DXY finally took the day off:

But AUD went no bid anyway:

North Asia enjoyed a relief rally:

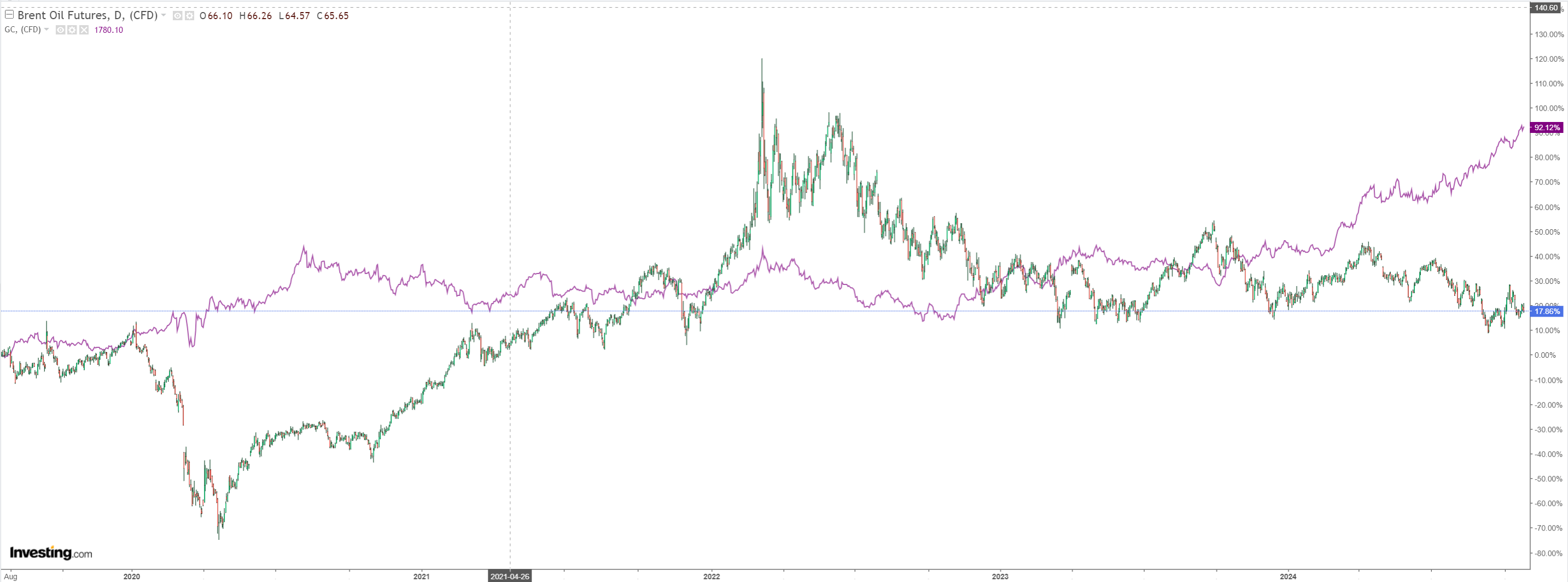

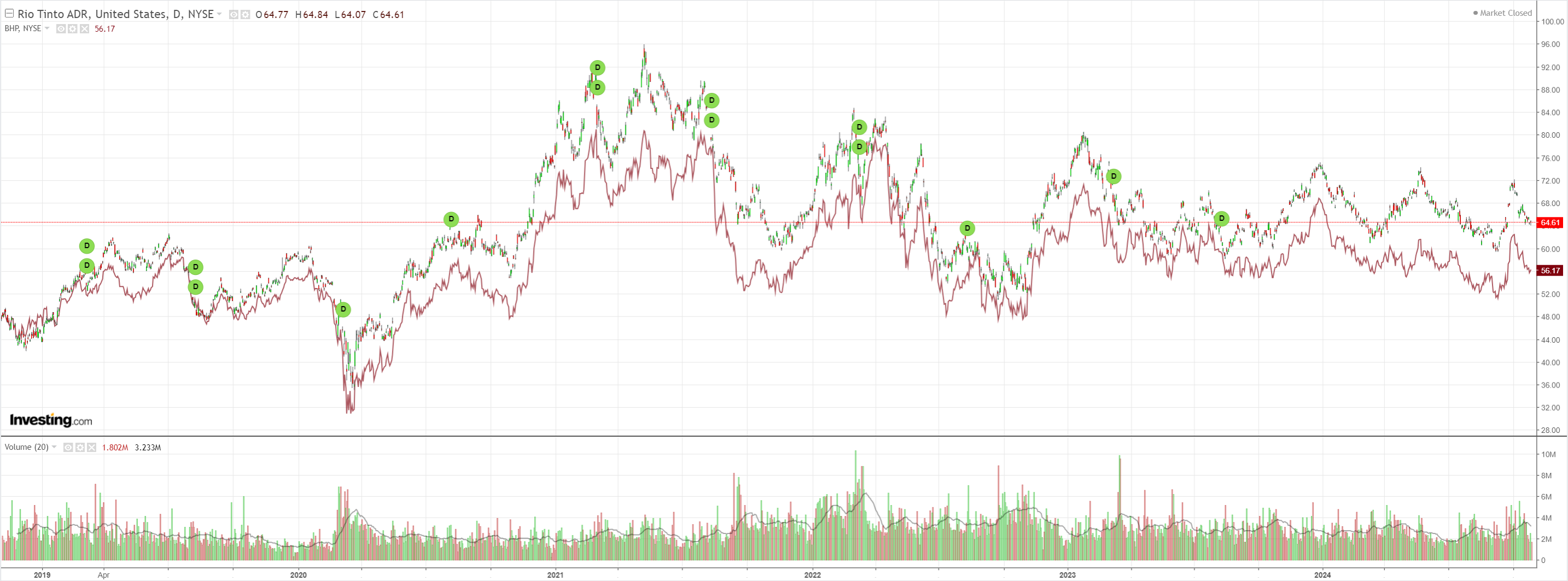

As did the crap complex of commods, miners and EM:

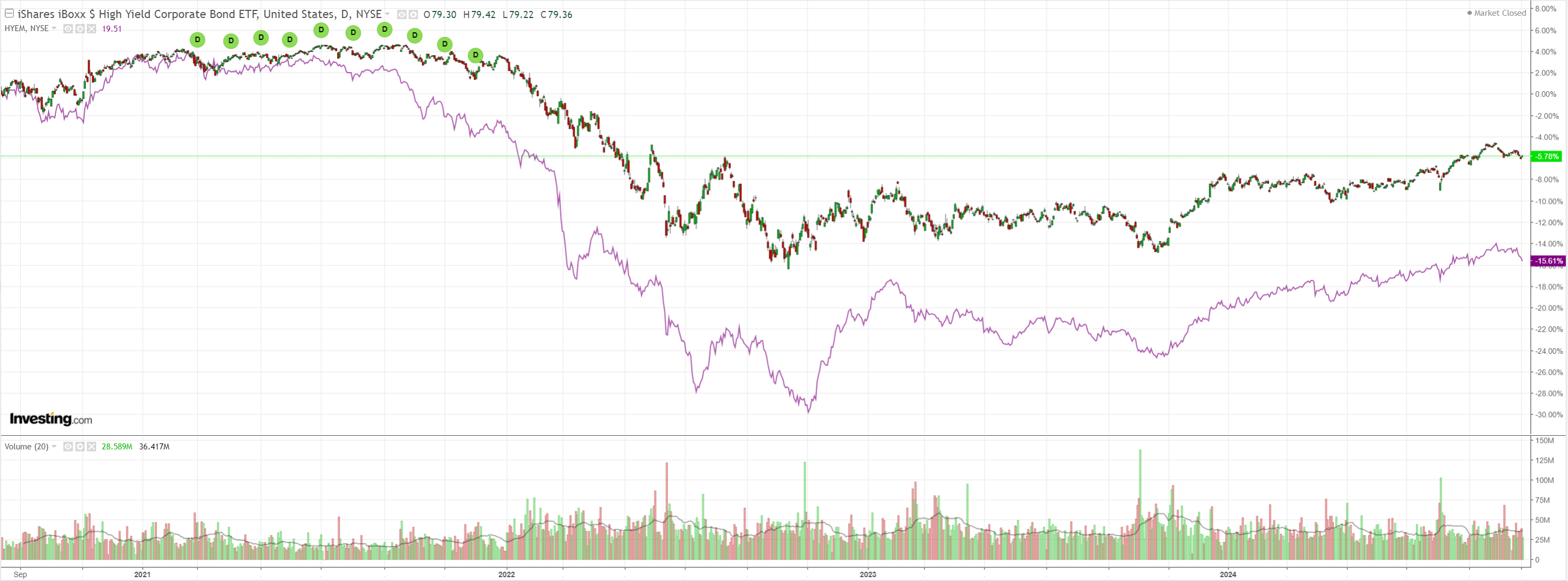

But not junk, which is a worry for risk:

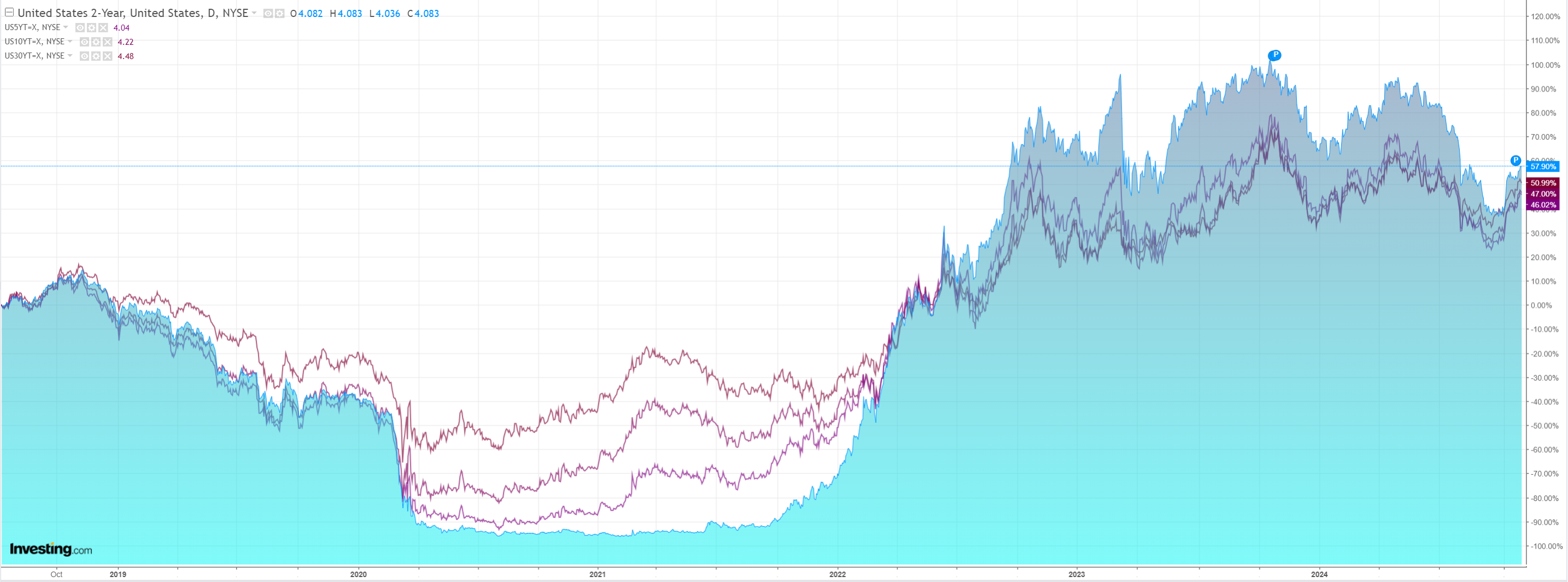

Eve though yields fell:

And stocks eked out gains:

Credit Agricole sums up the obvious:

Based on the feedback from our conversations with FX investors, our analysis focuses on two key scenarios ahead of the election: (1) a DonaldTrump win and a ‘red wave’ of US Congress that could reignite inflation risks and thus force the Fed to adopt a less dovish stance; and (2) a victory by Kamala Harris coupled with a divided US Congress that should preserve the status quo of Fed easing and a soft landing in the US in 2025.

We expect a Trump victory and a ‘red wave’ of US Congress to spark a USD rally due to expectations of trade tariffs, extra fiscal stimulus, stickier inflation and a less dovish Fed. Any attempts by Trump to pursue a ‘weak USD doctrine’ could fail like they did in 2018. While a Trump victory would not be the surprise it was in 2016, the c.4% USD rally in the wake of the 2016 election could still be a useful benchmark given the USD’s current huge rate appeal and the prospect for a soft landing in the US.

A Harris victory could, similar to JoeBiden’s election in 2020, weigh on the USD initially, as Trump hedges are unwound. We doubt that the USD would fall by 4% as was the case in 2020, however. Indeed, while the Fed easing cycle would remain an important negative for the currency, the FOMC’s dovish stance should also help engineer a soft landing in the US in a boost to the appeal of USD-denominated assets.

Coloured waves tend to be the fantasies of political strategists. Other than that, this looks about right to me.

Very binary for AUD which appears to be the source of its paralysis.