DXY has paused for now:

AUD has not and long positioning means it can keep falling. If it breaches 0.65 its uptrend is broken and all bets are off:

North Asia is ugly:

Gold is in blowoff. Oil might break:

Metals are in purgatory:

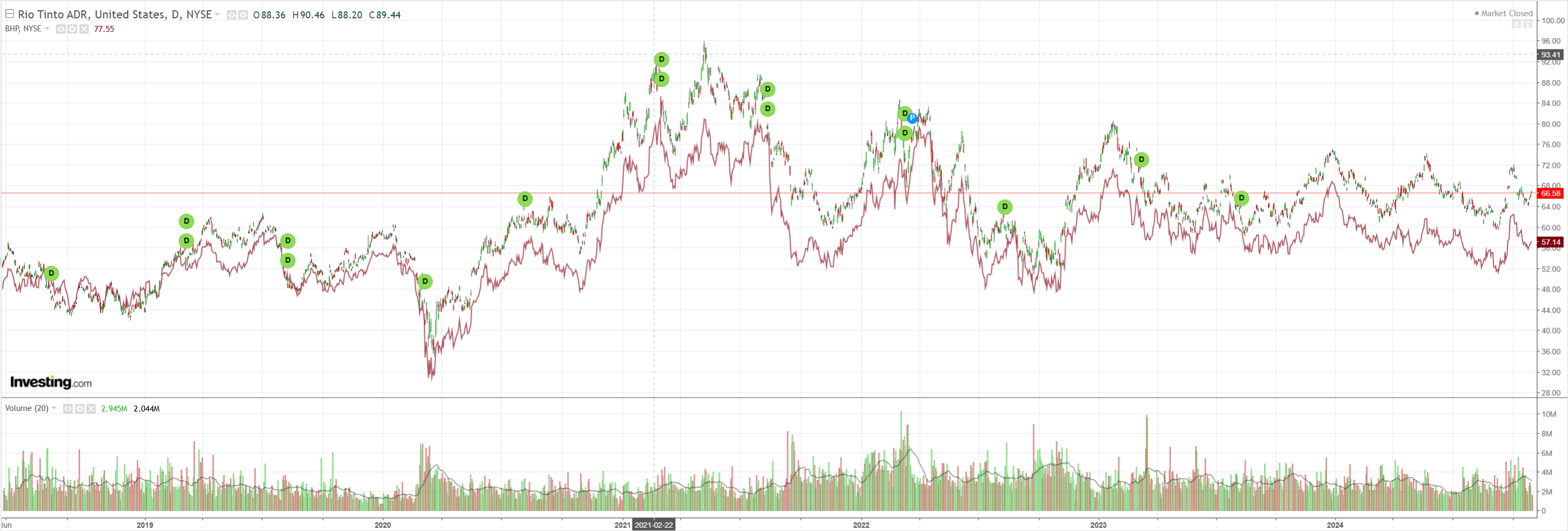

Miners too:

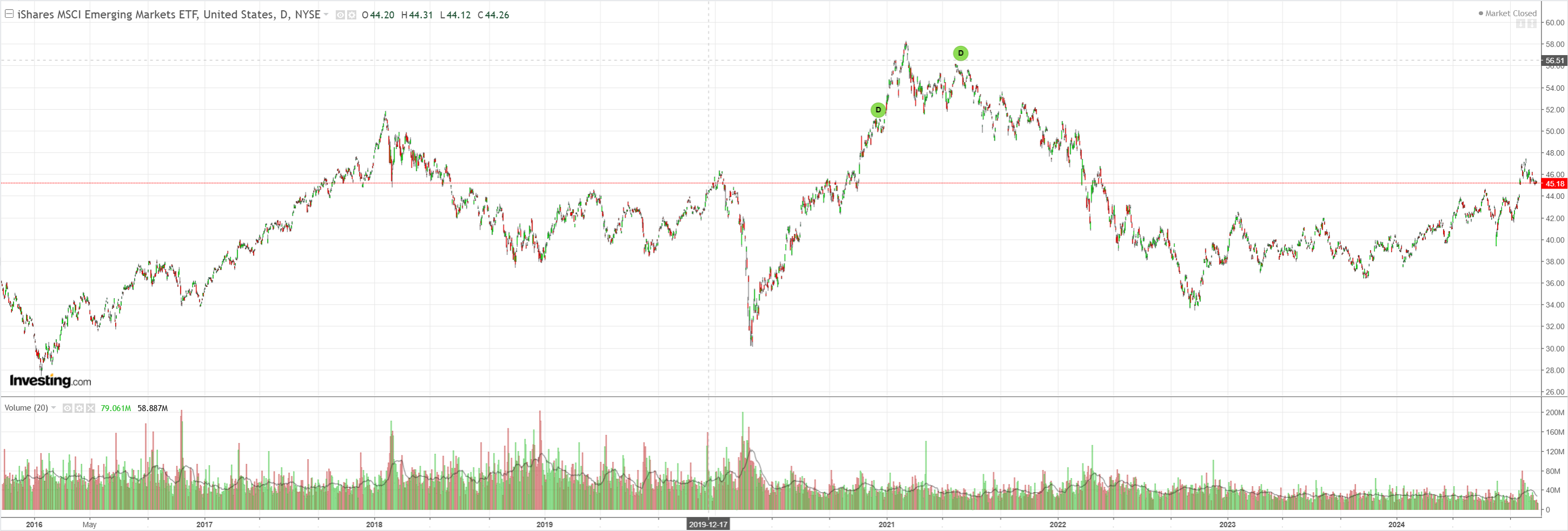

EM is stuffed:

Junk nervy:

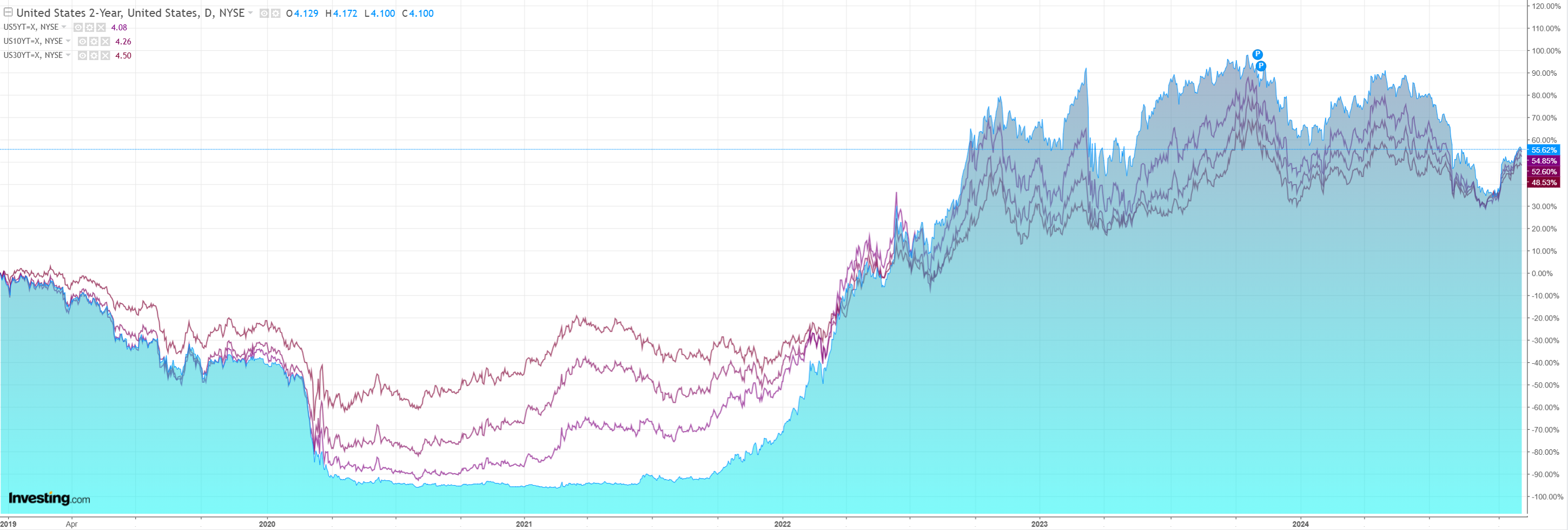

Yields down:

Stocks up:

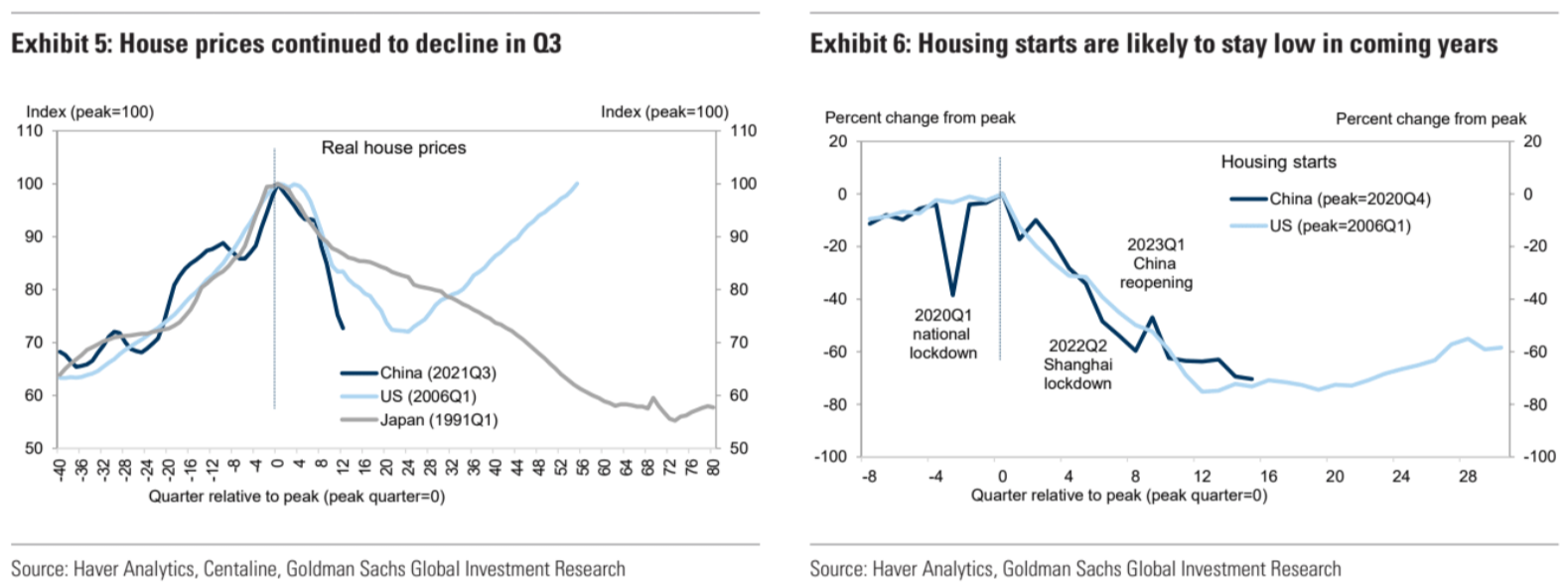

Goldman captures the moment nicely:

The debate this week has ranged from whether markets are already almost fully pricing a Republican victory to whether all of the recent moves can be attributed to economic news….

…But we think there are some clues that both forces are at work, and the correlation between Republican prediction market odds and the Dollar’s outperformance versus rate differentials is not spurious.

First, we calculate the response of EUR/USD to data surprises using our USMAP index.

We find that the sensitivity has increased significantly in recent weeks, which shows the compounding issues at work (Exhibit 1, left).

While US data surprises have turned positive, and the divergence with the rest of the world has grown, there is also more “follow-through” in the market than normal.

Next, we take advantage of cross-market correlations to show that some currencies are showing clear signs of a tariff premium (Exhibit 1, right).

In particular, it is notable that (i) most currencies have underperformed their expected returns against the Dollar (this is also true in our G10 models), and (ii) both MXN and KRW are particularly sensitive to tariff risks and have been clear outliers over the last couple of weeks when election risks were in focus.

This is not to say that our tariff expectations are fully embedded in market pricing, or close to it.

Our understanding is that our economists’ tariff scenarios are generally larger and implemented sooner than market consensus.

But more importantly, we note that FX responses to tariff outcomes rely heavily on how far the Yuan anchor moves.

And that yuan move will drag AUD to hell.

That said, I noted weeks ago that markets had not priced Trump.

Now he is overpriced so a Harris win will send the AUD straight up.

Bizarrely, it appears speculative positioning (not price) suggests markets are betting on a Trump win in the USD and a Harris win in the AUD.

Perhaps it is some huge long/short.