This month, we have received four critical pieces of data showing that Australian dwelling construction is sick, pointing to worsening shortages.

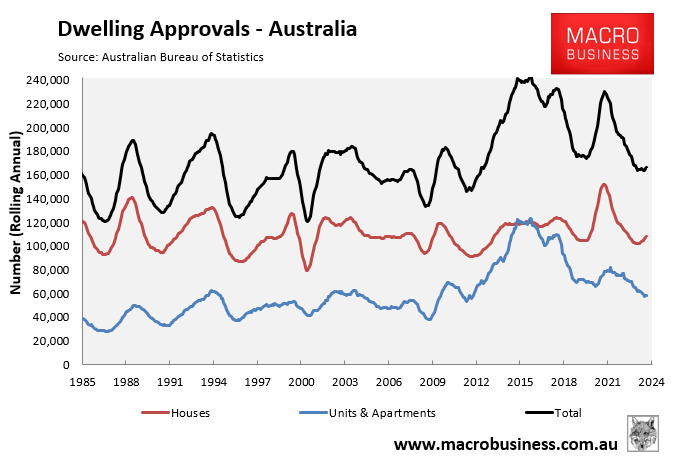

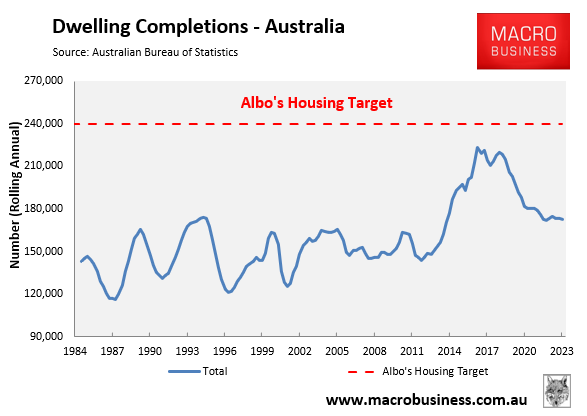

First, only 166,200 dwellings were approved for construction in the year to August, 78,800 (31%) below Labor’s housing target, which requires 240,000 homes to be constructed for five consecutive years.

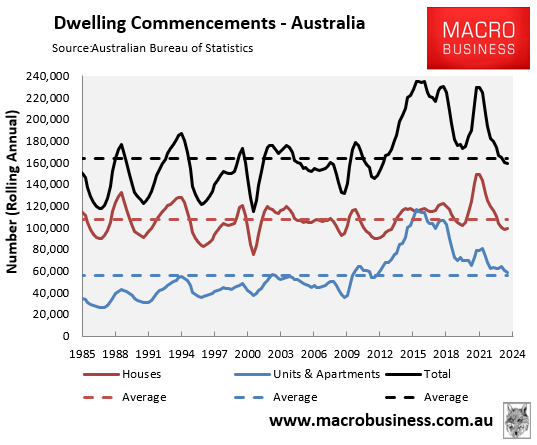

Second, only 158,750 dwellings commenced construction in the 2023-24 financial year, 81,250 (34%) below Labor’s target.

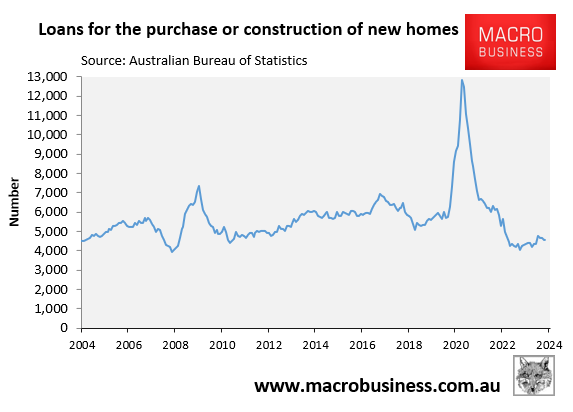

Third, there were only 4,551 loans for newly constructed homes issued in August, which was 65% below the early 2021 peak:

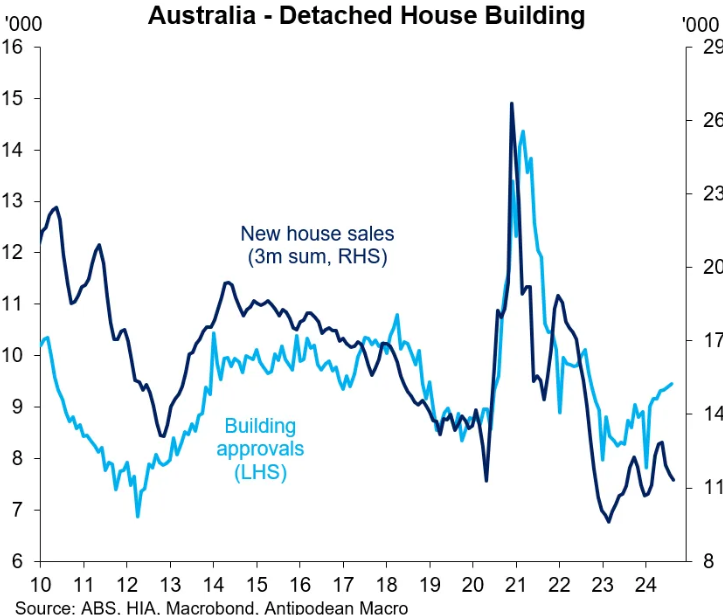

Finally, as illustrated below by Justin Fabo at Antipodean Macro, the number of detached houses sold fell over Q3 and is tracking near historical lows:

I have argued consistently that the government’s housing target was unrealistic from the get-go for a variety of reasons.

Australia has never built more than 223,500 houses in a single year. Even under ideal macroeconomic conditions, achieving 240,000 homes for five years in a row is fantastical.

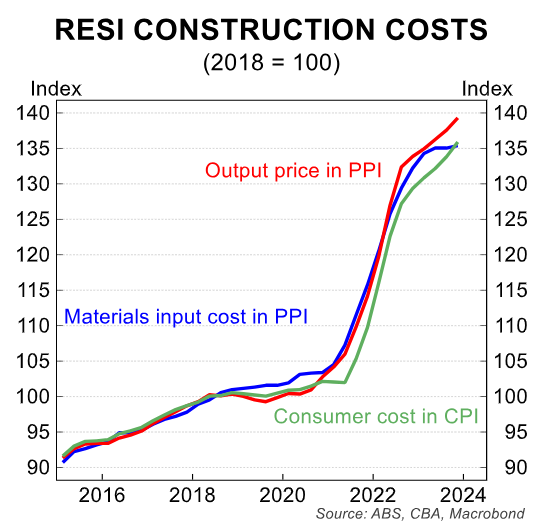

Worse, macroeconomic conditions are far from optimal. Construction costs have climbed by almost 40% since the beginning of the pandemic.

The official cash rate (4.35%) is significantly higher today than when building levels peaked in 2017 (1.5%). They are also unlikely to return to the rock bottom levels experienced during last decade’s construction peak.

Homebuilders are competing for labour and materials with government ‘Big Build’ infrastructure projects.

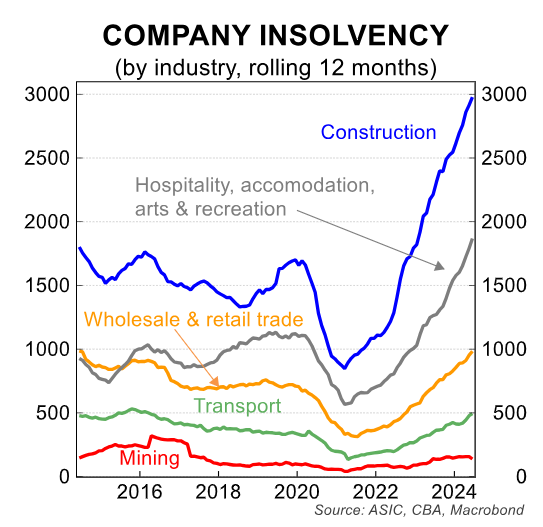

Finally, large numbers of homebuilders have collapsed due to rising costs and declining profitability.

Those hoping that more “supply” will magically solve the housing crisis are lying to themselves, given that construction rates have collapsed and build costs are structurally higher.

The number one solution to Australia’s housing crisis is to significantly cut net overseas migration to a level that is below the nation’s capacity to build housing and infrastructure.

Negligently, the federal government has targeted high levels of net overseas migration forever, which means the housing crisis will be ongoing.