The DXY face-ripper finally eased:

AUD firmed:

North Asia too:

Gold bubble alert. Oil is caput:

Commods did better:

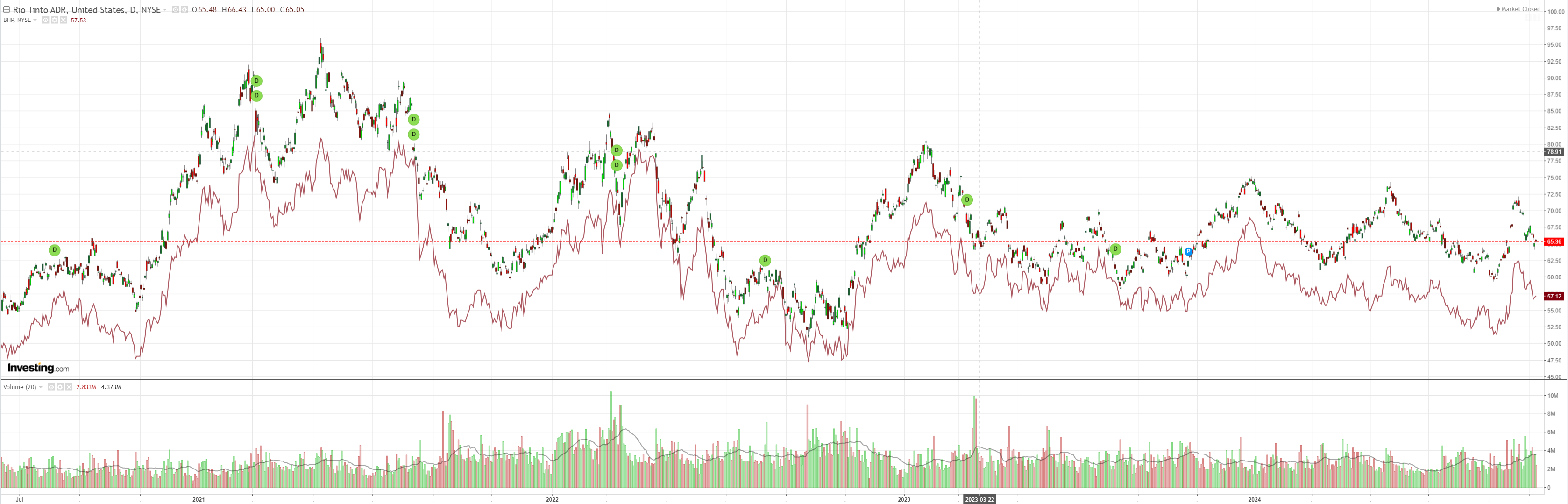

Miners stopped falling:

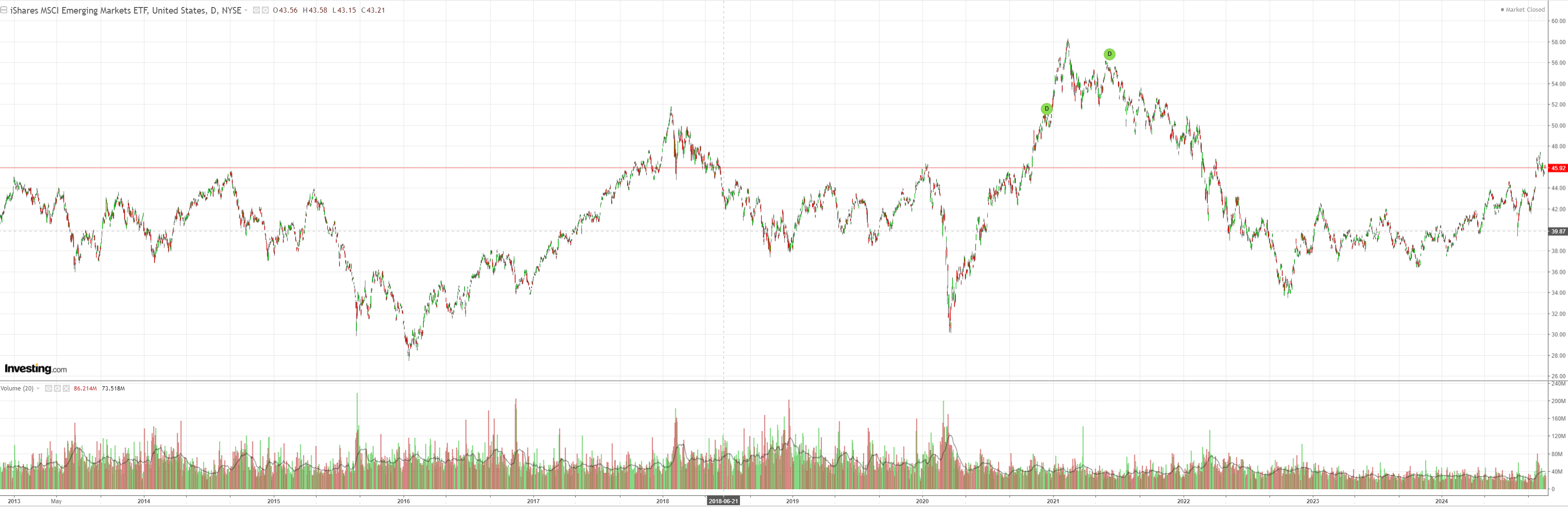

EM yawn:

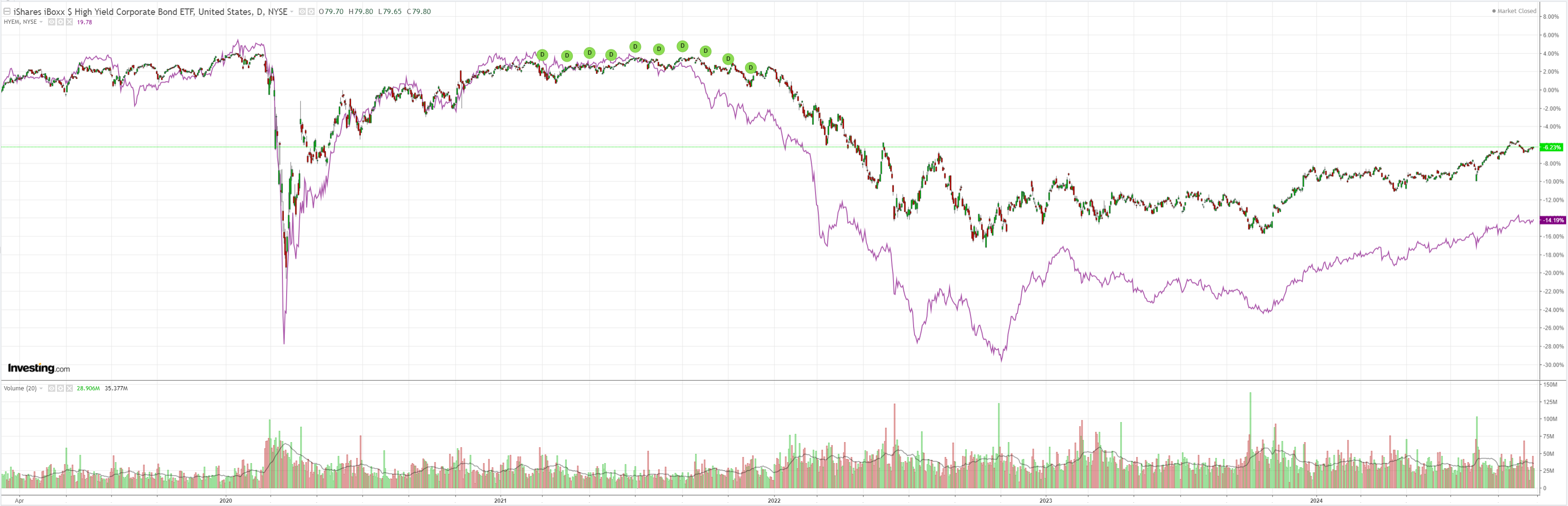

Junk snooze:

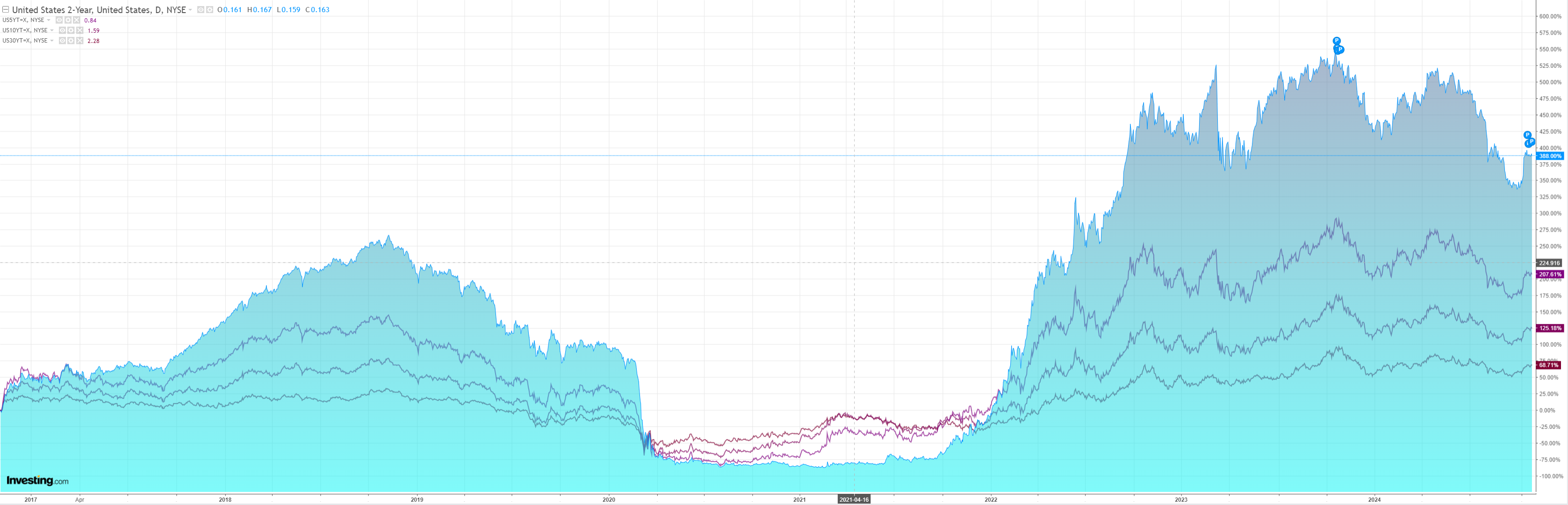

Yields stable:

Stocks only go up:

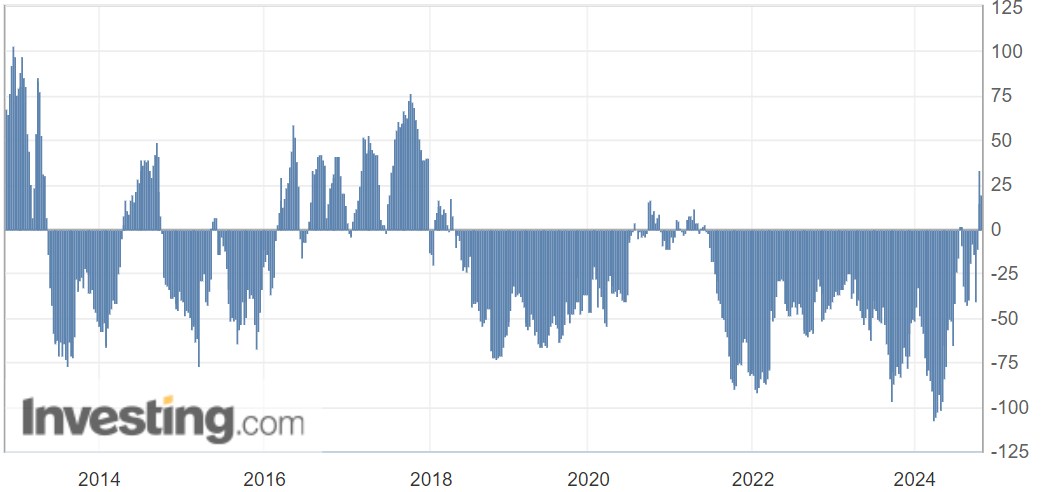

Markets are still long 19k contracts for AUD, opening the way for more falls into the US election:

Goldman has more on why:

Dollar strength has broadened, and our broad Dollar TWI has reached new highs for the year.

In our view, the recent strength reflects the macro environment becoming more aligned with tariff hedges just as the US election draws into view (and prediction markets have shifted towards Republican outcomes), unlike over the summer when similar shifts in election probabilities coincided with negative Dollar news.

The ECB meeting this week provided a useful window into the macro dynamic.

At the same time as the ECB went slightly further than we had expected to acknowledge that weaker activity news would weigh on the inflation outlook, the US reported stronger activity data across the board.

Rather than fading, US exceptionalism seems to have re-emerged.

Meanwhile, market disappointment with recent China policy announcements…

…but we do see building two-way risk into the election now that FX marketsare beginning to price a clearer tariff premium, unlike much of this year.

Good summary. I still favour AUD downside into the election, and more again if Trump wins:

Good luck picking that winner.