According to Juwai IQI, Australian property is once again the most sought-after destination for Asian buyers, especially Chinese.

Daniel Ho, co-founder and group managing director of Juwai IQI, said the strong returns on Australian property, where prices had climbed by 42% in the last four years, were a major appeal for overseas investors.

Other attractive qualities included proximity to Asia, economic stability, and a high standard of living.

“Australia’s large annual intake of overseas students and migrants helps create new demand for purchases”, the report said.

“Most Asian buyers aren’t pure investors”, Ho said. “They do appreciate that a home in Australia is probably a safe investment, but really, they are purchasing places they want to live in”.

“They are education buyers, migration buyers, and second-home buyers. They want to study, work, and live in Australia, or to visit family who do”.

Juwai’s findings come amid Foreign Investment Review Board figures showing that Asia-based investors without resident status spent $5.1 billion on homes in Australia over the first nine months of 2023.

Just under half ($2.5 billion) of the total expenditure came from mainland Chinese investors, followed by buyers from Hong Kong.

Daniel Ho said educational possibilities were a major drawcard of overseas purchases, particularly among Chinese buyers.

“By my estimate, perhaps as many as half of Chinese buyer transactions involve families with someone who is in Australia because they are studying or have completed their studies there”, he said.

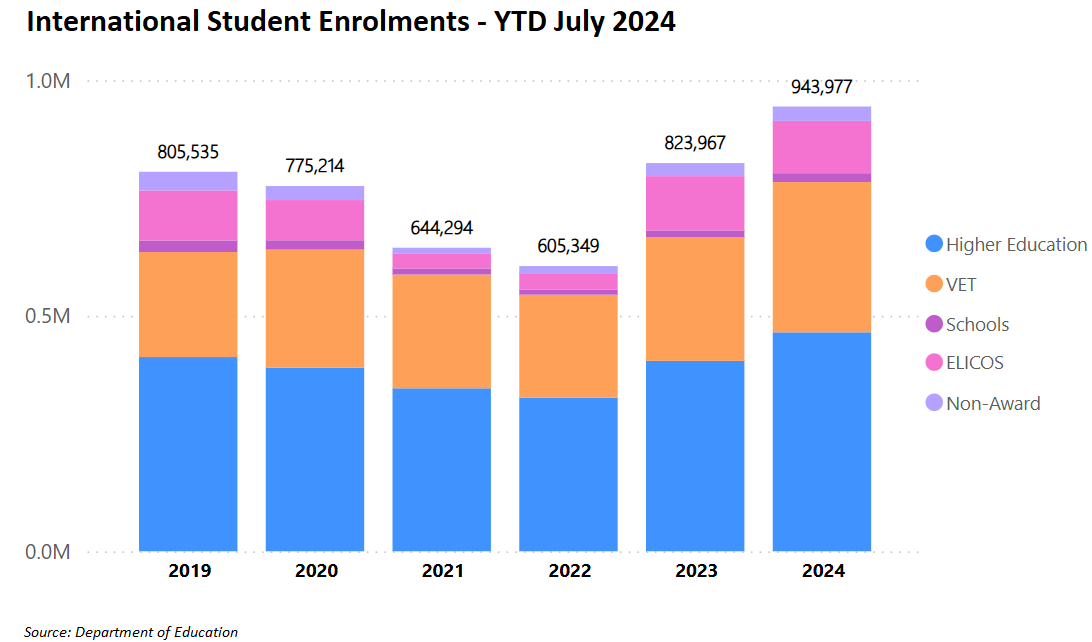

Indeed, the Department of Education shows that there were a record 943,977 international students enrolled in Australia as of July 2024:

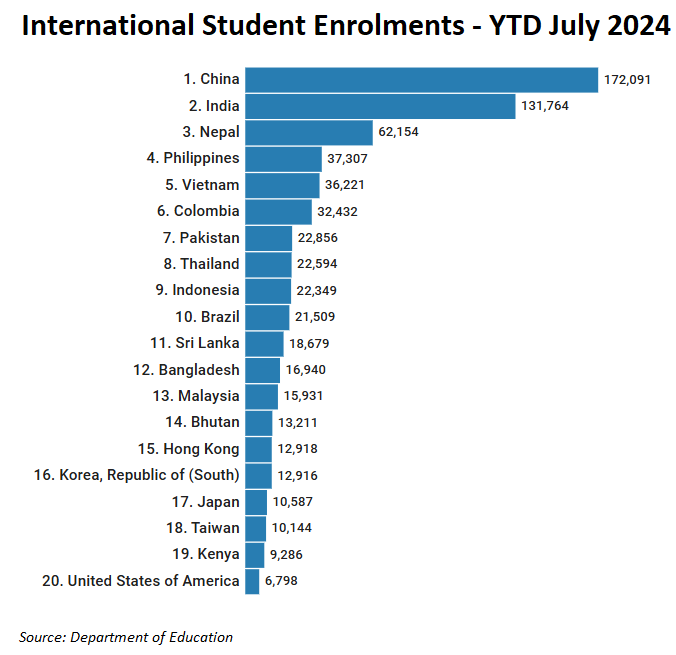

Mainland China is the single largest source nation for students, with a record 172,091 enrolled as at July:

Peter Li, general manager of the Sydney and Shanghai real estate group Plus Agency, claimed that most property purchases from foreign buyers preceded a move to Australia.

“The majority of Asian buyers in Sydney are looking to spend about $2 million”. he said.

“I’d say 80% of them are owner occupiers. They are buying to live in it, either now or sometime in the future”.

Last November, BetaShares’ chief economist, David Bassanese, questioned why Australia hasn’t imposed stricter limits on foreigners purchasing local homes, which he said is inflaming the property market:

In March, The AFR posted about a Chinese FIRB-approved temporary migrant who outbid locals by $1 million for a Miami-style mansion in Mermaid Waters:

“I have noticed in the last six months the influx of Chinese buyers at auctions and buying has been as high it was pre-COVID”, the real estate agent told The AFR. “They’re definitely getting access to cash and repatriating it to Australia”.

There are multiple cash buyers we’re seeing”, the agent said.

Who can blame them when Australia has the world’s weakest anti-money laundering rules? Australia also permits temporary migrants to buy homes. And we are running a hyper-aggressive immigration policy.

These conditions have turned Australian property into a magnet for global buyers, particularly wealthy Chinese.

The sad reality is that Australia’s property market no longer exists to house Australians.