DXY is holding. EUR is poised for beakout:

AUD is putting in a series of candles:

North Asia is fading:

Oil held on as the Levant burns:

Metals flamed out:

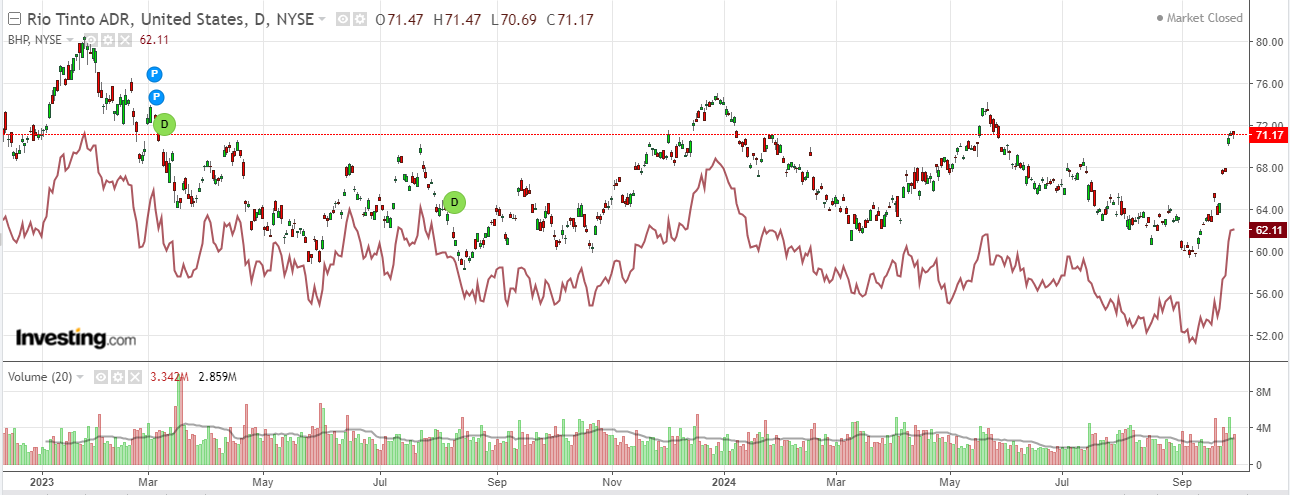

Miners topped:

EM too:

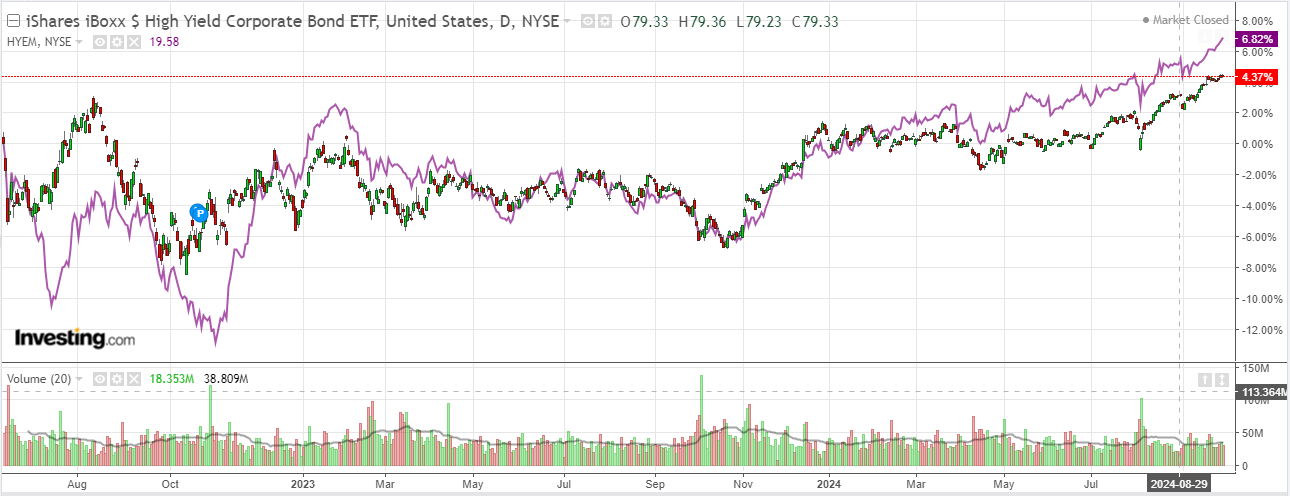

Junk is a one way bull train:

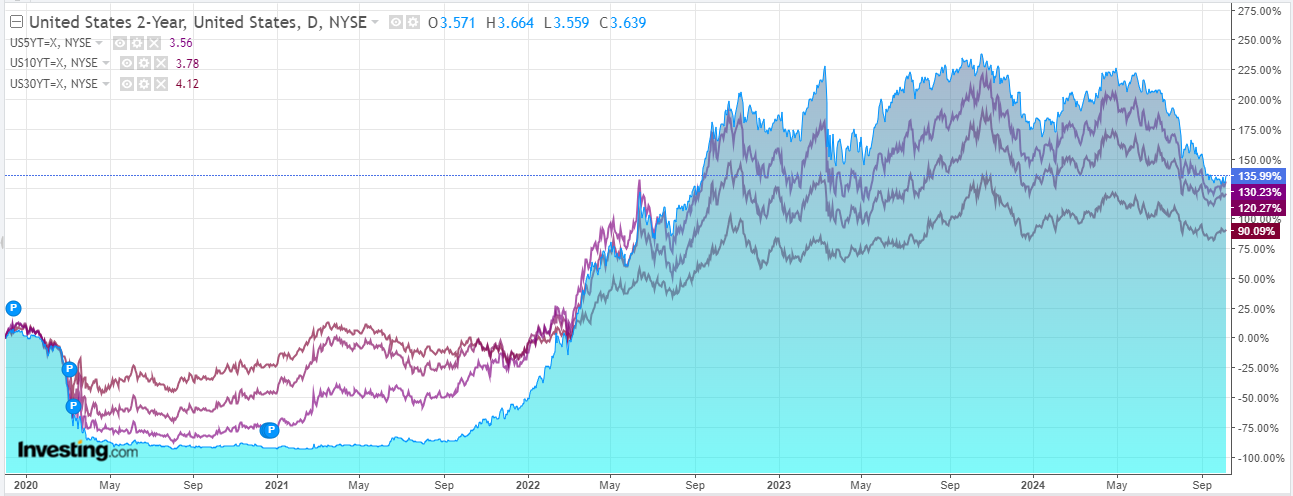

Yields firmed:

Stocks too:

The news is European inflation is cooked now too and the rate cuts are coming:

Lagarde told a regular hearing in the European Parliament that “the latest developments strengthen our confidence that inflation will return to target in a timely manner,” adding: ”We will take that into account in our next monetary policy meeting in October.”

Lagarde made her comments only an hour after fresh data suggesting that headline inflation in Germany, the eurozone’s largest economy, had fallen below 2 percent in September, rounding out a picture already evident in similar numbers from France, Italy and Spain.

The European economy is much weaker than that of the US.

As inflation eases, it will need more aggressive easing.

This is the specter of a top for the EUR.

We are not there yet. The China stimulus will support European assets more than American, including FX.

So, there is another up leg left in the AUD.

But we are closing in on the peak as the RBA also joins the rate cuts.