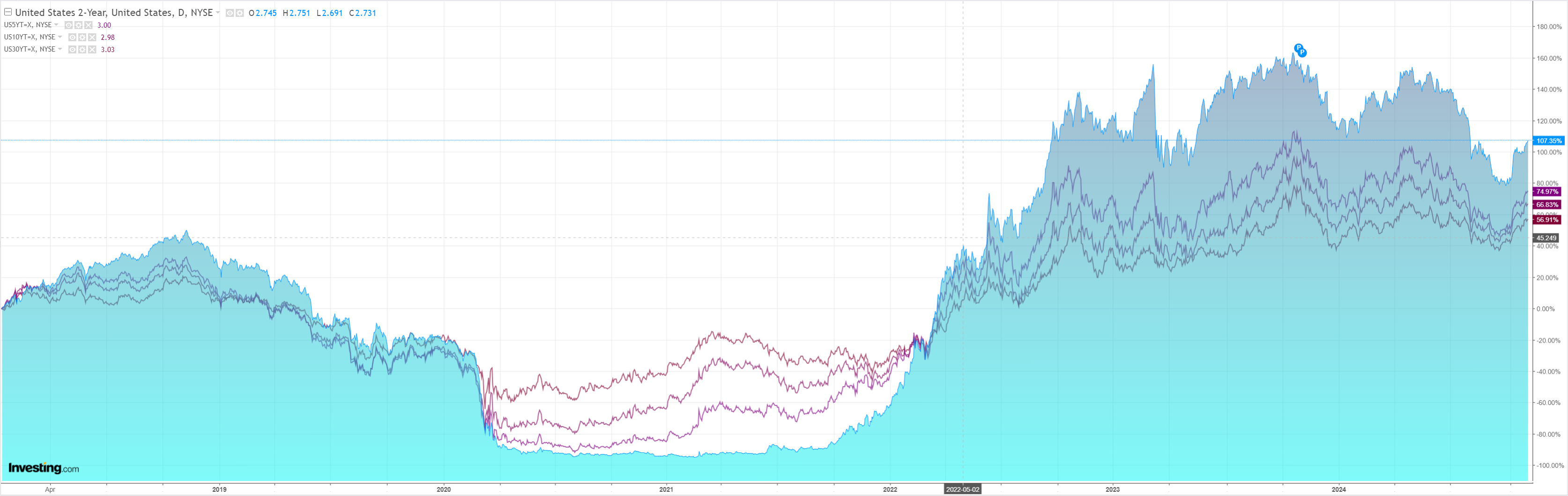

DXY was back Friday night:

AUD knows no bottom:

North Asia is buggered as BOJ hikes pause and Chinese cuts intensify:

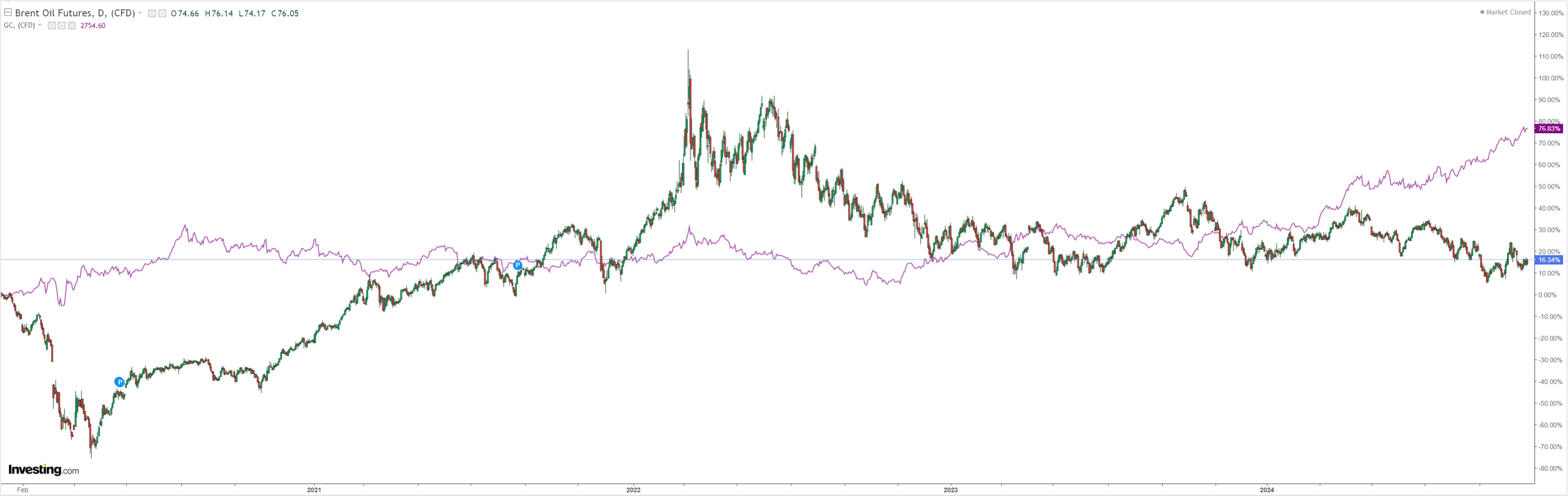

Oil will be tested after Israel’s benign response to Iran. Gold is a bubble:

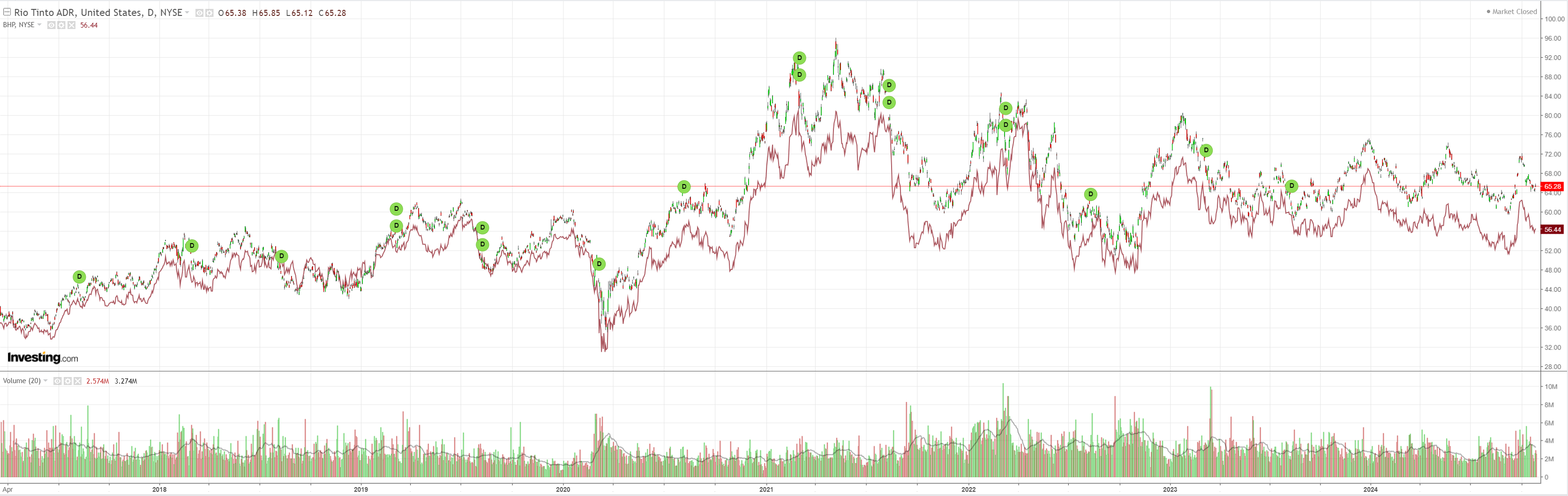

Base metals can’t decide:

Miners stopped the rot:

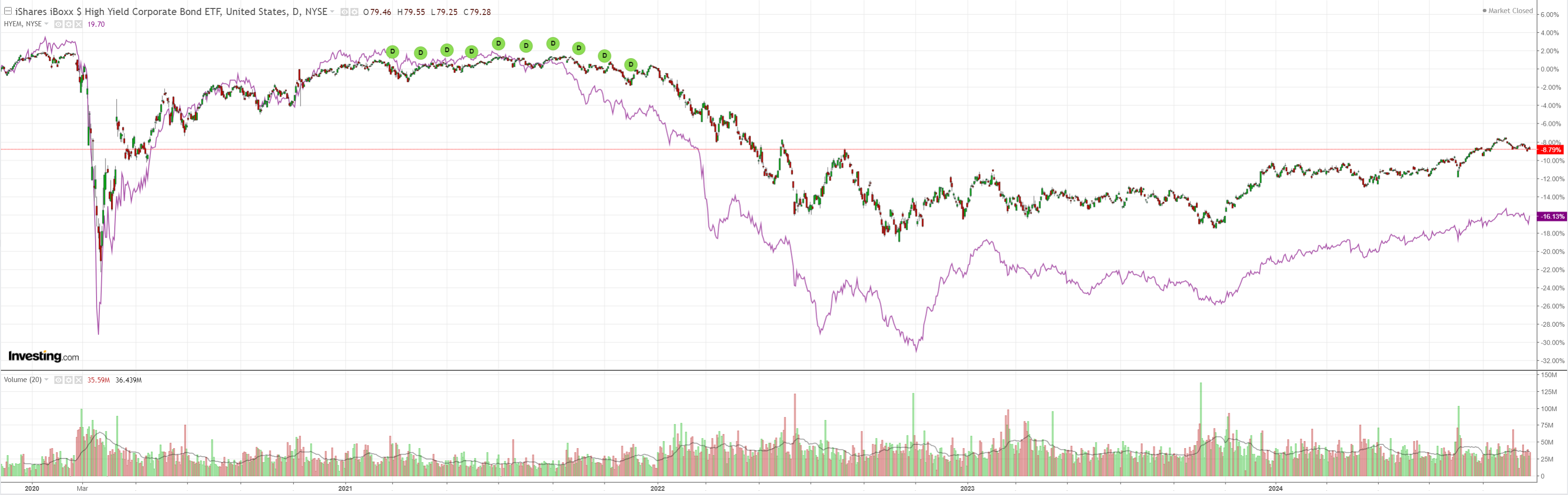

EM meh:

Junk saved itself:

But yields still up:

Stocks meh:

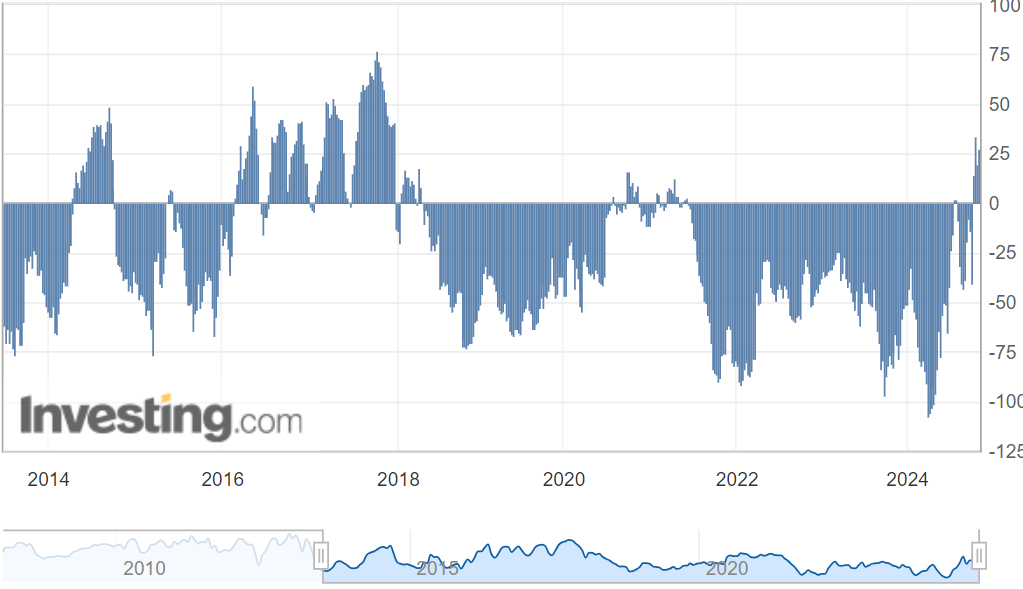

Remarkably, CFTC moved longer even as AUD crashed:

I have never seen a forex market move so strongly against market positioning. If China disappoints and Trump wins (both base cases) a rush to the exits may crater AUD.

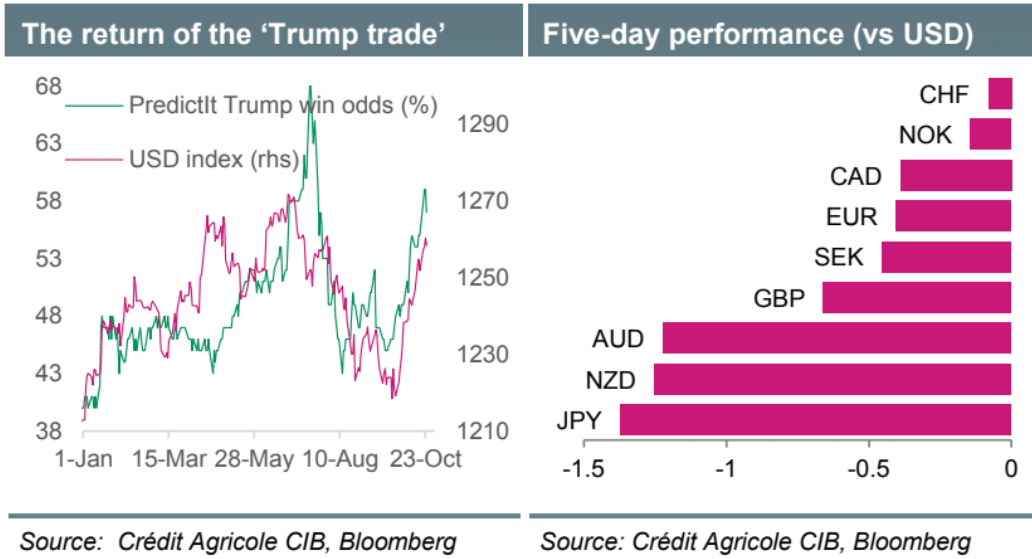

Credit Agricole has more on positioning:

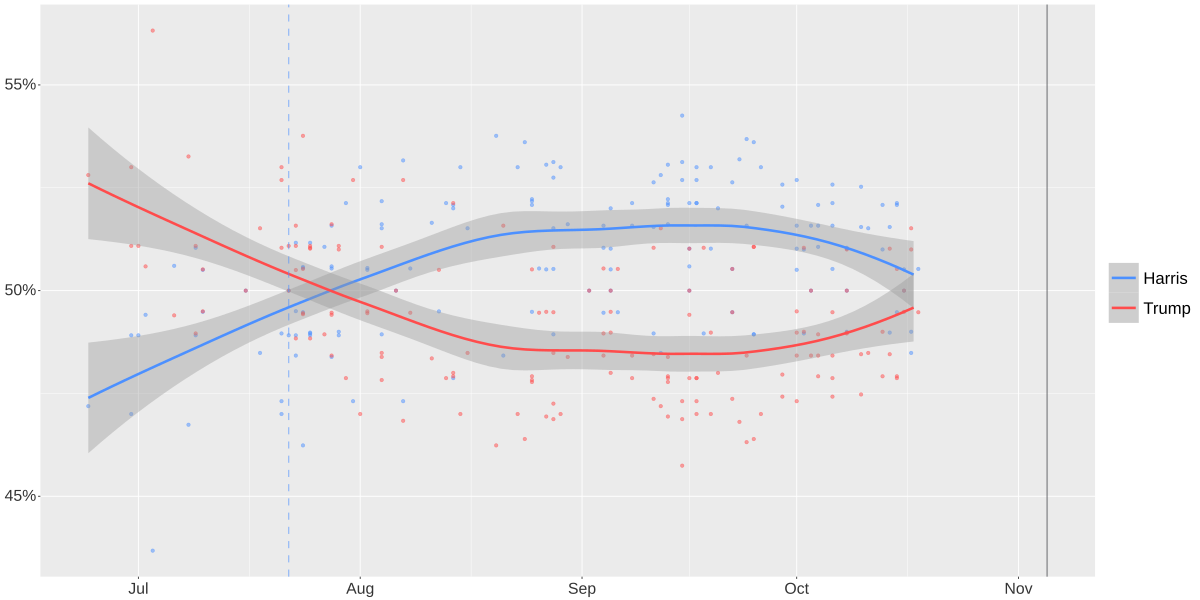

With the 5 November US presidential election fast approaching, improving odds of a Donald Trump victory have encouraged fixed income investors to put on ‘Trump trades’ once again.

The USD has rallied as a result, and a key question for FX investors at present is how much of a bump can the USD get from a Trump victory and/or how much of a downside should we expect if Kamala Harris wins.

Given the still-significant uncertainty surrounding the election outcome, FX investors do not seem to be running major USD-longs, according to our FX Positioning data.

We also believe that a big part of the recent USD gains reflects a reassessment of the market’s dovish Fed view on the back of recent positive US data surprises.

Recent client meetings have also suggested that global corporates may have largely completed their FX hedging programmes that traditionally led to broad USD-selling into year end already in Q324.

The above could suggest that a Trump victory, coupled with a ‘red wave’ in US Congress, could trigger a USD rally as more FX investors jump on the ‘Trump bandwagon’ while corporate USD-selling stays subdued.

The USD could come close to its 2024 highs as a result.

We also doubt that a Harris victory would lead to an aggressive USD selloff like the slump inthe wake of Joe Biden’s victory in 2020 given the currency’s still-superior rate advantage and the relative resilience of the US economy.

My own view is that a Harris win means AUD goes straight up, and vice versa: