The National Bank of Canada has released stunning data showing the extent to which government spending is holding up Canada’s economy while still shrinking at an alarming rate per capita.

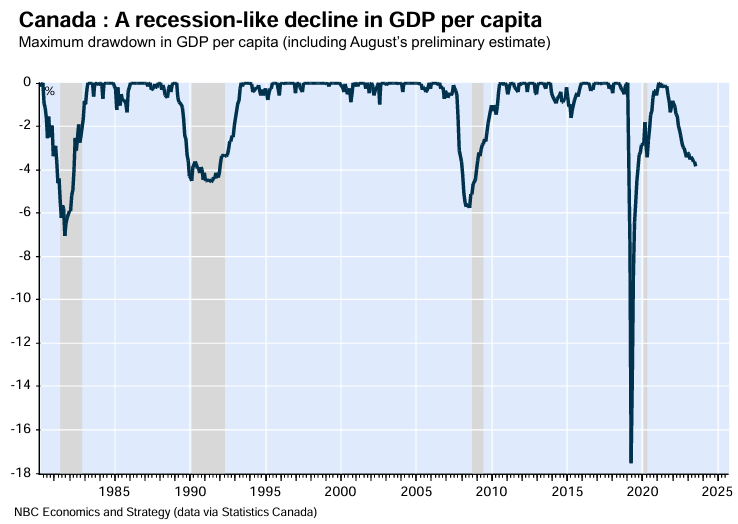

According to the National Bank of Canada, per capita “GDP has seen a cumulative decline of 3.9% since its peak in 2022, the first time this has occurred outside a recession”.

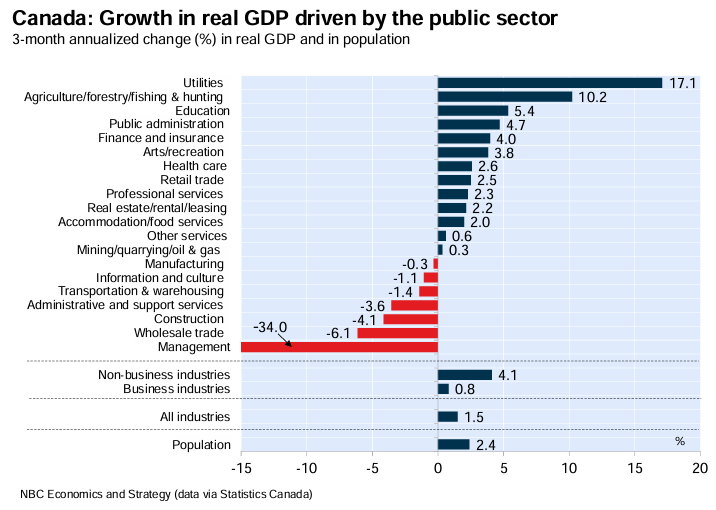

To add insult to injury, Canada’s economy is being driven by public sector spending:

“Over the past three months, economic activity in the business sector has been growing at an annualized rate of just 0.8%, compared with 4.1% in the government sector”.

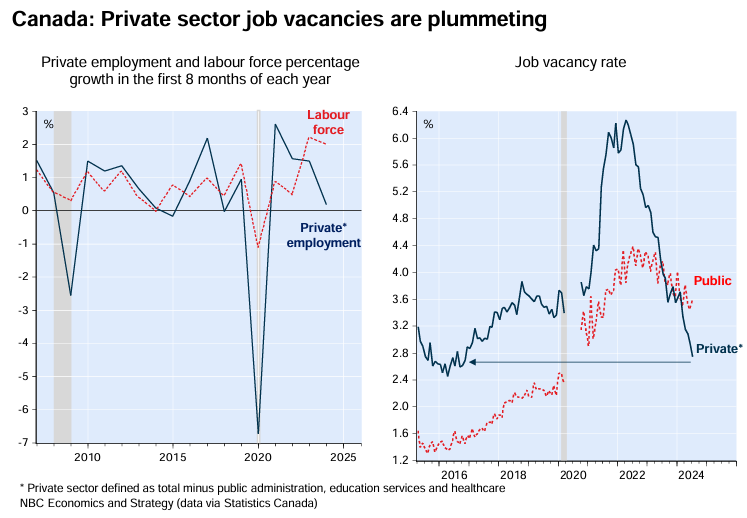

It is a similar story for Canada’s labour market, which is also being driven by the public sector:

“Job creation in the first eight months of the year was anaemic for the private sector, rising by just 0.2%, while the labour force grew by 2.0 %. Such a gap (1.8 percentage points) has never been seen outside a recession”, the National Bank of Canada reported.

“The private sector job vacancy rate has plummeted and was at its lowest level since 2016. As a result, we continue to see the unemployment rate rising above 7% over the next 6 months”.

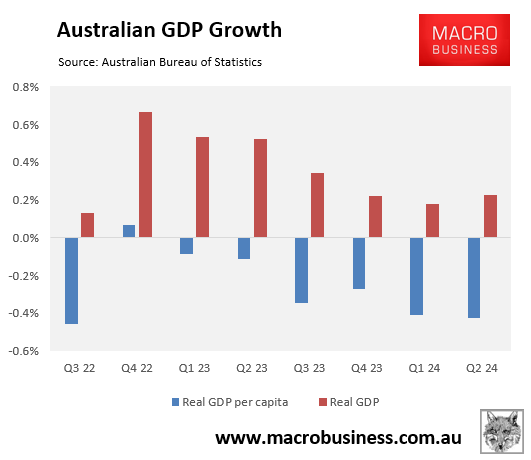

The public sector is having a similar impact on the Australian economy, which is also mired in a protracted per capita recession.

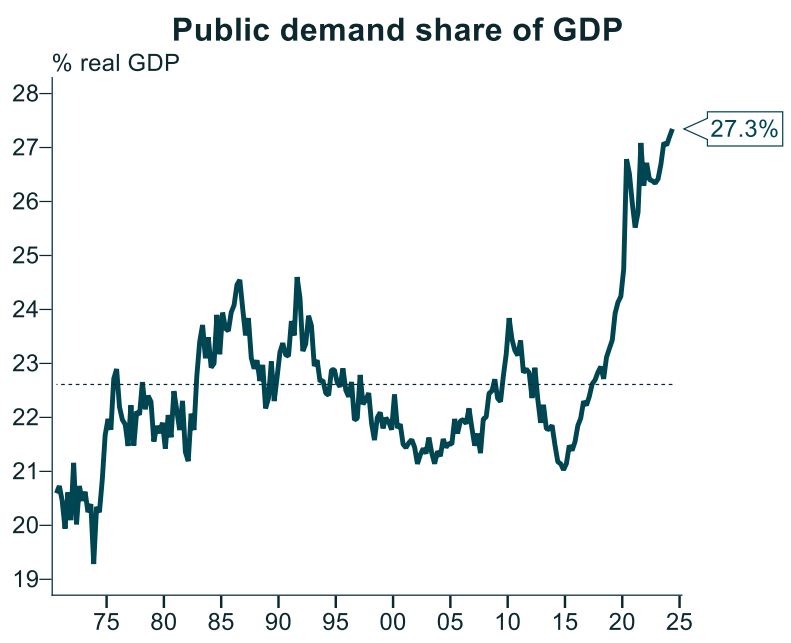

In Q2 2024, government spending reached a record high share of GDP after increasing by 1.5% over the quarter.

Source: Alex Joiner (IFM Investors)

In comparison, the market sector fell by 0.6% over the quarter.

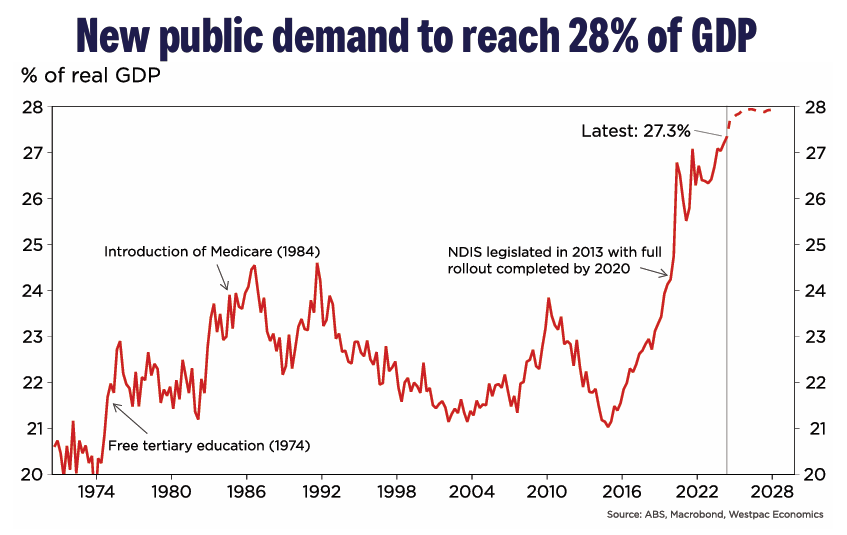

Westpac also forecasts that government spending will continue to rise as a share of the Australian economy, driving GDP growth:

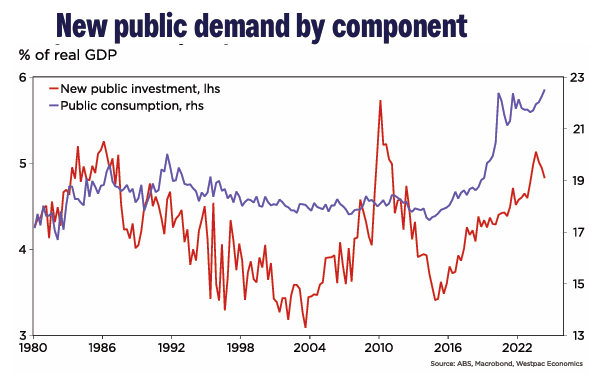

This surge in government spending has been driven by consumption, namely the provision of subsidised public goods and services, including the NDIS, childcare, education, healthcare, and aged care:

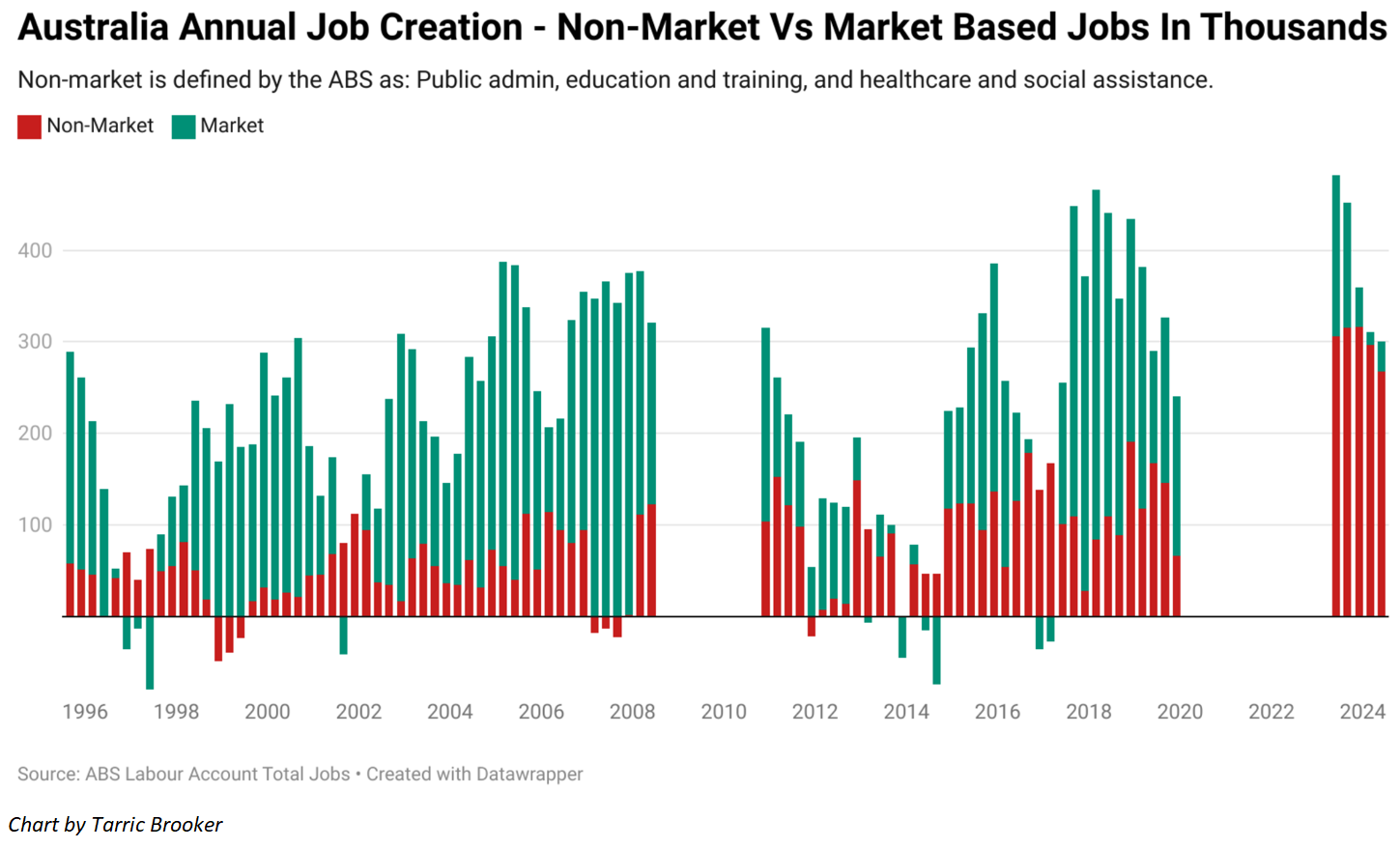

It is a similar story for Australia’s labour market, where 268,000 jobs were created in government-funded roles in 2023-24, versus only 33,000 new jobs created in the market sector (i.e., in all other industries):

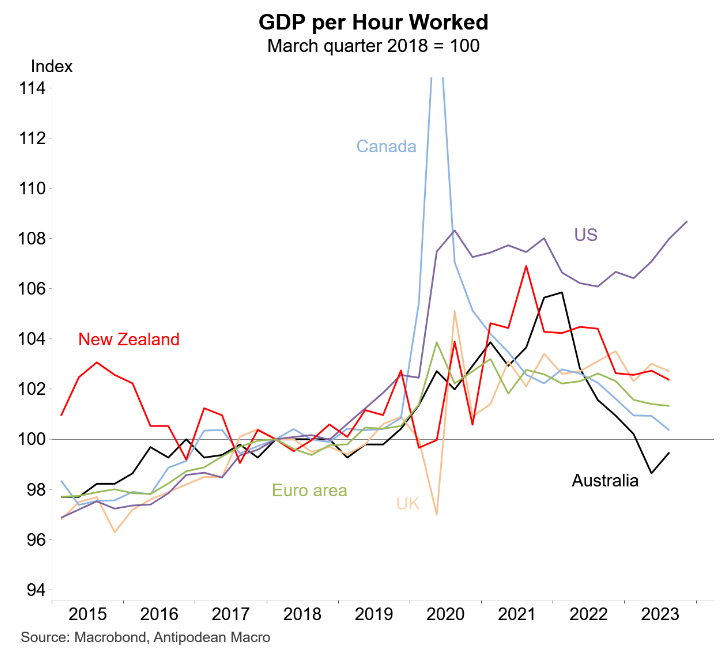

The expansion of the public demand helps to explain the poor productivity performance of Canada and Australia, as illustrated below by Justin Fabo at Antipodean Macro:

Both nations’ economies have avoided a technical recession through unprecedented immigration-driven population growth and record government spending.

However, productivity and per capita GDP have taken a giant dump.