The Reserve Bank of Australia (RBA) has released a review of its $188 billion Term Funding Facility (TFF), which revealed that the stimulus program did little to boost small business lending but was successful in pumping mortgage credit and house prices.

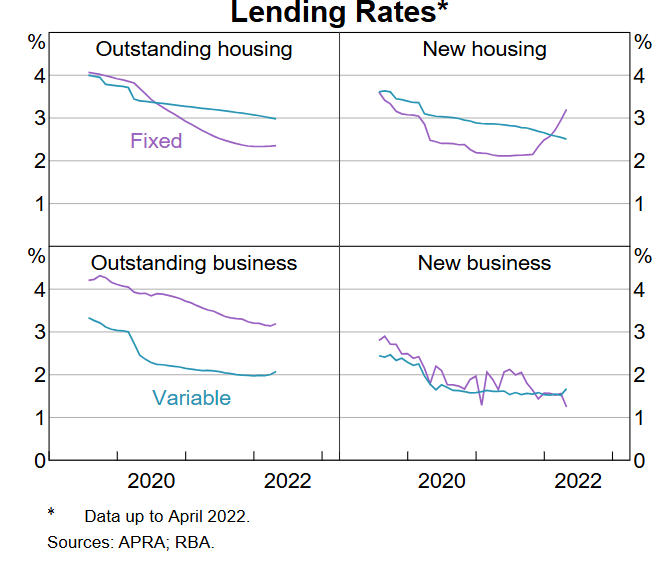

The RBA found that “the lower funding costs were passed through to rates on new and outstanding loans for both housing and businesses”.

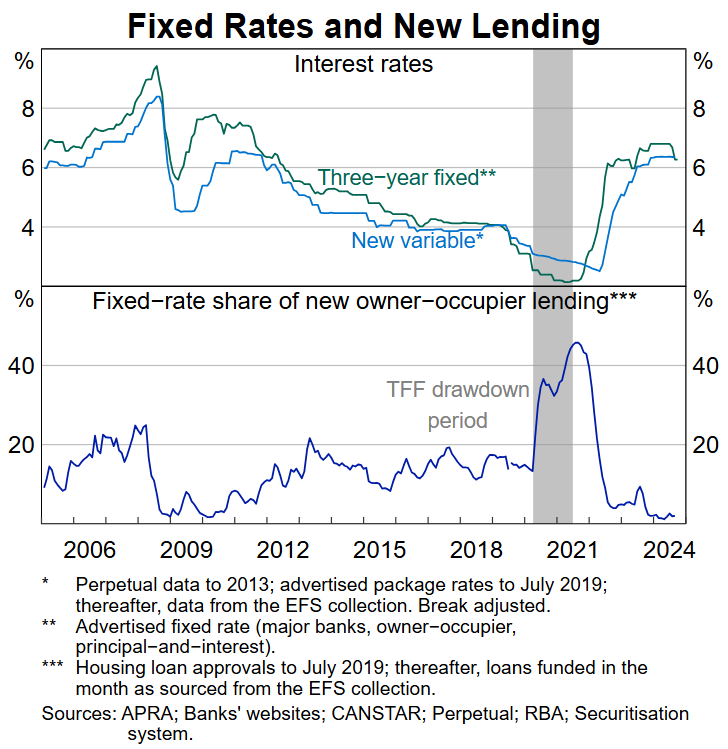

In particular, the TFF drove fixed mortgage rates down:

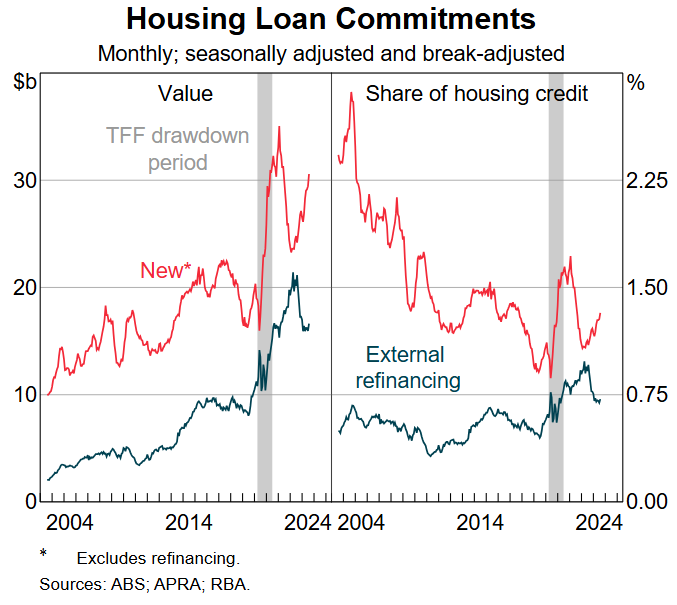

The RBA notes that “housing loan commitments rose by more than in any of the monetary policy easing phases in the past five economic cycles”:

By contrast, the RBA notes that “total business lending was little changed over the drawdown window”. It “found no statistically significant effects on aggregate business credit growth for eligible banks that accessed the [funding facility] compared with banks that did not draw down”.

“Despite the availability of credit and low interest rates, businesses’ demand for debt was weak throughout 2020 and early 2021, owing to the weakness in economic activity, heightened uncertainty around the outlook, and a reduced need for credit due to sizeable government support (e.g. JobKeeper) that boosted businesses’ cash flows”.

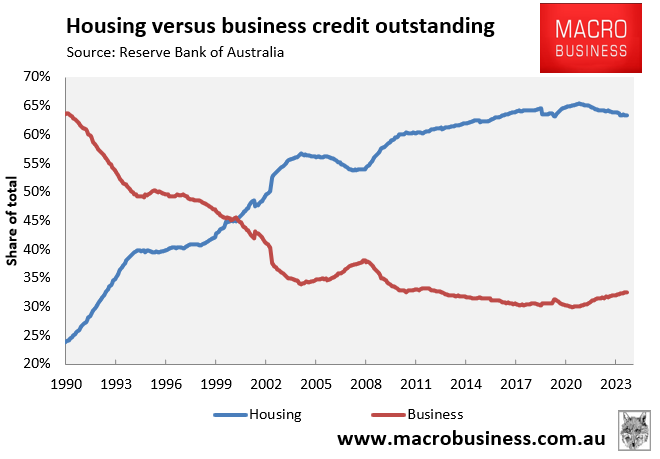

The reality is that Australian banks long ago gave up on lending to businesses, switching instead to mortgage lending:

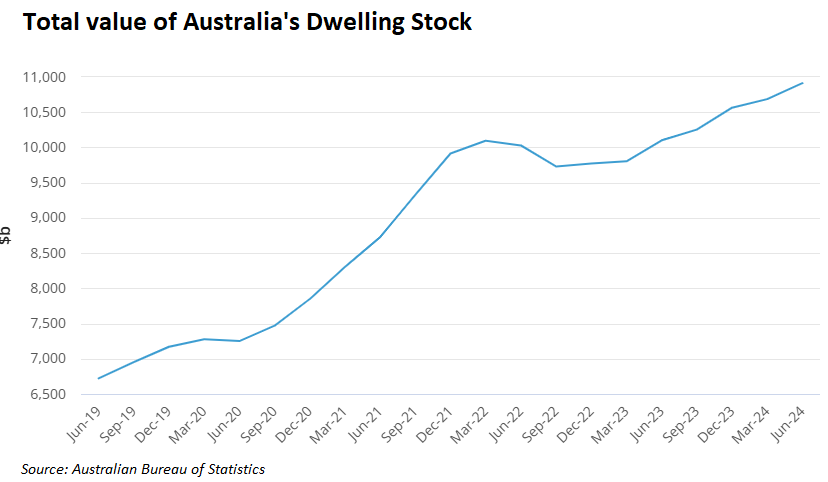

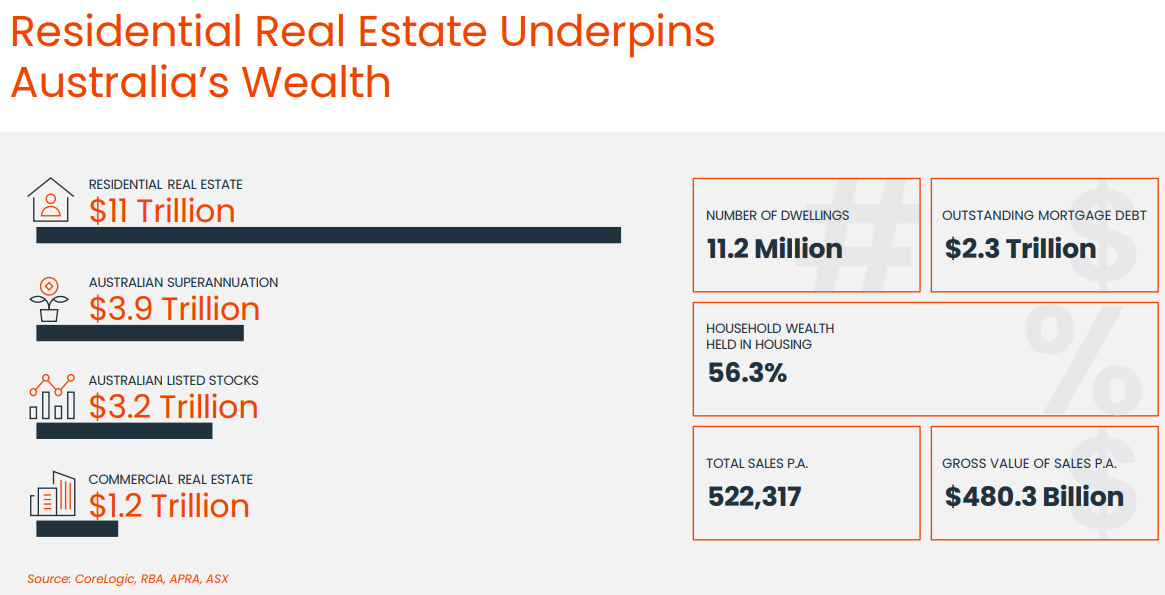

As a result, the total value of homes nationwide has ballooned to nearly $11 trillion, or roughly four times Australia’s GDP, according to the ABS:

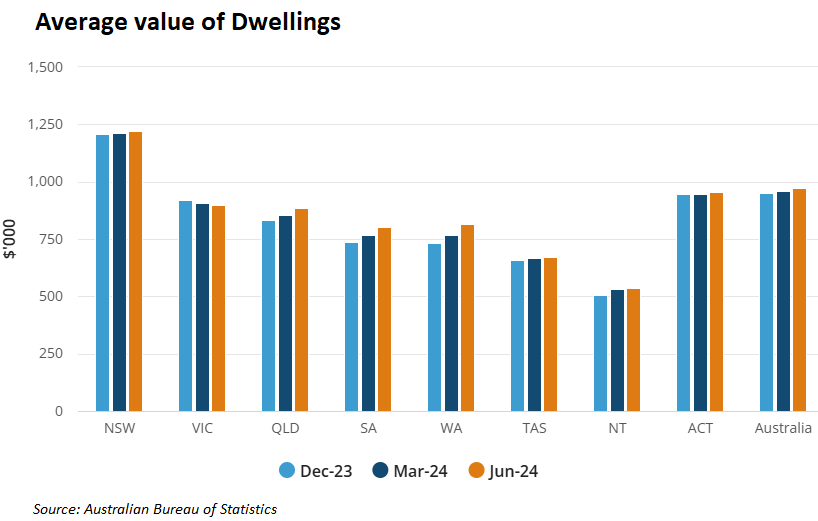

The average dwelling across Australia is now valued at more than $970,000:

CoreLogic values Australia’s residential housing stock at $11 trillion, or $982,000 on average.

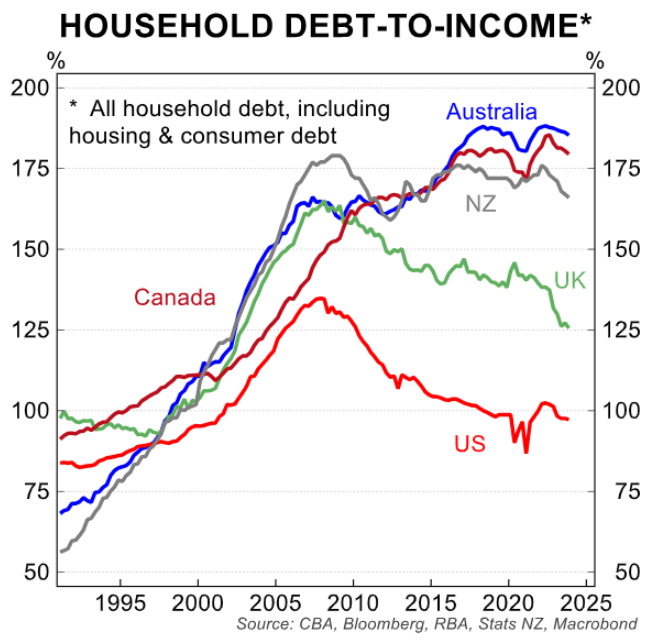

And Australians now carry one of the largest debt loads in the world:

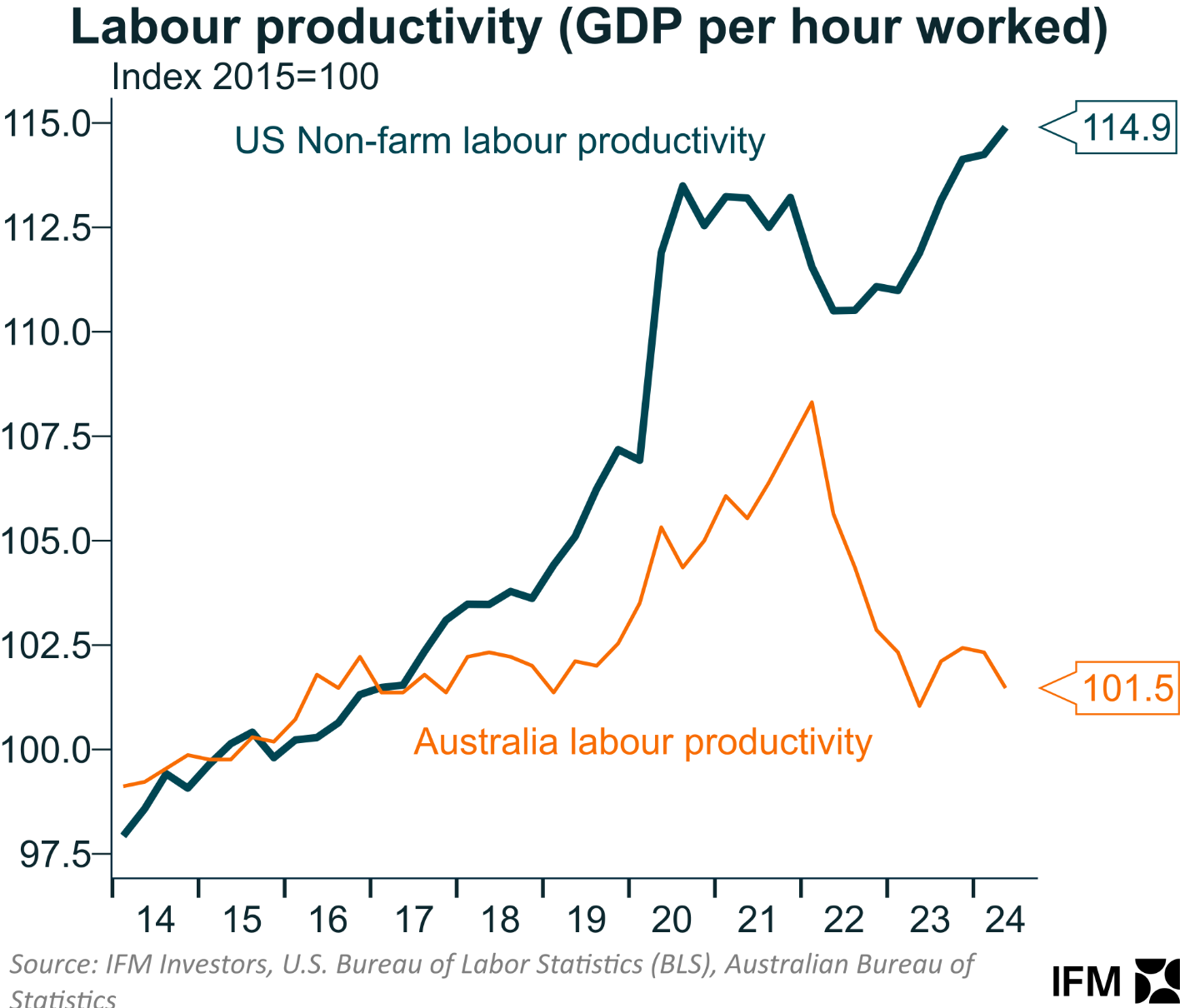

Australia’s productivity is suffering because an increasing share of our economic output is being channelled into non-productive housing:

The reality is that Australia’s economy would be more productive if our financial resources had been directed towards business investment and the real economy rather than merely pumping up the value of established homes.

Australia’s $11 trillion property market is a giant productivity sinkhole.