DXY is taking a breather:

As expected, AUD bounced:

North Asia is weak:

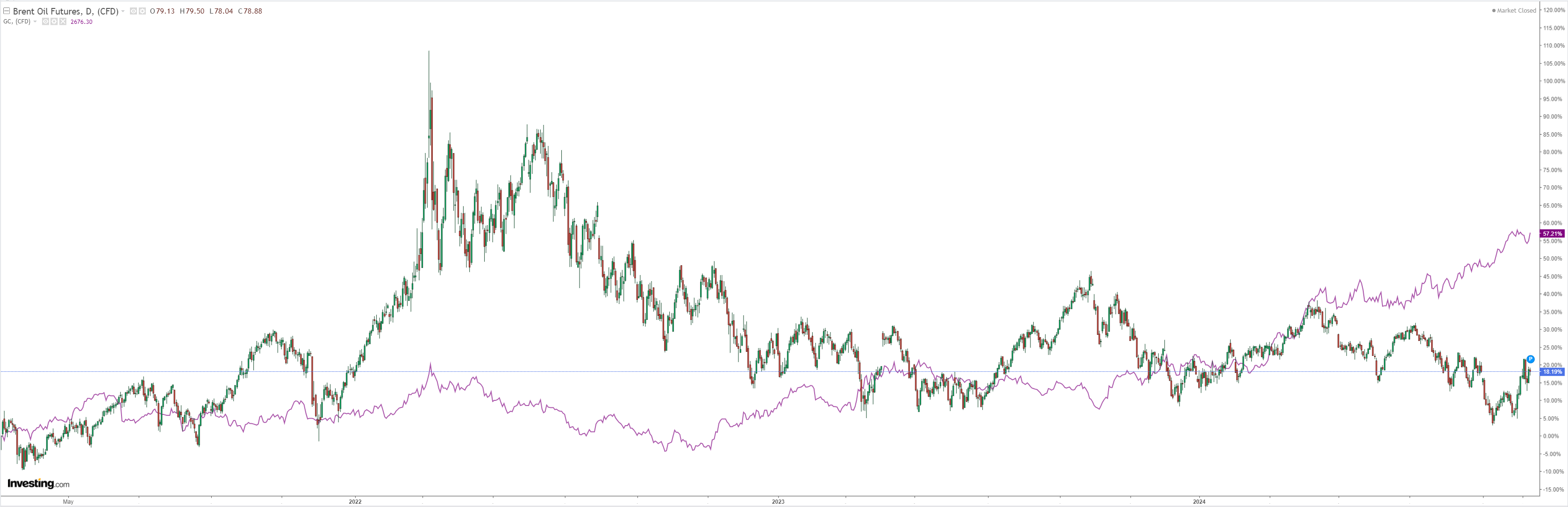

Gold and oil popped:

Advertisement

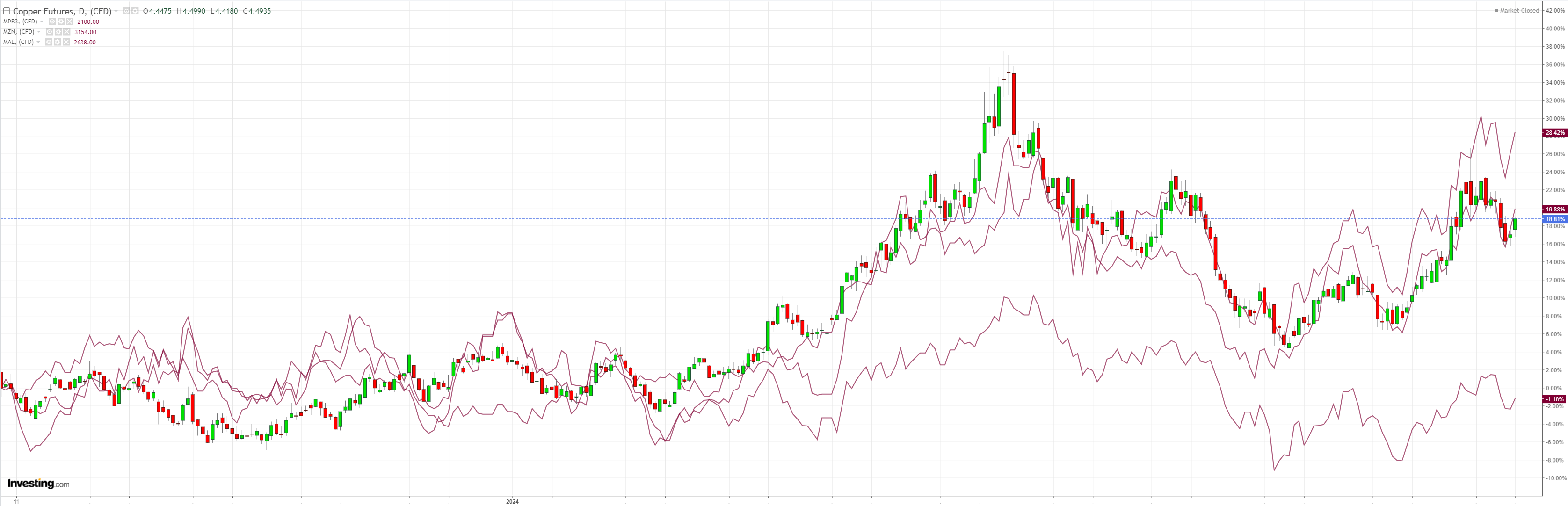

Metals too:

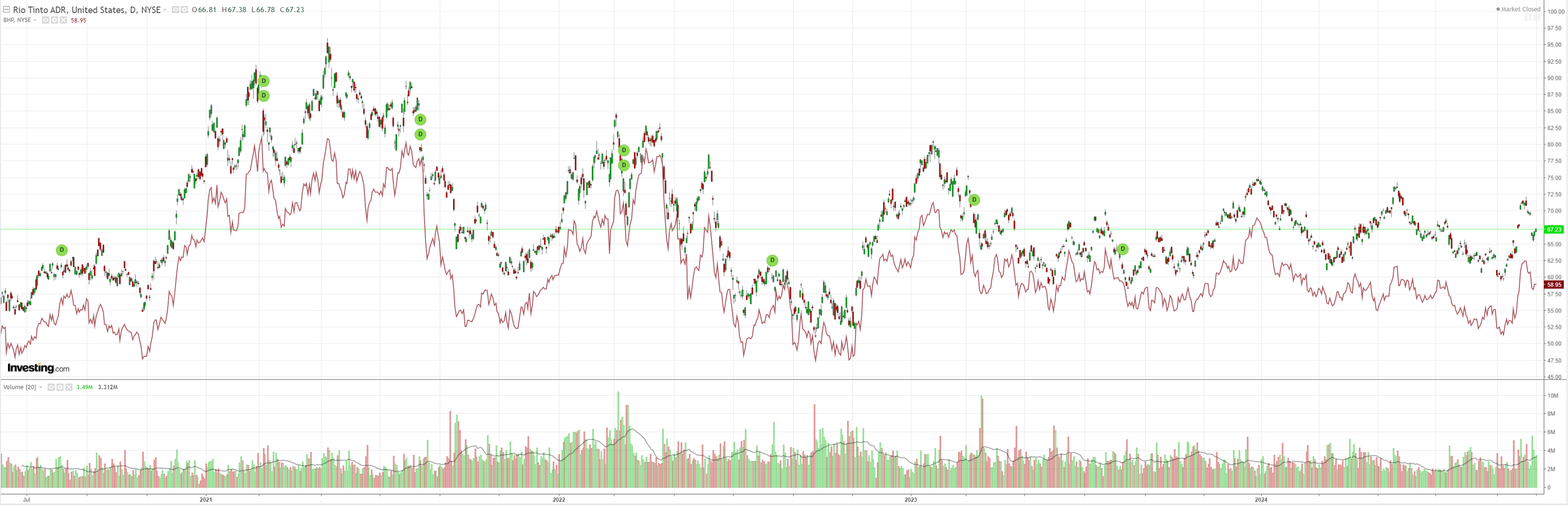

And bid miners:

EM yawn:

Advertisement

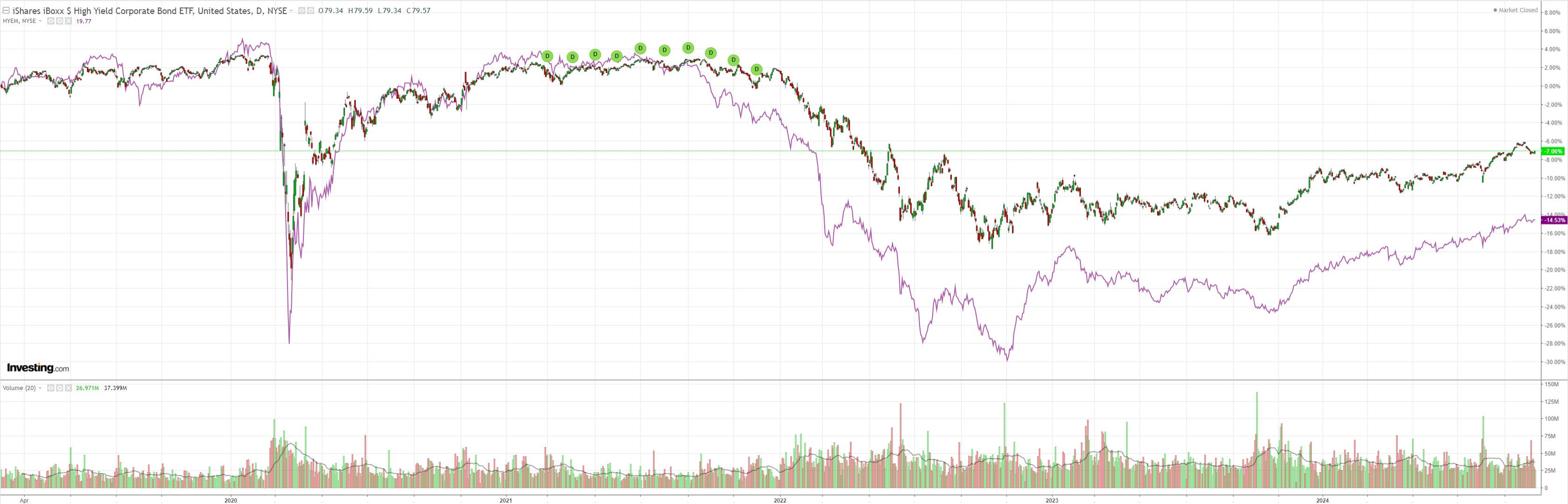

Junk is fine:

Yields eased:

Stocks ATH again:

Advertisement

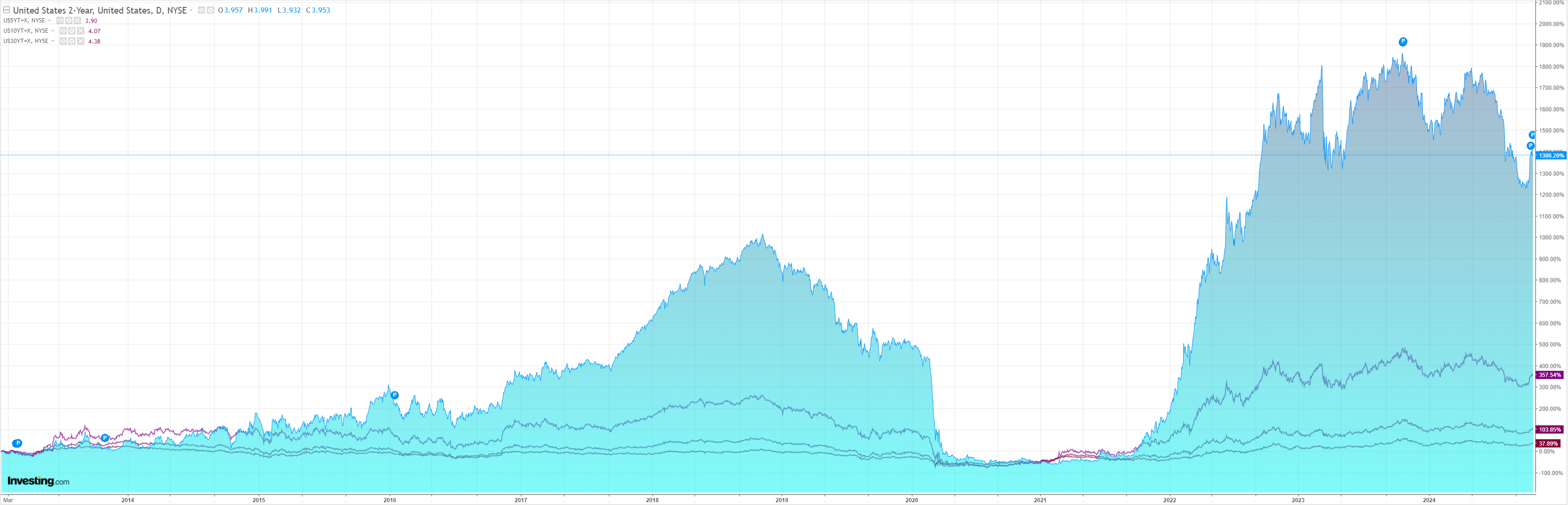

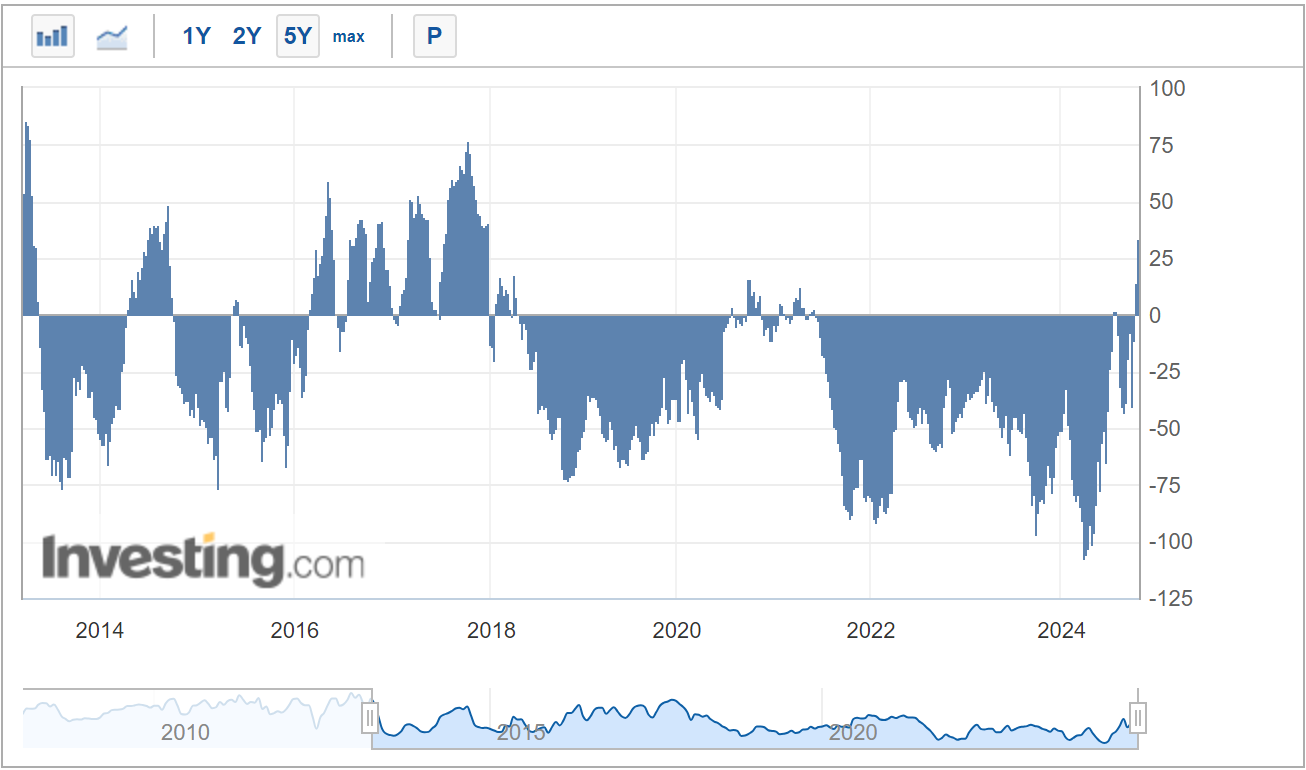

Here’s the chart of the week. CFTC longs jumped to 33k, the longest in six years, even as the price was smashed:

This is the kind of hysterical positioning and price action we are seeing in Chinese markets.

Advertisement

AUD has become a proxy for the so-called “stimulus” that is no such thing so far, including the Saturday MOF conference which was all extend and pretend measures channelling Japan.

With AUD positing surging so fast against the price movement, I can only conclude that it is indeed close to the top of its current surge.