Goldman with more on why the AUD is struggling to gain traction.

USD: Long wait to abdicate.

After showing some apparent cracks over the summer, the pillars of Dollar strength now appear just as solid as ever.

We had previously argued that the initial factors that weighed on the Dollar earlier in Q3 had mostly reversed, and last week’s employment report put an exclamation point on that.

While the news this week was more marginal, in our view both the CPI report and FOMC minutes imply that the Fed will at least not be in a rush to move quickly, while other central banks have recently been pushed to go a little faster.

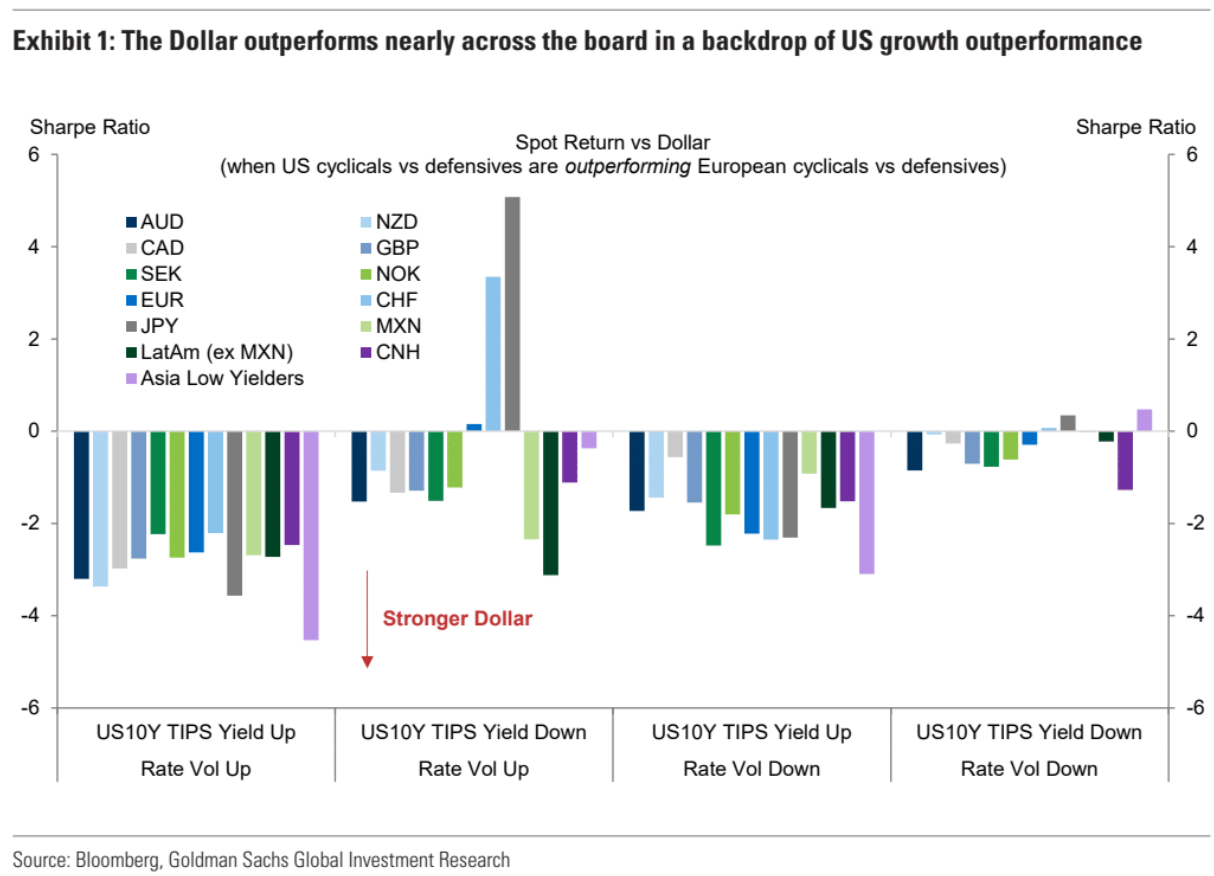

The Dollar’s broad-based strength in recent weeks is consistent with our findings that the Dollar outperforms nearly across the board in a backdrop of US growth outperformance, with especially strong returns when real yields and rate vol are both moving higher (Exhibit 1).

And we suspect that some of the momentum can be attributed to the macro backdrop moving into better alignment at the same time as election uncertainty and “tariff hedges” are back in focus for FX investors, so we think it will be difficult for the Dollar to give back this ground quickly over coming weeks, unless China stimulus delivery surprises significantly to the upside.

Which it did not. The reverse, in fact.

More AUD pressure ahead into the US election.