Builder Jason Janssen, chairman of Home Builders Action Group, has described the utter “decimation” of the home building industry in the wake of federal and state government Covid housing stimulus and the subsequent surge in construction costs.

“Unfortunately a lot of builders took on too much work as part of the stimulus and they are the ones that are still suffering at the moment”, Janssen said.

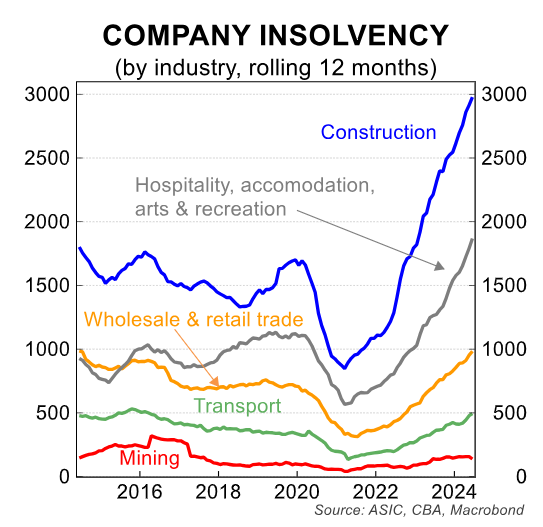

“This government stimulus structurally damaged and weakened the building industry, and we’ve seen insolvencies at record highs”.

“During that period, it was probably the toughest two years of my life”, he said.

“You’re going to work every day, busting your a**, losing money and getting whipped by everyone – clients, media, you name it. You’re just in an unwinnable situation”.

“They can’t pass on price increases and they’ve got no option but to work their a**es off and lose money”.

“That’s how severe this was. And it’s not just me; all the big companies have lost hundreds of millions of dollars”, he said.

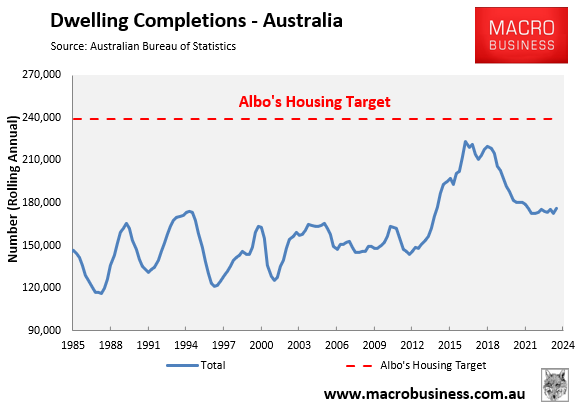

Janssen warned that it could take five years for the homebuilding industry to return to pre-covid levels.

“From 2020 to 2029, it’s basically a nine-year write-off. It’s almost like our decade of decimation effectively”, he said.

In this time period, the delusional Albanese government has promised to build 1.2 million homes – a rate of construction that has never been achieved before.

Meanwhile, new research from Equifax reveals that the proportion of insolvencies to credit-active construction firms has more than tripled over the last two years, reaching 3% of all credit-active businesses in Q2 2024.

Equifax also warned that the number of business exits across construction continues to rise, now tracking at more than 15% of total construction businesses.

“Equifax data reveals the number of credit-active businesses has actually fallen. For the period ending June 2024, the number of credit-active constructors dropped and were lower than the same time last year”, the media release reads.

“While the rate of construction insolvencies has slowed in recent months, the numbers remain nearly double historical levels. Additionally, the proportion of insolvencies to credit-active constructors has more than tripled over the last two years, reaching 3% of all credit-active businesses in Q2 2024”.

“With the number of business exits across construction continuing to rise (now more than 15% of total construction businesses), significant stress remains across the industry”.

“This is reflected in the latest data from Equifax, showing a drop in construction credit quality together with an elevated number of rating downgrades”.

The headwinds facing the homebuilding industry are immense, scuttling any hope of achieving Labor’s 1.2 million housing target. These headwind include:

- Interest rates are likely to remain structurally higher than they were at last decade’s construction peak.

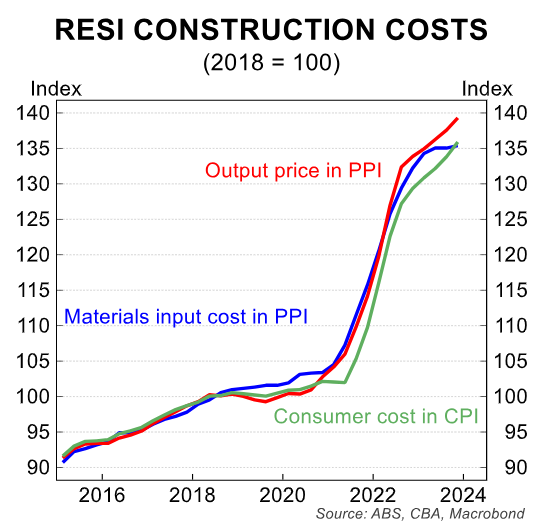

- Construction costs are around 40% higher than they were pre-pandemic.

- Builders are competing for labour and materials against government big build infrastructure projects.

- Thousands of home builders have collapsed, reducing capacity across the industry.

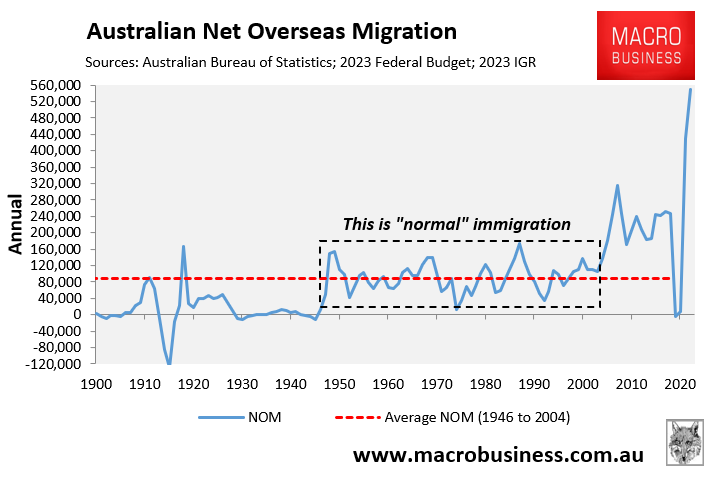

The only realistic solution to Australia’s housing shortage is to slash net overseas migration to a level that is below the capacity to build housing and infrastructure.

Otherwise, Australia’s housing crisis will worsen.