Earlier this year, Vanguard Australia warned that the housing crisis threatens the nation’s retirement system.

Vanguard projected that an increasing proportion of Australians would rent in retirement, while 30% would still be paying down their mortgages.

“Australians have this view that they will own a home and be debt-free when they get to those retirement years”, Vanguard Australia managing director Daniel Shrimski said.

“In actual fact the research suggests that’s not going to be the case in many instances … it will be a real financial burden”.

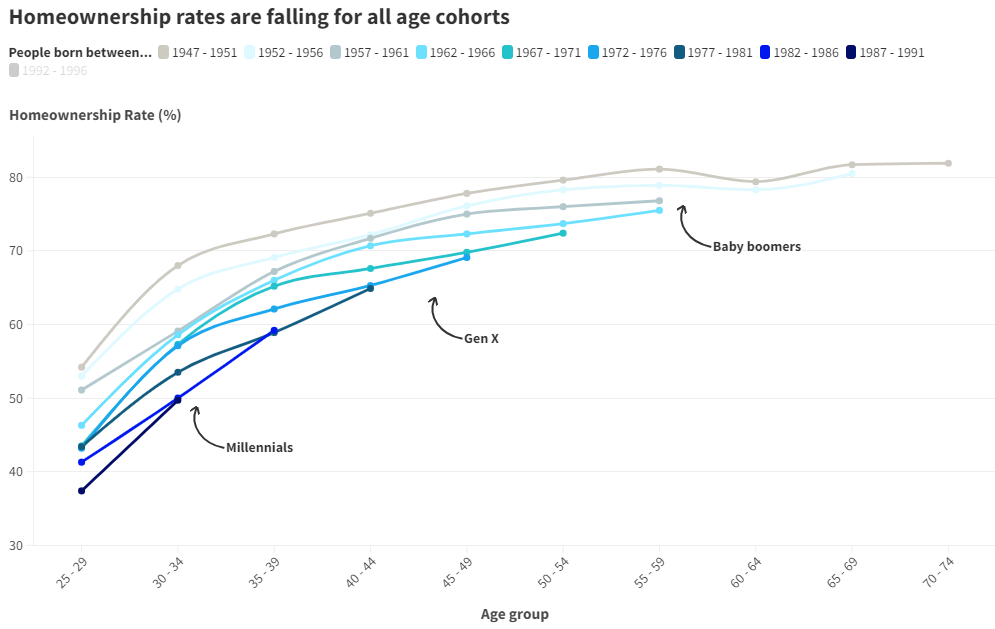

“In about 30 years, when millennials start retiring, they’re going to have much lower rates of home ownership … if housing remains expensive, it means a big chunk of your diminished [retirement] income from super goes into housing”, Demographer Simon Kuestenmacher added.

The Super Members Council of Australia estimated that over 40% of Australian retirees carry mortgage debt, compared to 16% two decades ago.

Furthermore, they estimated that 40% of singles and 33% of couples would use their whole superannuation nest egg to pay off debt.

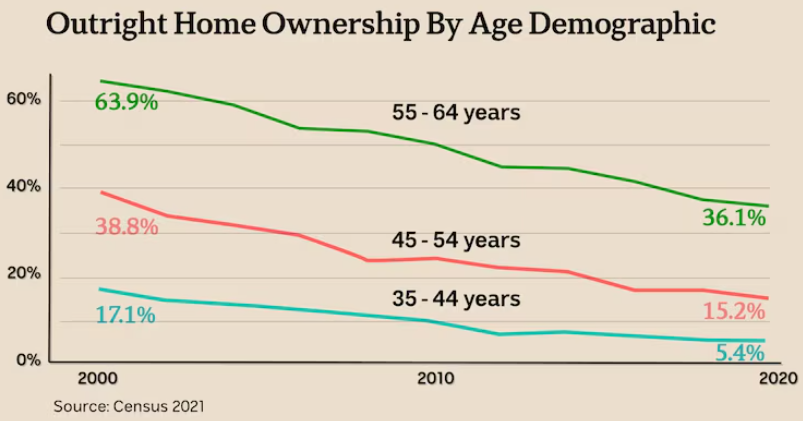

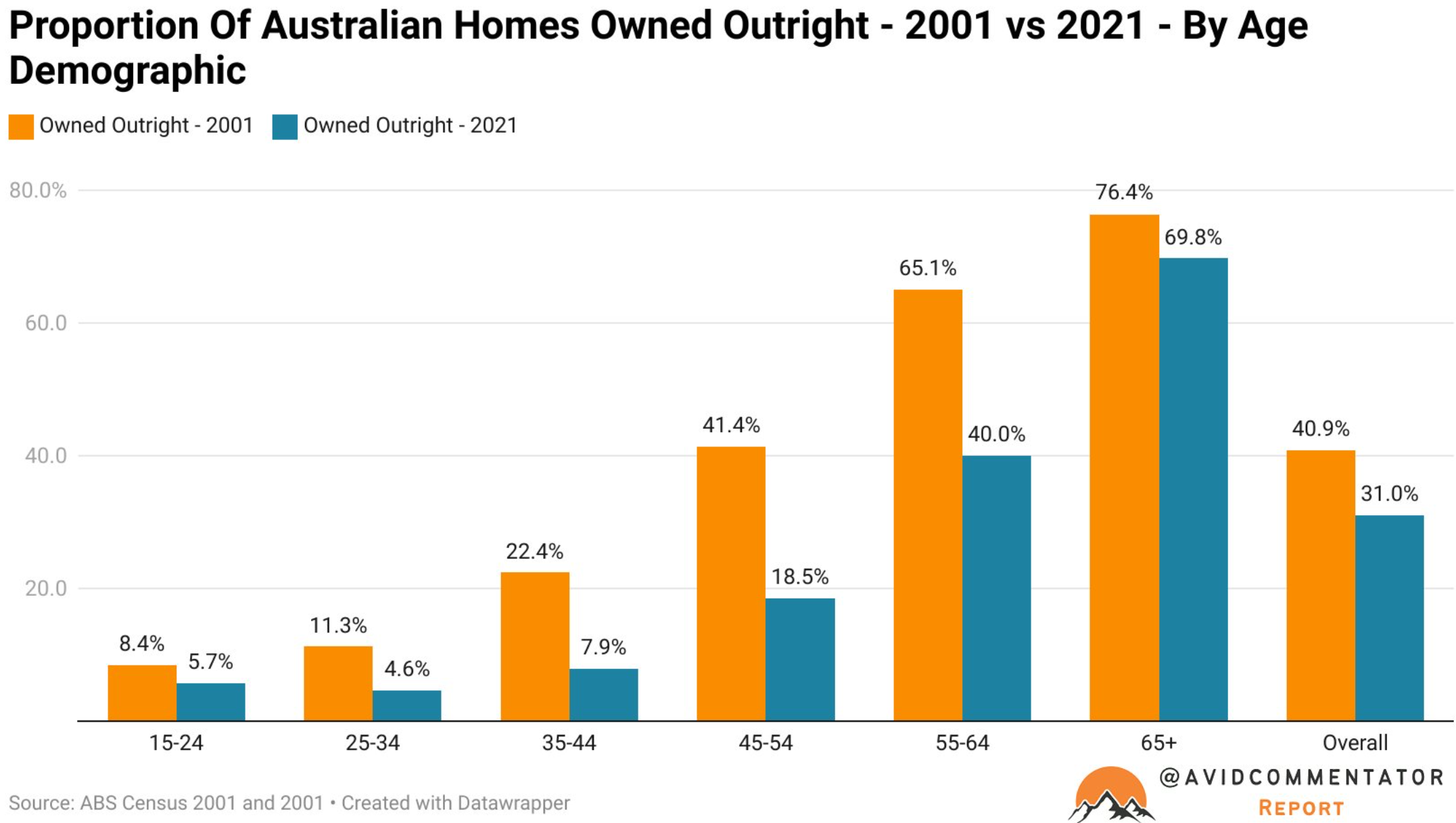

Census data, presented below by the ABC, showed that over the past 20 years, the number of Australians aged 55 to 64 who owned their homes outright had almost halved.

Chart by The ABC

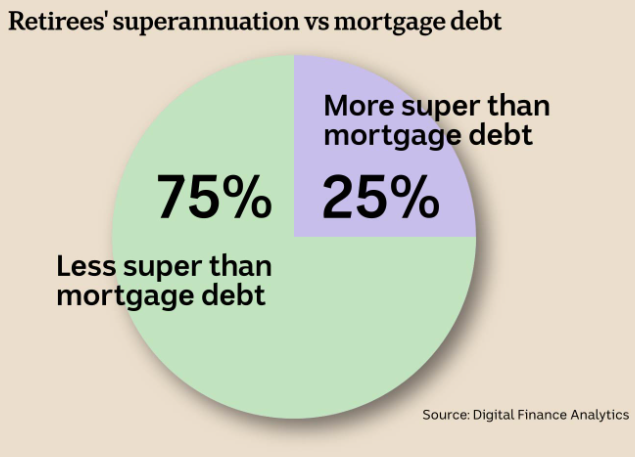

A new survey by Digital Finance Analytics found that nearly three-quarters of retirees with a mortgage owe more than they have in superannuation.

The trend is expected to continue as the age of first home buyers rises, meaning that many will use their superannuation to pay down their home loans and rely on the age pension.

The average mortgage balance in this group was around $190,000, but some owe up to half a million dollars.

Chart by The ABC

Given Australia’s declining homeownership rates, the above outcomes are inevitable.

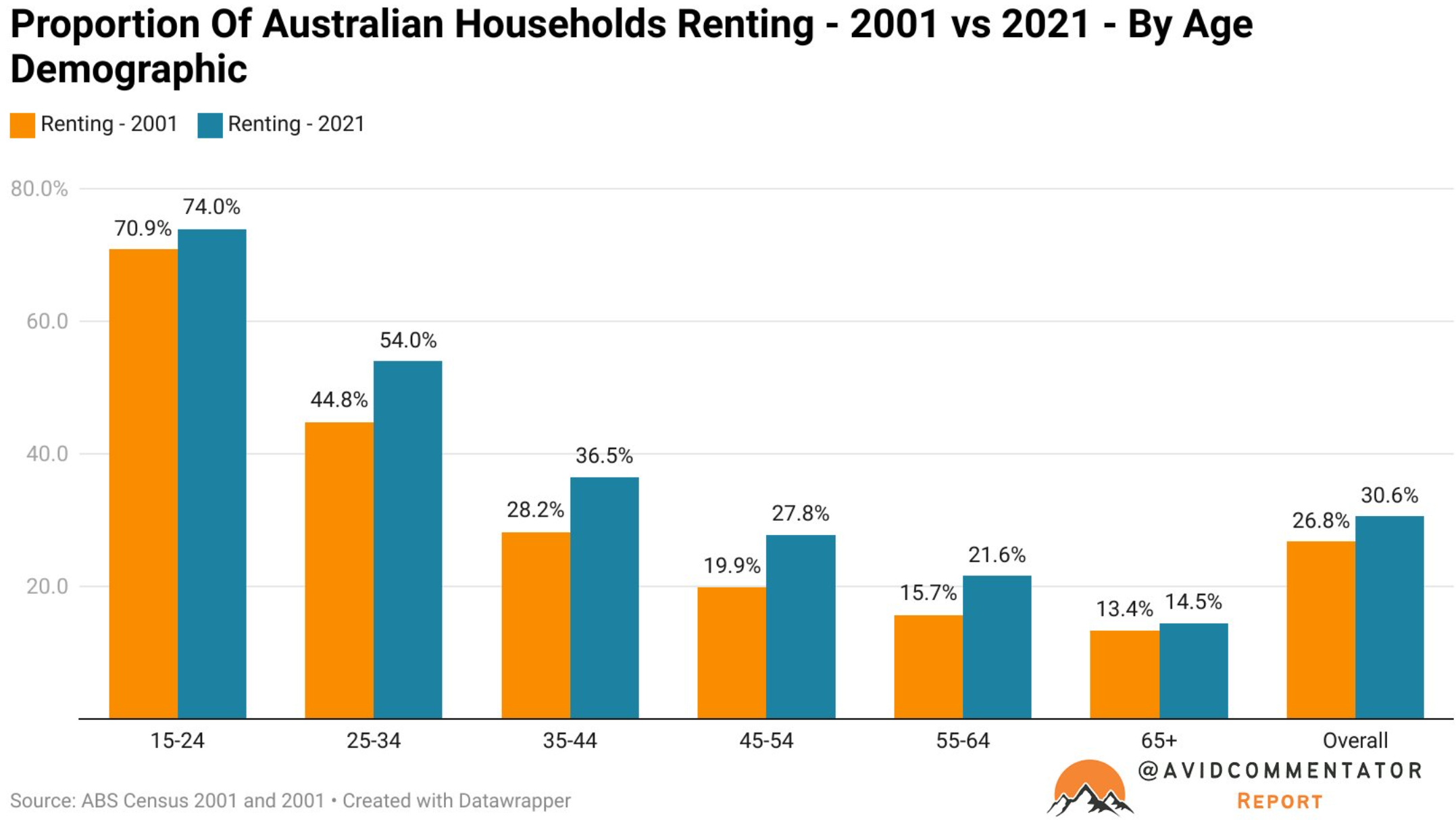

The proportion of households renting has increased significantly, as independent economist Tarric Brooker shows below.

Reflecting the decline in younger homeownership, the Grattan Institute predicts that the proportion of Australians aged 65 and more who own a property will fall from 76% now to 57% by 2056.

There has also been a significant increase in the number of Australians aged 55-64 and 45-54 who have mortgage debt, as well as a smaller increase among those who are already retired (65 or older).

The evidence is clear: an increasing proportion of Australian seniors will rent in the future, while others will face higher mortgage burdens.

Both developments pose a challenge to Australia’s retirement system, which is based on the assumption that most people will own their homes outright when they retire.