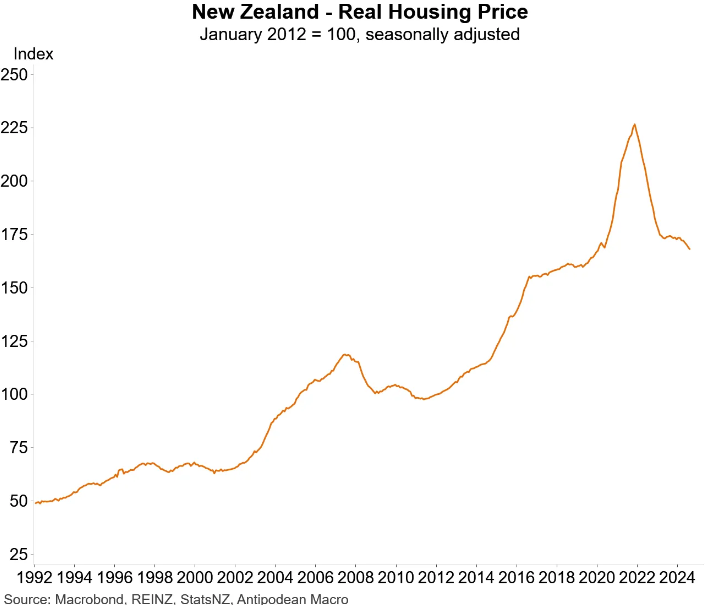

According to the REINZ house price index, national home values in New Zealand have fallen 16.7% since the market peak in 2021.

This decline has lowered real inflation-adjusted home values back to pre-pandemic levels at the start of 2020.

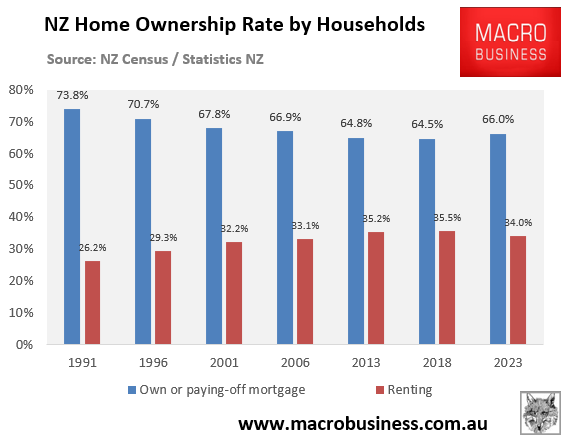

The results of the 2023 Census were released on Thursday and revealed that New Zealand’s home ownership rate has recorded its first rise in more than 30 years, rising to 66.0% in 2023 from 64.5% in 2018:

Auckland had the lowest rate of home ownership of all the regions in 2023, at 59.5%, which was largely unchanged from the 2018 rate of 59.4%.

Auckland’s lower home ownership rate reflects its status as New Zealand’s most expensive housing market.

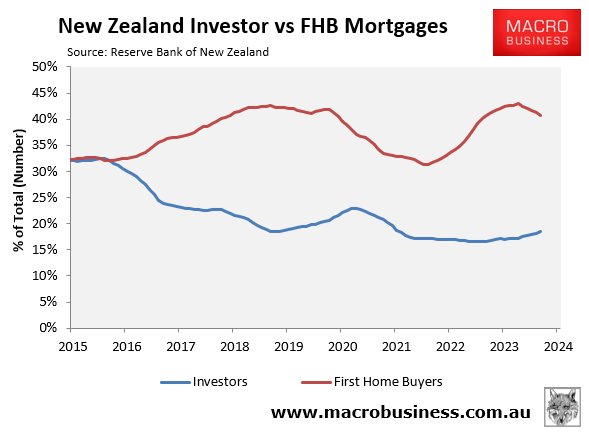

Separate data from the Reserve Bank of New Zealand shows that the share of mortgage going to first home buyers has risen over recent years, but remains at similar levels to 2018.

By contrast, the share of mortgages going to investors has fallen slightly since 2018.

Commenting on the results, Statistics New Zealand’s principal analyst, Rosemary Goodyear, noted that “this increase in home ownership, although small, is a reversal of the falling rates we have seen since home ownership peaked in the early 1990s”.

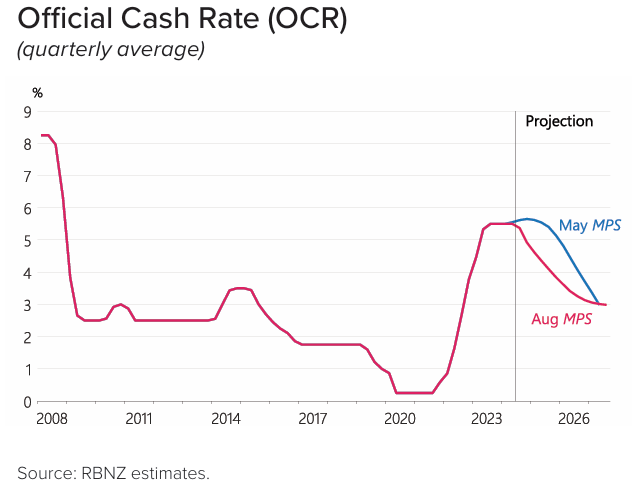

However, Brad Olsen, chief executive of Infometrics, noted that most of the improvement in the home ownership rate would have occurred when interest rates were low between 2019 and 2021, which was stifled when interest rates surged higher.

The Reserve Bank has now commenced an easing cycle and projected 2.5% of rate cuts over a 2.5 year period:

Falling mortgage rates combined with lower prices will hopefully lift the home ownership rate further.