Earlier this week, property industry analysts Charter Keck Cramer poured cold water on the notion that rezoning Australian suburbs for high density will lead to more affordable housing.

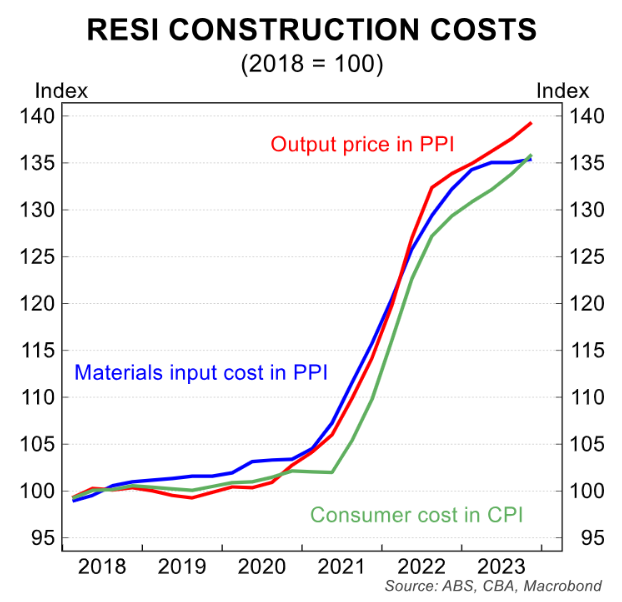

Charter Keck Cramer said that with the explosion in construction costs since the pandemic, apartment prices would need to rise by 15% to make it financially viable for construction firms to build apartments.

“Because building costs have jumped by 30% to 40%, prices have to basically go up to be about 30% higher compared to pre-pandemic levels”, Charter Keck Cramer national executive director of research Richard Temlett said.

“And what that means is that even with these incentives in place, there’s certain projects that will still not be financially viable”.

“The prices of established units need to recalibrate upwards by around 15% for new stock to be accepted by the market at current price points”, said its report, describing the price discrepancy between new and established apartments as a “major handbrake” for delivering new homes.

However, Charter Keck Cramer warned that a 15% increase in apartment prices would price them above what many buyers can afford.

Deloitte Access Economics has released its economic outlook for Australia, which downgraded its forecasts for house construction in Australia.

Deloitte projects that fewer than one million dwellings will be completed over the next five years, well below the federal government’s target of 1.2 million dwellings by mid-2029.

Stephen Smith, lead author of the Deloitte analysis, stated that a number of headwinds have plagued the construction industry since COVID, including extreme cost inflation, labour shortages, and reduced profitability, all of which will continue to weigh on new home development.

Accordingly, Deloitte also argued that prices would need to rise to make construction profitable, which will make housing even less affordable.

“With permanently higher construction costs, the sector will be both unwilling and unable to lift supply unless property prices also lift”, Smith said.

“That is, housing affordability will get worse before it has a hope of getting better”.

The reality is that high-rise developments are unaffordable for most Australians.

In addition to the high sticker prices, owners are slugged with excessive body corporate fees, as explained in the recent Four Corners report, “The Strata Trap”.

“After thousands of Australians wrote to the ABC with shocking stories of financial abuse, The Strata Trap uncovers the unethical practices that have drained untold sums of money from apartment owners’ pockets”, Four Corners reported.

“It’s almost as if the whole business model has been designed to frankly screw Australian apartment owners”, one Sydney apartment owner told Four Corners.

Then, there are the costs associated with remediating the high volume of defects.

A November 2023 NSW government strata survey revealed that more than half of newly registered buildings since 2016 have had at least one serious defect, costing an average of $331,829 per building to fix.

Research by the Strata Community Association NSW revealed that waterproofing was the most common major defect followed by fire safety.

These issues were captured in a separate Four Corners Report, “Cracking up”, revealing a systemic failure to regulate and protect the buying public despite repeated warnings.

Construction lawyer Bronwyn Weir warned that accelerating the construction of high-rise apartment complexes would inevitably result in corners being cut and more defects.

“Australia’s chronically undersupplied housing market is heading for another development boom and apartments will lead the way”, wrote The AFR’s Michael Bleby.

“On current estimates, 50% of what will be built will have serious defects”, Weir told The AFR in January.

She said that “thousands and thousands of apartments have serious defects in their buildings”, labelling the problem “enormous”.

“We have what is now, you know, a systemic failure that is quite difficult to unravel”.

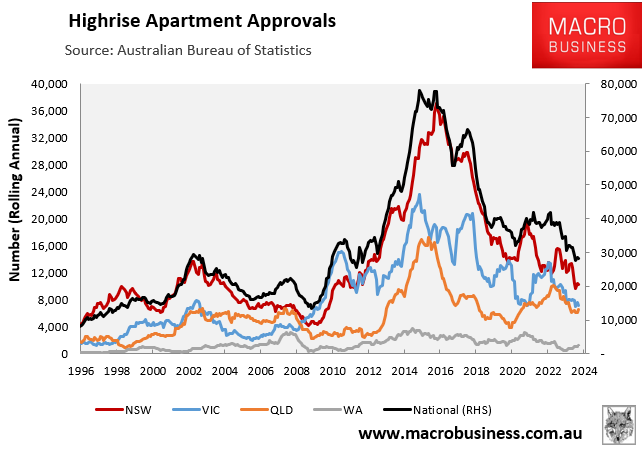

The last decade’s high-rise apartment boom was an unmitigated disaster, costing buyers and taxpayers dearly.

Australia’s politicians are now seeking to double down by facilitating an even larger construction boom that will inevitably result in worse outcomes.

High-rise shoebox apartments would not be required if the federal government did not choose to grow the nation’s population like an out-of-control science experiment via extreme levels of immigration.

Regrettably, federal and state politicians have given up on governing for the benefit of the Australian people. We are merely business units feeding the Ponzi economy.