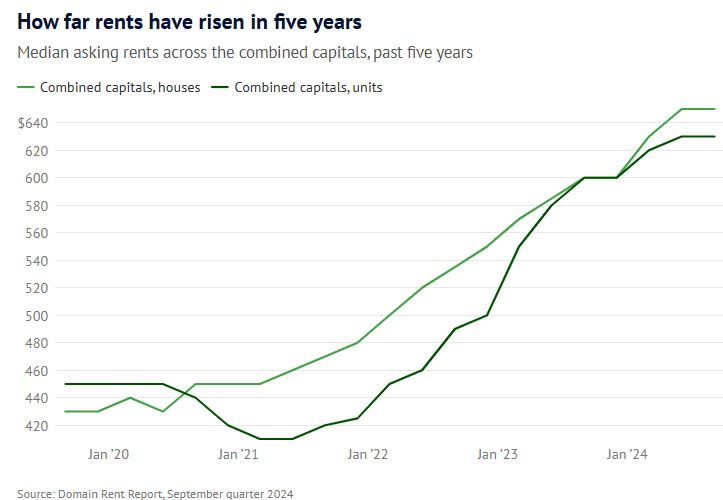

Australian renters have endured a torrid time over the past three years.

According to Domain, median house rents soared by $180, or 38%, from $470 to $650 between September 2021 and September 2024.

Over the same period, median unit rents rose by $210, or 50%, from $420 to $630.

Predictably, the rent surge has drained tenant households of disposable income, reducing consumption spending.

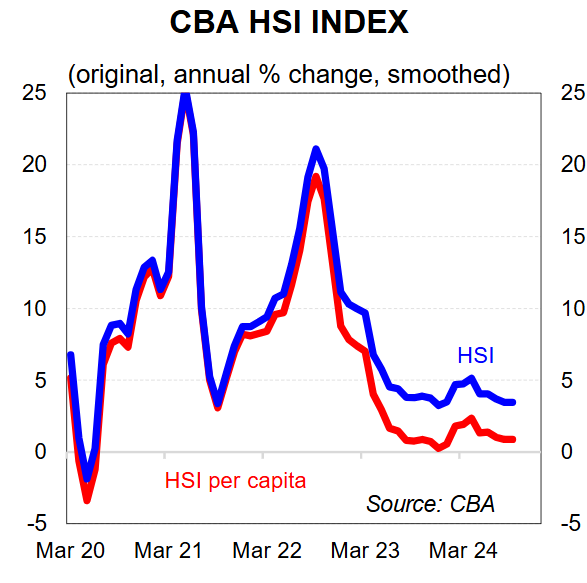

CBA has released its Household Spending Insights (HSI) survey for September, which is based on the spending of the bank’s customers.

Overall nominal household spending grew by 3.5% in the year to September and by just 0.9% in per capita terms:

Adjusted for underlying inflation of more than 3% suggests that spending fell sharply in real per capita terms.

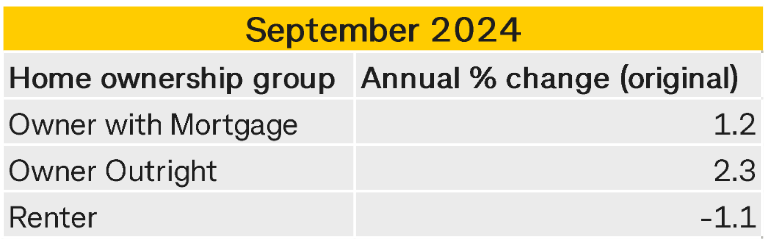

The most interesting piece of information from CBA’s survey is that renting households have experienced by far the largest contraction in spending:

The annual rate of spending in nominal per capita terms declined to 1.1% in September.

This compares to 1.2% growth for households with a mortgage and 2.3% growth for households who own their homes outright:

Source: CBA Spending Insights

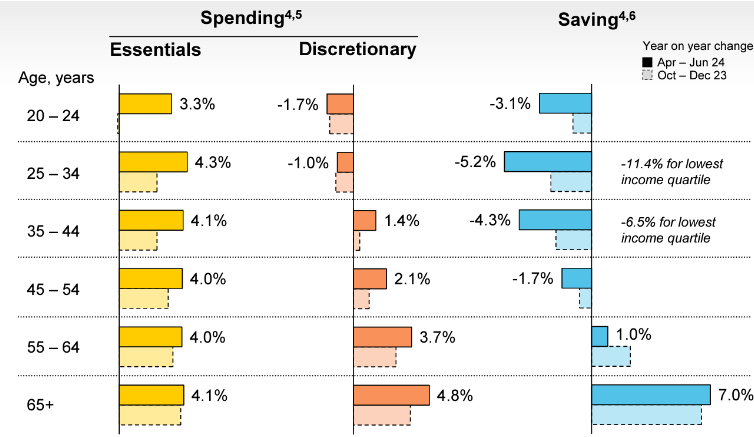

These results align with separate CBA data showing that older Australians, who tend to own their homes outright, grew their discretionary spending aggressively, whereas younger households, who tend to rent, have cut discretionary spending:

Source: CBA

Younger Australians are being hit hardest by rising rents, whereas mortgage holders have been hammered by rising mortgage rates.

By contrast, older home-owning Australians have been largely unaffected by the cost-of-living crisis.