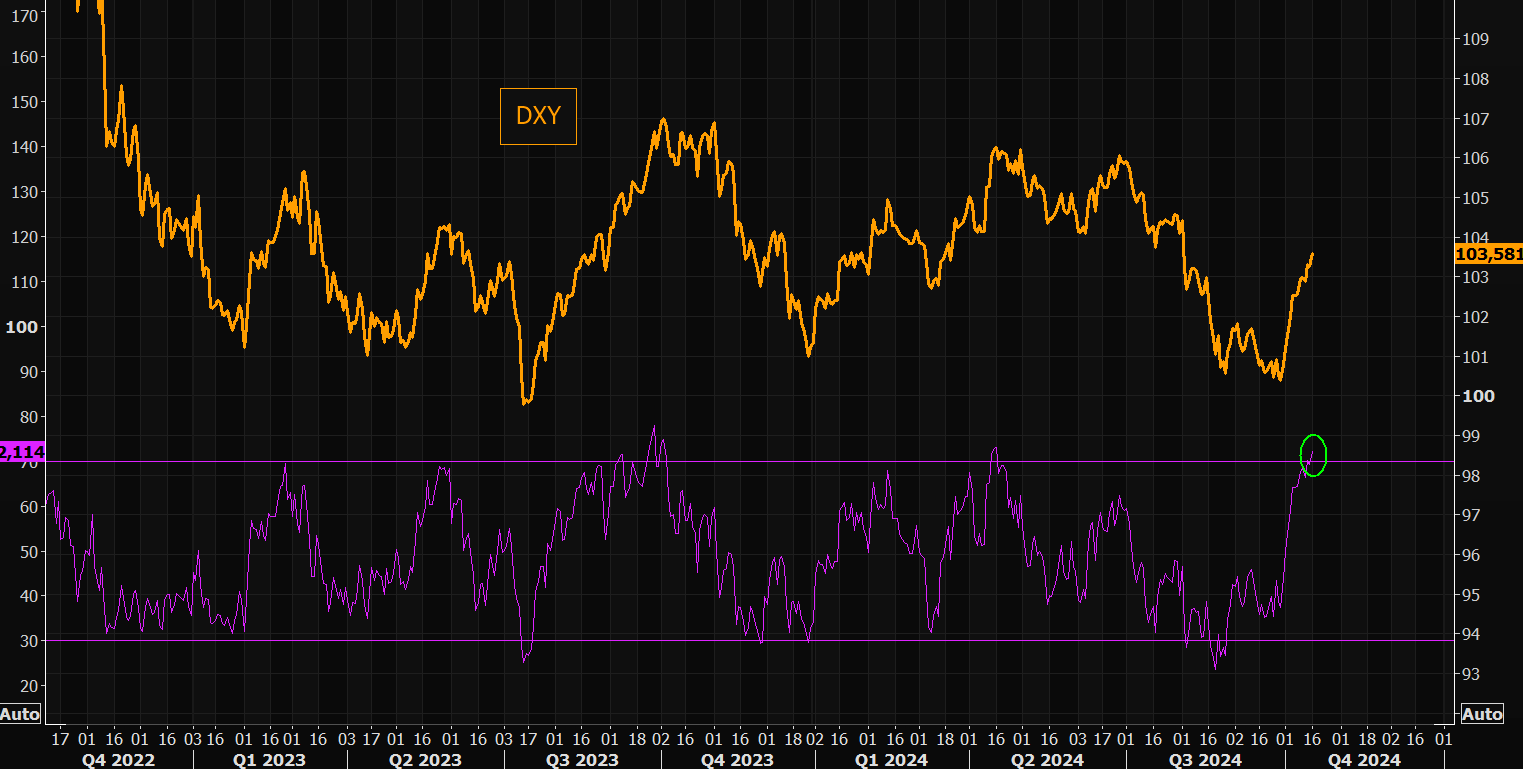

DXY is up and away:

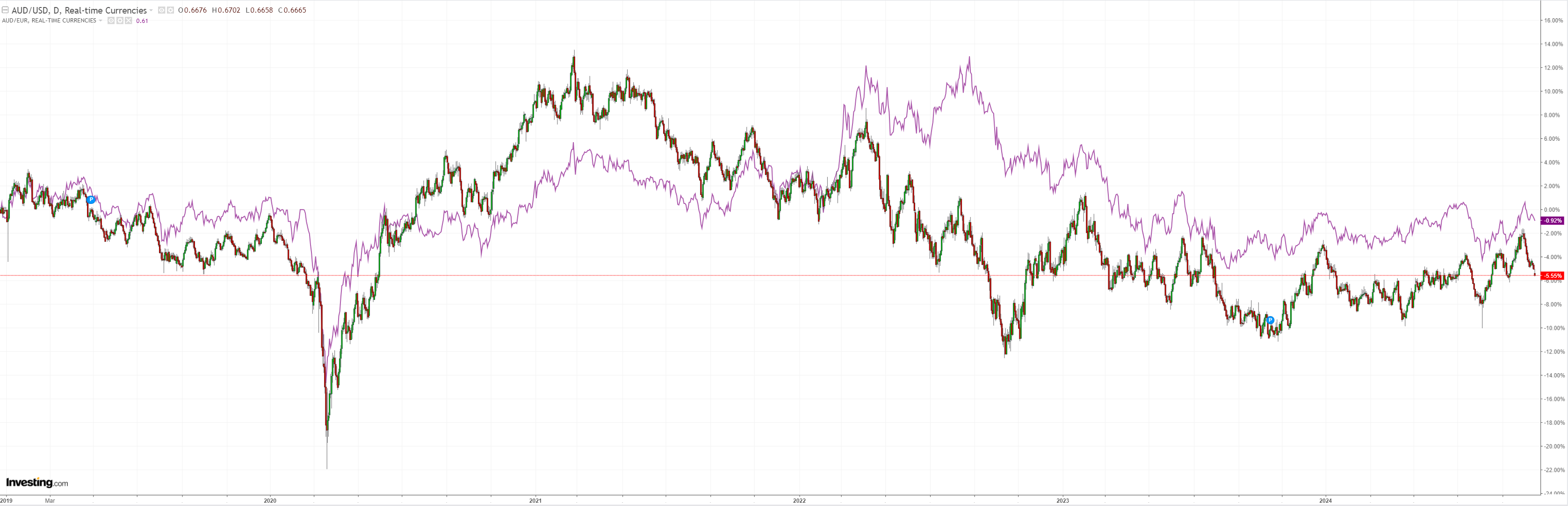

AUD is a free-falling stone:

North Asia too:

Gold has divorced from all fundamentals. Other commods not so much:

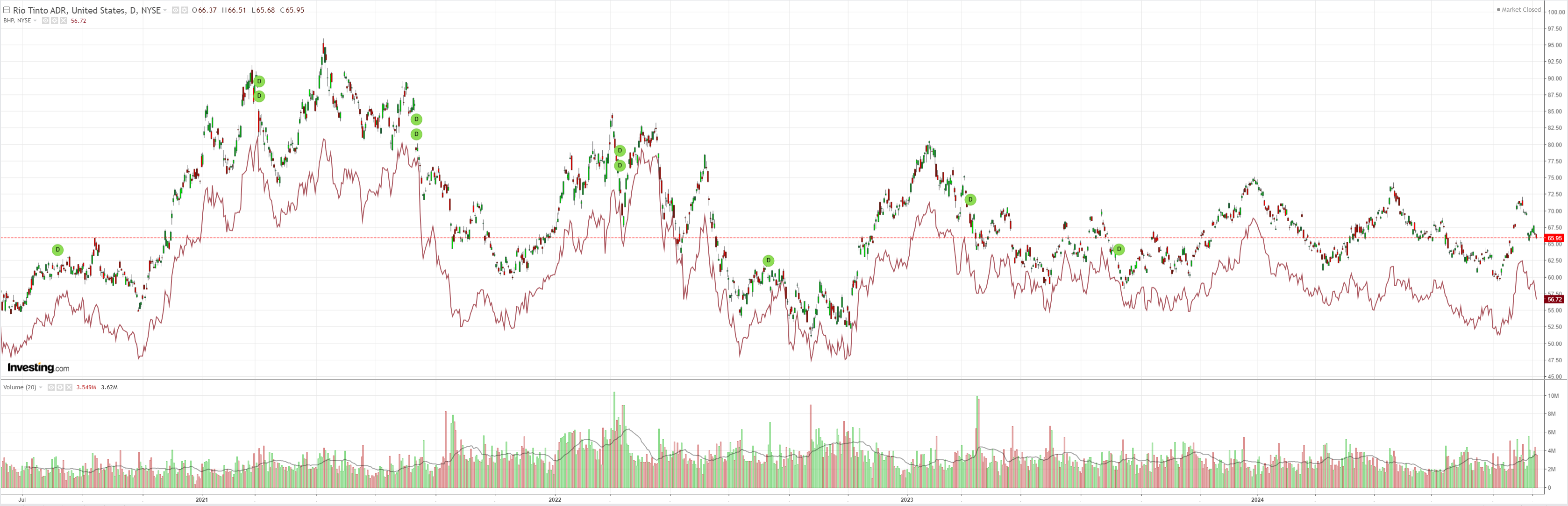

Big miners are saying Chinese yawnulus:

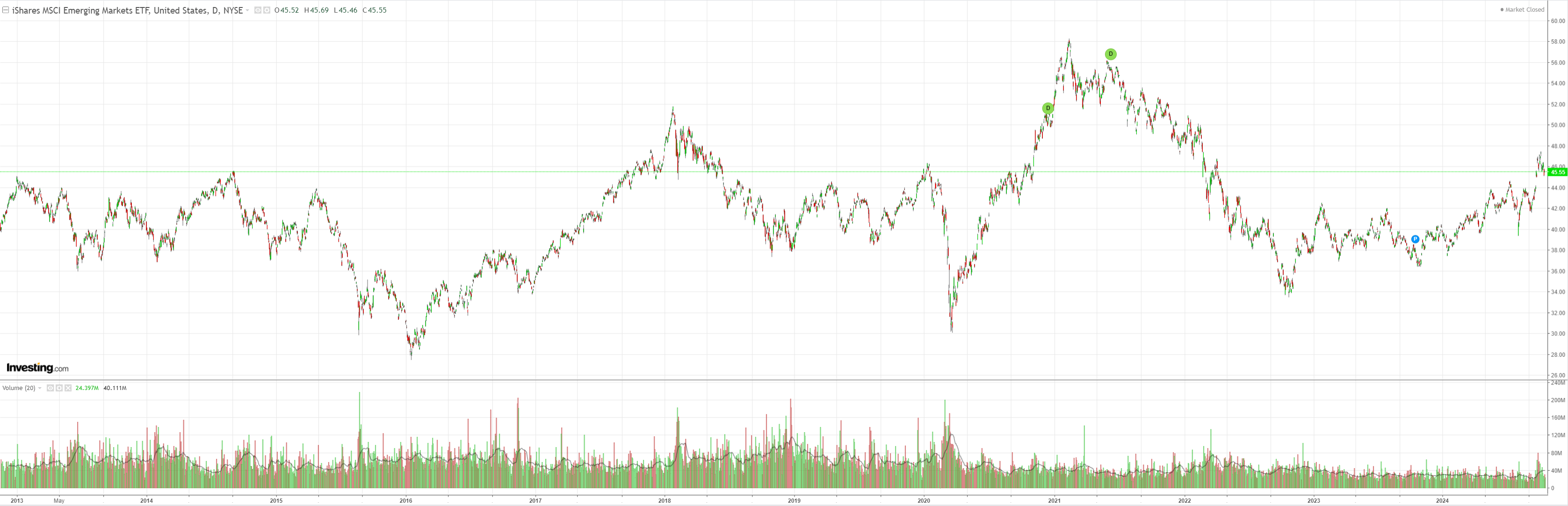

EM too:

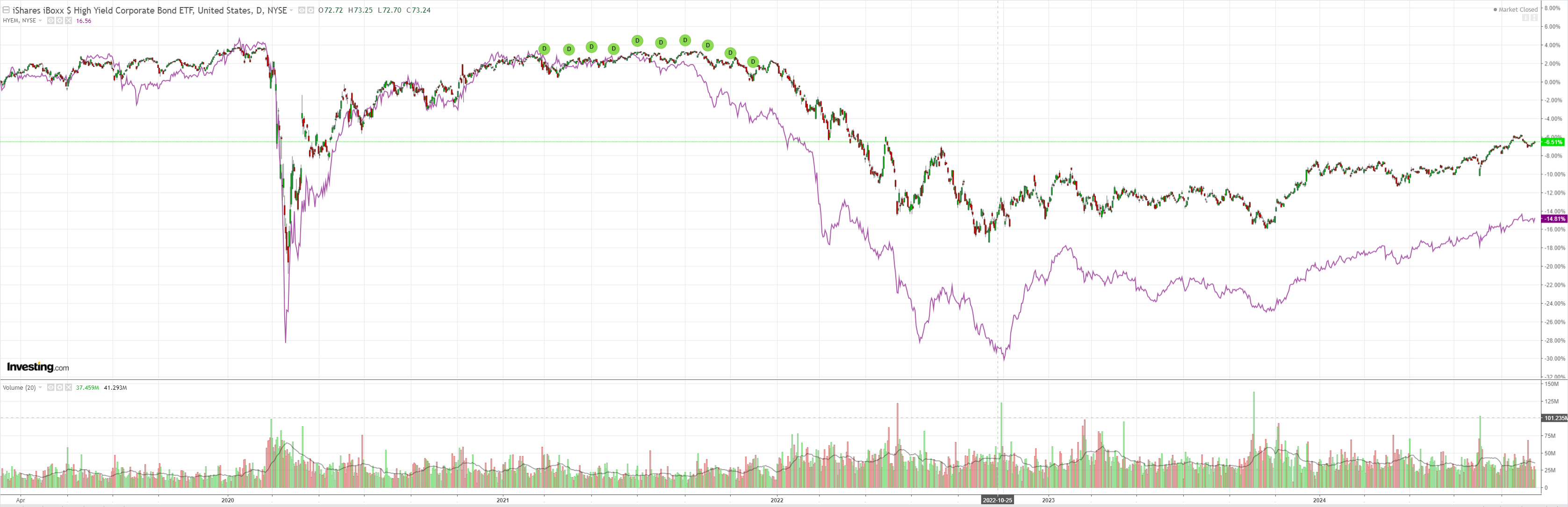

Junk party has stalled:

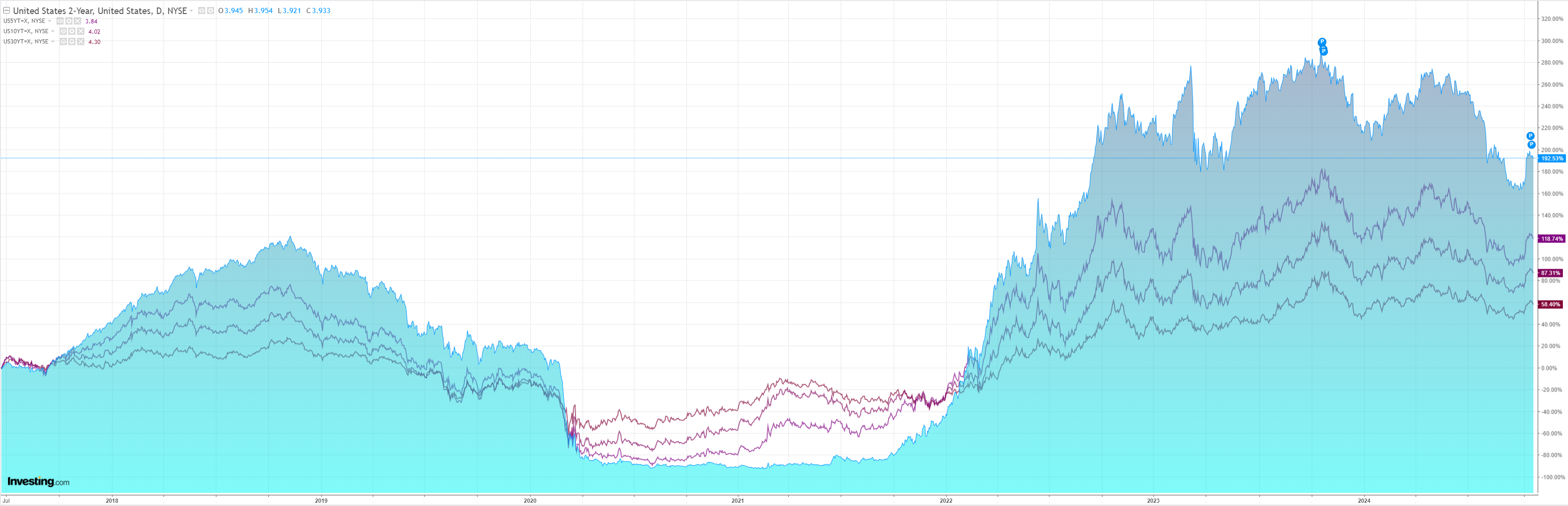

Yields bid:

Stocks edged up against the downdraft:

DXY is overbought but can get more so:

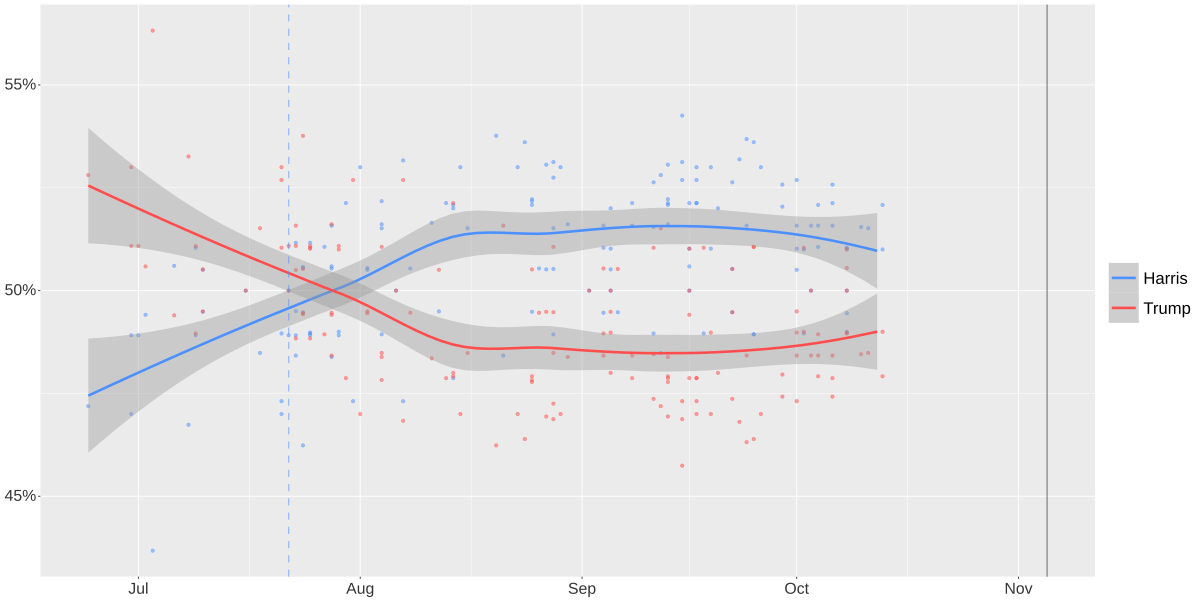

The reason? President Donald Trump 2.0 The popular vote is swinging back:

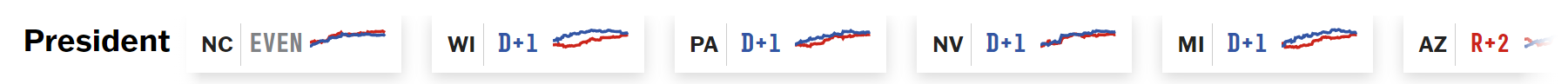

And swing states are a coin flip:

Forex is pricing for Trump. Yields have done so partly. Equities have not, even arguing for some corporate tax cuts.

If he gets in, expect a lot more DXY buying on tariffs and AUD selling regardless of China yawnulus.

It would be very bad for China as the Fed is slowed and exports dry up. The arse might fall out of CNY and threaten a global shock.

If Harris wins, AUD will rocket back up.

Toss up!