DXY is on a tear after holding support:

AUD is the reverse:

JPY has rolled. CNY is next:

Oil is blasting the shorts:

Metals have a new enemy in DXY:

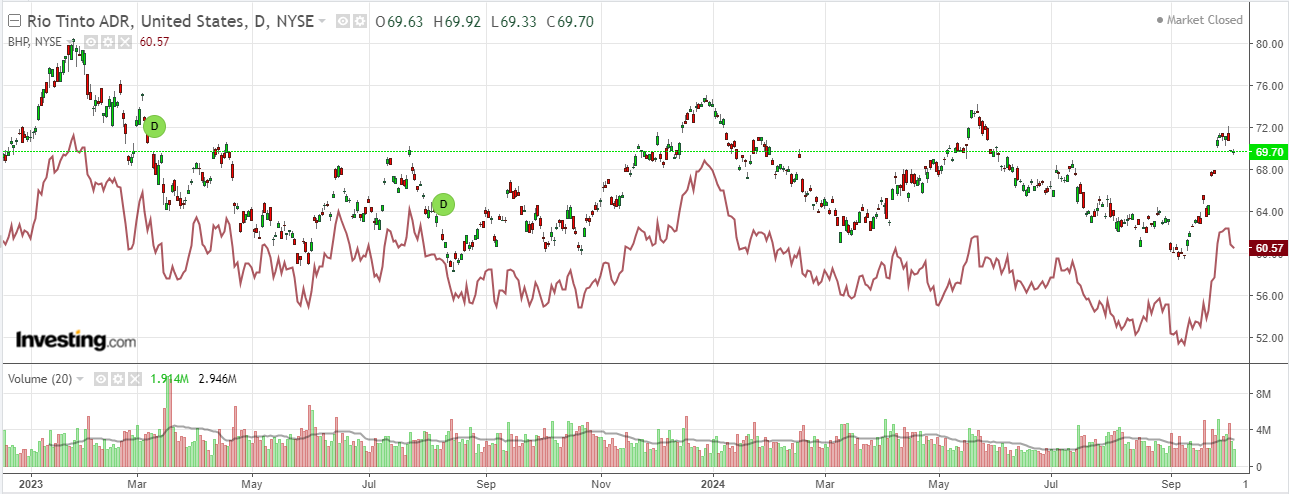

Miners look toppy:

EM awaits China’s return:

Junk is taking a breather:

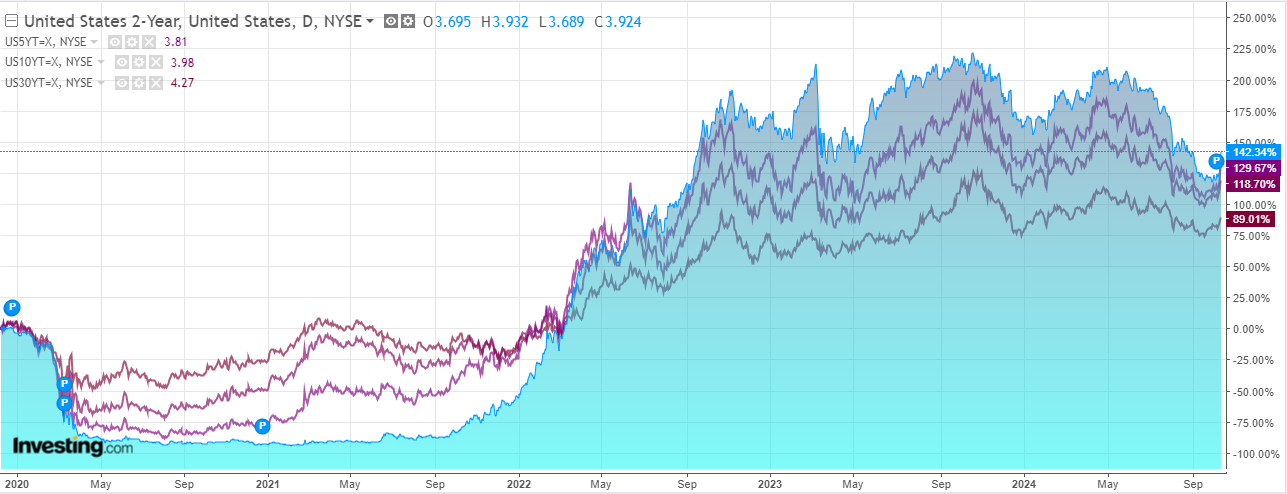

As yields back up:

While stocks take another crack at ATH:

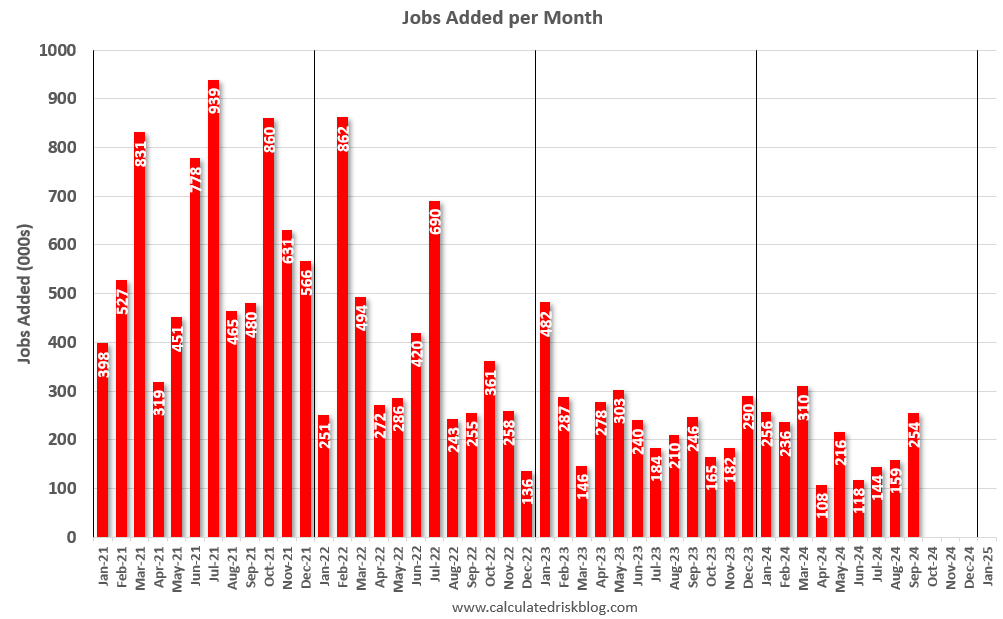

US jobs were stellar as jobs increased by 254,000 in September, and the unemployment rate edged down at 4.1%.

The pervious three months were revised up by 72k jobs:

Wages may be stabilising as well in the 4% range, excellent real income gains:

So long as productivity is good, and it is, with the prospect of a boom ahead, this is shaping as an exceptional landing for the US economy. A disinflationary no landing, for heaven’s sake!

As well, AUD positioning was positive 14k contracts last week, the highest in ages.

With the RBA set to cut, the Fed to slow its cuts, and assuming Chinese stimulus hoopla eases, AUD may have already topped out.