DXY is taking a breather:

AUD is not:

Flushed away with CNY as stimmies fail:

Commods too:

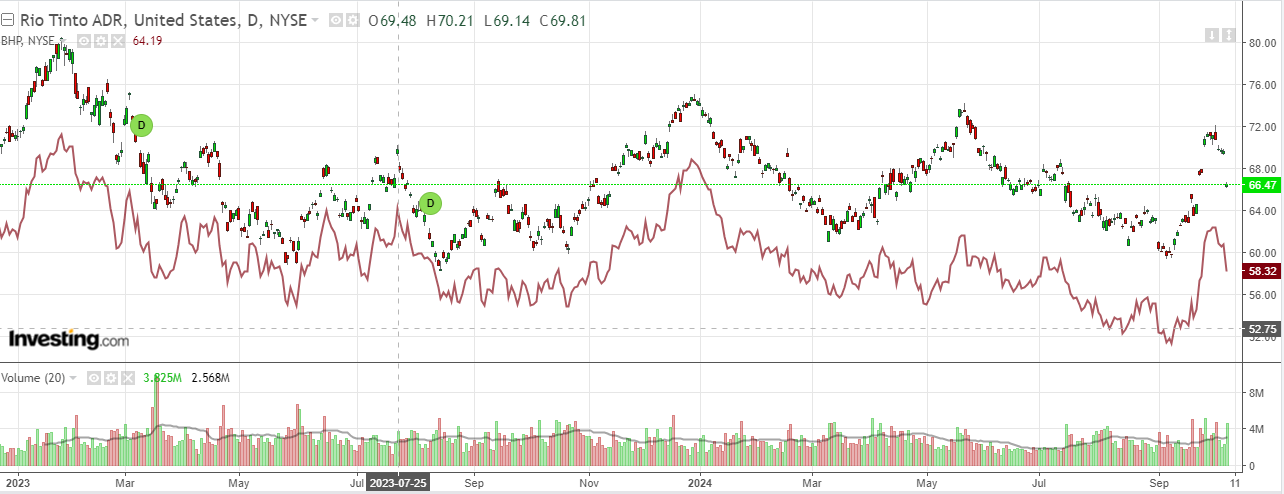

Miners ouch:

EM was not as bad:

Junk is serene:

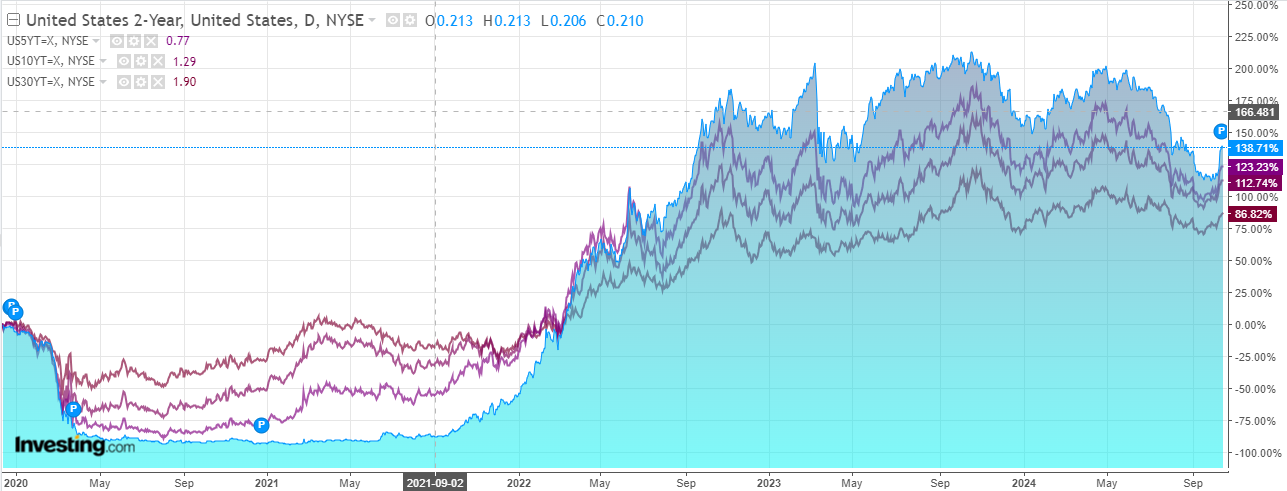

Nonetheless, yields backed up a bit. This is positional in my book:

Stocks just won’t sell:

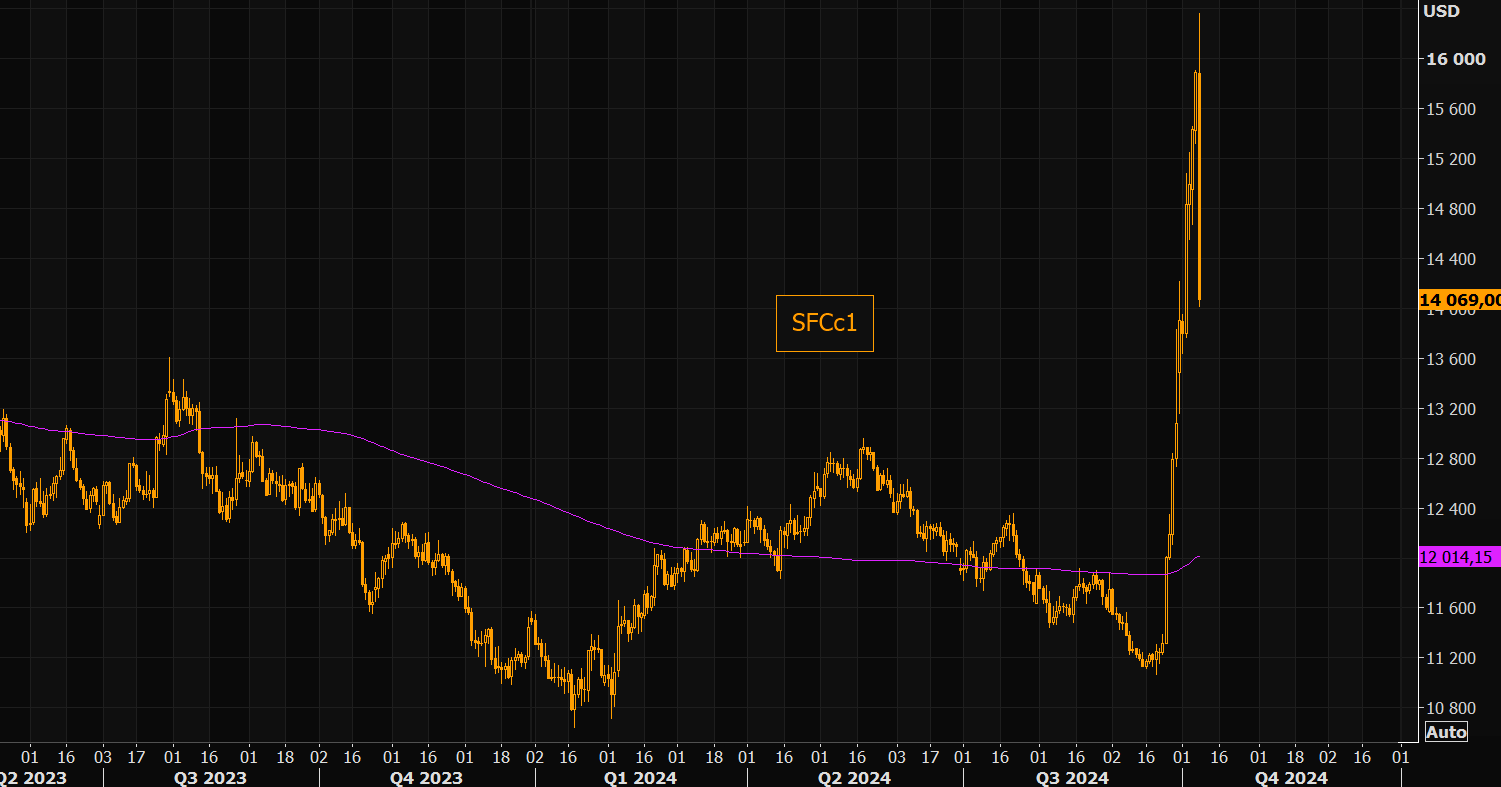

China pulled the rug with no new stimmies yesterday from the NDRC.

This is significant, especially for bulk commodities. The NDRC governs major projects and it knows if any more are coming. Nope.

The chain was pulled on Chinese stocks in the worst single day crash for Hong Kong since 2008:

This is the trouble with a policy driven market attached to a dictator.

You really need to know if he got laid to invest.

With the US economy in good shape, Aussie rate cuts imminent and Chinese stimmies modest, AUD doesn’t have a leg to stand on.