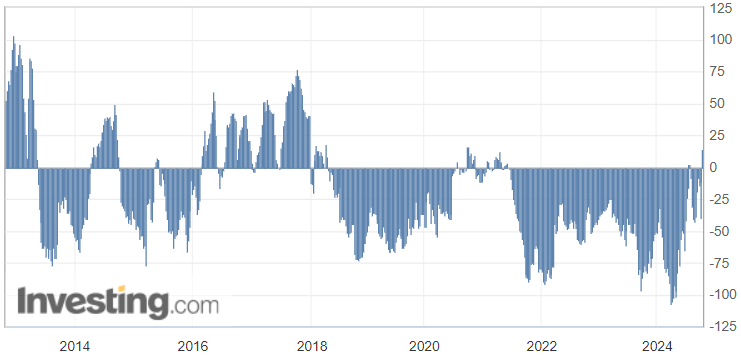

Australian dollar bulls are longer today than at any time since 2018:

Which is a contrarian signal as they get minced by DXY recovery:

AUD slain:

If CNY rolls, China stimmies go bye,bye:

Oil is about to become a global anti-semitism index. Bombing Iranian oil is a bad idea:

Metals are stalled:

Big miners too:

EM needs stimmies:

Junk isn’t worried:

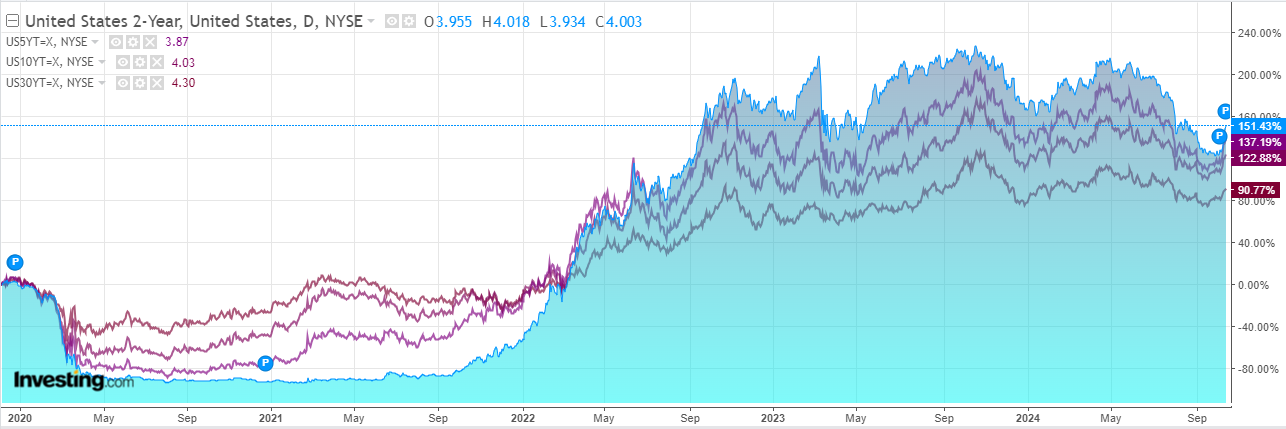

Yields track oil:

Stocks do the opposite:

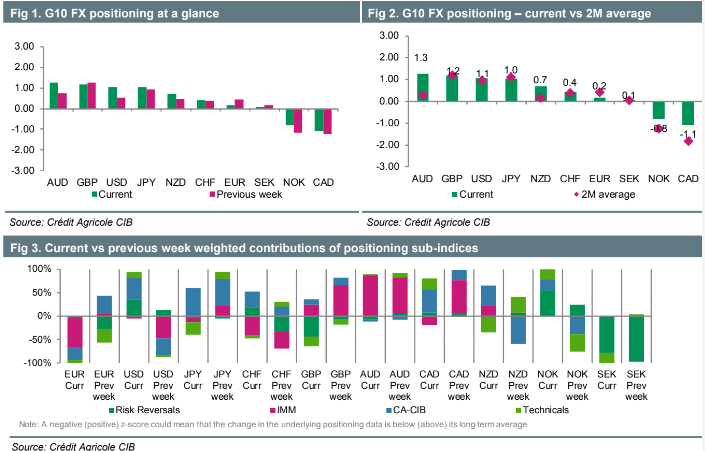

Australian dollar bulls have run head first into the global mincer. Credit Agricole:

The AUD took over as the G10FX’slargest long position following extra buying interest last week, predominantly driven by IMM flows.

Our FX flow data points at corporates and real money investors inflows, as well as banks and hedge funds outflows. All in all, the AUD remains in overbought territory.

The window for aggressive Chinese stimulus is rapidly closing as US exceptionalism and the Isreal War limits the Fed.

AUD going from boom to bust.