New Zealanders are experiencing one of the deepest recessions in modern times.

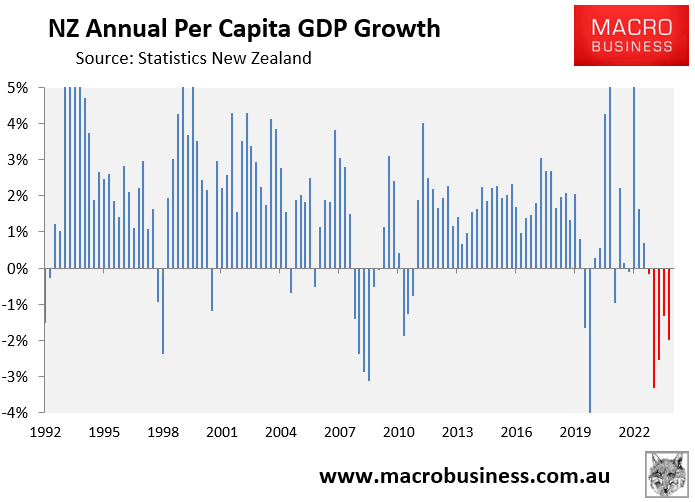

As of Q2 2024, real per capita GDP had collapsed by nearly 4%, as illustrated by the following chart:

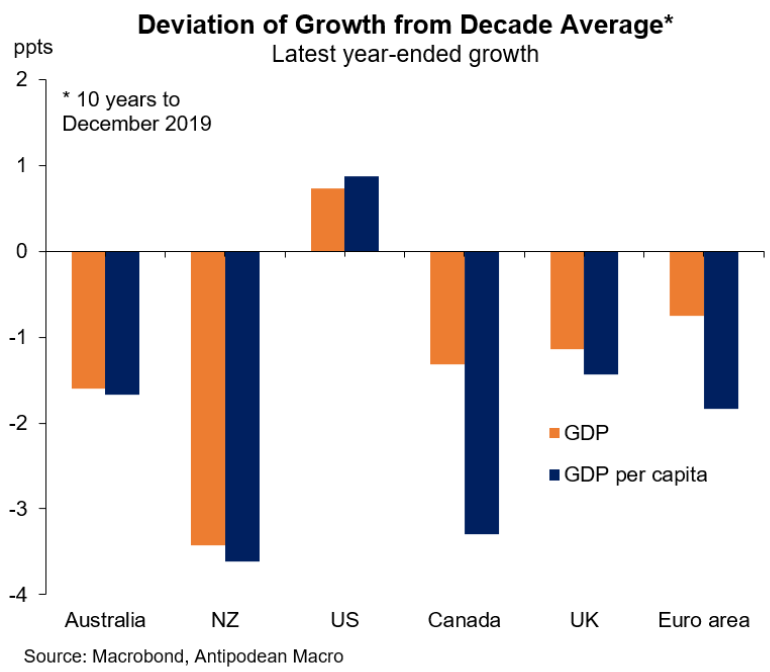

As shown by Justin Fabo at Antipodean Macro, New Zealand has recorded the largest decline in per capita GDP compared with the decade average out of the Anglo nations:

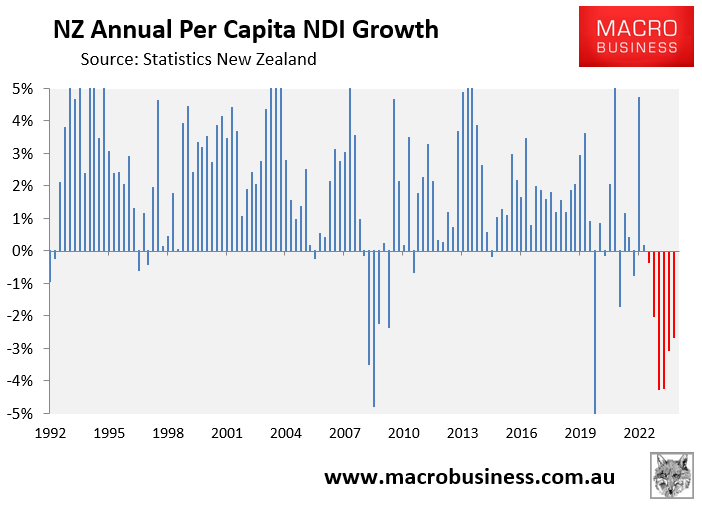

New Zealand’s real per capita national disposable income has also collapsed by nearly 6% over the same period:

Early last week, Greg Smith, head of retail at Devon Funds, called for the Reserve Bank to slash the cash rate by 1.5% by Christmas.

“We visit many businesses and it is clear that the economy is cratering”, Smith said. “Pressures faced by big business are also having knock-on impacts to smaller companies”.

The Reserve Bank obliged, lowering the official cash rate by 0.5% last week, which followed August’s initial 0.25% cut.

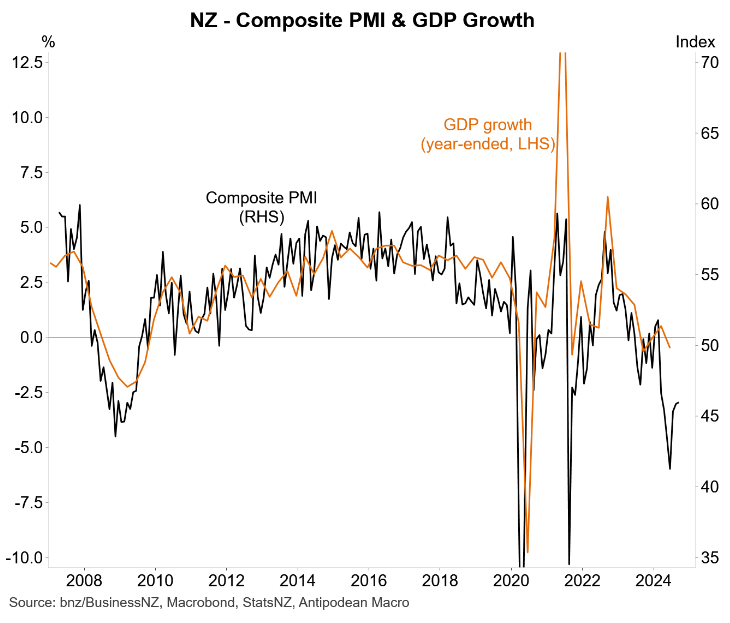

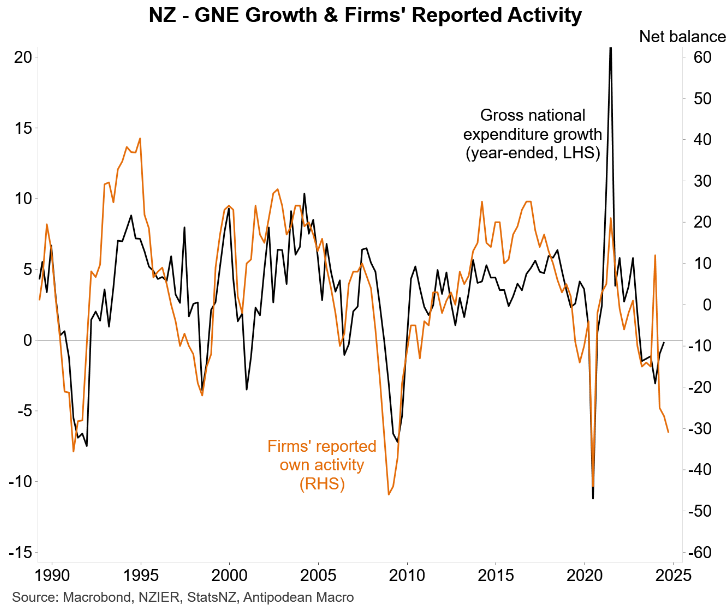

Justin Fabo at Antipodean Macro published charts on Monday suggesting that New Zealand’s economy continued to contract in Q3.

The composite PMI was little changed in the month of September but contracted sharply over the quarter:

The PCI weakness is consistent with the QSBO survey, which also contracted sharply in Q3:

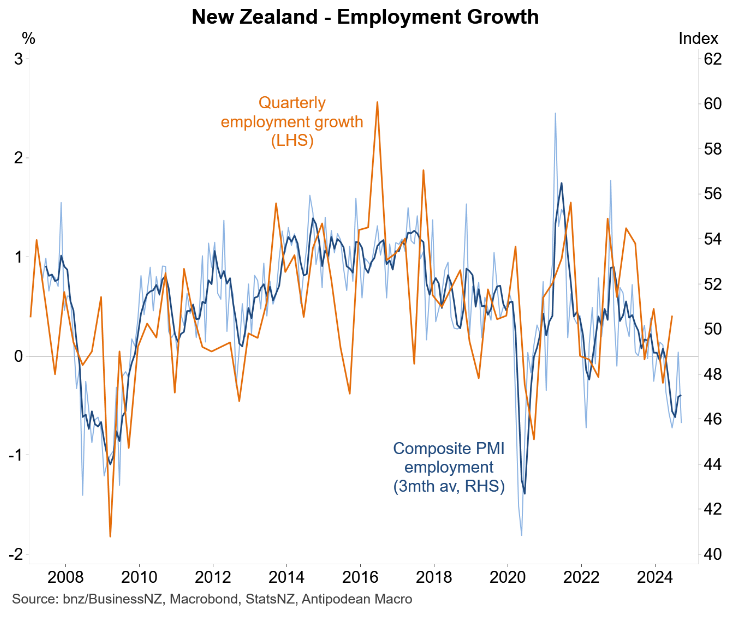

The BNZ Business Survey also suggested that New Zealand’s labour market weakened in Q3:

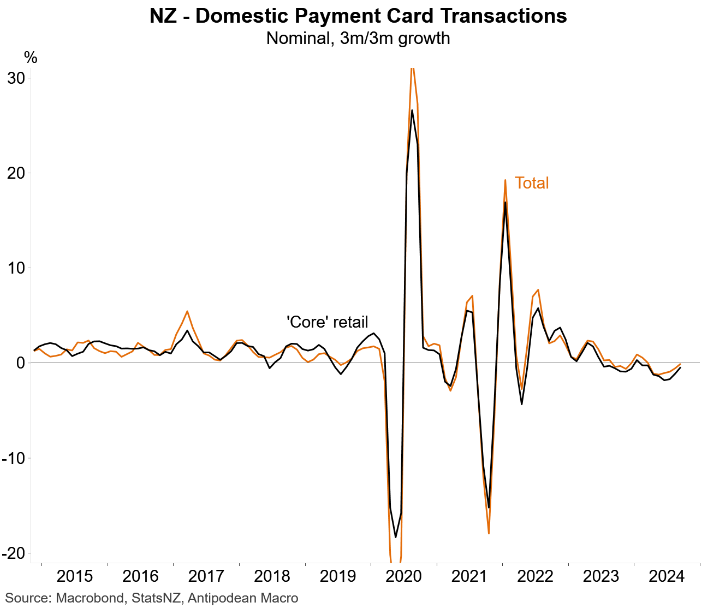

Finally, debit/credit card spending in New Zealand contracted slightly in Q3:

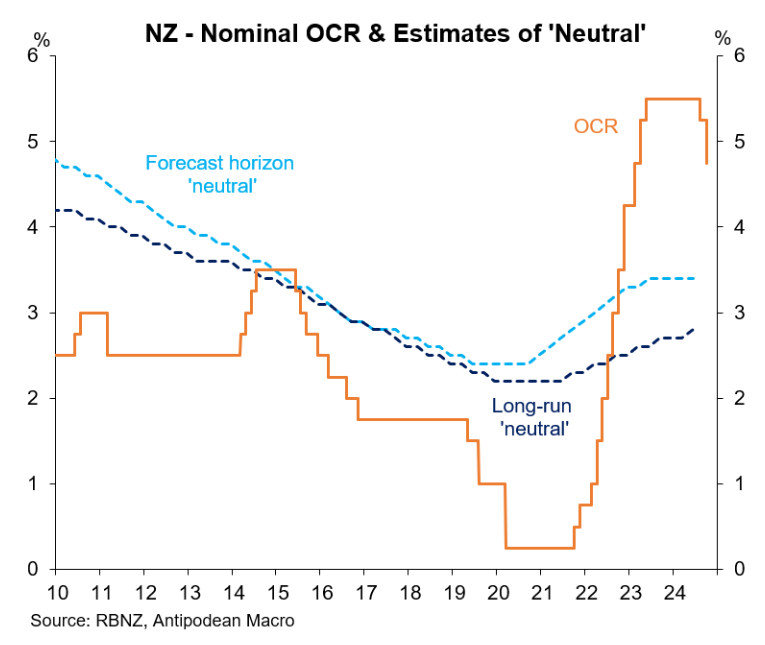

Overall, the data suggests that the Reserve Bank will follow up with another 0.5% cut at its final meeting on 27 November.

It will need to continue cutting hard as monetary policy remains highly restrictive.