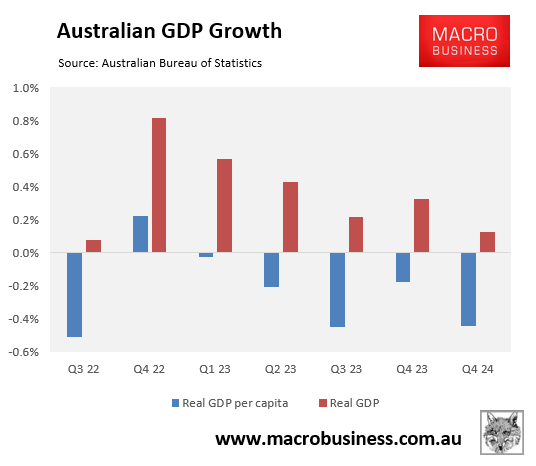

I noted on Monday how Australians are experiencing their longest per capita recession on record following six consecutive quarterly falls and seven declines in the previous eight quarters.

The OECD’s most recent economic outlook cut Australia’s GDP growth forecast for 2024 to 1.1%, down from 1.5% in the previous edition in May. The OECD also estimated that Australia’s GDP will increase by only 1.8% in 2025.

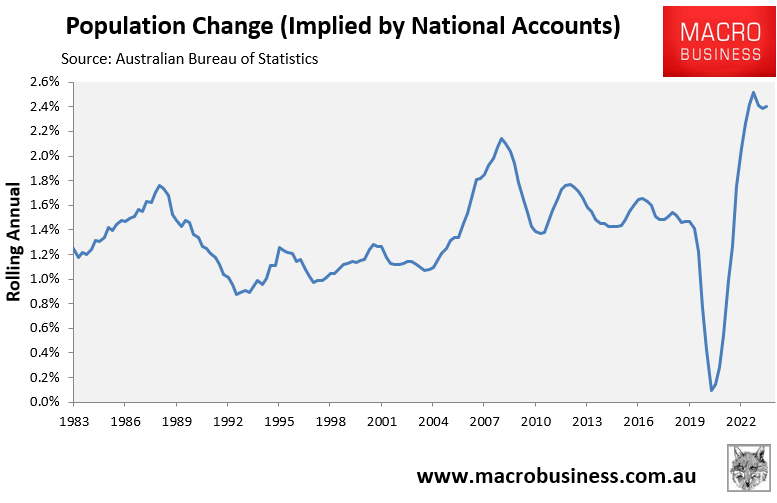

Given that Australia’s population grew by 2.4% in the year to June 2024, these forecasts suggest that the per capita recession will run into next year, an unprecedented fall.

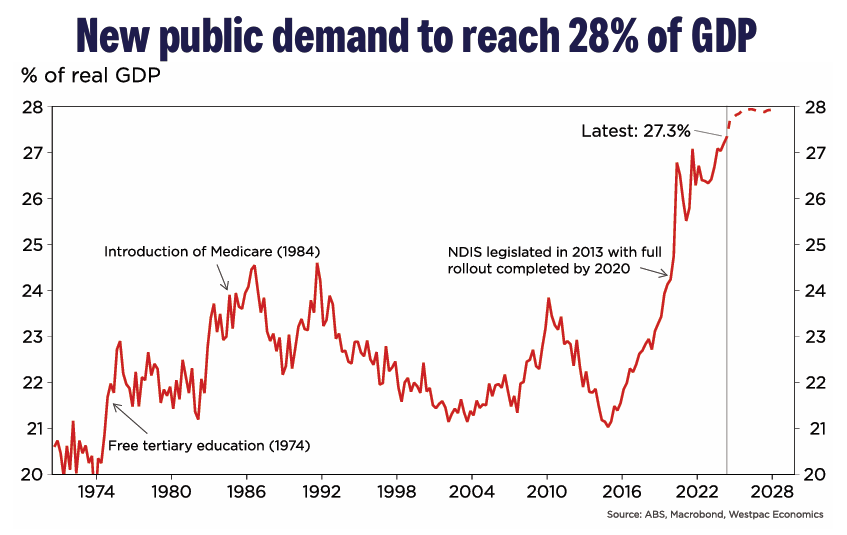

The per capita recession has arisen despite record government spending.

Public demand hit a record-high 27.3% share of GDP in Q2 after growing by 1.5% over the quarter. Westpac also projected that government spending will continue to rise as a share of the economy.

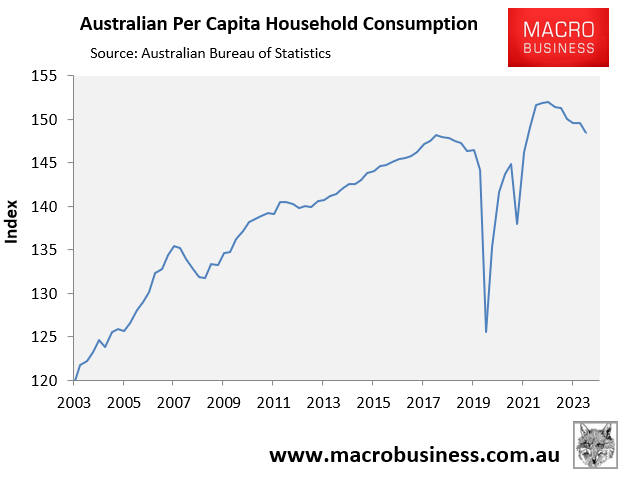

Australia’s households have been hit hardest by the recession and the RBA’s aggressive rate hikes.

As of Q2, household consumption had fallen 2.4% from its peak in real per capita terms:

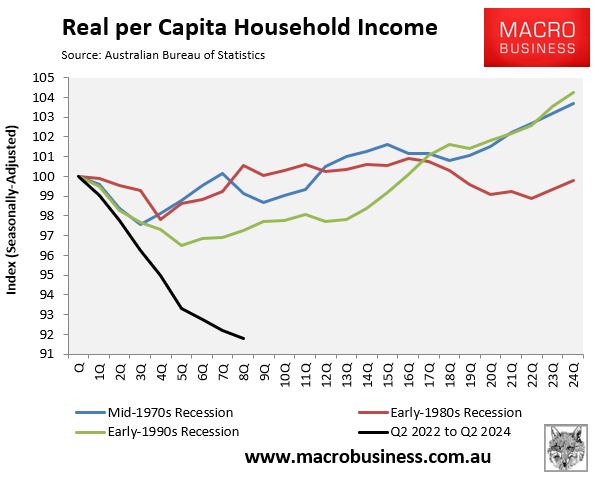

Even worse, real per capita household disposable income recorded its largest ever decline after contracting by 8.2% over the past two years:

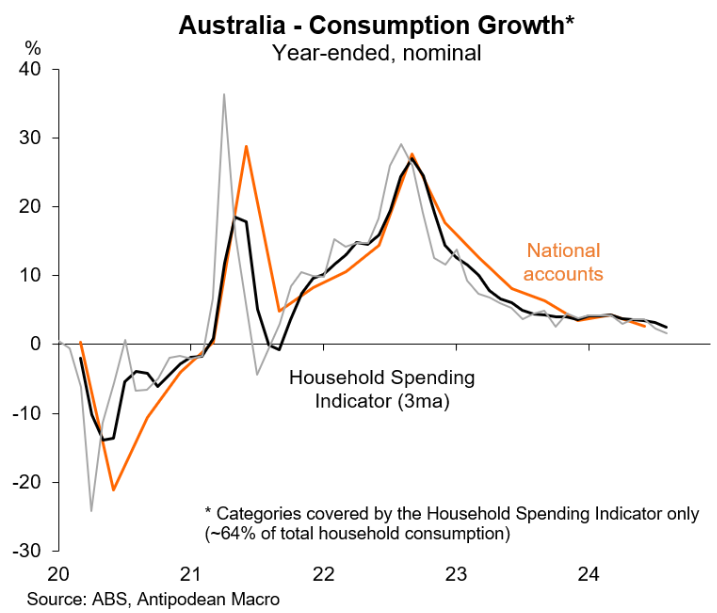

Last week’s Household Spending Indicator release from the ABS showed that aggregate spending growth had stalled despite the Stage 3 tax cuts.

Spending in August was flat in nominal terms following revised falls of 0.5% in July and 0.1% in June.

Adjusting for inflation and population growth means that spending continues to fall in real per capita terms.

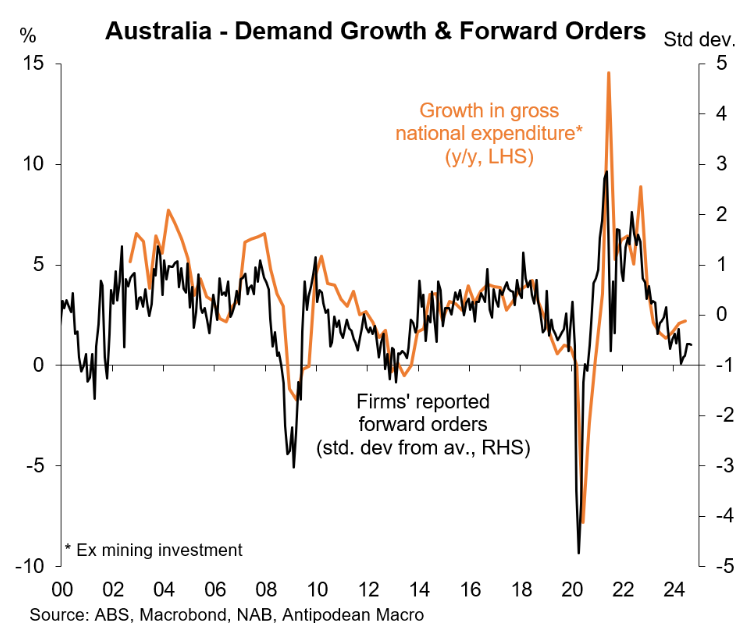

On Tuesday, the NAB business survey was released, which revealed that “forward orders remained weak at -5 index points suggesting there may continue to be some pressure on activity going forward”.

The following chart from Justin Fabo at Antipodean Macro plots forward orders against gross national expenditure and suggests that aggregate domestic demand remains weak, meaning it continues to fall in per capita terms:

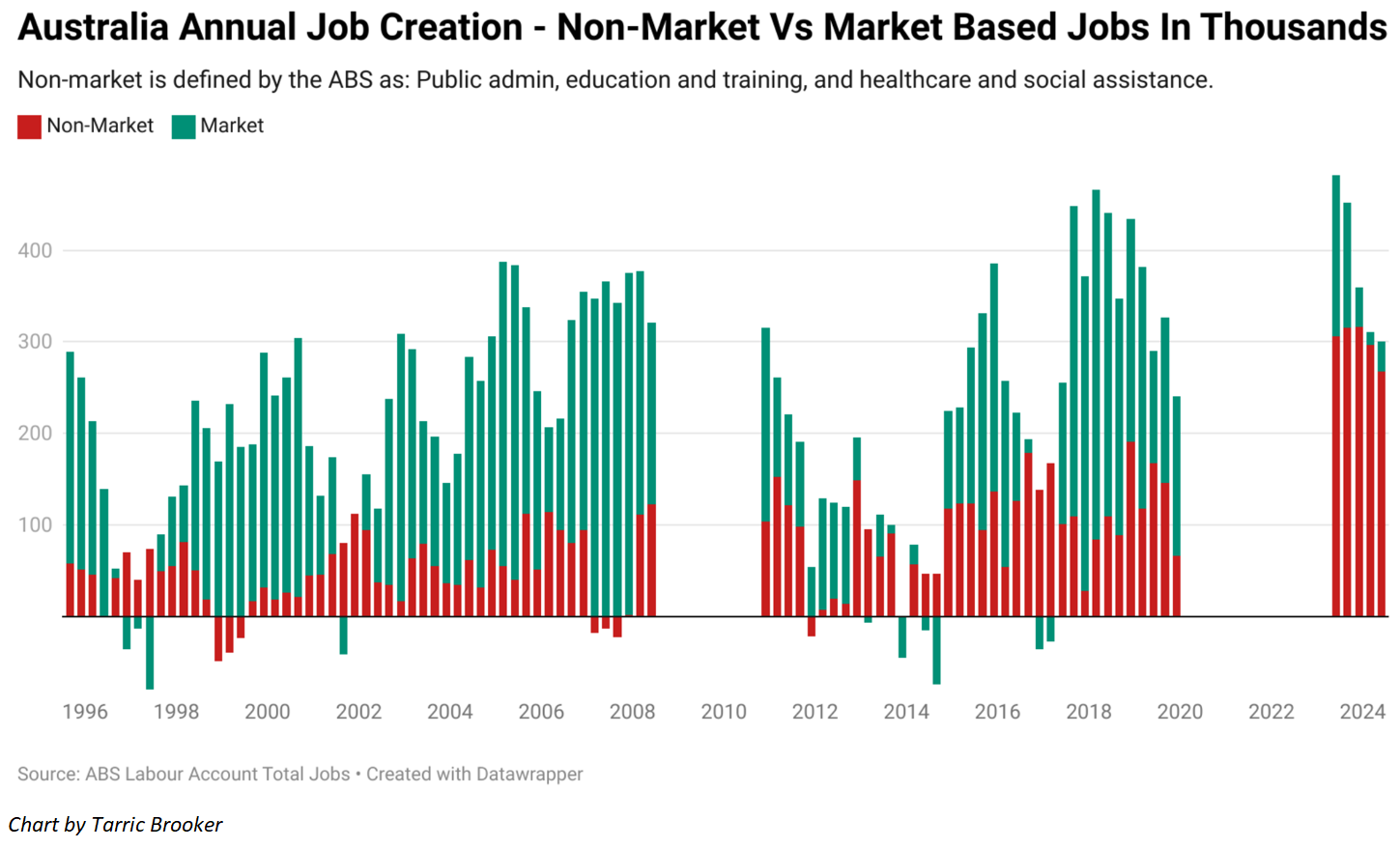

We also know from the latest quarterly labour market account from the ABS that private sector job growth is anaemic.

Specifically, 268,000 jobs were created in government-funded roles in 2023-24, whereas only 33,000 new jobs were created in the market sector (i.e., in all other industries):

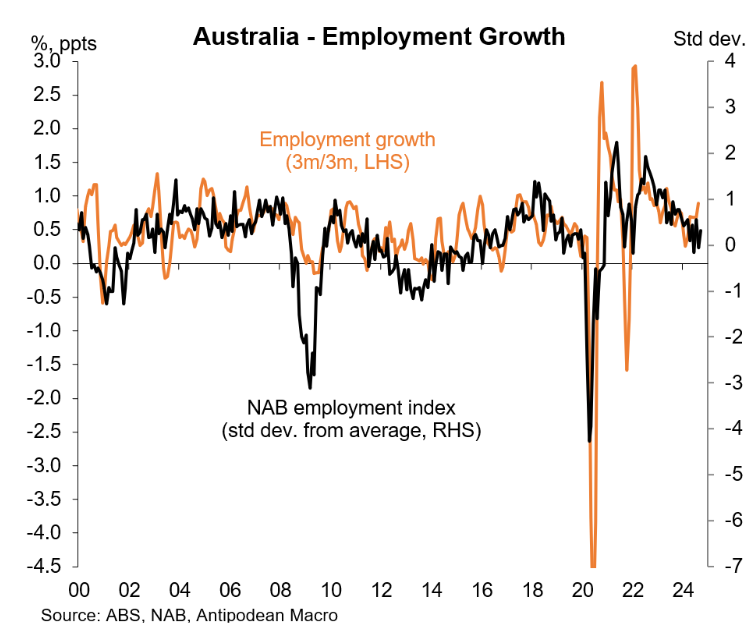

The NAB survey also showed that firms’ reported hiring in September was tracking around average levels, despite strong population growth:

The above data points to the private sector, and households in particular, remaining in recession, offset by record public sector spending and still turbo-charged population growth.

It also appears that the Stage 3 tax cuts have failed to stimulate demand and growth.

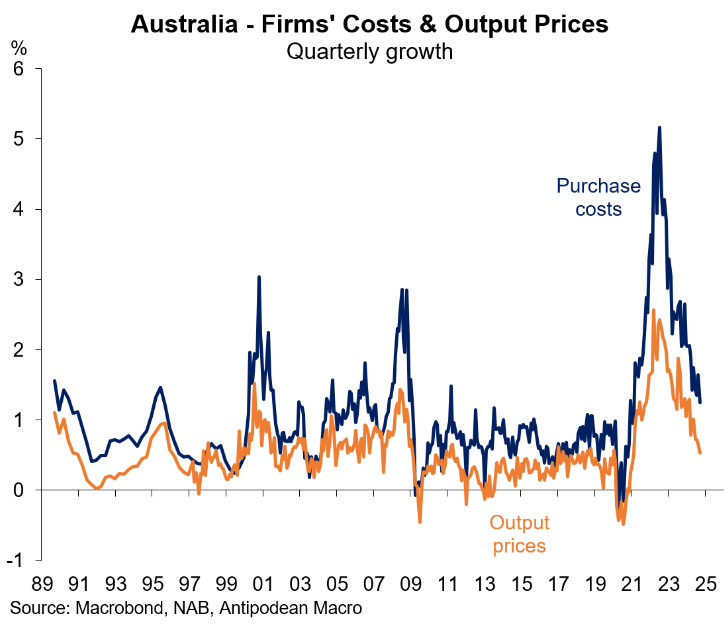

On the plus side, demand pressures are easing, with the NAB business survey showing both output and input cost inflation slowing:

This suggests that it could only be a matter of months before the RBA commences an interest rate easing cycle, which should drive a rebound in economic activity.