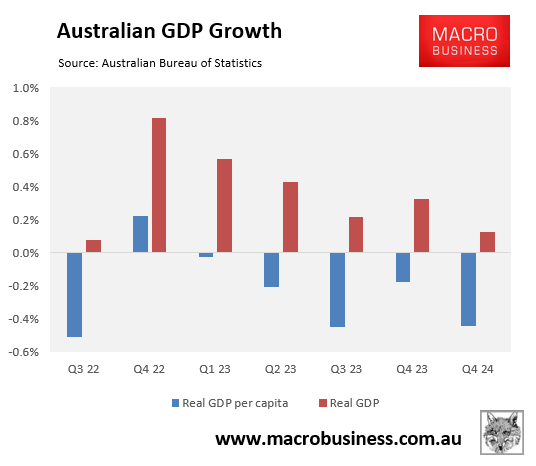

Australians are trapped in the most prolonged per capita recession on record, following six consecutive quarterly declines in per capita GDP and seven declines over the preceding eight quarters.

The International Monetary Fund’s latest World Economic Outlook report forecasts that the Australian economy will grow by just 1.2% in 2024, compared with its April forecast of 1.5% growth.

The IMF then tips that real GDP growth will recover slightly to 2.1% through 2025.

The IMF’s forecast is slightly more optimistic than similar to the OECD’s most recent economic outlook, which reduced Australia’s GDP growth prediction for 2024 to 1.1%, down from 1.5% in the previous edition published in May.

The OECD also predicted Australia’s GDP would grow by only 1.8% in 2025.

Deloitte is even more pessimistic, forecasting growth of only 1.1% this calendar year and 1.6% in 2025.

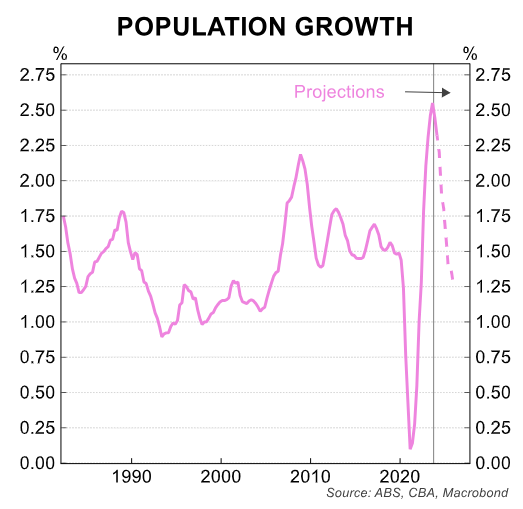

CBA forecasts that Australia’s population growth will slow from its current rate of around 2.3% to just under 2% by year-end 2024 and to around 1.5% in mid-2025.

This suggests that Australia’s per capita recession—already the longest in recorded history—will run into Q1 or Q2 2025.

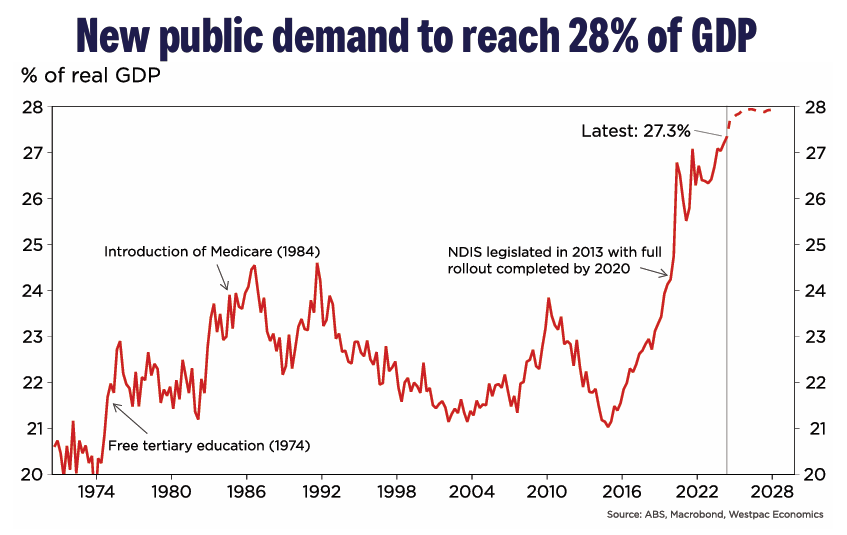

The recession has been masked by unprecedented public spending, which comprised a record 27.3% of the Australian economy’s growth in Q2 2024 and is projected to rise even further:

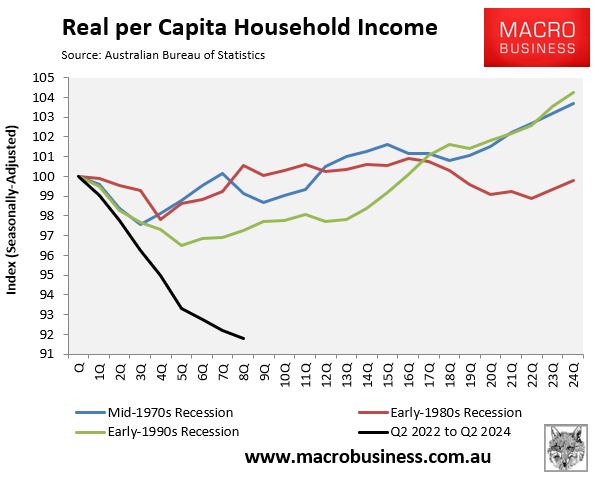

Australian households have been hit especially hard, recording the largest decline in disposable incomes in history over the two years to Q2 2024:

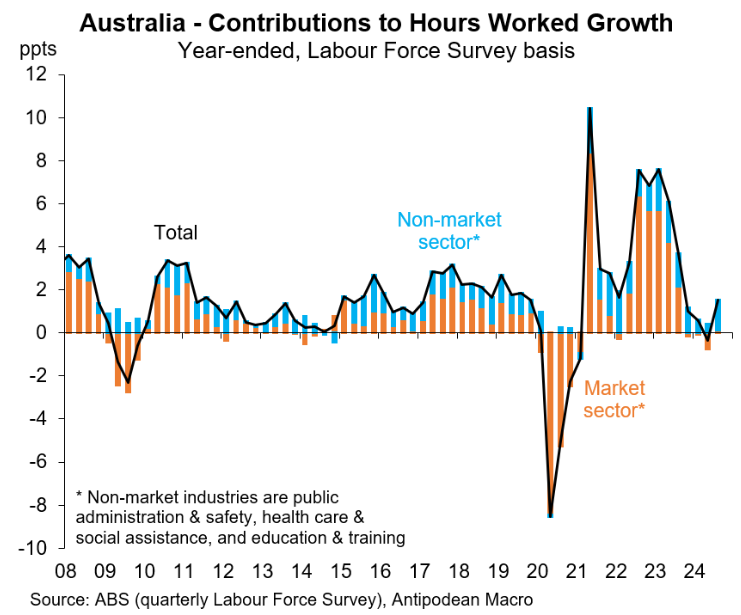

We also know from the latest labour force data that the private (market) sector is in dire straits, recording zero growth in hours worked over the past year despite 2.3% population growth:

The stimulus from near-record immigration (population growth) and record public spending are the only things preventing the Australian economy from sliding into a technical recession.

However, the private sector economy and per capita living standards have been shot.