Australians don’t want to live in apartment high-rises

The Victorian government’s plan to address the housing crisis by pushing for mid-level and high-rise apartment buildings to be developed in designated “activity centres” of Melbourne has been labelled as “not feasible to build and sell, especially at scale” by property developer Max Shifman.

Shifman notes that new apartments cost significantly more to build or buy in Australia than an equivalent new townhouse or detached house.

As a result, apartment developers have shifted their focus to the premium end of the market, such as people downsizing their existing home.

“It costs at least three times as much to build a square metre of a new apartment compared with a good-quality townhouse, or four times more than a new detached home”, Shifman wrote in The Age newspaper.

“This means the only apartments that generate a suitable return on investment are premium, boutique apartments targeted at wealthy downsizers”.

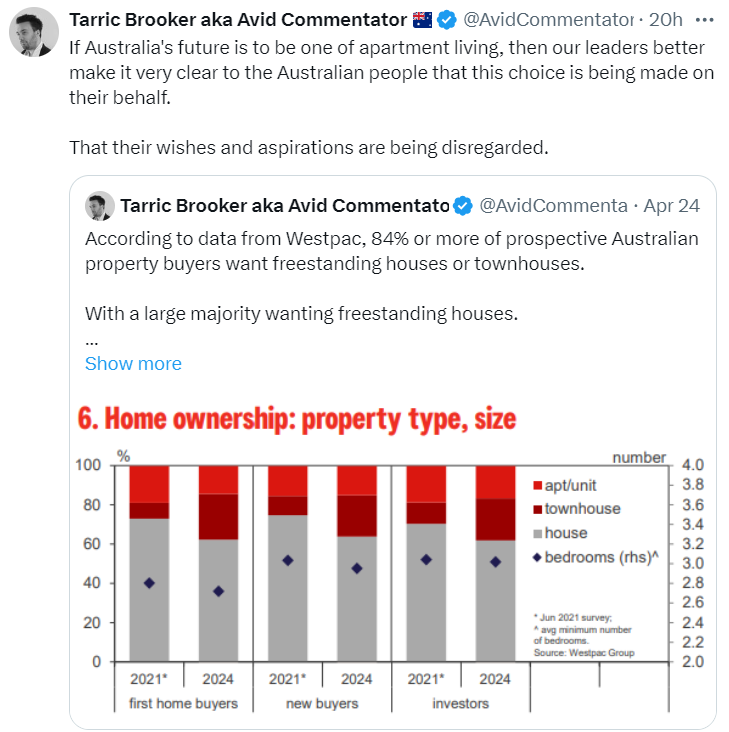

Shifman also argued that the majority of buyers still want at least three bedrooms in their next home, and they overwhelmingly do not want these bedrooms to be in an apartment building.

“This explains the growing chasm between the Victorian government’s aspiration to build thousands of “well-located” homes in established suburbs and the reality of delivering them”, Shifman wrote.

Shiftman pointed to the Westpac Housing Pulse survey published earlier this year, which showed that only 26% of buyers in Melbourne were seeking an apartment or unit.

The results echoed similar surveys over the years. These include Infrastructure Victoria’s often-referenced Our Home Choices report of 2023, “which showed just one in five people living in a greenfield suburb would consider an inner-city apartment or townhouse if the price was comparable (which it is not)”.

The key problem, according to Shifman, is that “across Australia, new apartments cost significantly more to build or buy than an equivalent new townhouse or detached house. The price of materials, high building standards, and labour costs all contribute”.

“Construction costs have risen so much that developers now need to sell apartments at the rate of $14,000 per square metre or more for a project to be feasible – about 40% higher than selling rates before COVID”, Shifman wrote.

“This translates into a small new one-bedroom apartment of about $650,000, a two-bedroom apartment of 70 square metres at nearly $1 million, or a reasonably sized three-bedroom “family” apartment at about $1.5 million or more”.

As a result, apartments are typically priced above what most buyers are willing or able to pay.

The end result, according to Shifman, is that the “Victorian government is selling an affordability dream to young people that cannot be realistically delivered”.

Therefore, “speeding up planning in these activity centres will deliver little benefit if the result is a housing product that costs too much and doesn’t meet the utility of buyers”.

Shifman’s concerns were echoed this week by property industry analysts Charter Keck Cramer, who argued that existing and new apartment prices will need to rise considerably to make it financially viable for developers to build new high-rises.

“Because building costs have jumped by 30% to 40%, prices have to basically go up to be about 30% higher compared to pre-pandemic levels”, Charter Keck Cramer national executive director of research Richard Temlett said.

“The prices of established units need to recalibrate upwards by around 15% for new stock to be accepted by the market at current price points”, with the price discrepancy between new and established apartments considered a “major handbrake” for delivering new homes.

The reality is that the escalation in costs and buyer preferences are the major roadblocks to achieving the state government’s high-rise utopia.

These apartments are simply too expensive to build, quality is poor, and most Australians do not want to live in them.

The underlying problem is that the federal government continues to inundate the nation with new migrants needing housing.

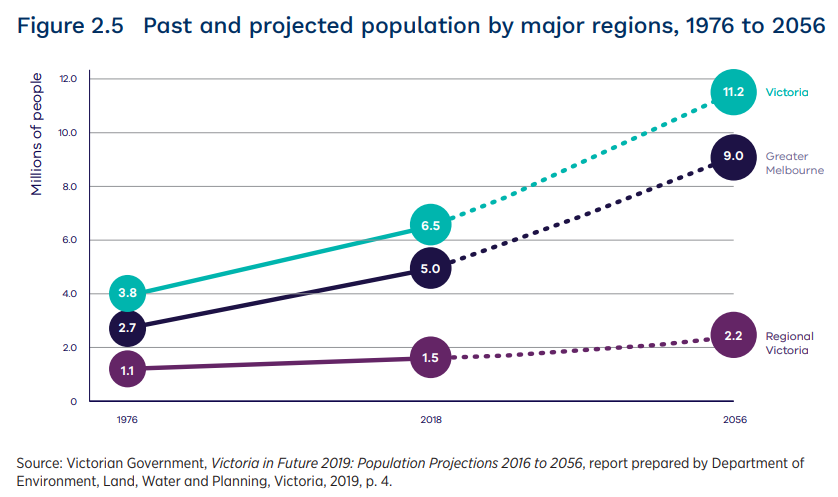

Melbourne’s population is officially projected to grow to 9.0 million people by 2056, which is 5.5 million more than the city’s population in 2000.

These millions of extra people will need to live somewhere and high-rise apartments are the path of least resistance.

Of course, the simplest and cheapest solution to Melbourne’s (and Australia’s) housing woes is to slash immigration and reduce the need for extra housing and infrastructure.

Who seriously believes that Melbourne will be a better place to live with 9 million people? It is bad enough at 5.4 million.