Prominent Sydney auctioneer and real estate agent Tom Panos has released his weekly market wrap, in which he notes that the “marketplace has very quickly moved from a seller’s market to a buyer’s market”.

According to Panos, there is only “one reason: supply and demand” for the change. The supply of listings right now is outstripping the increase in buyers”.

He also believes that there is more supply coming.

Panos also noted that Prime Minister Anthony Albanese pulled his investment property in Sydney’s inner-west from the market on Saturday because it did not attract any interest.

Albo’s real estate agent, Shad Hassan, told realestate.com.au that there was no “firm commitment” from an interested buyer.

“Albo and I decided that it’s best not to waste time”, he said. “It’s definitely worth the money and we’ll be having people come take a look at it over the weekend if we put an asking price on it”.

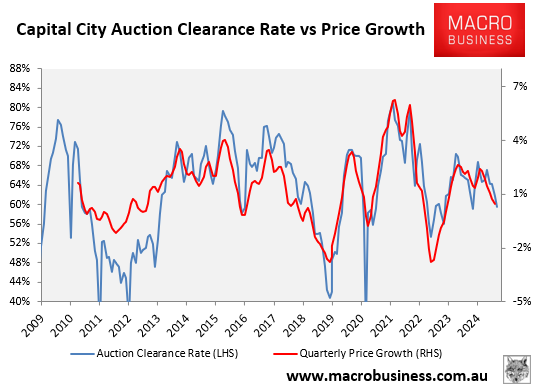

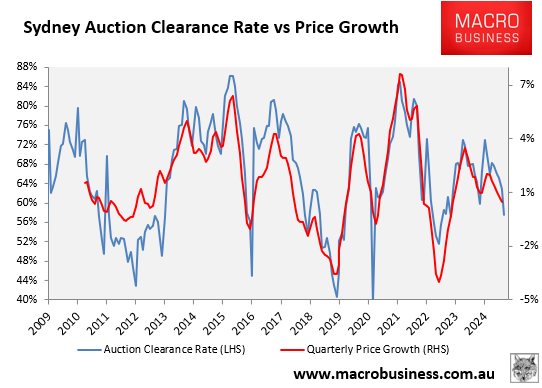

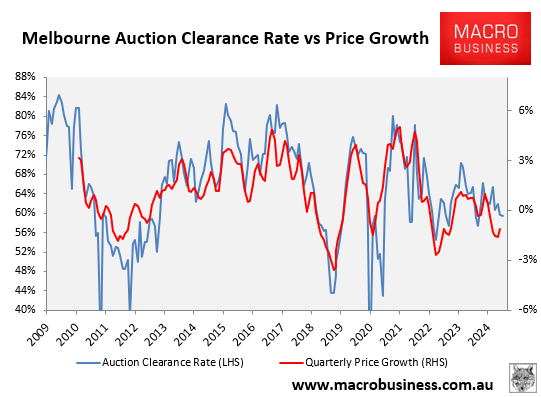

Australia’s auction market has weakened significantly, especially across Sydney and Melbourne.

Last weekend, Sydney’s final clearance rate plunged below 60% for the first time this year (57.6%), down from 65.9% a year ago.

Melbourne’s final clearance rate also held below 60% for the third consecutive week (59.4% last weekend), down from 66.9% one year ago.

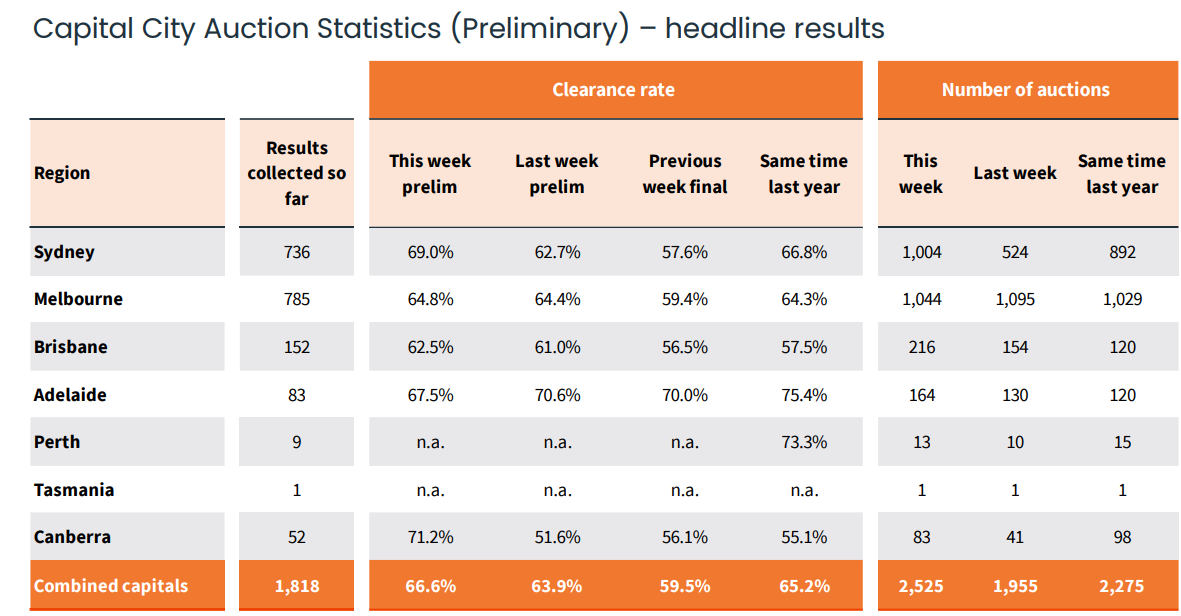

This weekend’s preliminary clearance rate bounced a little from last weekend’s low, as illustrated in the following table:

Source: CoreLogic

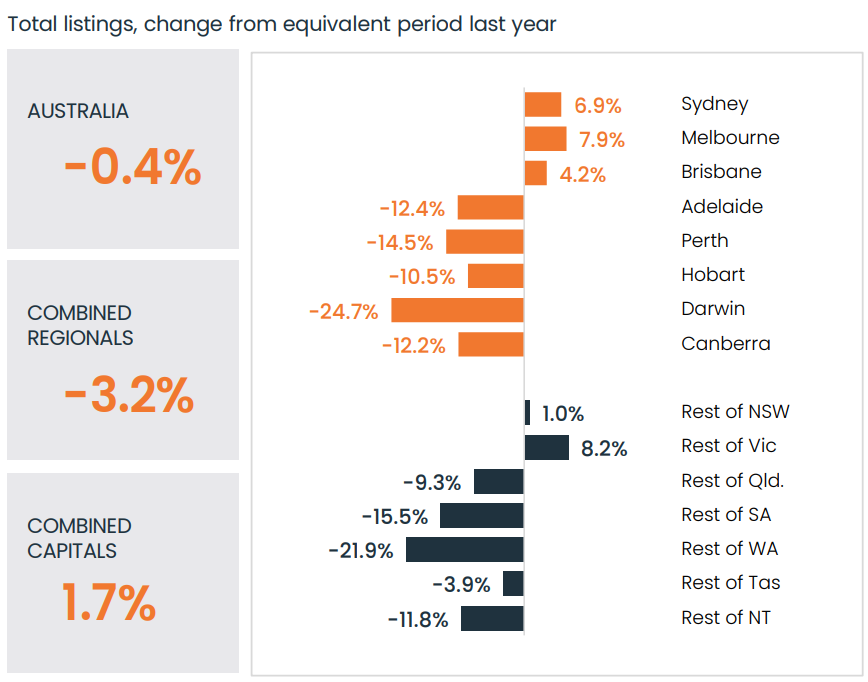

However, both Sydney and Melbourne have experienced a sharp lift in listings, which is now placing downward pressure on prices.

Source: CoreLogic

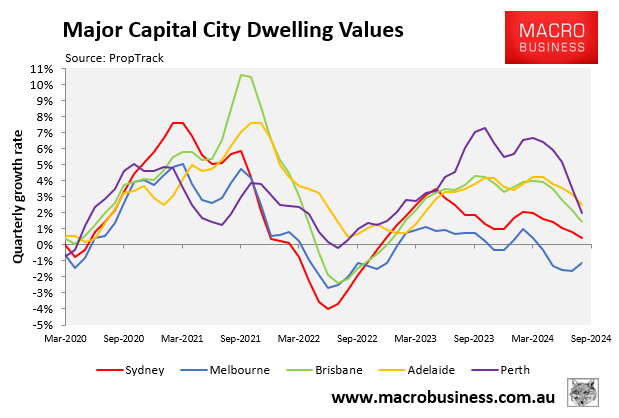

As a result, Melbourne home prices are falling and Sydney’s are close to sliding into negative territory:

In fact, value growth is slowing across all major capital city markets.