Deutsche Bank chief economist Phil Odonoghoe warned in September that Australia’s unemployment rate would be much higher if employers were not hoarding labour.

“Australia’s unemployment rate is lower than it should be because most of the adjustment to lower labour demand has occurred through hours worked, rather than through employment”, he said.

“We estimate that the unemployment rate would be closer to 5.25% if employment growth had matched the slowdown in hours worked”.

Reserve Bank of Australia (RBA) chief economist Sarah Hunter later acknowledged that if labour hoarding is commonplace, then unemployment could spike alongside and economic growth slow if bosses chose to end labour hoarding.

“If it turns out that more firms are currently hoarding labour, then we may expect to see a larger pick-up in the unemployment rate as firms reduce headcount to cut costs given the backdrop of weak growth in demand”, she said.

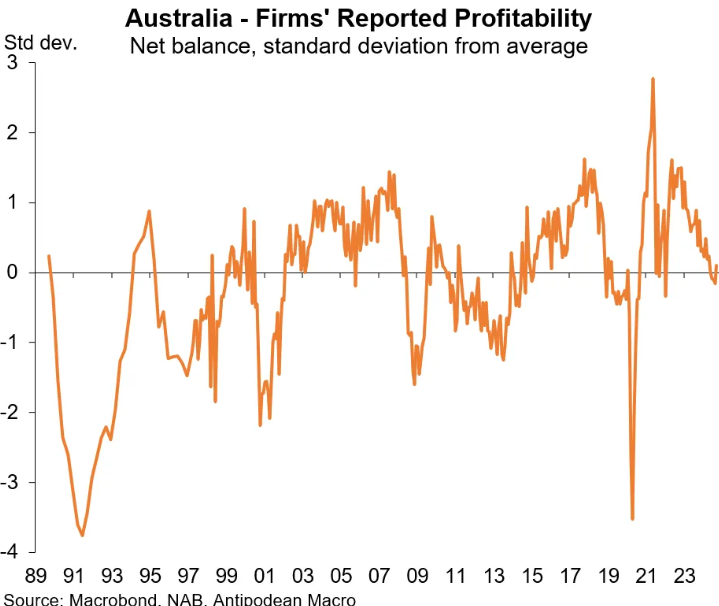

Wednesday’s NAB Business survey showed that demand remains very weak, and firms are experiencing falling profitability.

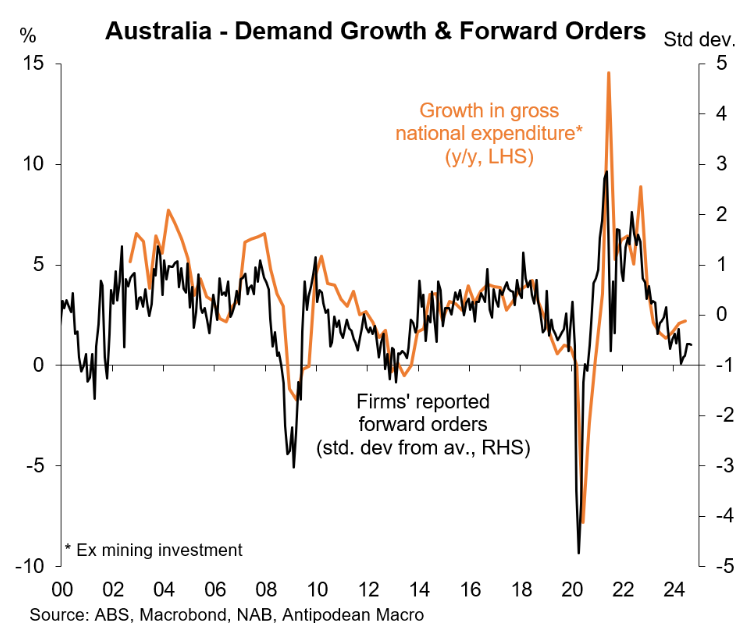

As illustrated below by Justin Fabo at Antipodean Macro, Forward orders have collapsed:

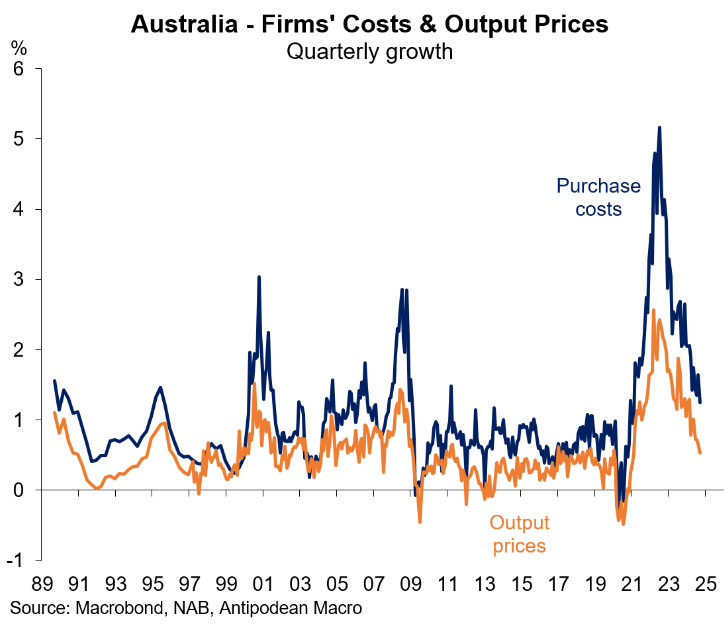

Output prices are moderating, suggesting reduced pricing power:

And firm profitability has nosedived:

It appears that Phil Odonoghoe’s warning around labour hoarding is coming to fruition, with a new survey by global human resources platform Deel, based on 250 bosses from businesses that employ at least 500 people, showing that 70% of Australian businesses intend to pursue cost-cutting measures.

About 41% of respondents to the survey indicated that they plan to shed jobs, while 45% flagged wage cuts.

“Many businesses are understandably cautious amid market uncertainties”, said Deel’s Australia manager Shannon Karaka, adding that companies were also considering which roles could be replaced with technology.

AMP chief economist Shane Oliver is unsurprised by the data noting that many of Australia’s largest companies flagged layoffs in their latest financial reports.

“It seems like the focus for corporates has sort of shifted a little bit from inflation towards lay-offs”, he said.

“Cost pressures are still quite significant and they’ve had softer sales which are the key factors driving talk of cost-cutting”.

Australia’s unemployment rate has defied gravity for the past 18 months on the back of Labour hoarding and unprecedented government-funded employment through the NDIS.

It looks like the employment dam may soon burst.