CoreLogic has identified 65 markets in Sydney and Melbourne where values are below record highs from the 2010s, and vendors are even willing to sell at a loss.

Despite the lower prices and improved housing affordability, buyers are refusing to bite, which CoreLogic attributes to “the wrong kind of supply”.

CoreLogic notes that underperforming markets tend to be “tied to an over-supply of investment-grade units built in the 2010s”.

“This period saw the investor share of new housing finance hitting record highs of 46% in 2015. Foreign investment purchases of off-the-plan apartments rose, and strong investor uptake of interest-only loans for tax purposes possibly added to speculative activity in the apartment sector”, CoreLogic explains.

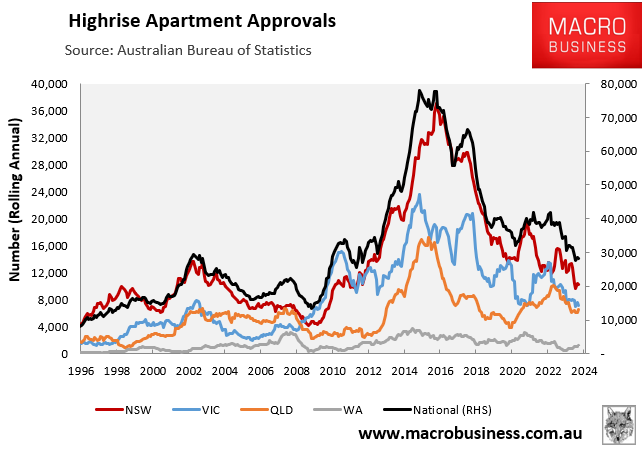

“Nationally, apartment approvals peaked at 123,000 in the year to August 2016. Notably, apartment approvals eclipsed detached house approvals during this period, another sign that the market was shaped by elevated levels of investment activity”.

CoreLogic adds that the apartment market “suffered a crisis in confidence after a raft of construction quality issues emerged from recent builds. These included high profile cases like Mascot Towers, and the cracks in Opal Tower in Olympic Park”.

As a result, many buyers “are likely to be wary of defects in these builds, or turned off by the high density and relatively small size of the units”.

The reality is that high-rise apartments can be a financial trap for buyers.

First, there are legitimate concerns around build quality and structural defects. These issues were uncovered in a 2019 Four Corners investigation entitled “cracking up”, which revealed a litany of failure to regulate and protect the buying public, even in the face of repeated warnings.

“We’ve got a real problem here. It’s systemic and it’s infecting lots of buildings across the landscape, in all parts of the country. It’s very clear”, one building analyst told Four Corners in 2019.

“I have never seen a building that isn’t defective in some way. I know it’s my job, but even just walking around in public, I notice these things”, a forensic engineer added.

Building construction lawyer, Bronwyn Weir, warned separately that “thousands and thousands of apartments have serious defects in their buildings”, labelling the problem “enormous”.

“We have what is now you know, a systemic failure that is quite difficult to unravel”.

“Some of these buildings could potentially be a write-off”, she warned.

A November 2023 NSW government strata survey revealed that more than half of newly registered buildings since 2016 have had at least one serious defect costing an average $331,829 per building to fix.

Research by the Strata Community Association NSW revealed that waterproofing was the most common major defect followed by fire safety.

Last month, Four Corners aired another segment entitled “The Strata Trap”, which exposed the graft and greed of the seven billion dollar a year strata industry.

“After thousands of Australians wrote to the ABC with shocking stories of financial abuse, The Strata Trap uncovers the unethical practices that have drained untold sums of money from apartment owners’ pockets”, Four Corners reported.

The Four Corners team investigated key industry players – from neighbourhood cowboys to multinational corporations.

“It’s almost as if the whole business model has been designed to frankly screw Australian apartment owners”, one Sydney apartment owner told Four Corners.

The Albanese government’s target of building 1.2 million homes over five years is predicated on igniting another high-rise apartment boom.

However, construction lawyer Bronwyn Weir warned that ramping up the construction of high-rise apartments would inevitably lead to corners being cut, resulting in lowered quality and defects.

“Australia’s chronically undersupplied housing market is heading for another development boom and apartments will lead the way”, wrote The AFR’s Michael Bleby.

“On current estimates, 50% of what will be built will have serious defects”, Weir told The AFR in January.

The last decade’s high-rise apartment boom was an unmitigated disaster, costing buyers and taxpayers dearly.

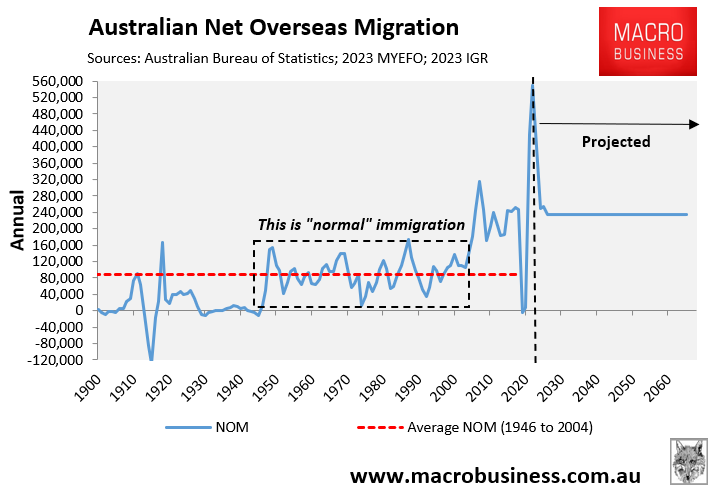

Instead of repeating the mistakes again, the federal government should dramatically slow net overseas migration, so that the building industry can prioritise quality over quantity of construction.

Why repeat the same mistakes by accelerating the rate of construction to meet unsustainable levels of immigration that Australians neither want nor need?

Why pursue a low-quality high-rise slum future?