DXY finally flamed out:

Cutting AUD some slack:

And North Asia:

Gold is going to end badly. Oil bounced:

Dirt down suggest the Chian stimulus leak was not well received:

Miners same:

EM same:

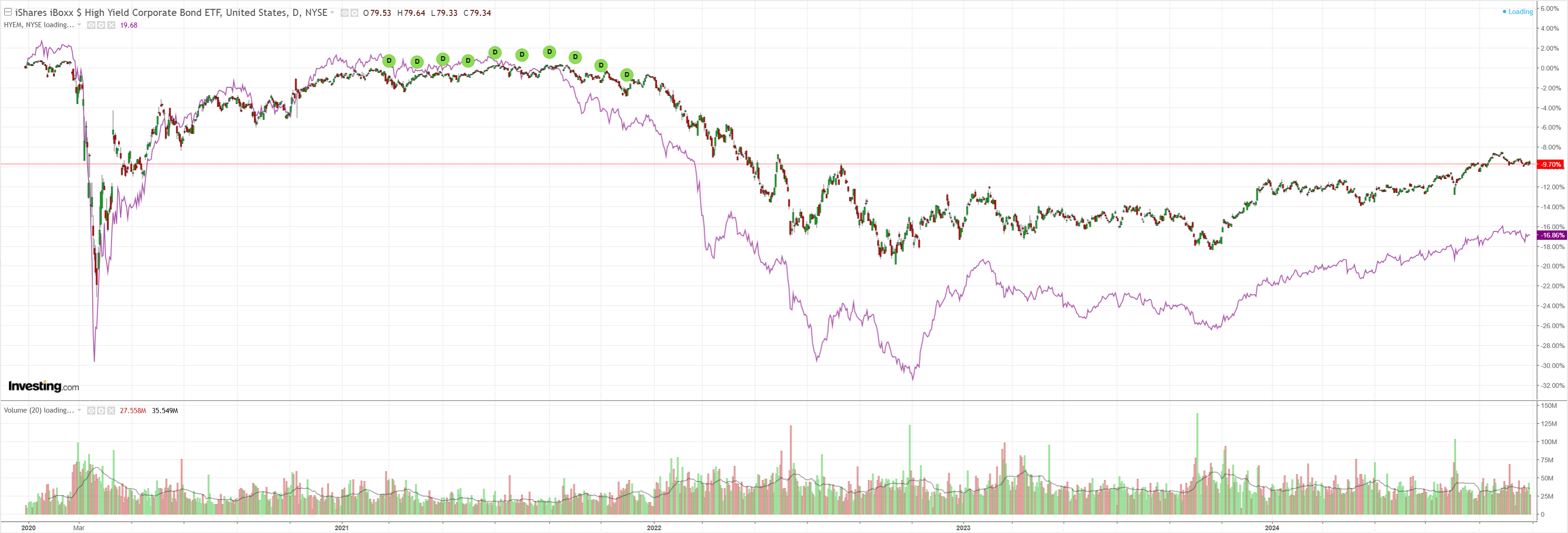

Junk is worried:

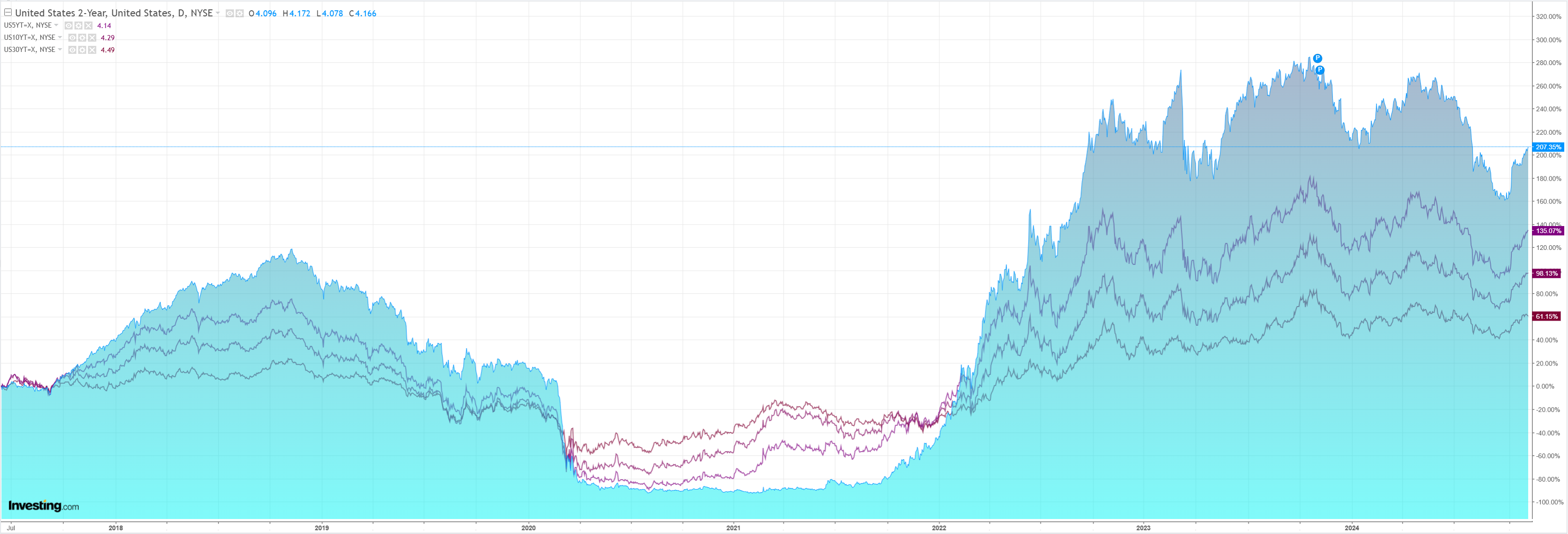

As yields climb while robots sell:

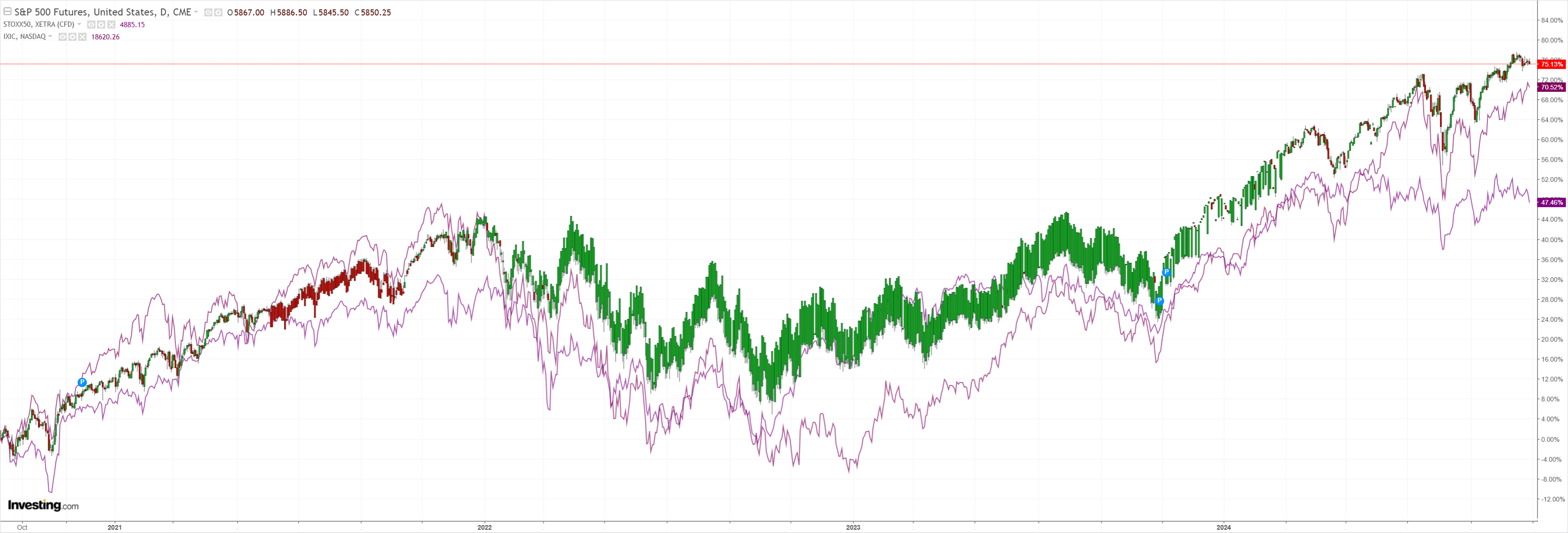

Stocks are going to get pressure:

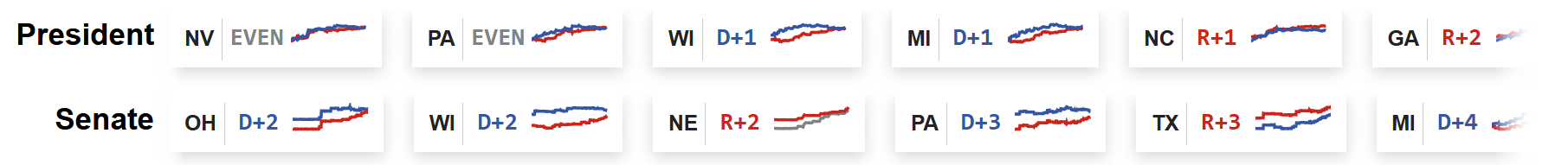

White House fever appears to have finally broken as markets realised they were all in on one horse in a dead even two-horse race.

As well, the fading of the Crap Complex – dirt, miners, EM – suggests markets are not happy with the leaked 10tr yuan stimulus package out of China. Nor should they be given its meek impact on growth.

So, two fevers broke yesterday, one that has been driving AUD down and the other up.

This suggests we are unlikely to see much of a rebound in AUD before we get resolution in the US election and how that will affect China.

So, we are back to where we started.

A Trump win sends AUD to Hell and a Harris win sends it to Heaven. The latest swing state polls have a nudge back to Hzrris:

Unless you have some kind of paranormal handle on the US polity, I recommend sitting this one out!