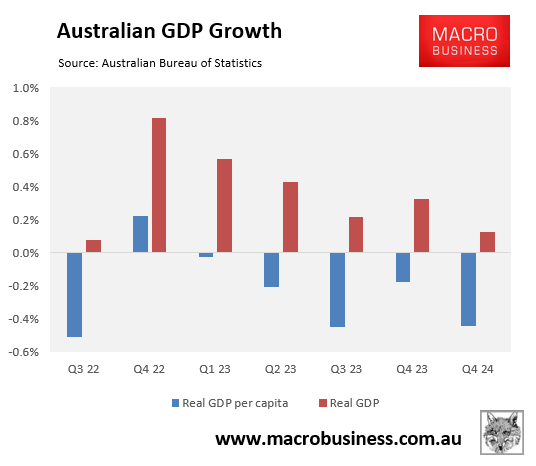

Australians are experiencing the longest per capita recession on record, with six straight quarterly declines and seven declines over the previous eight quarters.

The OECD’s latest economic outlook reduced Australia’s GDP growth prediction for 2024 to 1.1%, down from 1.5% in the previous edition in May. The OECD also predicted Australia’s GDP would expand by 1.8% in 2025.

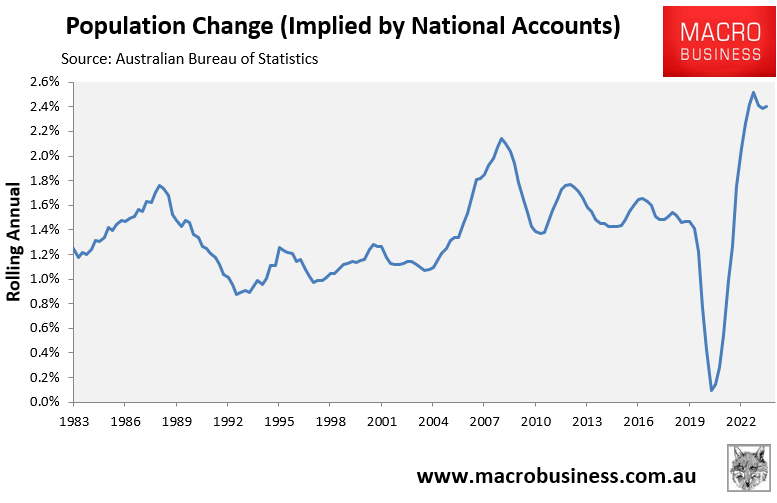

Given that Australia’s population grew by 2.4% in the year to June 2024, these projections imply that the per capita recession will drag well into next year—an unparalleled decline.

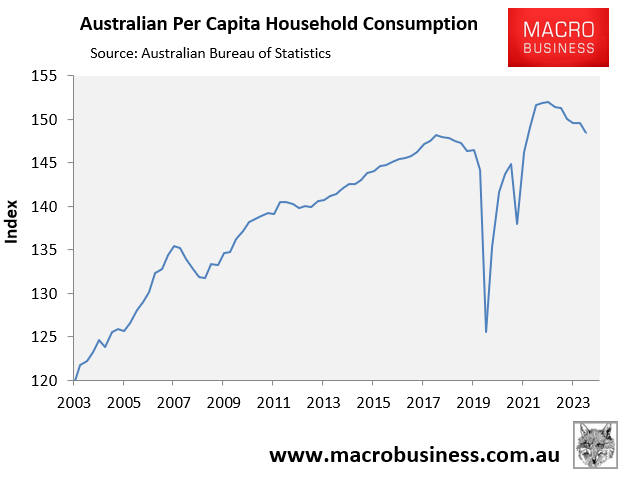

Australia’s households have borne the brunt of the decline via the Reserve Bank of Australia’s aggressive interest rate hikes.

Household consumption has fallen 2.4% from its peak in real per capita terms:

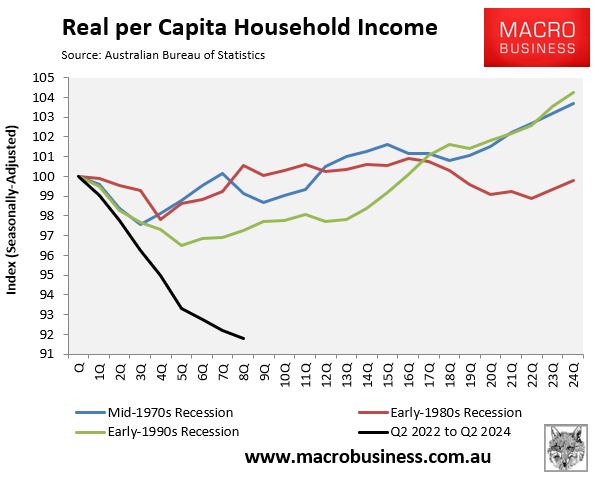

Worse, real per capita household disposable income has recorded an 8% decline from peak—the largest fall in modern recorded history:

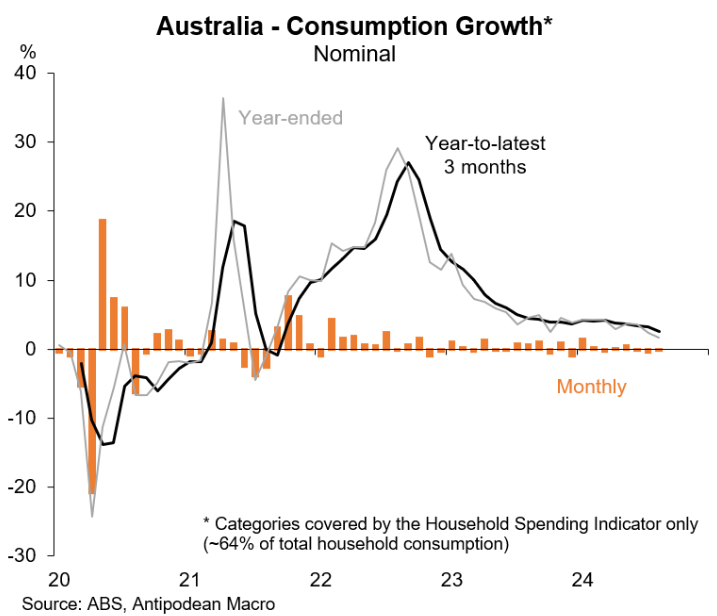

On Friday, the Australian Bureau of Statistics (ABS) released the Household Spending Indicator for August, which showed that spending was flat in nominal terms following revised falls of 0.5% in July and 0.1% in June.

“Growth in household spending has stalled at the start of the financial year, even as the Federal government’s Stage 3 tax cuts came into effect on 1 July”, noted Robert Ewing, ABS head of business statistics.

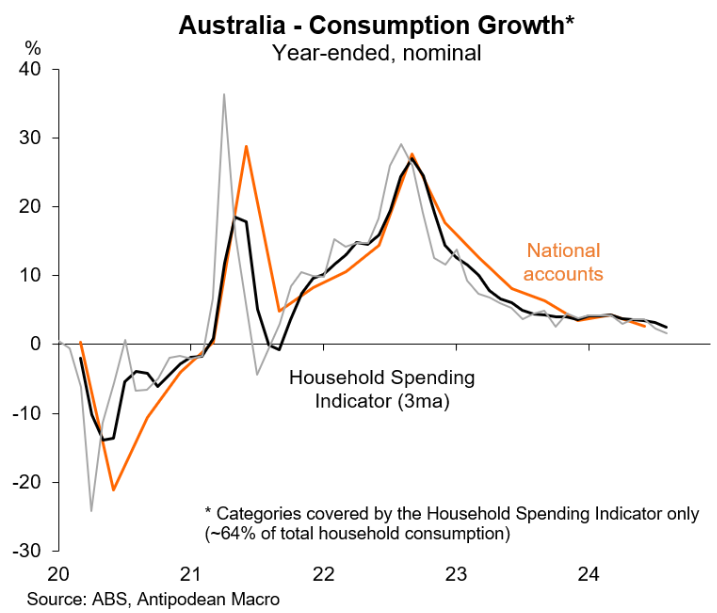

The following chart by Justin Fabo at Antipodean Macro plots the ABS Household Spending Indicator against household consumption from the quarterly national accounts:

As you can see, the ABS Household Spending Indicator points to further weakness in the national accounts over Q3, which means a continuation of the per capita recession afflicting Australians.

It also appears that the Stage 3 tax cuts have had little effect on stimulating demand and growth.