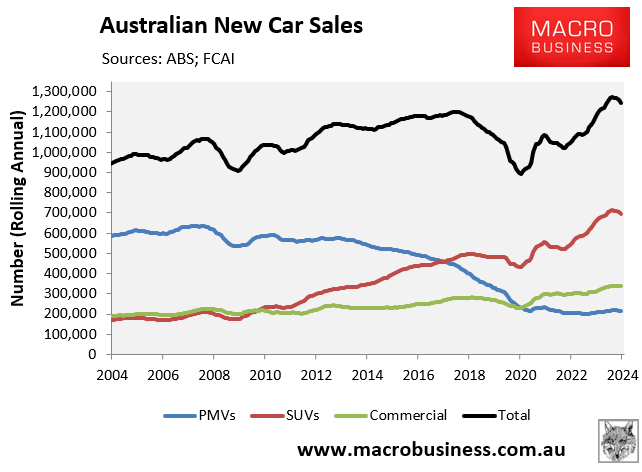

The Federal Chamber of Automotive Industries (FCAI) released new car sale data for September, which showed that overall sales fell by 12.4% versus the same month last year.

FCAI Chief Executive Tony Weber noted that “the September result shows that the state of the economy is impacting purchasing intentions”.

However, it was the first time Australia’s automotive industry had achieved sales exceeding 900,000 by the end of the third quarter.

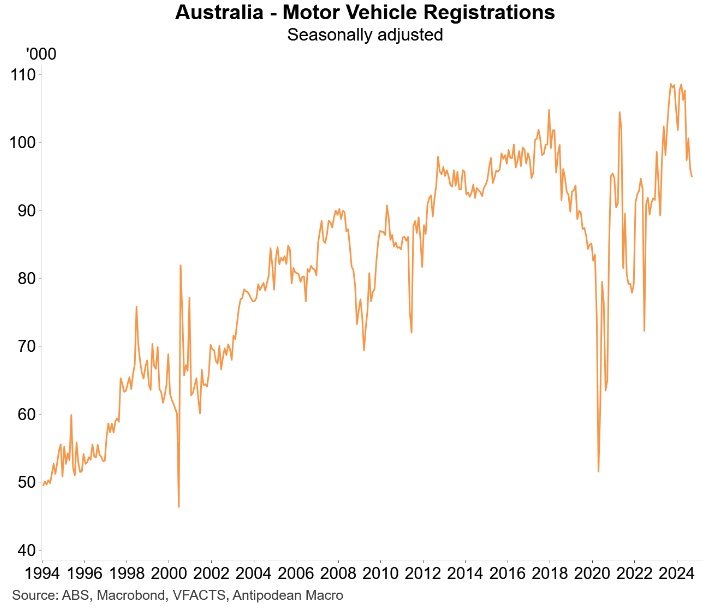

Vehicle registrations have also declined, suggesting further sales declines in the period ahead.

The most interesting titbit from FCAI’s media release was the following statement from Tony Weber:

“Customers are showing a willingness to take steps towards lower emission vehicles with sales of hybrid and plug-in hybrid continuing to increase”…

“Recorded sales of battery electric vehicles are again disappointing this month. This is in spite of a strong supply of EVs and the addition of a number of new brands and models being introduced into the Australian market”…

“This trend in lower EV sales and increased hybrid and plug-in hybrids is reflected in markets across the world as production and purchase incentives are being wound back”.

Recall that the Australian Energy Market Operator (AEMO) recently sliced its projections for battery EV take-up over the next decade, from seven million to four million.

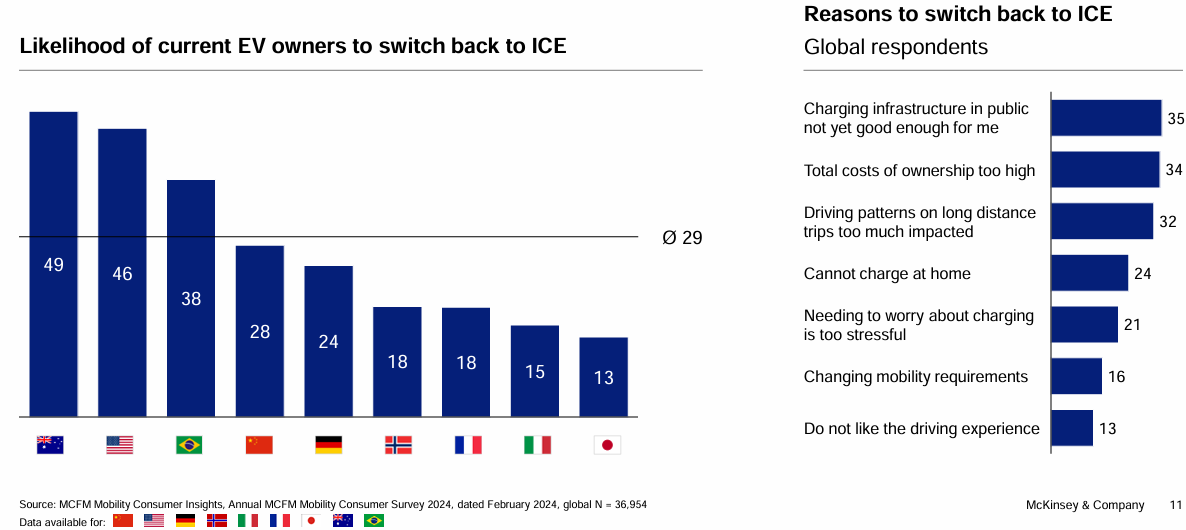

A recent McKinsey Mobility Consumer survey found that nearly half of Australian EV owners (49%) are “very likely” to return to traditional petrol and diesel vehicles.

The biggest concerns cited by respondents included the existing state of public charging infrastructure (35%) followed by concerns about ownership costs (34%).

Concerns around ownership costs were highlighted last week in a study of 12 insurers carried out by comparison site Compare the Market, which found that electric cars are almost 50% more expensive to insure than their ICE equivalents.

“EVs are generally more expensive to insure because the battery pack creates more complexity for repairers, many EV-specific parts need to be imported from overseas, and there are fewer qualified smash repairers for electric cars”, Compare the Market’s economic director, David Koch said.

Meanwhile, GM, Ford, Volkswagen, Volvo, and other manufacturers are pulling back on EV production amid stalling global sales.

The reality is that battery EVs are not ready for prime time. They are still overpriced, lack fast and convenient charging options, offer poor range (especially on highways where regenerative braking is not needed), and are expensive to insure and repair.

Standard hybrids, on the other hand, overcome most of these shortcomings, which is why their sales are exploding.

Toyota has made reliable and competitively-priced hybrids for decades. They get fantastic fuel economy and range and have fantastic resale value, unlike battery EVs, whose depreciation is akin to disposable junk.

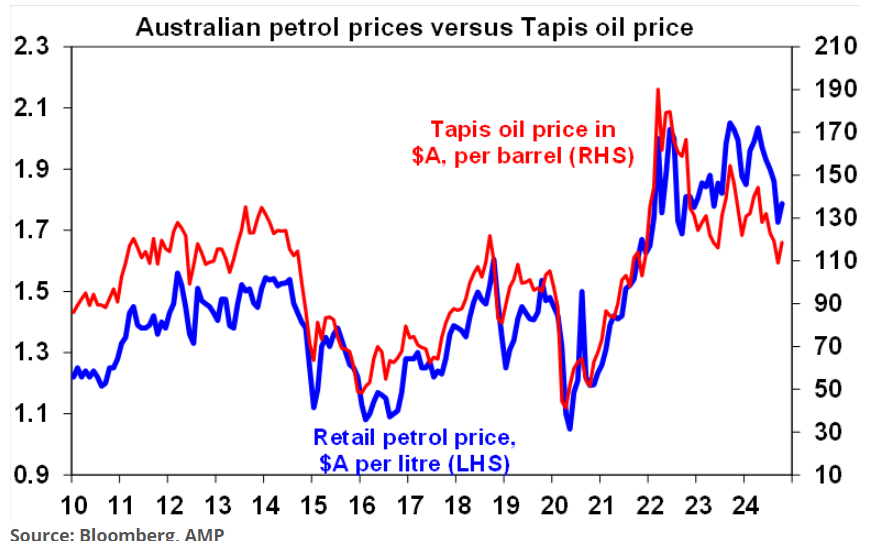

Finally, the moderation of petrol prices has improved the cost equation for traditional ICE and hybrids over battery EVs.