By Gareth Aird, head of Australian economics at CBA.

Key Points

- A firmer disinflationary pulse than the RBA anticipates is a necessary condition for the Board to ease policy this calendar year.

- The already released September quarter consumer prices data in a raft of surveys gives us greater confidence that the much desired disinflationary process has recently gathered momentum.

- But it will be up to the Q3 24 CPI, due to be released on 30 October, to confirm that our assessment of the current pace of inflation is the correct one.

- The RBA Board will be more willing to commence normalising the cash rate if inflation proves less persistent than previously assumed.

Inflation outcomes dictate how many gains in the labour market the RBA will likely preserve

The September RBA Board Minutes, released last week, outlined scenarios that could see monetary policy either tightened or loosened.

At the heart of the discussed scenarios were potential trajectories for inflation. The scenarios also provided an insight into how the Board might respond should inflation fall either faster or slower relative to the RBA’s central scenario.

The RBA Board’s current objectives have been clearly articulated: bring inflation to target within a reasonable timeframe, while preserving as many gains in the labour market as possible.

The Board has not set a target on how many gains in the labour market are possible to preserve. Rather, the RBA is seeking the maximum level of employment that is consistent with the price stability mandate of 2-3% consumer inflation over time.

If inflation falls faster than anticipated, the labour market may not need to loosen much further (i.e. a lower than assumed unemployment rate might be consistent with the inflation target).

Working the other way, a slower than forecast return of inflation to target might require a more substantial loosening in the labour market than the RBA’s forecasts imply.

In many respects the lack of a numerical target around what constitutes full employment puts the spotlight firmly on the inflation target and by extension the inflation data.

The inflation target and full employment mandates are complementary, especially over the longer term. But monetary policy generally has a shorter to medium term focus, which means the Board is heavily guided by actual inflation outcomes when assessing what level of unemployment is consistent with returning inflation to the target band.

Inflation expectations play an important role too.

Regular readers will be aware that our base case sees the RBA commence normalising the cash rate by the end of 2024 (we have pencilled in December for the first 25bp interest rate cut).

A firmer disinflationary pulse than the RBA anticipates is a necessary condition for the Board to ease policy this calendar year.

The quarterly inflation report from the official statistician trumps any other consumer prices data when it comes to the monetary policy debate. Indeed there is probably no other single data release that can move domestic money markets like the quarterly CPI from the ABS.

But there is a host of other monthly prices data that provide us with timely signals on how the inflationary pulse is travelling between official quarterly updates. All of the series we monitor indicate to us that the disinflationary process has gathered momentum over the September quarter. We are encouraged, albeit not surprised.

Consumer demand growth has weakened over the past year and a half. Indeed real household consumption growth has been incredibly weak and spending per capita has been in trend decline over that period. Against this backdrop, consumer inflation should be expected to fall, but it takes time.

Inflation is a lagging indicator. And some components of inflation in Australia have been elevated due to idiosyncratic factors (e.g. rents and insurance). In addition, there are many administered prices in the CPI whereby price changes have been propped up because prices growth is linked to prior inflation outcomes. But administered prices growth is backward looking.

Administered prices growth will slow in 2025 given the fall in actual inflation. That will further assist the return of inflation to the target band.

In this note we take a look at the already released consumer prices data from the various monthly surveys over the September quarter. We also look at some recent measures that relate to wages outcomes.

Of course the proof of the inflation pudding will be in the Q3 24 CPI. But for us, it’s very much a case of so far so good for a firmer disinflationary pulse to be rubber stamped in the official quarterly inflation report on 30 October (ahead of the November Board decision – 5 November).

If we are correct, the door should start to open for a year end interest rate cut.

Melbourne Institute Inflation Gauge has dropped sharply

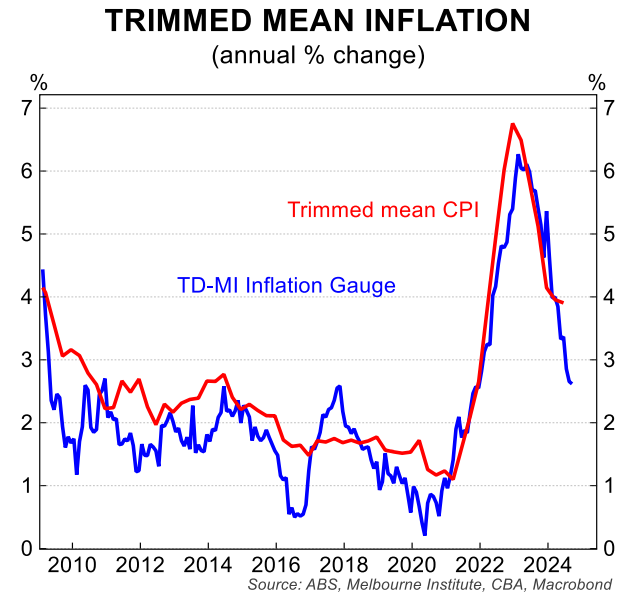

The Melbourne Institute (MI) monthly inflation gauge is based on ABS methodology.

It is designed to replicate the quarterly CPI based on estimates of monthly price movements of goods and services. Prior to the introduction of the ABS monthly CPI indicator it was considered the main monthly inflation gauge in Australia.

Whilst the importance of the MI inflation gauge has diminished a little because of the ABS monthly CPI indicator, it is still a timely update on the inflationary pulse.

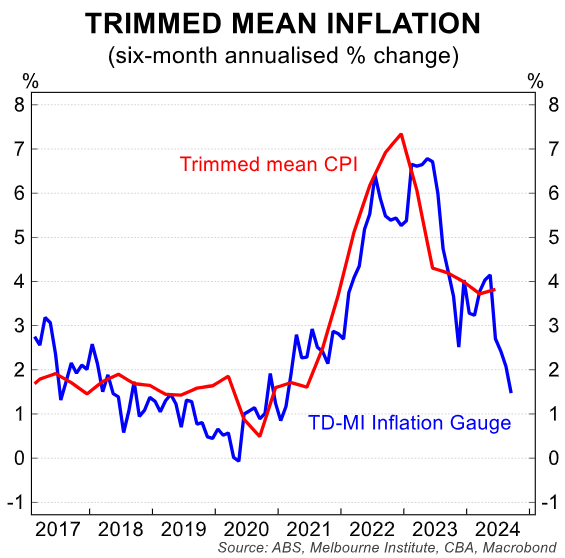

The September MI trimmed mean inflation gauge, which was released last week, rose by 0.1%/mth. The September result followed a flat outcome in August and a 0.1%/mth lift in July.

The annual pace of core inflation held at 2.7%, while the three month moving average rate of inflation dropped to its lowest level since late 2020.

At times the MI trimmed mean inflation gauge deviates from the ABS trimmed mean, so the correlation is certainly not perfect. But the gauge has historically provided a good directional steer on changes in the rate of core inflation.

We are particularly encouraged by the monthly outcomes over the September quarter.

NAB final prices measure eased further in September

The September NAB monthly business survey firmed a little. Confidence edged higher, albeit it remains in negative territory. And the more important business conditions measure moved up to sit at its long run average.

Measures on trading, profitability and employment all rose, but forward orders remained at very low levels.

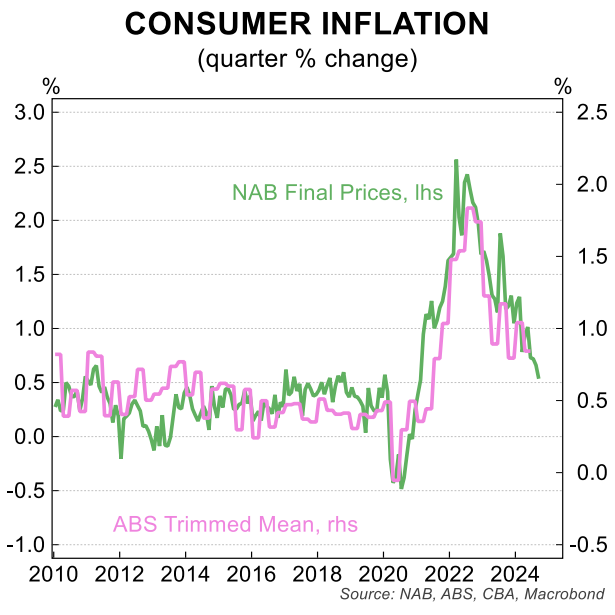

The NAB final prices gauge, which is most positively correlated with consumer prices, was the standout piece of good news in the survey. Final prices grew by 0.5%/qtr in September, down from 0.7%/qtr in both August and July.

The final prices gauge averaged 0.6%/qtr in Q3 24 compared with 0.9%/qtr in Q2 24 and 1.1%/qtr in Q1 24.

The three-monthly reads on final prices over the September quarter in the NAB Business survey indicate a firming disinflationary pulse, particularly when placed in the context of the outcomes recorded earlier in the year.

In short, the signal from the NAB business survey on final prices has been overwhelmingly positive in Q3 24.

Output prices in the S&P/Judo PMI back to their pre-pandemic run rate in September

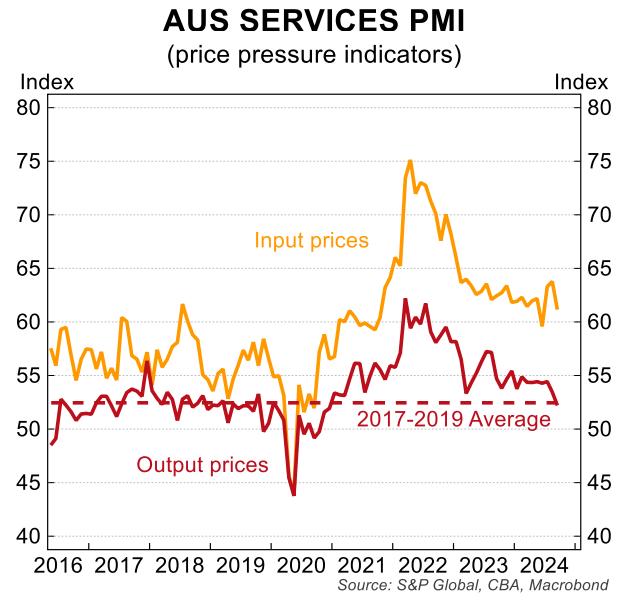

The PMIs in Australia tend to fly under the radar as the data has only been published since 2016. But the Judo Bank Purchasing Managers’ Index (PMIs) are part of the S&P Global PMIs and the survey methodology is sound.

The PMIs contain a gauge on output prices in the services sector. The news in the prices gauge more recently is very much welcome and aligns with the signal from the NAB final prices measure.

For readers unfamiliar with the PMIs we note that they are diffusion indices. A reading >50 indicates an overall increase compared to the previous month and <50 an overall decrease.

In September the services output prices gauge was 52.1, its lowest level since late 2020. Over the September quarter the output prices gauge averaged 53.6. This compares with the Q2 24 average of 54.2 and the Q1 24 average of 54.5.

The upshot is that the output prices gauge is consistent with a firming disinflationary pulse over recent months.

It is also worth noting that the September services output prices gauge was in line with the pre-pandemic average monthly read.

Advertised rental growth has dropped sharply

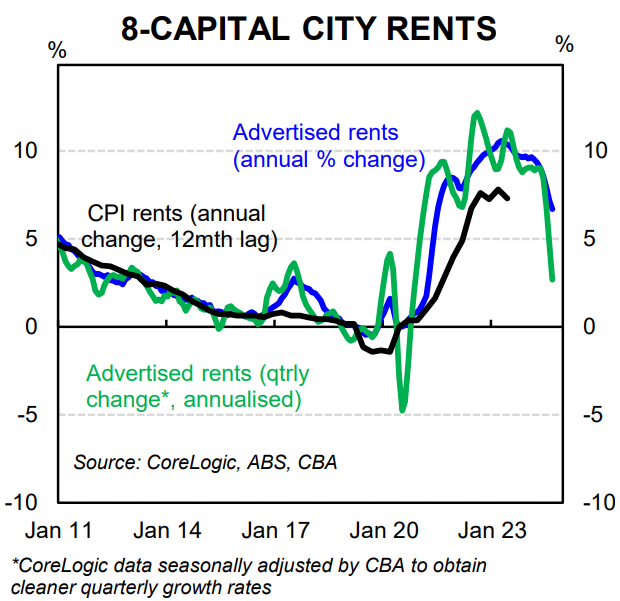

The September RBA Board Minutes noted that, “the easing in the rate of growth in advertised rents over the preceding three months was expected to feed through gradually to lower rent inflation in the CPI.”

We completely agree. As the facing chart shows, growth in advertised rents has slowed considerably.

Elevated rental growth as measured in the CPI is expected to persist in the near term as we are simply not building enough homes. But the lead signal from advertised rents suggests growth in the overall stock of rents will moderate. Changes to household formation are assisting.

My colleague Harry Ottley will publish a more detailed note later this week fleshing out recent trends in the rental market.

ABS monthly CPI indicator posted a welcome drop in August

Annual headline inflation as measured by the monthly CPI inflation eased to 2.7% in August. And all measures of underlying inflation moderated as well.

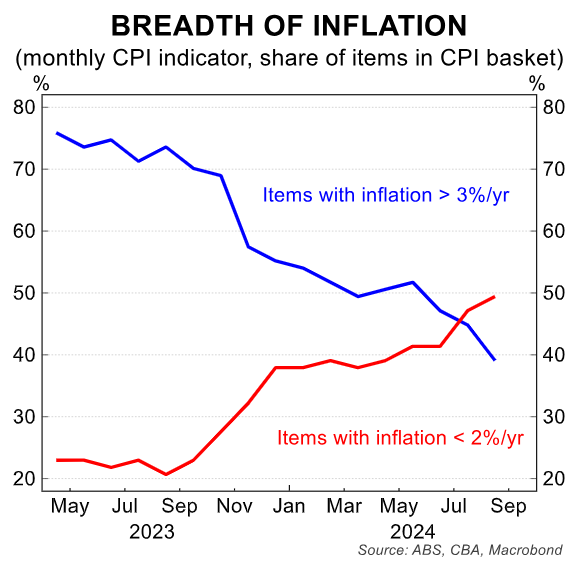

The annual trimmed mean measure fell to 3.4%, it’s lowest rate in 2½ years and consistent with further disinflation. As Stephen Wu noted at the time, there continued to be a broadening in the breadth of disinflation (see facing chart).

More specifically, the number of items with annual price rises above 3% continued to fall while the number of items with annual price changes below 2% continued to rise.

CBA internal wages model has turned down

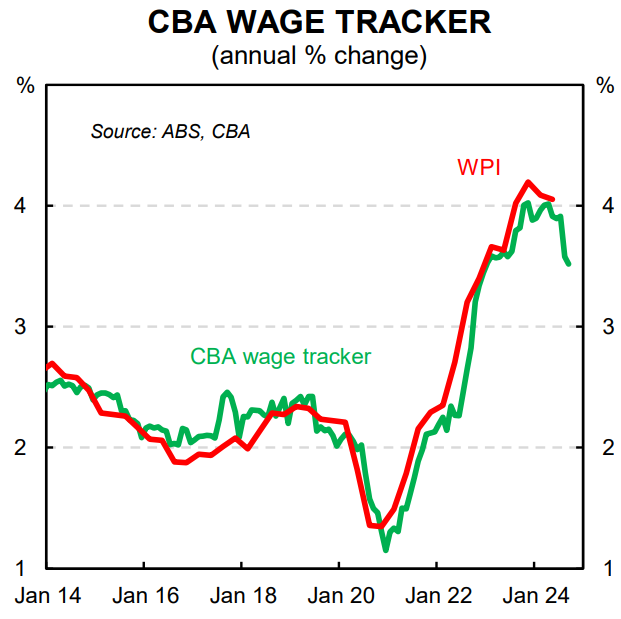

There is a growing body of evidence that indicates wages pressures are moderating in line with the gradual loosening in the labour market. This evidence includes our internal data at CBA.

We use a sophisticated methodology based on our internal data on wages and salaries paid into CBA bank accounts to model the WPI.

More specifically, we apply a strict criteria to the accounts we include in our sample each month to account for people moving jobs, receiving a bonus or modifying hours worked in any material sense. We also take into account changes in tax rates or levies.

The upshot is that our real time wage price model, which is based exclusively on wages and salary payments into CBA bank accounts, very accurately tracks the WPI.

Our wages model suggests the annual change in the WPI will step down materially in Q3 24 (see below chart). This outcome is expected by most analysts given that the large increase in wages in Q3 23 due to the big lift in the minimum wage will drop out of the annual calculation.

Our data provides us with a clear signal that this has indeed occurred.

Consumer inflation expectations are also trending lower

Consumer inflation expectations have tended to have a close relationship with actual wages outcomes (see below chart). The MI monthly measure of consumer inflation expectations, released last week, stepped down to 4.0%/yr in September from 4.4%/yr in August.

This measure has historically tracked higher than actual inflation – households tend to perceive future inflation to be higher than actual outcomes. But the relationship between inflation expectations and wages growth is sound.

To be fair, we don’t put a lot of weight on consumer inflation expectations. But these recent outcomes are yet another data point to add to the suite of monthly data that leaves us feeling increasingly optimistic around the inflation outlook.

It is now over to the Q3 24 CPI to confirm if our view on a firming disinflationary pulse is correct.

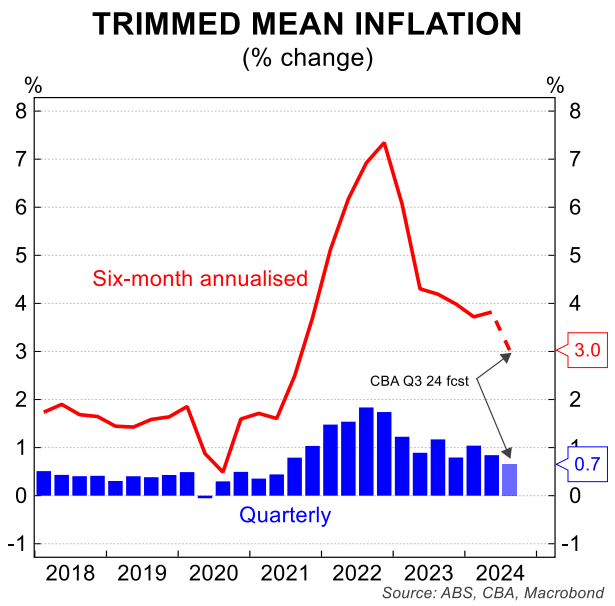

Note that we continue to look for an increase of 0.7%/qtr in the trimmed mean CPI over Q3 24. Such an outcome would take the six-month annualised pace of underlying inflation to 3.0% – the top of the RBA’s target band (note we look for a soft 0.7%/qtr to two decimal places – see below chart).

The case not to commence normalising the cash rate would weaken significantly with six-month annualised core inflation at ~3%, headline inflation within the target band and the unemployment rate on its gradual upward trend.

Stephen Wu will publish our full CPI preview next week.