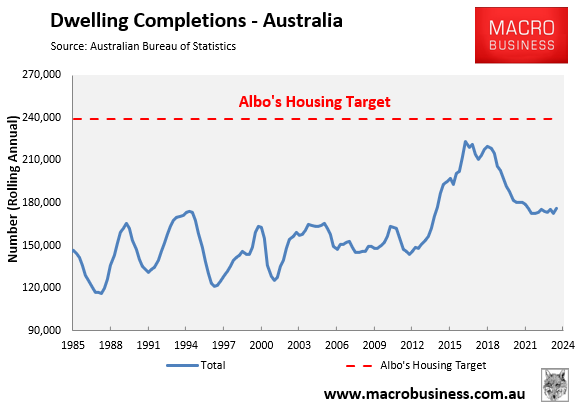

I have written repeatedly how Australia’s home building industry is facing stiff headwinds that will keep the volume of housing construction depressed for the foreseeable future and unable to meet the Albanese government’s fantastical housing target.

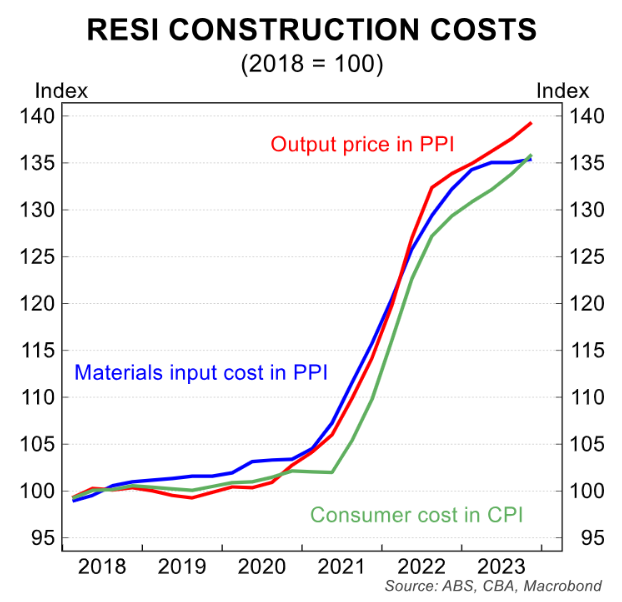

First and most importantly, construction costs have risen nearly 40% since the start of the pandemic, meaning that it is now much more expensive to build housing.

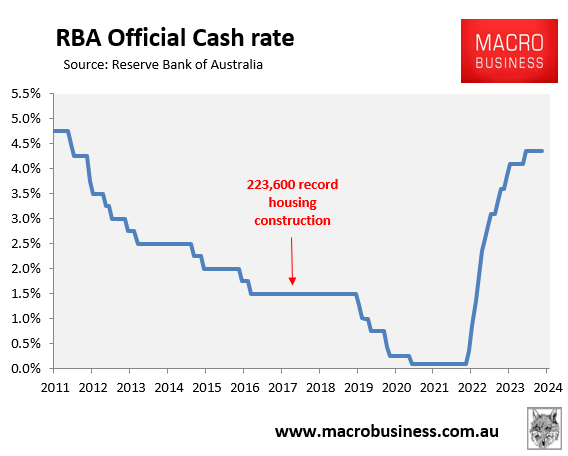

Second, interest rates are likely to remain structurally higher than they were during last decade’s construction peak.

Third, home builders are facing chronic shortages of workers, driven in part by government big build infrastructure projects.

Finally, thousands of home builders have collapsed, reducing capacity within the industry.

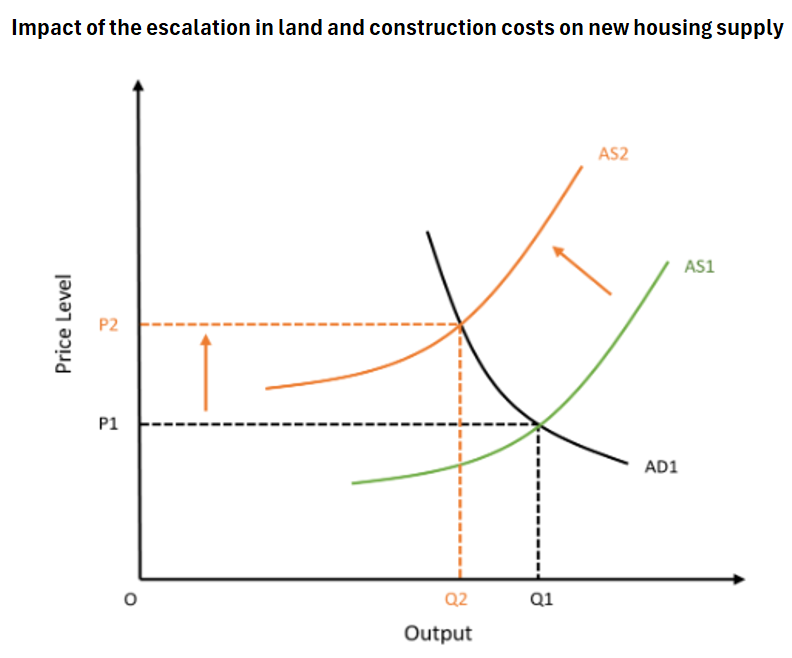

These supply-side forces have shifted the housing construction supply curve to the left, increasing costs and reducing the volume of homes that can be built.

The housing sector is also facing a perfect storm on the demand side.

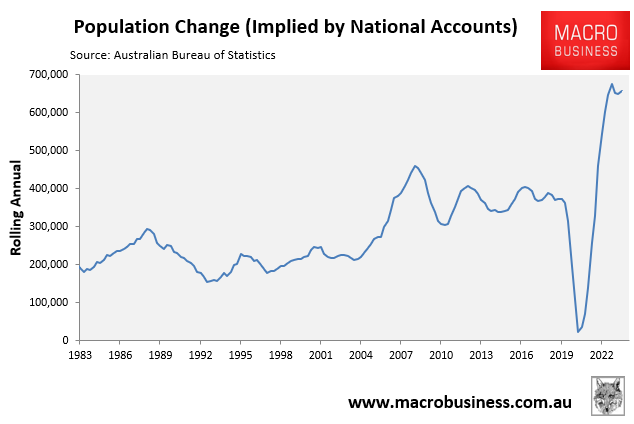

We already know that Australia’s population has grown strongly due to historically high net overseas migration, which has added massively to housing demand:

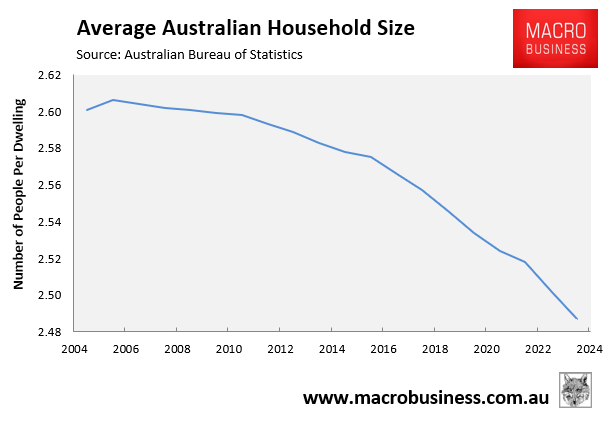

The Australian Bureau of Statistics (ABS) on Tuesday released data on average household size, which showed that the number of people per dwelling fell to a 19-year low of 2.49, down from 2.60 in 2005:

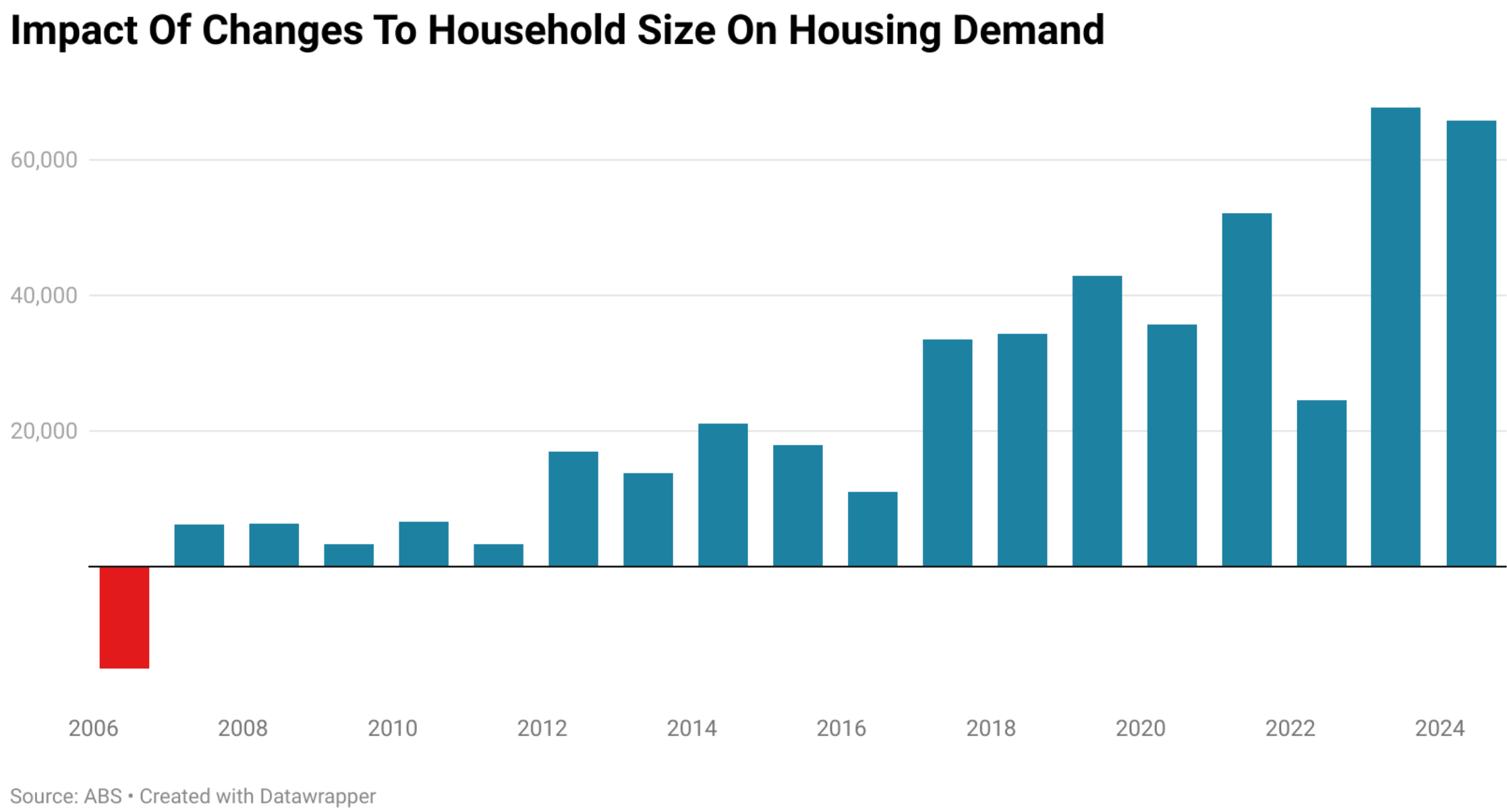

Independent economist Tarric Brooker estimates that “the change in household sizes in the last 12 months have demanded 65,700 additional homes”.

“Changing demographics now consume 37.3% of all home completions”, Brooker noted on Twitter (X).

Source: Tarric Brooker

The above data is an unmitigated disaster for Australians seeking to rent or purchase a home.

Construction rates have collapsed at the same time as demand has soared, meaning chronic housing shortages will remain.