Westpac with the note.

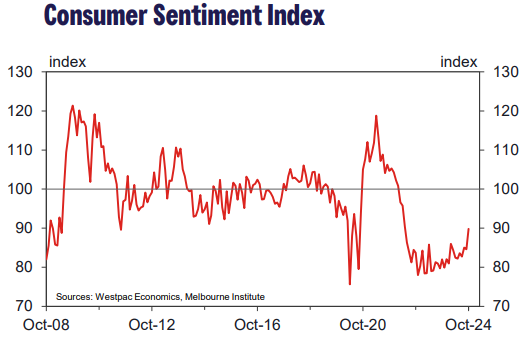

- Consumer Sentiment rises 6.2% to 89.8, a two and a half year high.

- Consumer expectations for interest rates fall sharply.

- Cost-of-living pressures continue to moderate, but progress remains slow.

- Consumers see finances broadly stabilising over the year ahead.

- Home-buyer sentiment improves slightly but still downbeat overall.

- House price expectations tick up, gain centred on Victoria and New South Wales.

The Westpac–Melbourne Institute Consumer Sentiment Index rose 6.2% to 89.8 in October from 84.6 in September.

Advertisement