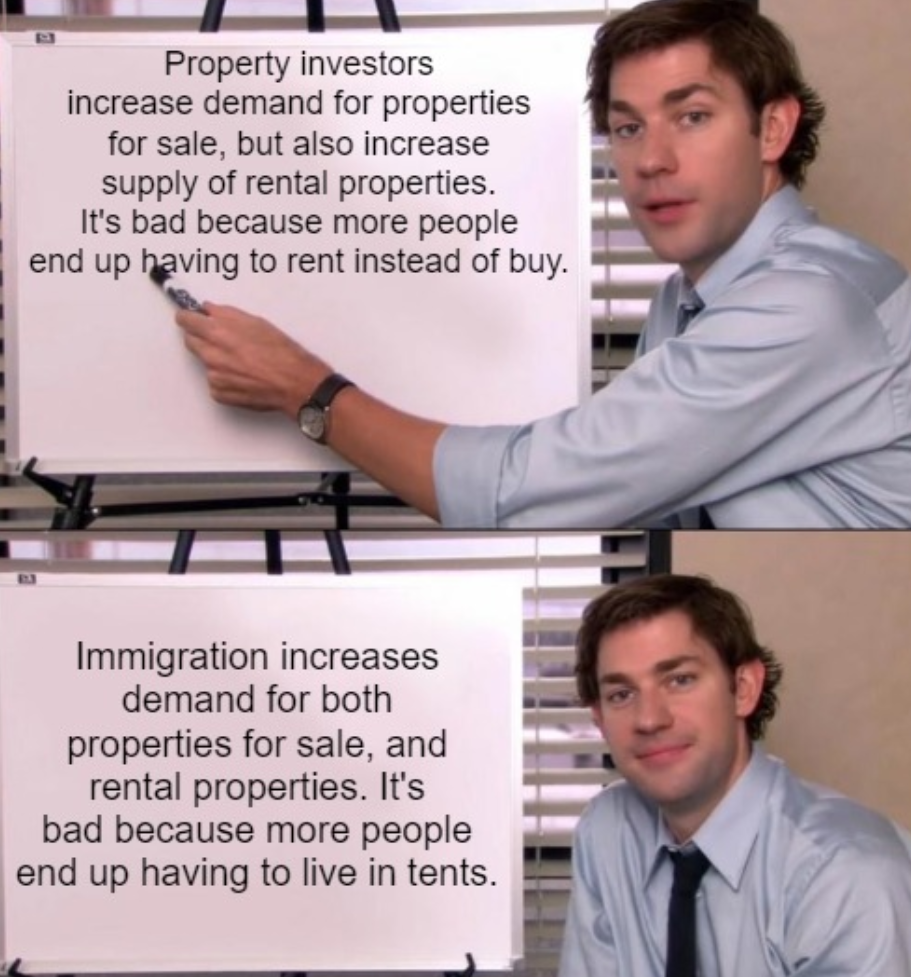

A reader sent me the below meme, which neatly explains why curbing immigration is far more important for housing affordability than curbing negative gearing:

Stimulating property investment via tax policies like negative gearing does push up house prices by stimulating investor demand.

Investors also outbid and crowd-out first home buyers, thereby lowering the nation’s home ownership rate.

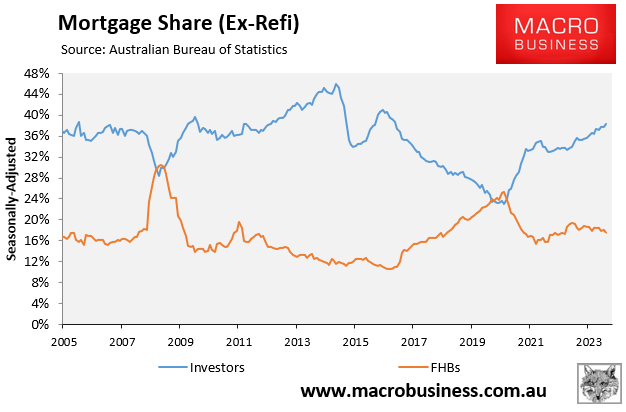

Indeed, there is almost a perfect negative correlation between the investor mortgage share and the first home buyer mortgage share, suggesting that when investor demand rises, first home buyers are necessarily crowded out.

However, when an investor crowds out a first home buyer, forcing them to become a renter, they also add to the supply of rental homes.

Therefore, tax concessions like negative gearing have minimal impact on the rental market since they increase rental demand (by crowding out first home buyers) but also increase rental supply.

High levels of immigration have a much more pernicious impact on housing affordability because it pushes up both house prices and rents.

Every additional migrant that arrives in Australia needs somewhere to live. Therefore, more people via immigration means greater competition for homes to purchase and rent, driving up the costs of both.

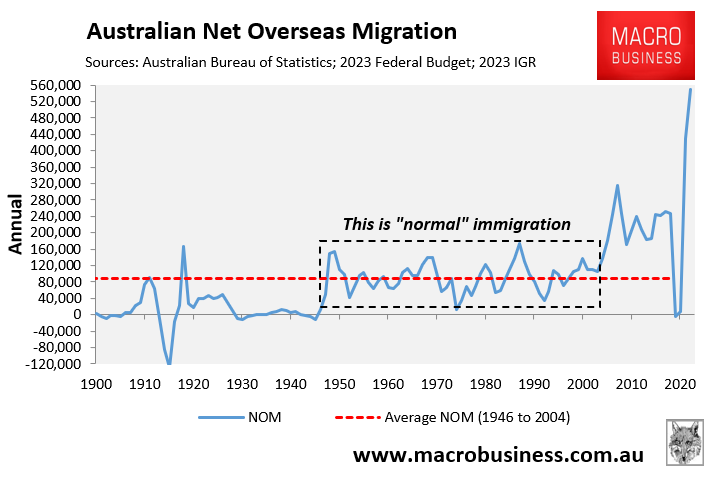

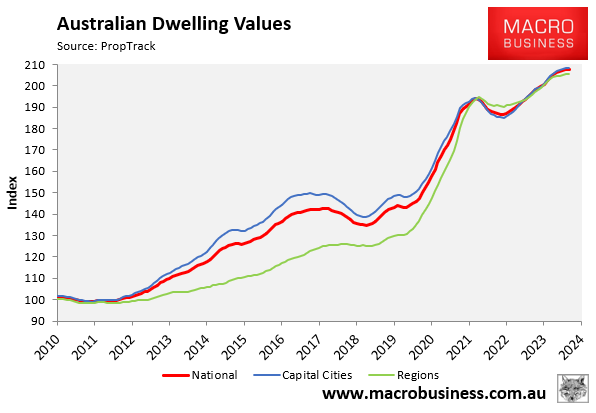

The recent record explosion of net overseas migration is a case in point. It has driven home prices to record highs, despite higher interest rates:

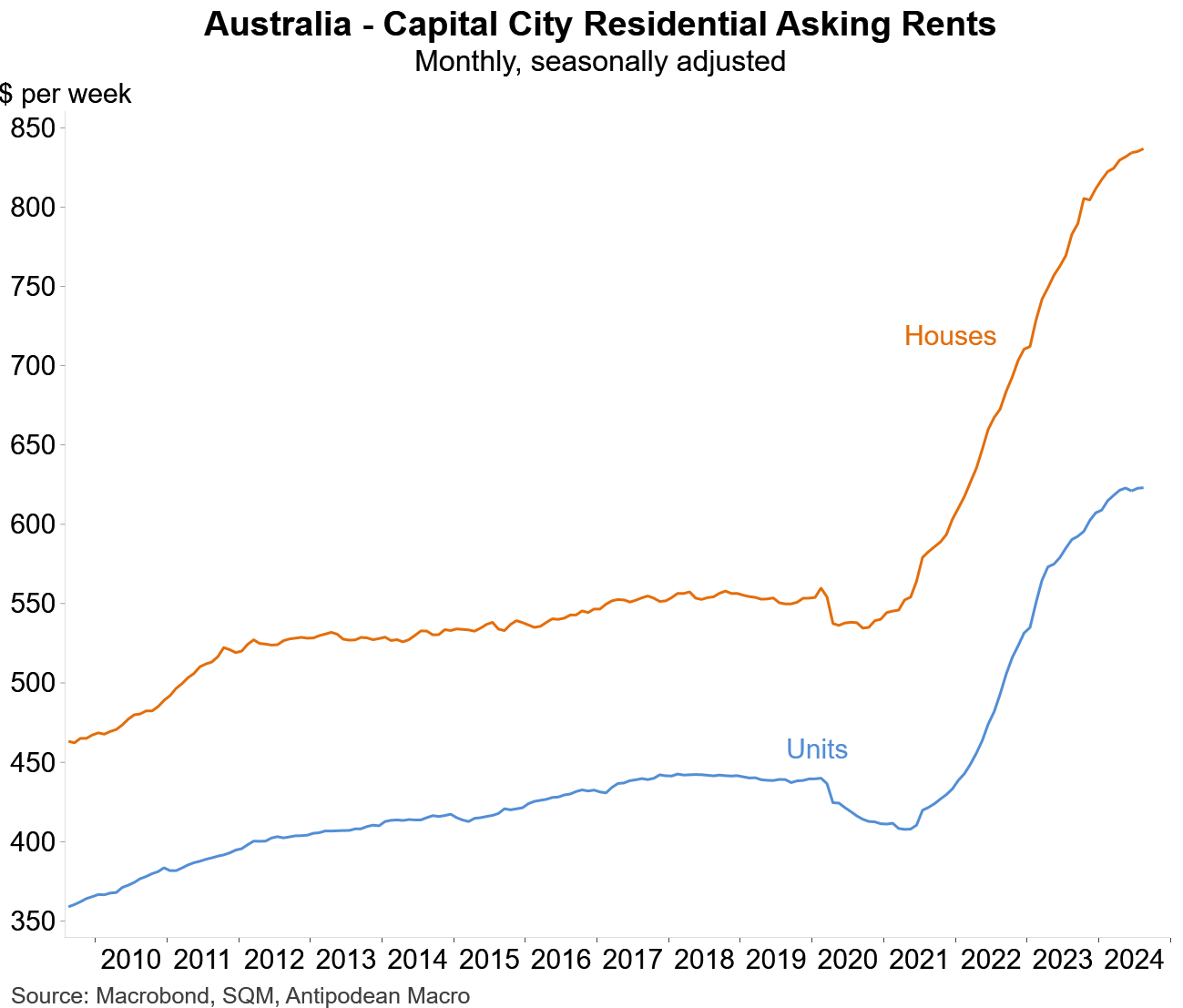

Asking rents have also surged:

The situation is especially dire for first home buyers, as the surge in asking rents has made it harder for would-be buyers to save a deposit at the same time as prices have surged higher.

The added negative impact on the rental market is why curbing immigration is more important for overall housing affordability than curbing negative gearing.