The DXY rally paused:

Freeing AUD to bounce:

North Asia too:

Plus commods:

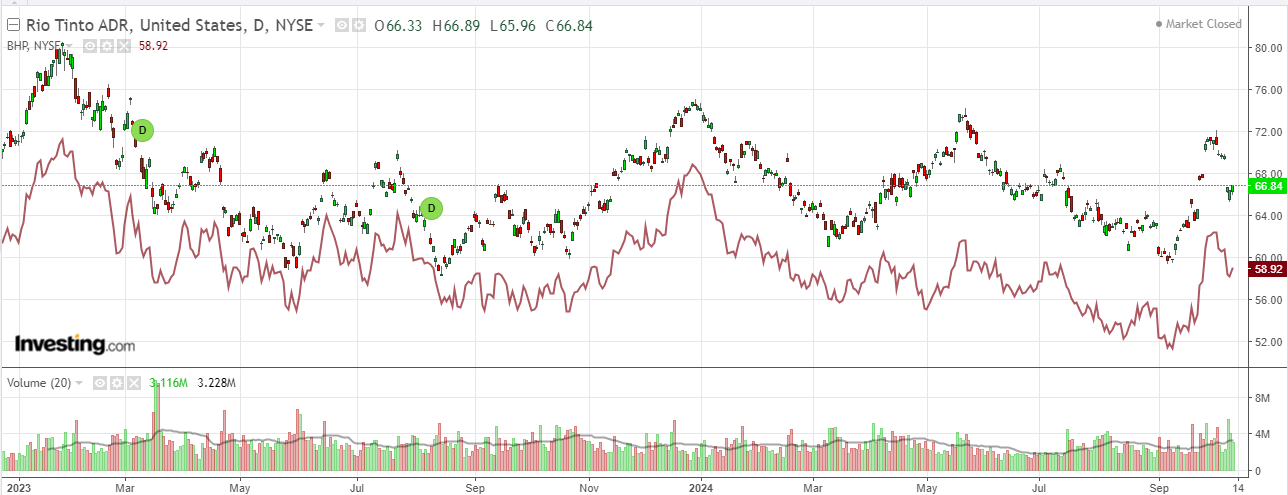

And miners:

EM yawn:

Junk if still OK:

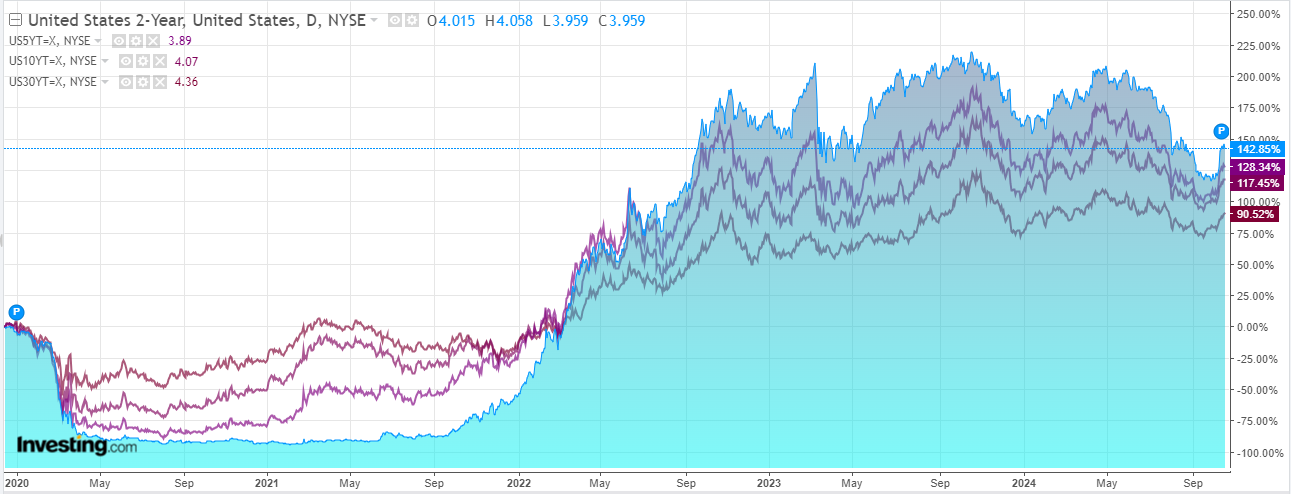

Despite rising yields:

Stocks eased:

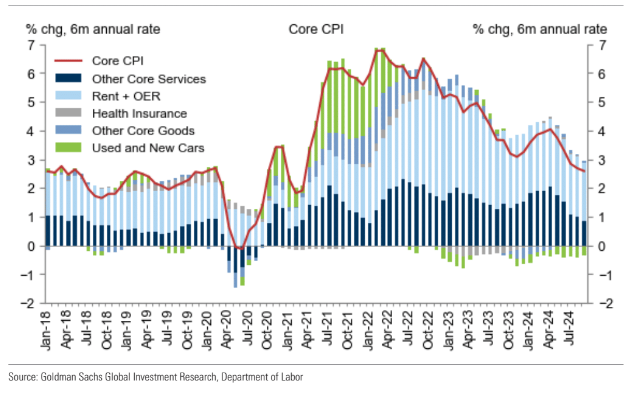

The US inflation report was above expectations but not worrying. Core CPI was 0.3% versus 0.2% expected, largely on a pop in food inflation.

However, the OER disinflation continues and this is the anchor for keeping inflation low:

The upshot is, the Fed will revert to 25bps cuts for now.

Which is one major reason why the Australian dollar rally has been snuffed out.

Net up, the ECB will cut and the odds favour more easing in Europe than exceptional America.

From December, the RBA may well keep pace with the Fed.

Deutsche:

…in the event of no global trade shock EUR/USD should be in a 1.10-1.05 range but biased towards the lower end of this range.

This is in line with our current year-end forecasts.

In the event of a global trade war we would be likely to break below 1.05 and potentially move closer to parity, though our analysis does not assume extra dollar bullish effects on the back of rising global risk premia.

In short, Harris equals a firmer DXY. Trump equals a runaway DXY.

AUD vice versa.