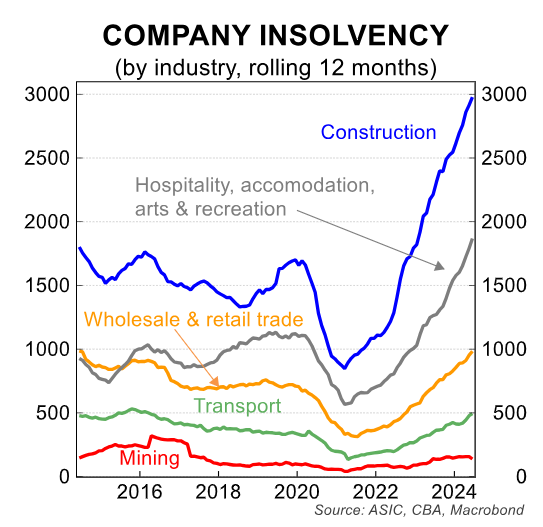

A record number of Australian businesses entered insolvency last financial year, with firms in the construction and hospitality sectors most heavily impacted.

According to data from the Australian Securities and Investments Commission (ASIC), 11,053 companies went into administration in the 2023-24 financial year.

The rate of collapse has continued into this financial year, with ASIC data showing that administrators were appointed to 6,636 companies in the six months to September.

ASIC recorded 3,305 insolvencies in the June quarter and 3,331 in the September quarter, which the Coalition small business minister Sussan Ley says is the worst six-month period on record.

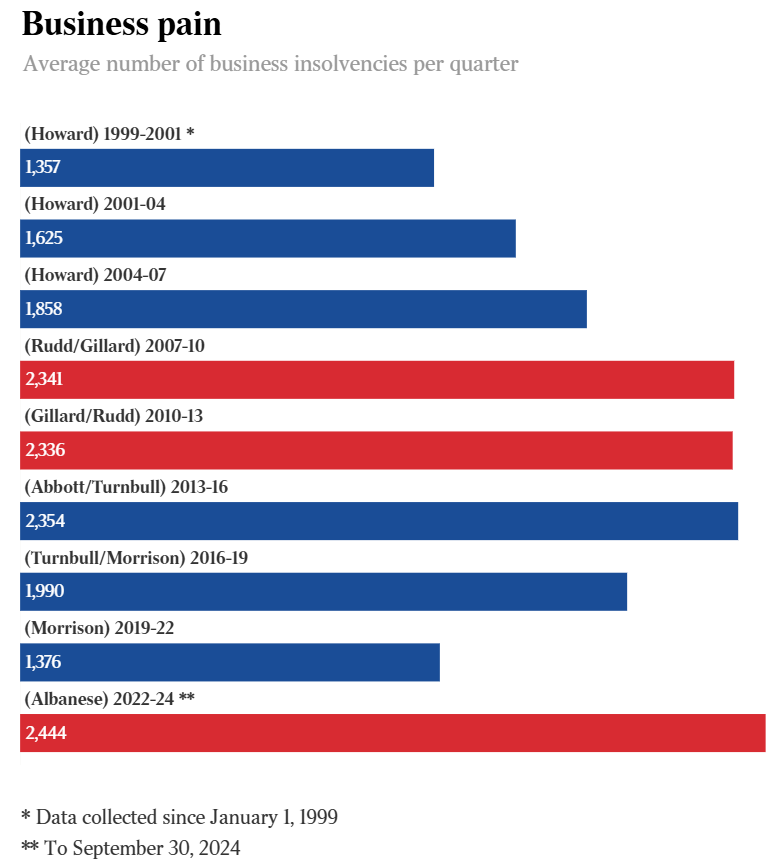

“The Albanese government is on track to be the worst on record when it comes to businesses going to the wall”, Ley said.

Around 22,800 businesses have collapsed since the federal election in May 2022, which the Coalition claims is the worst period on record.

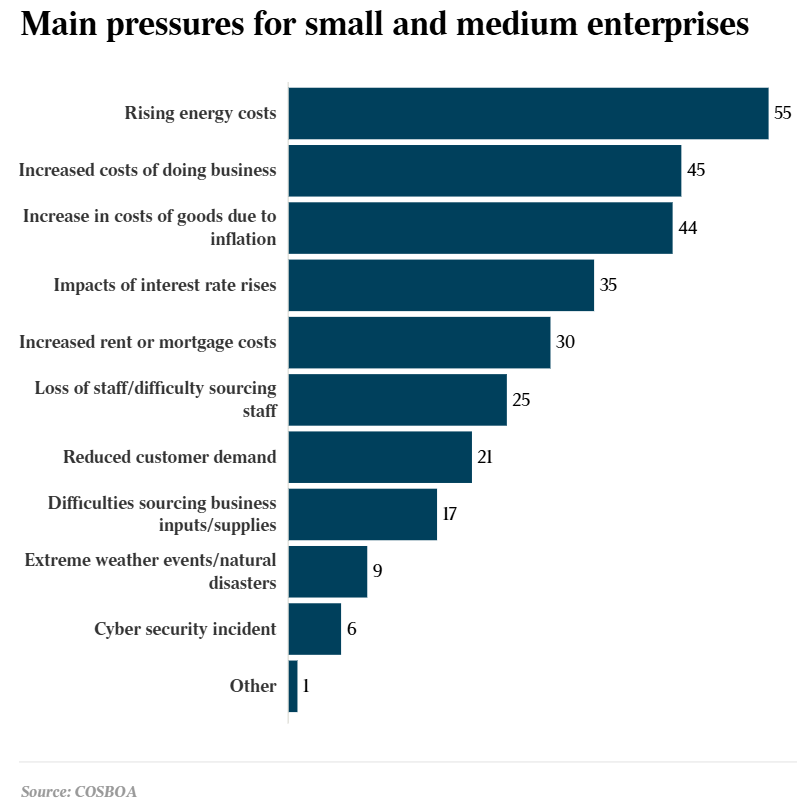

“Small businesses are facing a difficult external environment posed by high inflation and interest rates as well as workforce challenges. Rising costs of goods, wages, and regulatory compliance continue to squeeze profit margins”, CBA small business banking executive general manager Rebecca Warren said.

Meanwhile, a report from the Council of Small Business Organisations Australia and the Commonwealth Bank has warned that operating conditions for small businesses are “arguably the most challenging in living memory”, with twin challenges of increasing living and business expenses “impacting the wellbeing of 2.5 million small business owners”.

Interestingly, Labor’s energy policy failures are having a pernicious impact on small businesses, with “rising energy costs” cited as the number one concern of SMEs:

According to the survey, 57% of small business owners are stressed out about their finances, with one-third not paying themselves owing to cash flow concerns and 25% relying on personal funds.

Rising operating costs have harmed profit margins, with 46% of enterprises reporting increased expenses.

“When a small business isn’t breaking even, the last person to get paid is the owners themselves, and that means the cost of doing business crisis compounds the cost-of-living crisis for small business owners and their families”, COSBOA chief executive Luke Achterstraat said.

“If we do not create better policies to support the engine room of the economy, we will have less small business, reduced competition and be stuck with higher prices for longer”.

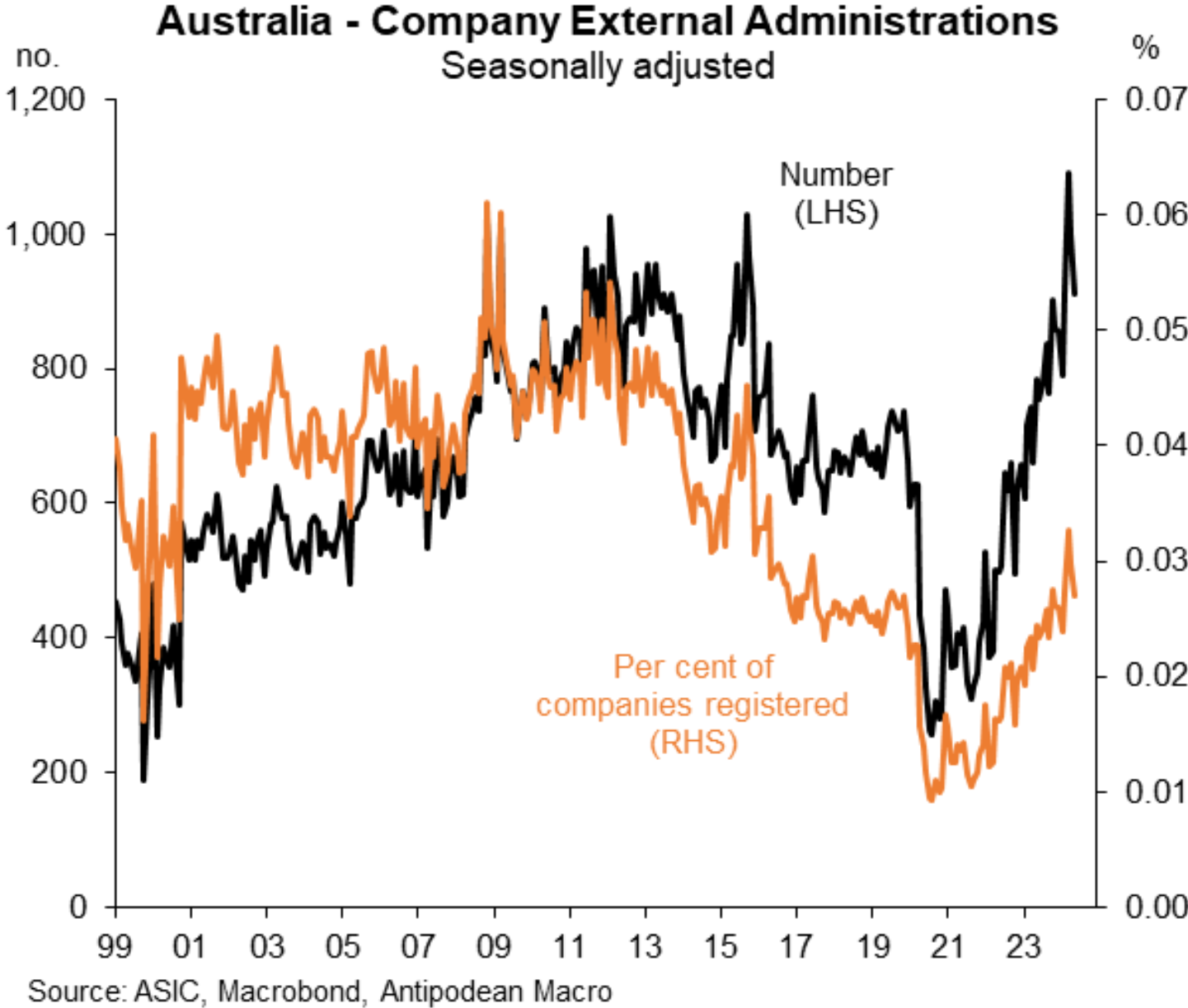

To be fair, the rate of collapse is not nearly as scary when adjusted for the number of businesses operating in Australia:

However, the insolvency situation would worsen if Australia’s unemployment rate shot up and/or there was a sharp correction in home prices.

The Reserve Bank of Australia needs to tread carefully on interest rates as the private sector economy is in recession.