The past twenty years saw an explosion of cafes across Australia.

For example, when I moved to the Melbourne suburb of Ashburton in 2006, there were only a handful of cafes along the local High Street shopping strip.

In the years leading up to the pandemic, the number of cafes expanded to more than a dozen along or just off the strip.

This number of cafes was never sustainable. While a few were always busy, most cafes sat idle most of the time with very few customers.

For Lease signs now adorn several cafes along my local High Street strip. For the first time in a decade, the number of cafes operating has shrunk.

A similar picture is playing out across Australia.

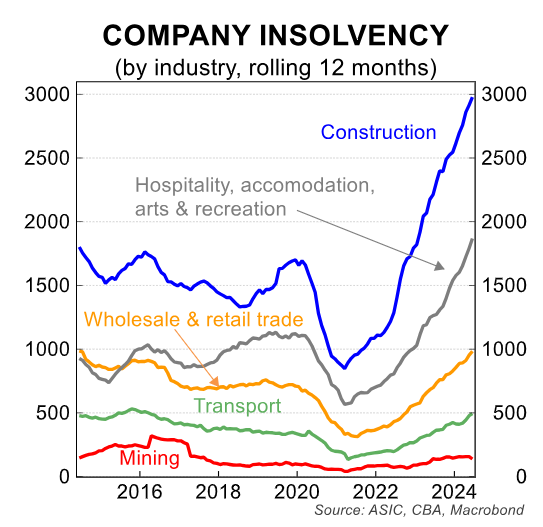

The spike in hospitality industry insolvencies, which are tracking at roughly double pre-pandemic levels, serves as evidence that the great cafe bubble has burst.

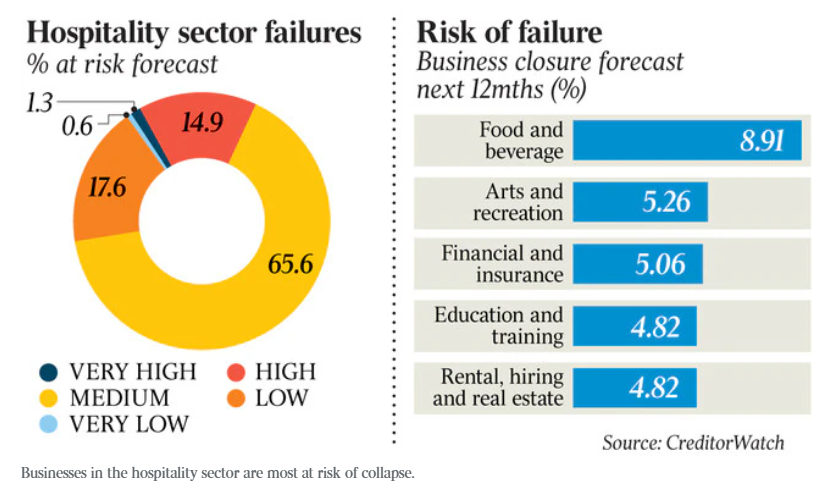

The situation is unlikely to improve anytime soon. A new CreditorWatch survey found that almost one in six (16.2%) of hospitality businesses are rated at a high risk of collapsing due to high interest rates, cost of living pressures, and the lingering effects of the pandemic.

Moreover, nearly 9% of businesses operating in the food and beverage sector are forecast to close down in the next 12 months.

CreditorWatch Chief executive Patrick Coghlan warned that these businesses are “heavily reliant on discretionary spending” and will “continue to find it tough until consumers feel a reduction in cost-of-living pressures, which won’t happen until we see a couple of rate cuts”.

“Discretionary spending is one of the few ways that consumers can actively cut costs – whether that’s eating out less, buying fewer coffees at cafes or not seeing so many concerts or theatre shows”, he said.

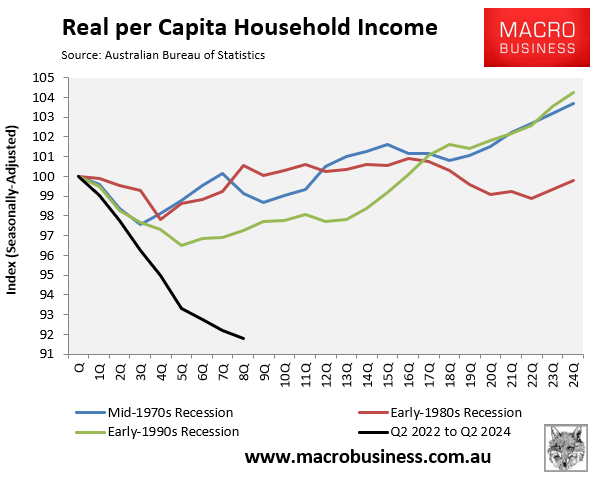

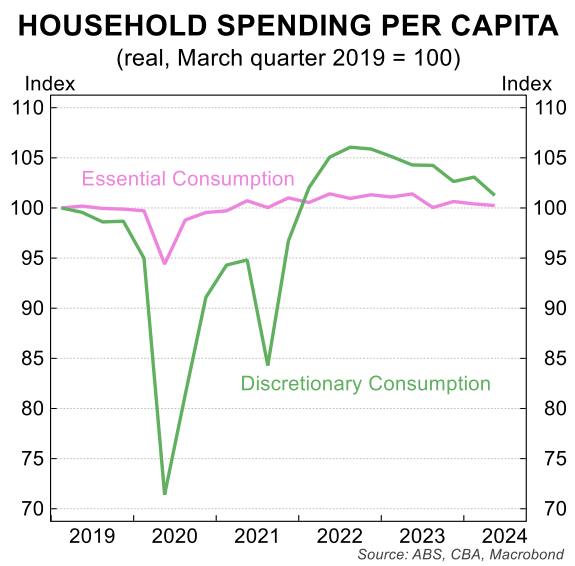

Australians have just experienced their sharpest decline in real per capita disposable incomes on record, which fell by 8% over the last two financial years.

This decline in incomes has prompted households to cut back on discretionary spending, including cafes.

The reality of the situation is that most Australians cannot afford to spend more than $5 for a coffee and $20 for smashed avocado and eggs on toast. Rampant price inflation has killed demand.

Thus, the twenty-year Australian cafe boom is now unwinding, with supply shrinking to meet demand.

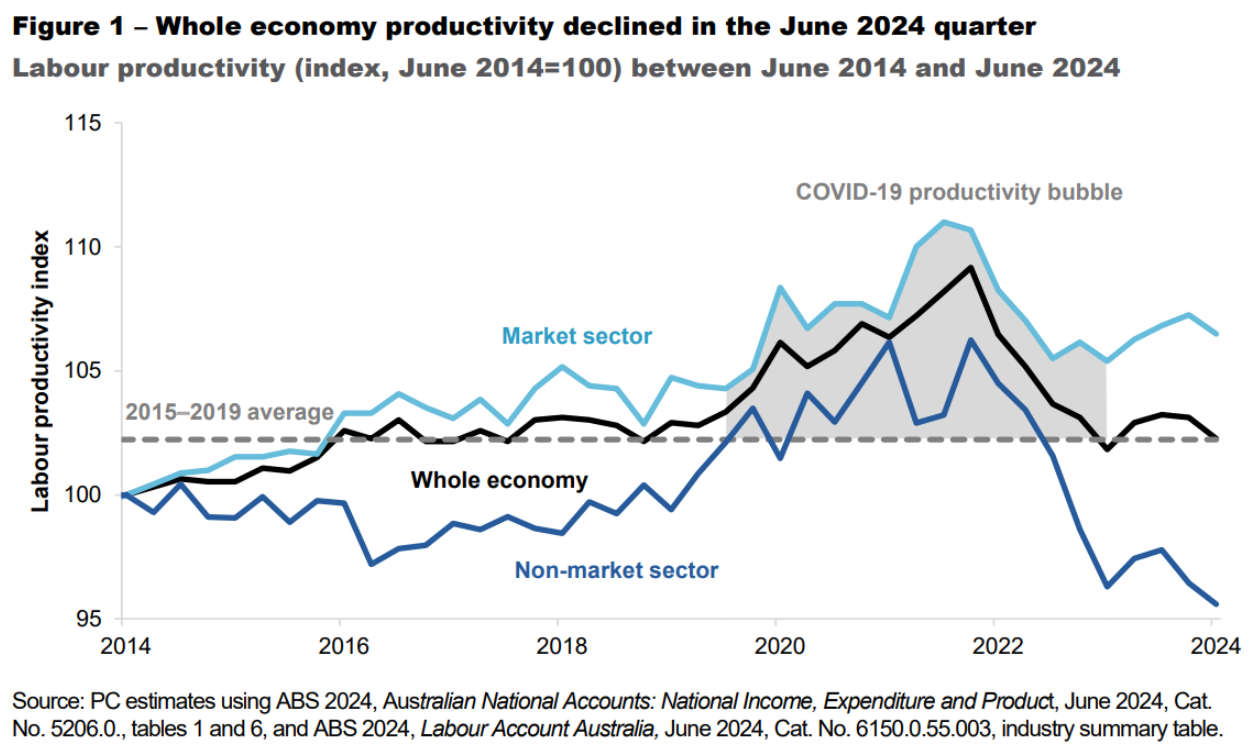

The upside is that hospitality is a low-productivity, low-wage industry, and labour and capital have the opportunity to shift to more productive areas of the economy.

The downside is that they will likely instead end up moving into non-market sectors like the NDIS, which suffers from even lower productivity.