DXY is up and how:

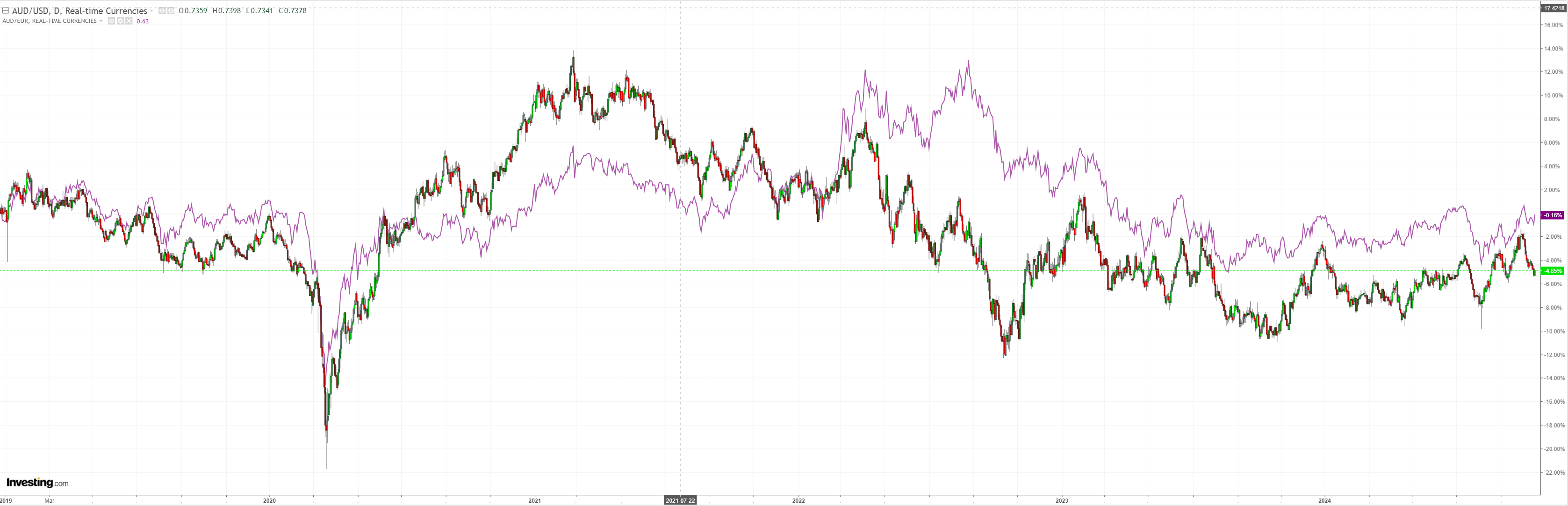

AUD fought it for a day after the NDIS jobs release:

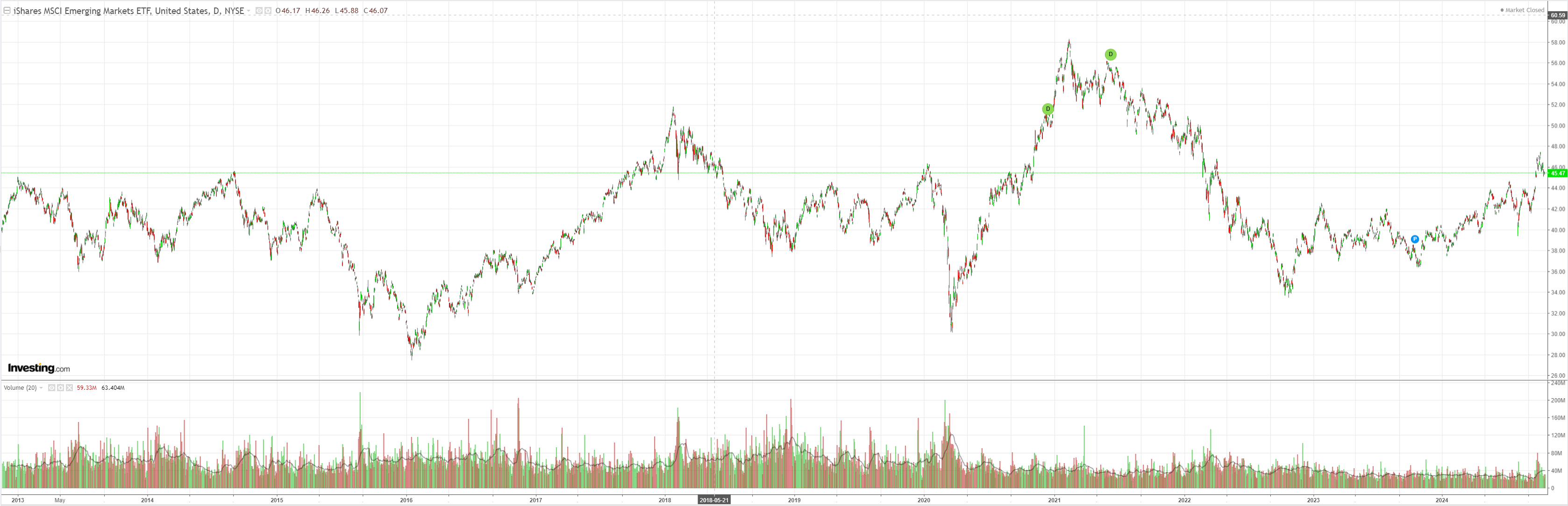

North Asia is cooked:

Gold is completely dislocated from all traditional supports. Other commods are cooked:

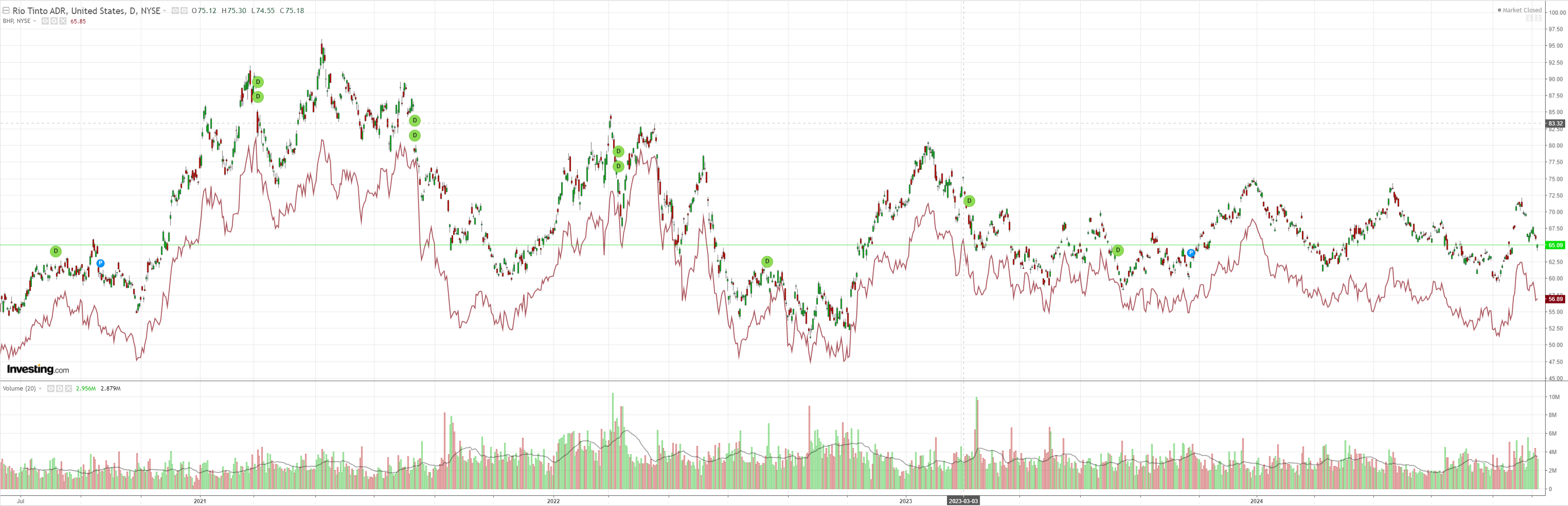

Miners mashed:

EM ouch:

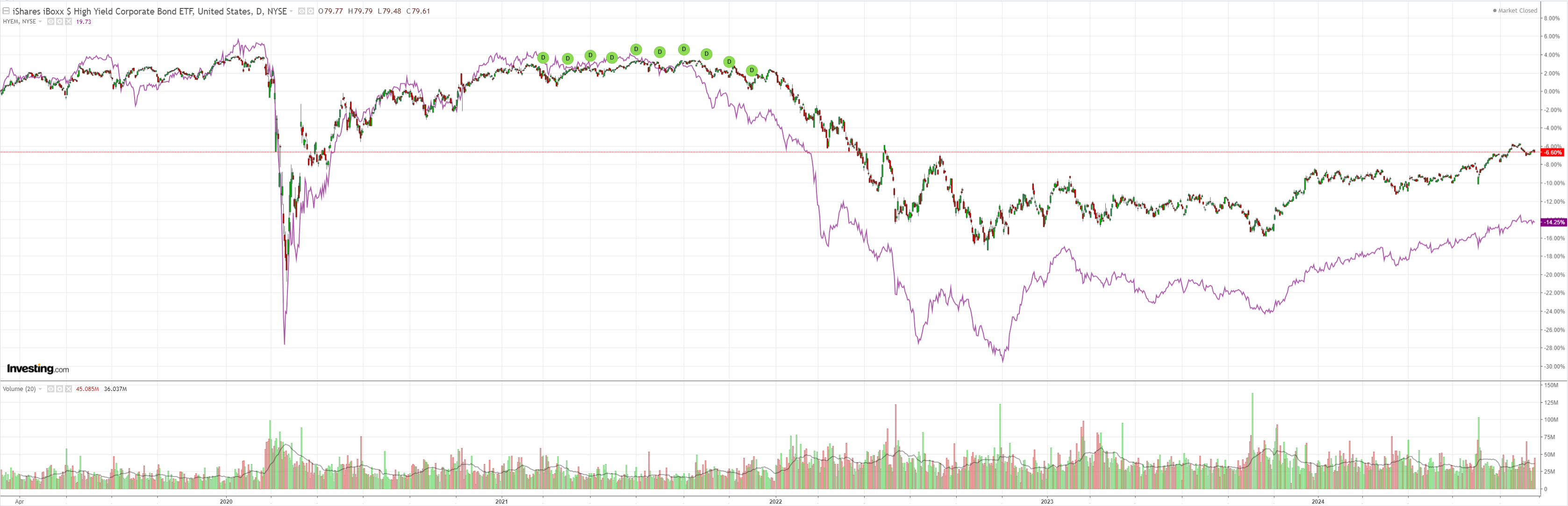

Junk is feeling nervous:

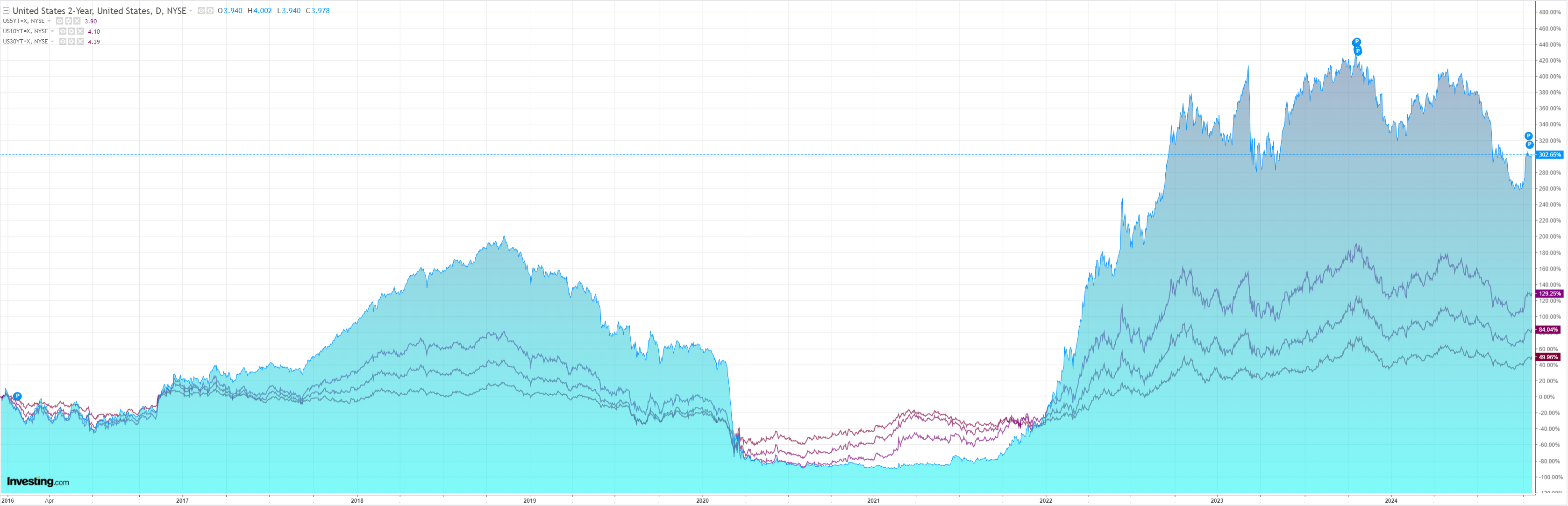

Yields firmed:

Stocks stalled:

AUD jumped on the strong NDIS jobs report as we all work at Sunnyfields now.

But this misses a much bigger story:

A red sweep of the US election is rising:

And markets must price it:

To be clear, a red sweep would guarantee two macro outcomes:

- big new tariffs;

- big new tax cuts.

Both are inflationary and strongly DXY positive.

Both are also extremely China-negative, as they prevent it from easing further unless it is prepared to let go of the yuan.

Which I guess it will unleash trade hell.

To me, it is not at all clear that equities will benefit in this scenario beyond an initial surge but what is more certain is that the US economy will do better than most and Australia worse than most.

Fade any AUD rally headed into the US election while Trump charges.