The US dollar is up and away:

AUD is in free fall though its uptrend is intact:

North Asian has fallen through the trap door:

Oil is caput:

Metals hate DXY:

Miners ouch:

EM yawn:

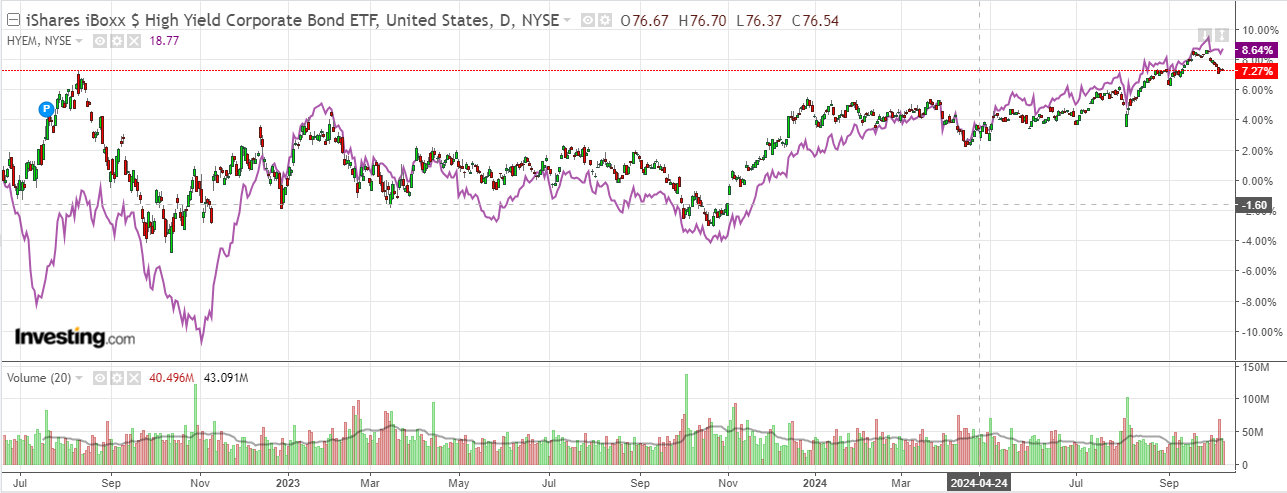

Junk no worries:

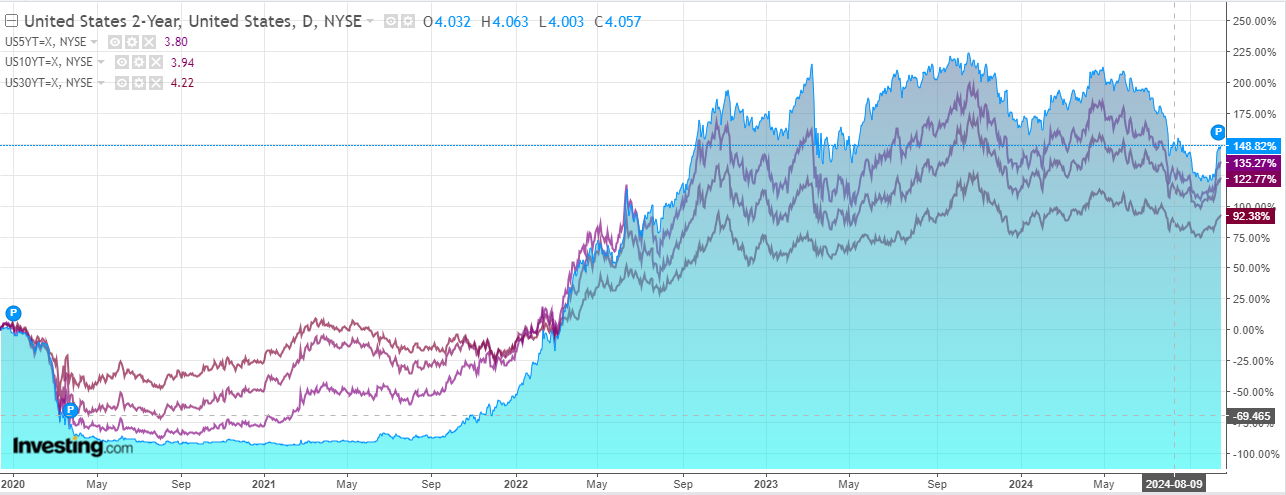

Yields back-up ongoing:

Stocks ATH:

The Fed minutes were less unanimous on 50bps than it appeared but it was still a “substantial majority” decision.

More importantly, tomorrow is US CPI day. I have reason to expect anything other than ongoing disinflation.

If so, it may be enough to rescue AUD from its swoon as yields roll over again.

Or we get a firmer number and markets price out more Fed easing:

My guess is on the former.

If we add the Chinese Ministry of Finance presser on Saturday, AUD looks ripe for a reversal higher in the near term.

Beyond that and into 2025, I can’t see us blasting higher barring an unexpected Chinese bazooka (I’m talking trillions of yuan for the real economy).

It’s odds-on for a hard RBA pivot in December and NZ is slashing rates.

A grind higher perhaps on a marginally better year for global growth (unless Trump wins) but hard yakka nonetheless as the iron ore ice age steadily plays out and deeper RBA cuts firm.