In late May, Judo Bank chief economist Warren Hogan projected that the Reserve Bank of Australia (RBA) would raise the official cash rate three times by the end of this year.

It was an overly hawkish projection that the bulk of Australia’s economists disagreed with.

The Australian Bureau of Statistics (ABS) stronger-than-expected employment report from last week strengthened the consensus among Australian economists that the RBA will start its easing cycle in February 2025.

Warren Hogan again disagrees with the consensus view and believes that the RBA needs to lift the official cash rate further to cool the economy.

Speaking to Sky News last week, Hogan noted that the economy is “creating 40,000 to 50,000 jobs a month”, which is well above the past 20 years, where “we have probably averaged just under 20,000 a month”.

“It reflects the fact that the economy is operating in a very different way in the post COVID world and of course it highlights that this inflation problem is not necessarily going to go away very quick”, he said.

Hogan also argued that the strong employment report indicates that monetary policy is not tight enough.

“It also highlights the RBA cash rate might not be high enough to get inflation and this cost of living crisis behind us”, he said.

“We have still got the inflation problem. And it is not at all clear, not just here but overseas, that the underlying pulse of inflation is going away”.

“So I think it shows that the RBA strategy of doing less than other countries is leaving us still exposed to an ongoing cost of living crisis which is actually what is hurting the great majority of Australians”, he said.

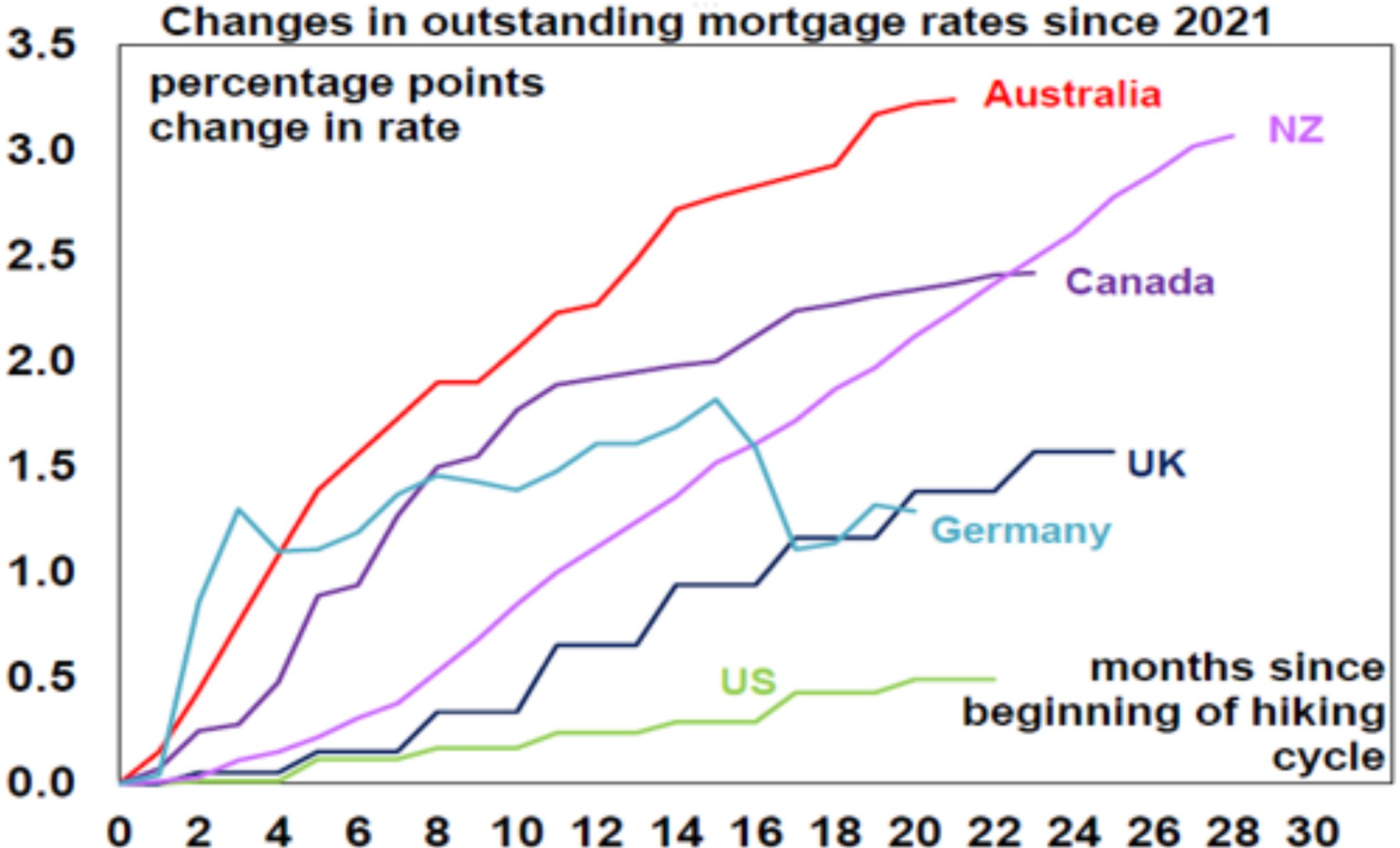

The notion that the RBA has done “less than other countries” on interest rates is wrong.

As AMP chief economist Shane Oliver noted on Twitter (X), “While central banks in the UK, NZ and Canada all raised rates by more than the RBA did (to 5% plus), Australian mortgage rates actually paid increased by more than in the UK and Canada and by about the same as in NZ”:

Source: Shane Oliver (AMP)

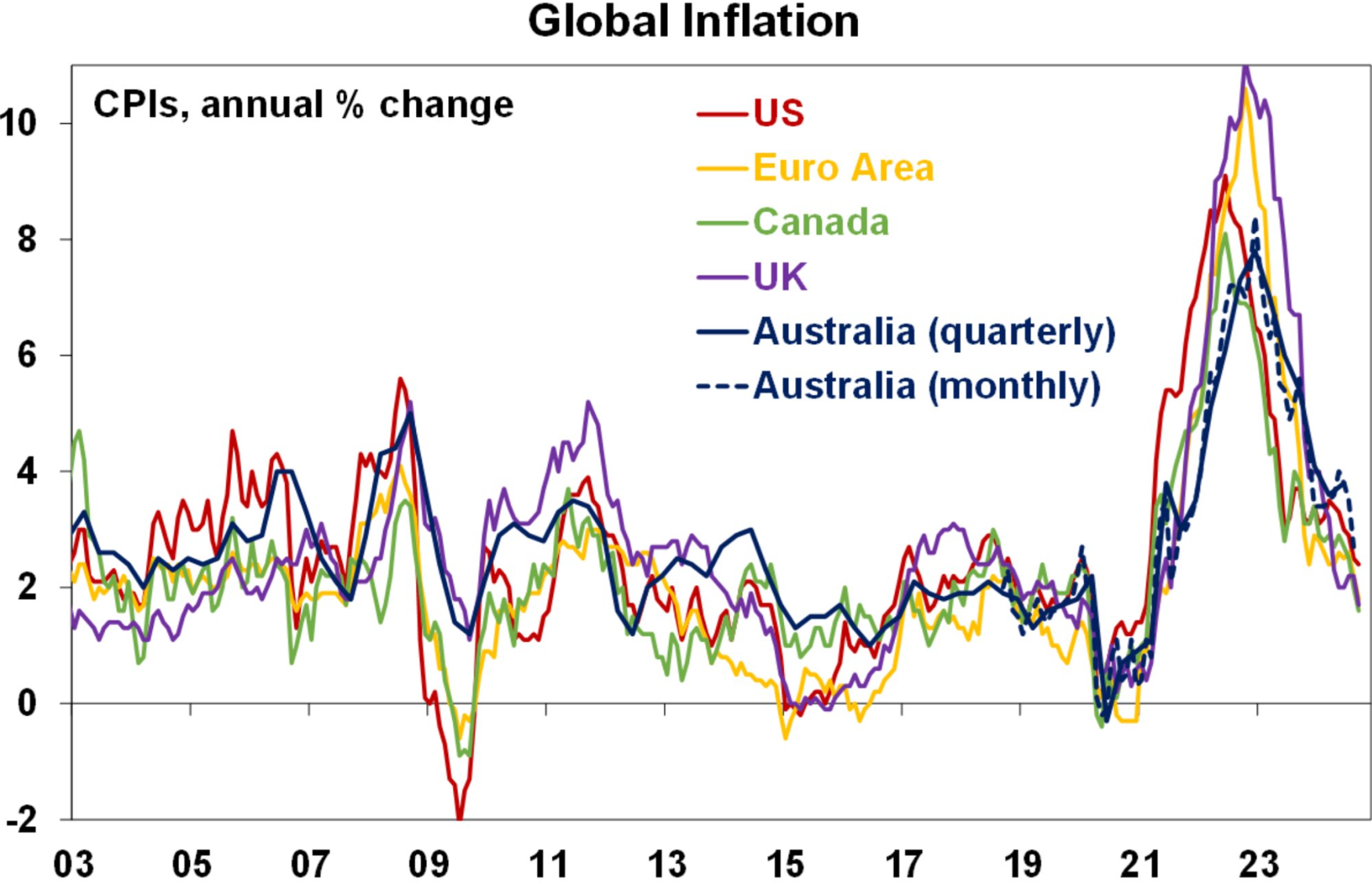

Oliver also noted that “Australian inflation generally lagged on the way up and peaked a bit lower”. Therefore, Australia’s CPI inflation is “so not that different once the lag is allowed for”:

Source: Shane Oliver (AMP)

Last week’s stronger-than-expected employment report has undoubtedly lessened the chance of the RBA delivering a rate cut before Christmas.

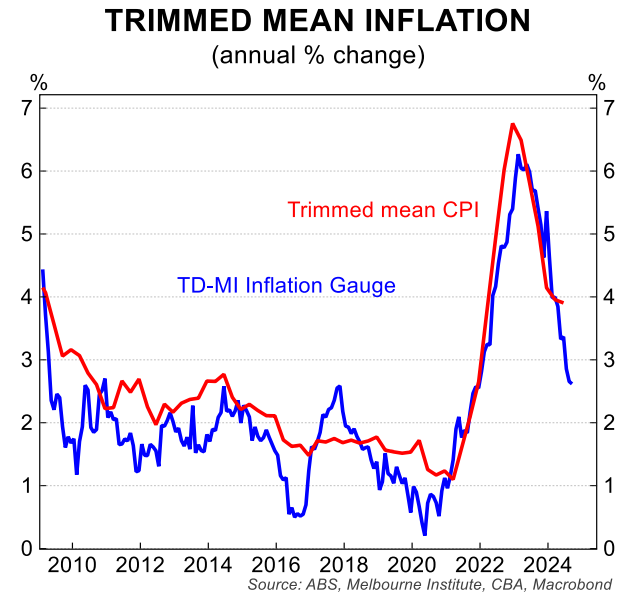

However, inflation pressures are easing. This is illustrated by the Melbourne Institute Inflation Gauge:

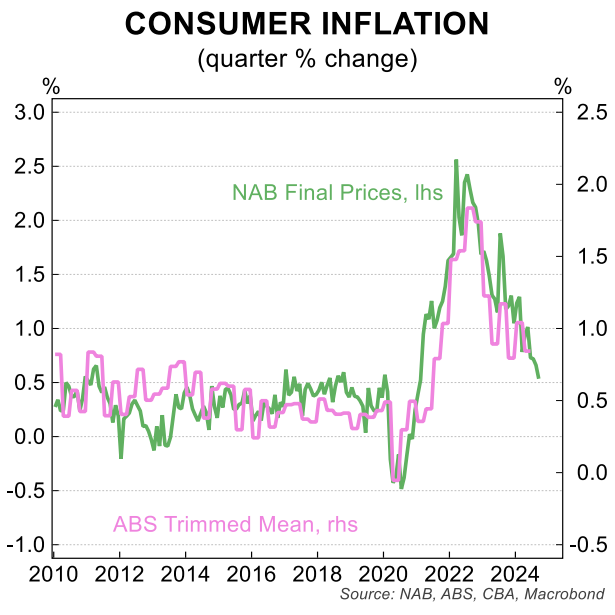

The NAB final prices measure:

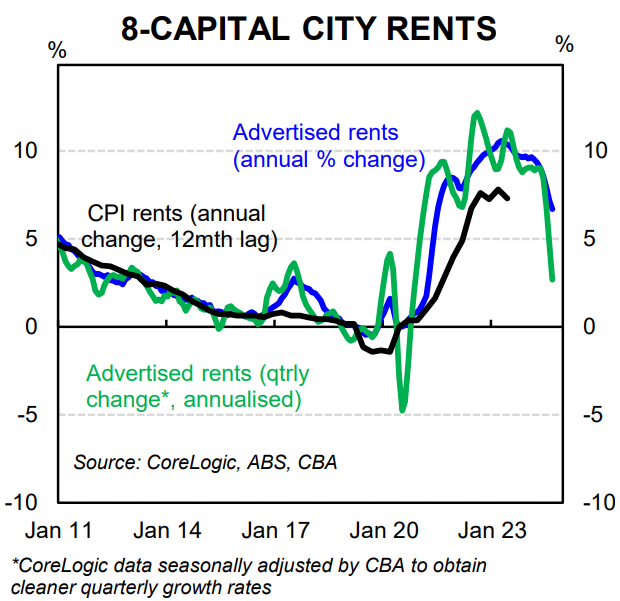

The growth in Australian advertised rents:

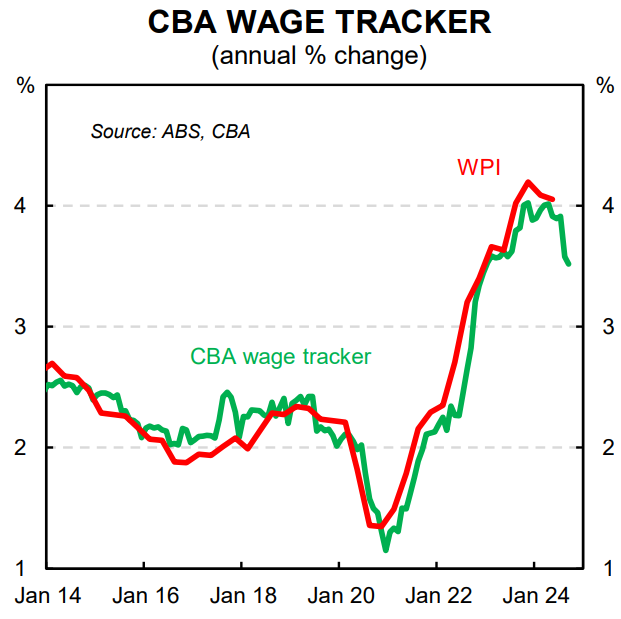

Finally, CBA’s wage tracker shows that wage inflation has fallen:

At the end of the month, the ABS will release the Q3 CPI inflation. A soft result will likely see the discussion pivot back to rate cuts.