Goldman has declared DXY at the bottom.

USD: That oughta do it.

Over the last few weeks, we have written that Dollar underperformance looked overdone, particularly in DXY terms.

Many of the factors that weighed on the Dollar through the summer had reversed—our data surprise index has steadily improved, recession concerns have faded somewhat, and price action after the Fed’s 50bp cut suggest we are at the limits of pricing a dovish reaction function with this dataset.

While DXY had already started to move higher, the last employment report puts an exclamation point on that.

Still, the Dollar is not completely out of the woods.

A number of Fed officials have said that encouraging inflation data played a bigger role in their decision to move at a faster pace than labor market worries.

Next week’s CPI report should therefore again be important, although with lower stakes.

That should help dictate how well the cyclical flanks of the broad TWI can perform, but we think the payrolls report is sufficient to draw a line under DXY.

Elsewhere, news this week helped demonstrate that the broad Dollar can also benefit from its safe-haven status.

With reasons to be cautious on other safe-havens (see the JPY and CHF), we think the Dollar is the best expression for risk-off hedges.

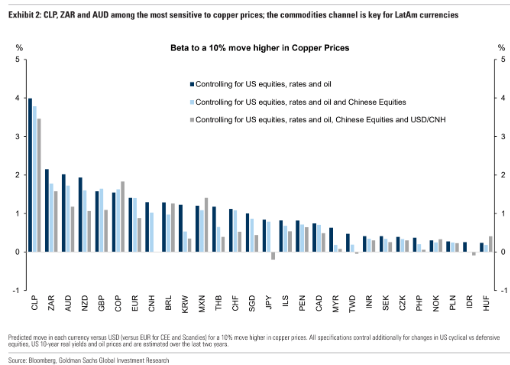

However, in our baseline, we continue to believe that procyclical currencies like MXN, GBP, and AUD can outperform from the main macro trend of solid US activity set against broad ‘risk management’ rate cuts.

In short, barring a trillion dollar Chinese bazooka, the easy money has been made in the AUD rally.