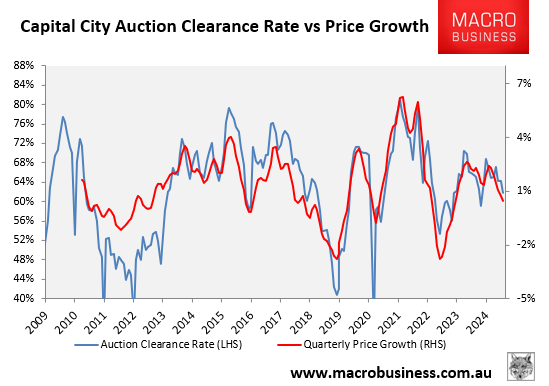

Australia’s auction market has stalled, indicating that both Melbourne and Sydney could soon experience falling prices.

Last weekend’s final national auction clearance rate of 60.6% was the lowest of 2024, following six consecutive weekly declines.

It was also well below the 64.4% final auction clearance rate recorded in the same weekend last year.

Melbourne’s final clearance rate held below 60% for the second consecutive week, slipping to 57.0% last weekend. This was the lowest clearance rate Melbourne has seen since 9 June (55.6%).

Sydney’s final clearance rate declined for the third straight week, coming in at 60.9% last weekend, the lowest clearance rate Sydney has seen all year.

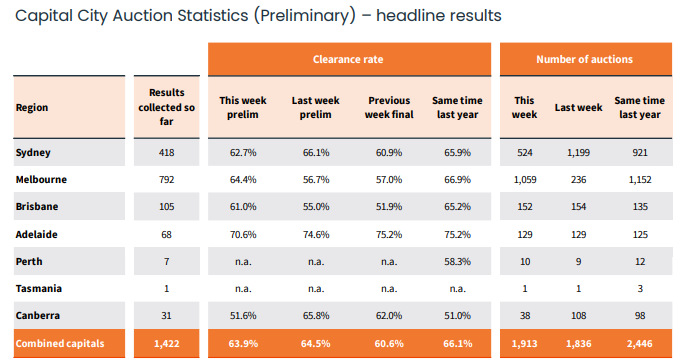

This weekend’s auction results are even weaker, with 63.9% of auctions successful at the national level based on preliminary results. This was down from 64.5% in the previous weekend (downgraded to 60.6% on final figures):

Source: CoreLogic

This weekend’s preliminary rate was the lowest since the week ending 18 December 2023 at 57.6%.

In his weekend market wrap, prominent Sydney real estate agent and auctioneer Tom Panos declared that “everywhere bar Perth is now a buyer’s market”.

Panos explained that it “is purely an equation of demand and supply”. There are “high listing volumes, so to the buyers are having a much better time than I’ve seen for a very long time”.

He believes “it will only get better [for buyers] as these volumes go up”.

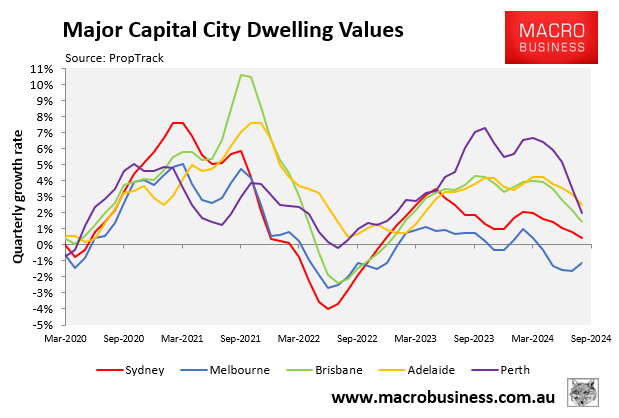

Melbourne’s quarterly dwelling values have fallen for five straight months, whereas Sydney’s quarterly value growth was only 0.5% in September and is trending lower:

By the end of the year, we may see falling prices across both major markets.

Just in time for the Reserve Bank of Australia to begin cutting interest rates.