DXY is back as the safe haven as bombs fall in the Levant:

An overbought AUD retraced:

Oil and gold to the moon!

Dragging up metals:

Miners have held the gains:

EM faded:

Junk pulled back:

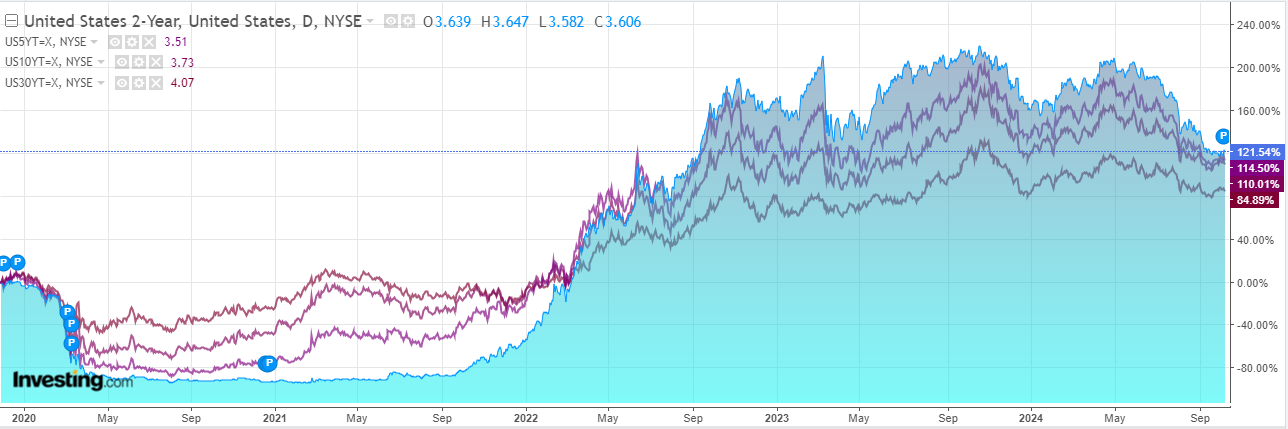

Haven bonds were bid despite oil telling you inflation is cooked:

Stocks fell:

Much ado about nothing is the base case in the endless Israel War.

It’s in nobody’s interests to escalate beyond the lobbing of symbolic missiles.

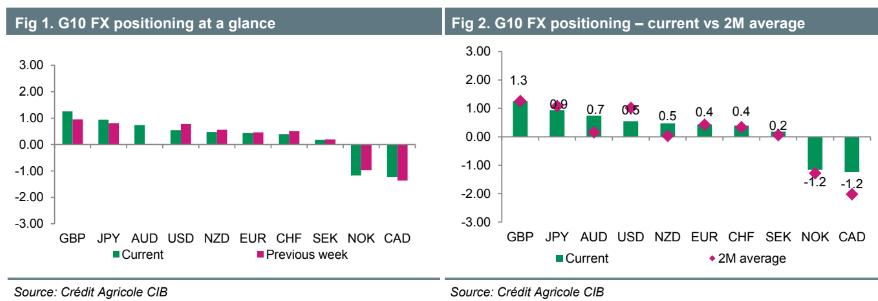

Still, it’s chance for overbought markets to correct. The AUD was certainly one of those. Credit Agricole:

At present, the G10 FX PIX 2.0 signals that the AUD is overbought.

We have temporarily suspended the model’s trading strategy for maintenance though and we hope to be able to report new FX trading signals soon.

The AUD saw new buying interest last week, predominantly driven by IMM flows.

Our FX flow data points at banks and hedge funds inflows, as well as corporates and real money investors outflows.

All in all, the AUD is in overbought territory.

I still think there is one more up-leg for AUD as global easing accelerates but the easy money has been made.