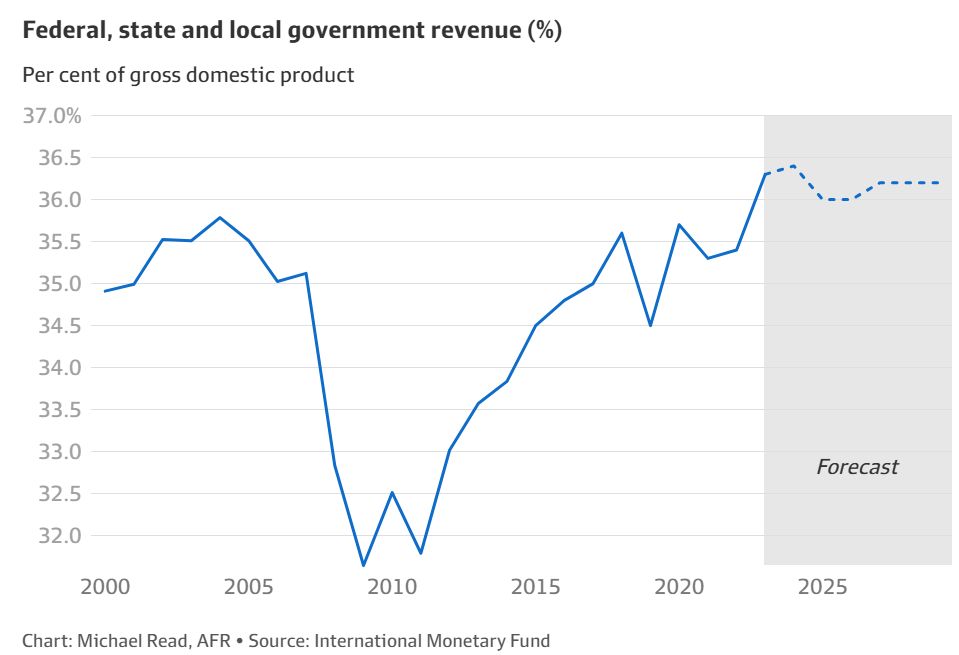

Michael Read from the Australian Financial Review published the following chart showing the strong growth in federal, state, and local government taxes over the past decade, which have hit a record share of gross domestic product.

However, despite the record tax take, the International Monetary Fund (IMF) forecasts that Australia faces six years of deficits amid rising spending pressures.

“Pretty much all the big drivers of tax were pointed in the same direction for the first time in a very long time”, economist Chris Richardson said, in reference to high commodity prices, rising home prices, the historically large increase in the population, and record workforce participation.

Cherelle Murphy, the chief economist for EY Oceania, added that bracket creep had also increased personal income tax collections.

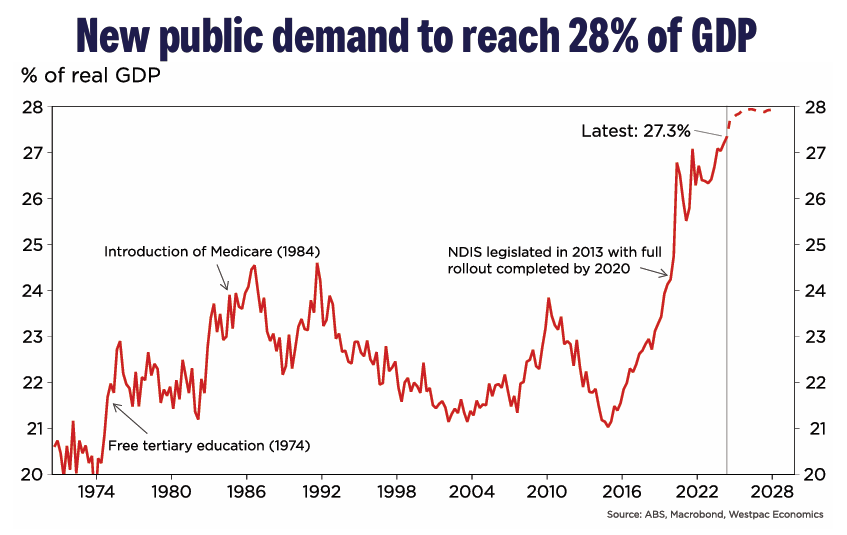

At the same time as revenues are booming, public spending hit a record 27.3% share of gross domestic product in Q2 2024 and is projected by Westpac to rise further over the coming years.

Part of this increase in public spending relates to the National Disability Insurance Scheme (NDIS), which has been growing in cost by around 20% annually to nearly $50 billion currently.

The Parliamentary Budget Office projected that the annual cost of the NDIS will rise to around $100 billion within a decade and will rival the cost of the aged pension.

Australia has an ageing population, which means that health and aged care spending will also rise as a share of gross domestic product.

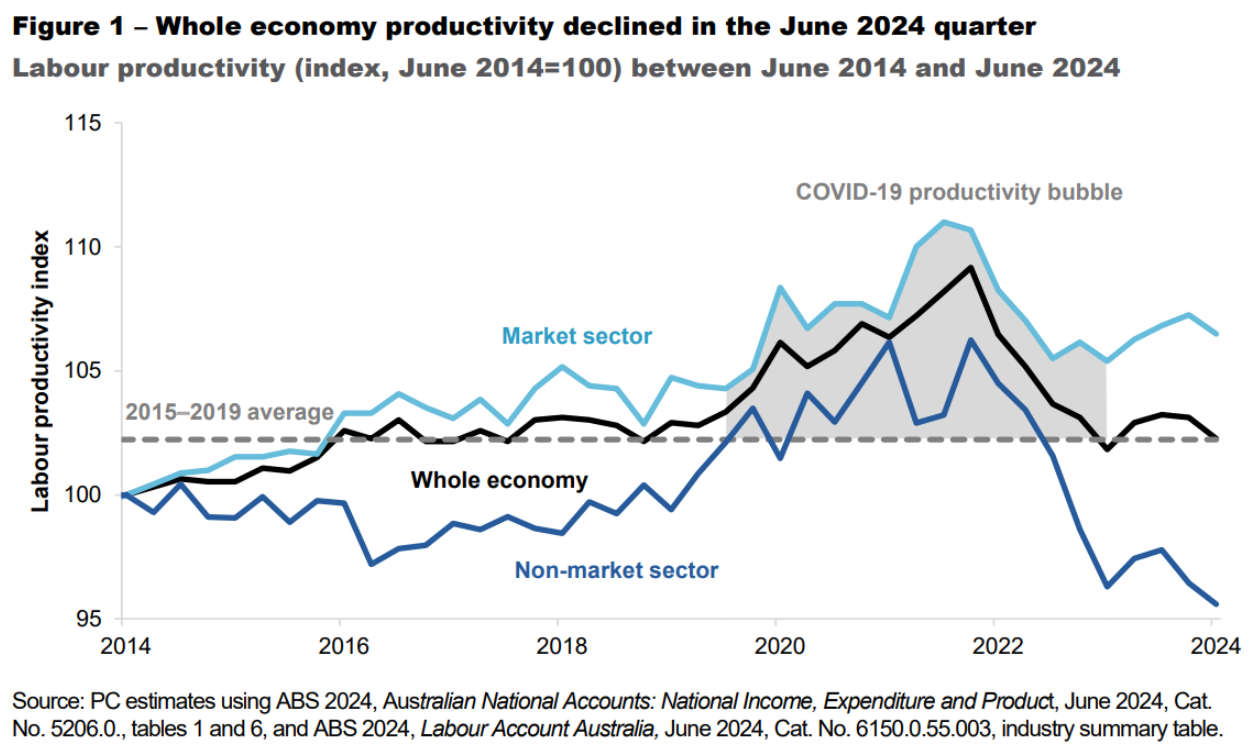

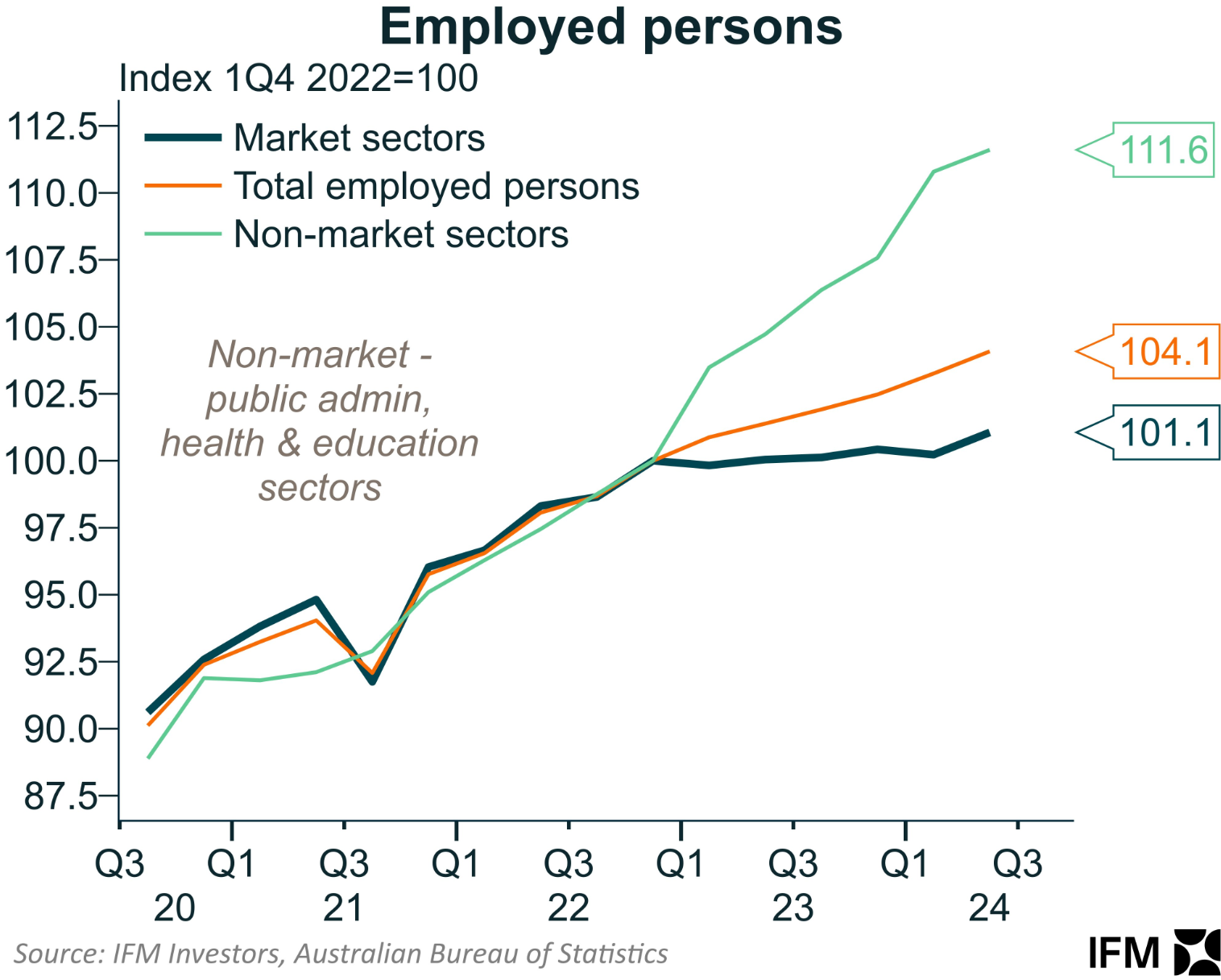

This expansion in public spending will have negative productivity implications for the economy, given that the non-market (government-aligned) sector has historically experienced much weaker labour productivity growth than the market sector.

Most of Australia’s recent job growth has come from the non-market sector, which helps to explain why Australia’s productivity growth has been so poor.

Meanwhile, personal income taxes reached $331 billion in 2023-24, accounting for 52% of the federal government’s total tax revenue.

Treasury’s Intergenerational Report also projected that personal income tax revenue will increase to 58.4% of total taxes in 2062-63 without changes to the tax mix.

This increase in personal income taxes will be levied on a diminishing share of workers in the economy because of population ageing.

Therefore, Australia faces the unsustainable situation whereby a diminishing pool of workers will pay increasing taxes to support growing NDIS, health, and aged care expenditures.

Australia clearly needs to undertake broad-based tax reform that broadens the base and shifts the burden away from workers to resources, land, consumption, and wealth.